The 104 per cent tariff increase on Chinese goods represents a significant blow to China's textile industry. This steep tariff hike, implemented by the US, will make Chinese-made products substantially more expensive, eroding their USP of cost-competitiveness in global markets. As a result, US businesses and consumers will likely turn to alternative suppliers from countries with lower tariff rates, such as Vietnam, Bangladesh, Indonesia, India, and Pakistan.The tariff increase compounds existing challenges in China, including rising production costs, labour shortages, and a slowdown in export growth. For China, this punitive tariff will not only hinder its ability to export to one of its largest markets but will also accelerate the decline of its market share in global apparel trade, further damaging the sector.

US' 104 per cent tariff on Chinese apparel threatens China's global competitiveness by drastically increasing product costs. Vietnam, Bangladesh, Indonesia, Pakistan, and India stand to gain by offering cheaper alternatives. While Vietnam and Bangladesh are expected to gain most substantially, India and Pakistan must address infrastructure and efficiency challenges to fully capitalise on this shift.

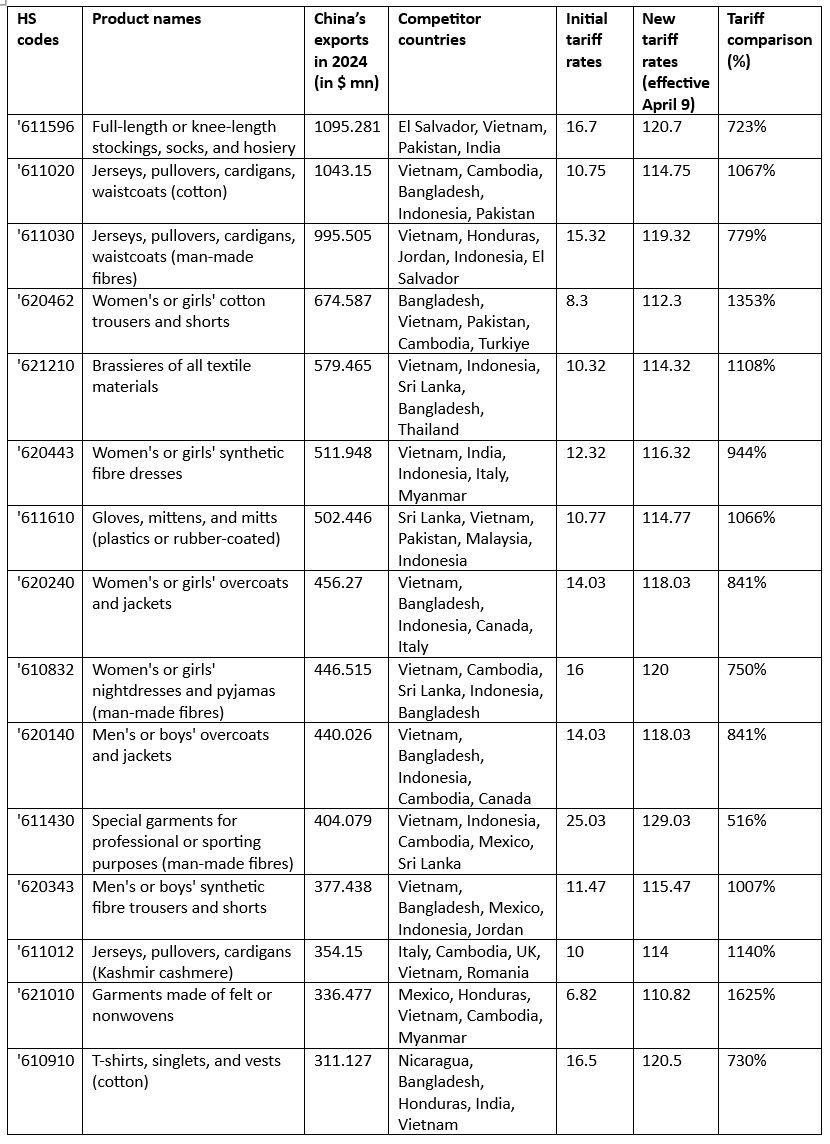

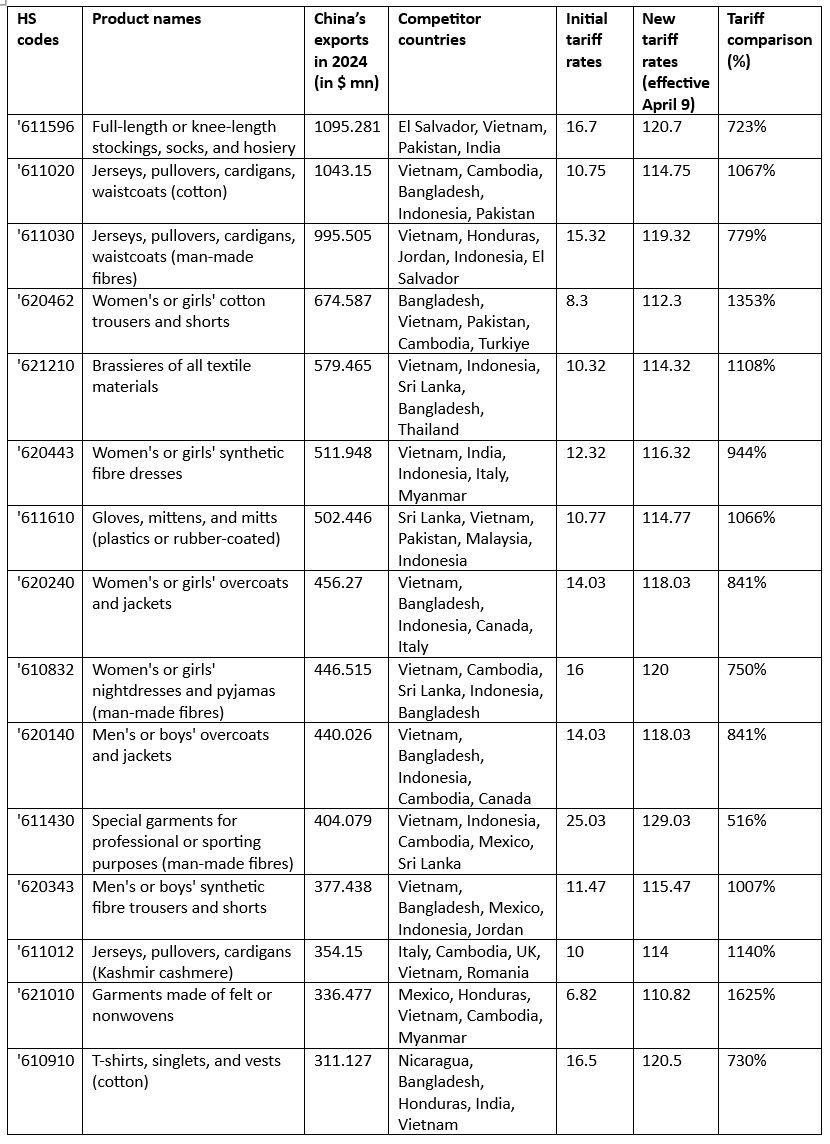

Figure 1: Top 15 highest imported Chinese products into the US in CY 2024, their initial and new tariffs and their % change

Source: TexPro

The above table reveals that certain products, especially those with already high initial tariff rates, will experience a significant price increase in the US market due to the new tariff hikes. Products such as Kashmir cashmere jerseys, pullovers, and cardigans (HS code 611012), which had an initial tariff rate of 10 per cent, will see a dramatic rise to 114 per cent, marking an increase of 1,140 per cent. Similarly, special garments for professional or sporting purposes made from man-made fibres (HS code 611430), which already had a relatively high tariff rate of 25.03 per cent, will see an even steeper increase to 129.03 per cent—an increase of 516 per cent. These products, which are typically higher-end or niche items, will now become significantly more expensive for US consumers, likely reducing their market competitiveness compared to lower-cost alternatives from countries like Vietnam or Bangladesh.

In contrast, products with lower initial tariff rates, such as full-length or knee-length stockings, socks, and hosiery (HS code 611596), which had an initial tariff of 16.7 per cent, will now see a massive jump to 120.7 per cent, marking a 723 per cent increase. This will make these items significantly more expensive and potentially less attractive in the US market, especially as suppliers from countries with lower tariff increases, such as Vietnam or El Salvador, become more competitive. Similarly, jerseys, pullovers, cardigans, and waistcoats made from cotton (HS code 611020), with an initial tariff of 10.75 per cent, will rise to 114.75 per cent, reflecting a 1,067 per cent increase in tariffs. These hikes will affect price-sensitive segments of the market, increasing costs for US consumers and potentially prompting them to seek alternatives from lower-cost countries.

Products like brassieres (HS code 621210) and women’s cotton trousers (HS code 620462), which had tariff rates of 10.32 per cent and 8.3 per cent, respectively, will also see steep increases, rising by 1,108 per cent and 1,353 per cent, respectively. These product categories, which are typically in high demand, will now become significantly more expensive, potentially causing shifts in purchasing patterns toward competitors in other countries such as Vietnam or Bangladesh, where tariff increases are also substantial but relatively more manageable.

Countries set to benefit

Vietnam: The biggest beneficiary

- Tariff Increase: 46 per cent

- Key Products:

- Jerseys, pullovers, and cardigans (both cotton and man-made fibres)

- Women’s or girls’ cotton trousers and hosiery

- Impact: Vietnam, with the highest tariff increase at 46 per cent, is positioned to gain the most from the changes. The country already leads in several high-value textile categories, making it well-positioned to capitalise on the higher tariffs imposed on Chinese goods. As the cost of Chinese products rises, Vietnamese products will become substantially more attractive to international buyers, enhancing the country’s competitiveness in markets that were previously dominated by China. Products such as jerseys, pullovers, and hosiery are key categories where Vietnam may see significant growth.

Bangladesh: Gaining market share

- Tariff Increase: 37 per cent

- Key Products:

- Women’s cotton trousers

- Men’s and women’s outerwear

- Brassieres

- Impact: Bangladesh follows closely with a 37 per cent tariff increase, positioning itself well to capture market share, particularly in high-demand categories. The women’s cotton trousers sector is especially impacted, with tariff increases on Chinese products reaching as high as 1,353 per cent. This gives Bangladesh a significant competitive advantage, making its apparel offerings more appealing globally. With a focus on outerwear and brassieres, Bangladesh is likely to experience a substantial increase in market share as buyers seek more cost-effective alternatives to Chinese goods.

Indonesia: Benefitting from niche categories

- Tariff Increase: 32 per cent

- Key Products:

- Brassieres

- Synthetic fibre dresses

- Impact: Indonesia, with a 32 per cent tariff increase, will see moderate yet significant benefits in specific product categories such as brassieres and synthetic fibre dresses. In these segments, tariff rates jump from 10.32 per cent to 114.32 per cent, making Indonesian products more competitively priced compared to Chinese alternatives. While Indonesia's overall tariff increase is not as high as that of Vietnam or Bangladesh, its strong presence in these niche markets is likely to enable it to capture a larger share of the global textile and apparel market.

Pakistan: Moderate gains

- Tariff Increase: 29 per cent

- Key Products:

- Hosiery

- Synthetic fibre dresses

- Impact: Pakistan will experience moderate benefits from the tariff hikes, with a 29 per cent increase. Although Pakistan holds a strong position in certain high-value categories such as hosiery and synthetic fibre dresses, the overall market impact is not as dramatic as it is for countries like Vietnam or Bangladesh. However, the hosiery sector, in particular, may see a rise in competitiveness due to the higher tariffs on Chinese goods, allowing Pakistan to gain market share—especially in markets where quality hosiery is in demand.

India: Least impacted and positioned for gains

- Tariff Increase: 26 per cent

- Key Products:

- Jerseys and pullovers (man-made fibres)

- Synthetic fibre dresses

- Impact: India benefits from the smallest tariff increase among these countries at 26 per cent, meaning it will experience less of a competitive shift compared to them. India’s key product categories—man-made fibre jerseys and synthetic fibre dresses—will still see a market boost due to the rise in the cost of Chinese products. However, the tariff increase is not as significant as that faced by Vietnam or Bangladesh, so the price advantage may be smaller. To fully capitalise on the opportunity, India will need to continue leveraging its competitive strengths and production capabilities.

In conclusion, China’s textile industry is already grappling with significant challenges, including rising production costs, labour shortages, and declining export growth. The US tariff hikes of up to 104 per cent on Chinese goods will further exacerbate these issues, making Chinese products more expensive and less competitive in global markets. China’s textile exports already saw a 7.6 per cent year-on-year decrease in 2023, and as global buyers turn to alternative suppliers, China’s dominance in the textile market is likely to continue shrinking.

Meanwhile, India and Pakistan—despite benefitting from relatively lower tariff increases—face their own challenges. Both countries will only fully benefit from the tariff hikes if they can efficiently scale up production. India continues to struggle with infrastructure limitations and supply chain inefficiencies, while Pakistan contends with political instability and a lack of modernisation in its manufacturing processes. Without addressing these hurdles, both India and Pakistan risk missing the opportunity to capture a significant share of the market currently held by China.

Fibre2Fashion News Desk (NS)