- News

- City News

- chennai News

- Backing people to create wealth

Trending

Backing people to create wealth

In 2013, while digital payments and e-commerce were taking off in India, investing in mutual funds was still a tedious process involving paperwork and long waiting periods. Vishranth Suresh, then an aspiring entrepreneur with an engineering background, saw an opportunity in this.

He founded AssetPlus, a wealth management platform for mutual fund distributors, with his co-worker at a startup and fellow IIT-Madras graduate Awanish Raj, who had expertise in application building.

"In 2016, mutual funds were still considered a bit of a taboo. People perceived mutual funds as risky, and the investment process was cumbersome, often taking 15-18 days. But the same people were starting to use Ola and Flipkart," says Suresh.

AssetPlus is a B2B wealth-tech startup providing mutual fund distributors with digital tools to onboard customers, handle KYC, purchase MFs and provide end customers with portfolio insights. The startup bets on financial advisors helping individuals, competing with do-it-yourself investment platforms such as Groww.

"Customers start their first 5,000 or 10,000 systematic investment plans (SIP) online but how many of them are actually creating wealth by staying invested? In many of the DIY platforms the average tenure of the SIP is four months whereas it is supposed to be a 10-year SIP. The lack of a human advisor to be able to guide is resulting in them taking hasty decisions," he adds.

Suresh says advisory-based platforms can improve financial literacy penetration and that AssetPlus can scale business. Initially they built the platform for themselves with three to four team members advising the customers. By 2020, after four and a half years, they had only 20 crore in assets under management (AUM). Realizing the need for scale coinciding with SEBI's ban on upfront commissions for mutual fund distributors they shifted to a B2B2C model, helping independent financial advisors with tech infrastructure. "It's much more scalable. After four years, our cumulative AUM is 4,500 crore today," he says.

AssetPlus gets a transaction-based fee and has a revenue sharing model with the advisors. It also offers select fixed deposits, term and health insurance products and National Pension Scheme. Suresh believes trusted advisors help capture a larger wallet share through cross-selling, though he estimates non-mutual fund products contribute less than 20% of their business.

It has raised 110 crore from three rounds with participation from notable founders such as InCred's Bhupinder Singh and Zerodha's Nithin Kamath, along with US-based venture firm Eight Roads and angel investors.

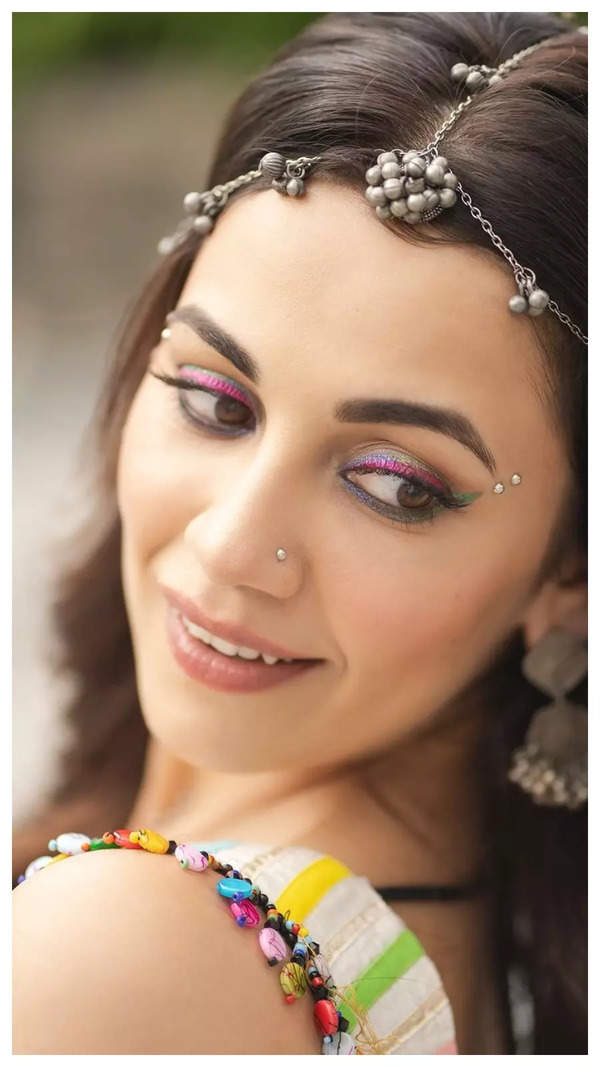

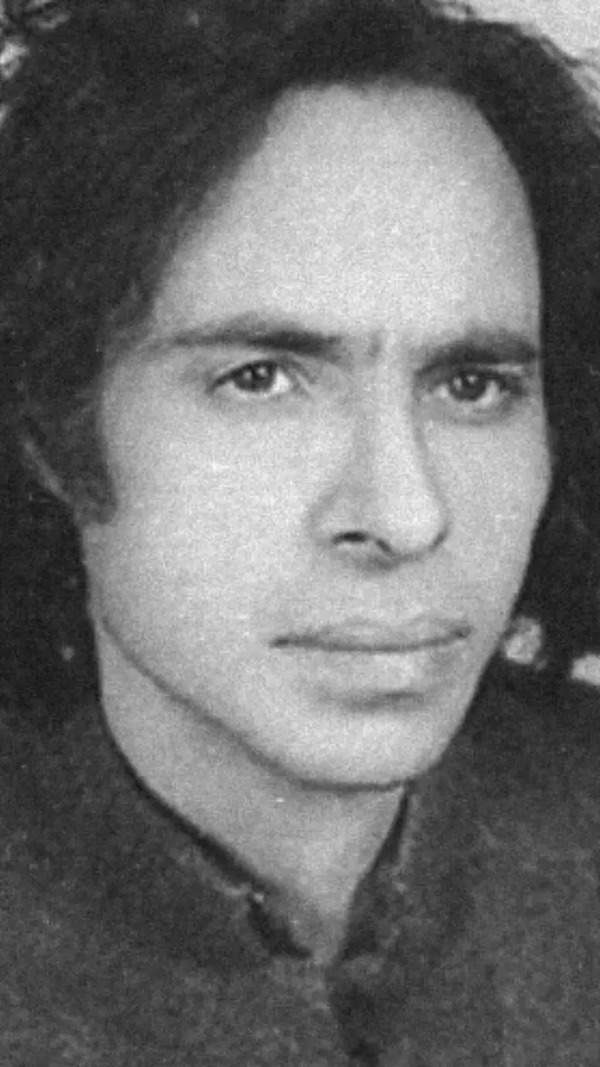

Vishranth Suresh and Awanish Raj have

ambitious plans on scaling business by inducting one lakh advisors, against 13,500 now, and crossing 1 lakh crore AUM in five to seven years.

End of Article

FOLLOW US ON SOCIAL MEDIA