Figure 1

Source: White House

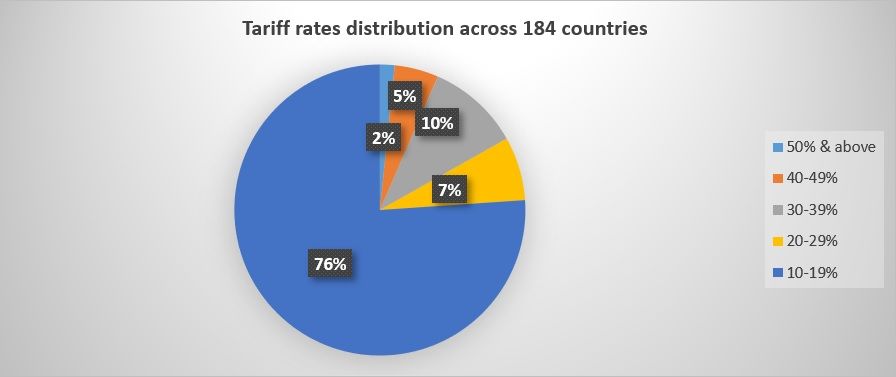

A significant three-fourth of the countries have been imposed a tariff in the range of 10 to 19 per cent, 83 per cent of which have now attained tariff evenness with the US, i.e. each side would be charging a 10 per cent tariff to the other. Overall, the hike in tariff rates reached half of what these nations currently charge on imports from the US. China – the world’s manufacturing hub and a major US economic rival – now faces the highest tariff of 54 per cent, with the loading of an additional 34 per cent on the existing 20 per cent levy. The Asian giant charges 67 per cent on US imports. The EU, which charges 39 per cent to the US, has been slapped with a 20 per cent rate. However, Trump exempted two of America’s closest trading partners and immediate neighbours, Canada and Mexico, from the tariff hike. There would hardly be any change for them.

The new tariffs aim to boost US manufacturing and could raise $2.2 trillion in revenue by 2034, as per the non-partisan Congressional Budget Office.

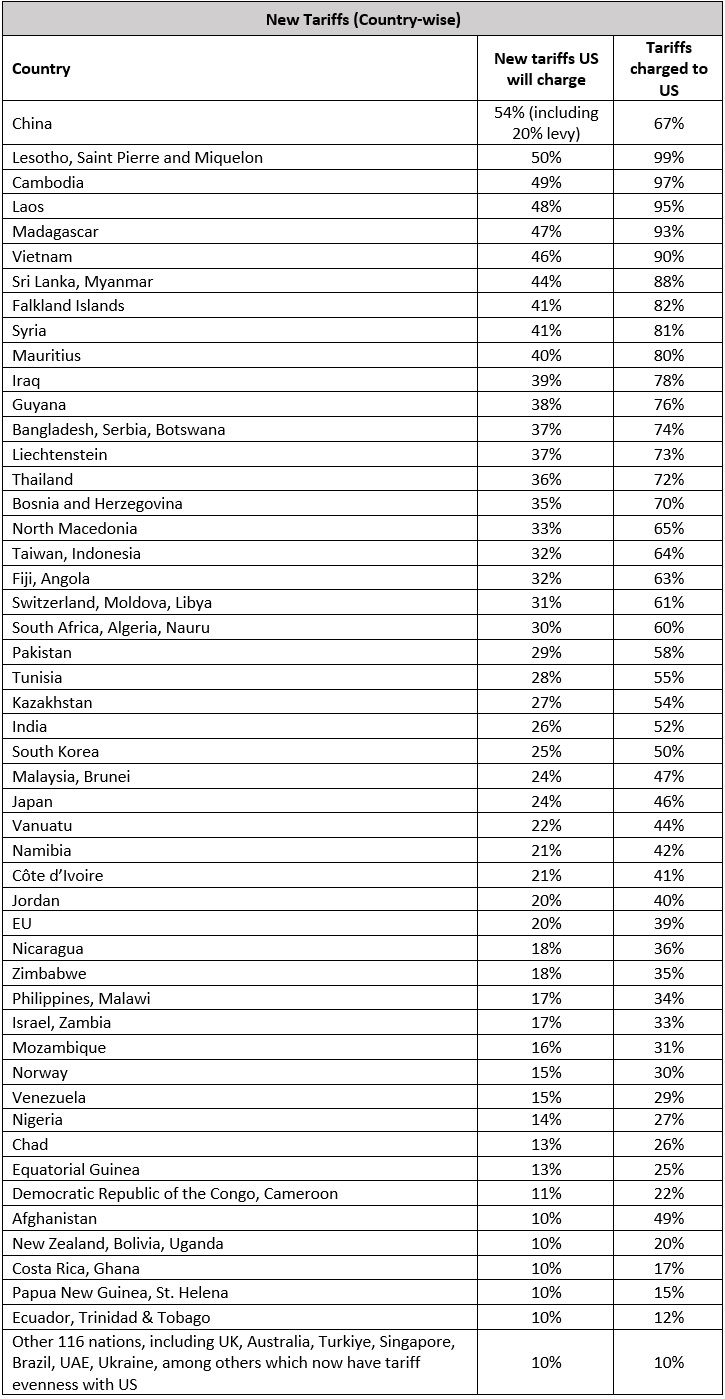

Table 1

Source: White House

Stock market’s reaction

The tariff hike impacted stock markets across the world. Dow Jones Futures tumbled more than 1.5 per cent, while shares in the Asia-Pacific region opened lower on Thursday morning. Japan's benchmark stock index, the Nikkei 225, was down by 4 per cent in early trading, and Australia's ASX 200 was around 2 per cent lower. In India, Gift Nifty dropped by 1.5 per cent. Going further, sectors like IT and automobiles (with 25 per cent tariff) may face selling pressure, though the market impact is expected to be absorbed in the medium to long term. The stock market's initial reaction to the announcement could signal a rush towards safe-haven assets while offloading riskier ones. A key shift in investor behaviour may be on the cards, with investors likely to shift funds to safer assets such as gold, the Japanese yen, the Swiss franc, and Japanese government bonds.

Indian trade

Experts feel that the Trump tariff may not have any major negative impact on the Indian economy, as India’s exports in the most vulnerable sectors amount to only 1.1 per cent of India’s GDP. India’s trade surplus with the US stood at $36.8 billion in FY24, with India exporting $77.5 billion worth of goods to the US and receiving $40.7 billion worth of American goods in India during the year. Only the sectors with high exposure to the US markets, such as electronic items (15.6 per cent of total exports to the US), gems and jewellery (11.5 per cent), pharma products (11 per cent), machinery for nuclear reactors (8.1 per cent), and refined petroleum products (5.5 per cent), are prone to some impact. As of now, goods from India will face a 25 per cent tariff on steel, aluminium, and auto-related goods, while pharmaceuticals, semiconductors, copper, and energy products will have no tariffs.

Impact areas

Despite relatively lower tariffs than many Asian countries, the new tariffs could still pose a significant challenge for Indian exporters, who would now have to navigate increased costs and reduced competitiveness in the US market. The higher duties would erode their margins as well. The tariff differential or gap (the difference between the import duties imposed by the US and India on a product) indicates which goods from a sector will be impacted by the revised tariff—meaning, the higher the tariff gap, the more adversely affected a sector could be. In this context, the wide range of tariff gaps (in descending order) exhibited by Indian goods are: 24.99 per cent for processed food, sugar, and cocoa; 23.1 per cent for automobiles and auto components; 13.3 per cent for diamonds, gold, and jewellery; 8.6 per cent for chemicals and pharmaceuticals; 7.2 per cent for electronics; 5.72 per cent for cereals, spices, and F&V; 5.6 per cent for plastics; 5.3 per cent for machinery and computers; 2.5 per cent for iron, steel, and base metals; and 1.4 per cent for textiles and clothing.

Advantage for India

In 2024, Chinese textile exports to the US, valued at $36 billion, accounted for nearly 30 per cent of total US textile imports. China was followed by Vietnam with $15.5 billion in value and a 13 per cent share. India ranked third with an 8 per cent share, amounting to $9.7 billion. Bangladesh, though previously holding a larger share, saw its US textile exports drop to 6 per cent, at $7.49 billion, due to political turmoil in 2024.

Now, with rivals China, Vietnam, and Bangladesh facing higher tariffs of 54 per cent, 46 per cent, and 37 per cent respectively, the Indian textile industry stands to gain due to the lower tariff of 27 per cent imposed on India. Other Asian players—Sri Lanka (44 per cent) and Cambodia (49 per cent)—will also be affected. Higher tariffs on imports from these Asian rivals will escalate the cost of goods for American consumers, leading to inflation and higher prices, resulting in reduced consumer demand.

If this situation remains unchanged, Indian companies such as Trident, Welspun India, Arvind, KPR Mill, Vardhman Textiles, Page Industries, Raymond, and Alok Industries stand to gain, as revenue from the US market accounts for 20–60 per cent of their earnings. Another advantage in India’s favour is the fact that textiles contribute just 2 per cent to its GDP, compared to 11 per cent in Bangladesh and 15 per cent in Vietnam, making it less vulnerable to tariff impacts.

Further, if India also reduces its cotton import duty from 11 per cent to zero, both countries will benefit. India’s Apparel Export Promotion Council (AEPC) has already urged the textile ministry to implement a ‘zero for zero’ duty policy, with the hope that the elimination of import duties on textile products would encourage the US to do the same for Indian exports. Ongoing trade negotiations could further strengthen India’s position.

However, inflation-driven buyer sentiment may dampen the potential gains for India. Additionally, Turkiye and Brazil, facing a 10 per cent tariff, could also emerge as attractive sourcing destinations for US buyers, posing another competitive front for India. Some apparel orders might also shift to Italy, Germany, and Spain, where tariffs stand at 20 per cent.

Road ahead

Largely, the tariff hike looks negative for the global market. Short-term buying will also slow down as companies try to deplete their inventory while awaiting tariff relief through renegotiations. However, if the announced tariffs carry on, the US will have no choice but to continue sourcing apparel. Excluding the EU, India will emerge as the cheaper option and preferred sourcing destination for the US, compared to all major global textile suppliers.

From a global perspective, the trade war escalation is likely to lead to higher prices for Americans and slower growth in the US, while at the same time, some countries around the world are feared to plunge into recession. As long as the new duties are implemented in their present form, they will affect trillions of dollars in trade, likely setting the stage for higher prices in the US on clothing, European wine, bicycles, toys, and thousands of other items.

Fibre2Fashion News Desk (WE-SB)