- News

- City News

- ahmedabad News

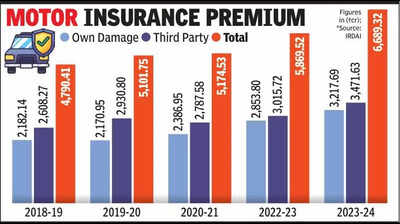

- Motor insurance premium collection in Gujarat jumps by 47% in 5 years

Trending

Motor insurance premium collection in Gujarat jumps by 47% in 5 years

Ahmedabad: Owning a car in Gujarat is becoming more expensive — not just at the showroom but at the insurance counter too. According to data from the Insurance Regulatory and Development Authority of India (IRDAI), the state experienced a 47% rise in motor insurance premium collection over the last five years.

The gross direct premium collected for the own damage category was Rs 3,217.69 crore in FY 2023-24, compared to Rs 2,182.14 crore in 2018-19.

When third-party premiums are included, the total motor insurance premium collected increased from Rs 4,790 crore to Rs 6,689 crore during this period.

Over the past five years, Gujarat has seen a steady rise in vehicle ownership, particularly in the passenger car and two-wheeler segments. Car registrations grew from 3.2 lakh in 2018-19 to 3.81 lakh in 2022-23, while two-wheeler sales, though fluctuating, remained consistently above 8 lakh annually.

"A scratch that would cost Rs 1,500 earlier now costs Rs 5,000 in the aftermarket. At a company service centre, the same repair could be billed at Rs 15,000," said Snehal Patel, an insurance expert. "With such steep repair bills, more people are claiming insurance instead of paying from their pocket. They don't mind losing the 20% no-claim bonus."

Experts say the dynamics have changed drastically in recent years. Previously, insurers allowed customers to combine two or more issues into a single claim, which helped reduce the number of claims made. "That practice has stopped. Now people are showing up for every little thing, even a small bumper scuff," said Patel.

Adding to this is the behavioural shift among a new generation of car buyers. A senior RTO official, requesting anonymity, said, "People are buying cars at a younger age and are far more conscious about how their car looks. They want their vehicle spotless, and for even the slightest scratch, they rush to the authorised showroom."

The growing preference for showroom repairs over roadside garages is also pushing up insurance payouts.

Moreover, the repair market, combined with the rising cost of parts, labour and urban road mishaps, is leading insurers to recalibrate their rates to stay competitive.

End of Article

FOLLOW US ON SOCIAL MEDIA