- News

- Tax reforms will help people invest more, say Gurgaon business leaders

Tax reforms will help people invest more, say Gurgaon business leaders

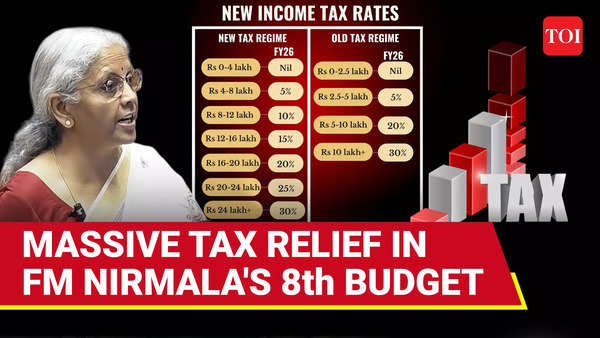

Gurgaon: Industry leaders in the city backed the new tax policy announced in the Union Budget on Saturday, saying it would not only empower the middle class but also promote investments in various sectors.

Around 6.5 lakh taxpayers are set to benefit from the new policy in Gurgaon, which is the ninth highest tax paying city in the country. Some 25,000 taxpayers earning more than Rs 50 lakh per annum will not see any change, officials in the income tax department said.

Industry leaders welcomed the tax reforms, anticipating increased consumption and economic growth.

Budget 2025 Updates

Gautam Kanodia, founder of KREEVA and Kanodia Group, said, "The waiving of income tax up to Rs 12 lakh will boost the sentiments of the middle class." He also highlighted the significance of the Rs 1 lakh crore "urban challenge fund", saying it "demonstrates the govt's commitment to urban development".

The hospitality sector is expected to see positive impact, according to SKYE MD Ankit Kansal, who pointed out that the homestay segment alone was growing at a CAGR of 33% and is projected to reach $1,377 million by 2028.

"The homestay segment in India is rising and fast becoming one of the key enablers in the hospitality sector. The unorganised segment is even larger," he added.

Payal Kanodia, the chairperson of FICCI YFLO Delhi, emphasised the benefits for young professionals. "The younger professionals will not have a tax burden in the initial years. This will bring some financial stability for a large working population. We believe these measures will boost economic growth, laying the foundation for an inclusive, modern, and interconnected urban environment," she said.

Pradeep Aggarwal, chairperson of Signature Global (India) Ltd, termed the tax reform a "masterstroke", predicting that increased disposable income would boost housing demand.

Industry professionals and city residents also expressed satisfaction with the reforms. Sharad Mehta from the automobile industry welcomed the long-awaited change in tax slabs, noting that it would benefit the "most loyal taxpayers" — the working class.

"People have been waiting for a change in the tax slab for years. The govt has finally made the much-needed change in the tax policy. The working class, who are the most loyal taxpayers, will get some relief from the govt now. A large number of people will be covered under the policy.," he added.

CA Vaibhav Gupta of NAVG & Associates praised the budget's comprehensive approach to economic growth and public welfare, insisting that the new policy would boost household consumption and investment.

"The budget aims to foster economic growth, enhance public welfare, and ensure financial stability. The govt understands the pain of the middle class and has removed the income tax burden on salaried individuals with an income of up to Rs 12 lakh. This will leave more money in their hands, boosting household consumption, saving, and investment," he added.

IIM Ahmedabad student Lekisha highlighted the policy's potential to improve tax compliance, adding that it was a welcome change from typical "freebies" to provide meaningful relief to the working class.

End of Article

FOLLOW US ON SOCIAL MEDIA