- News

- City News

- bengaluru News

- Young tech professionals sayrevised tax slabs a breather

Trending

Young tech professionals sayrevised tax slabs a breather

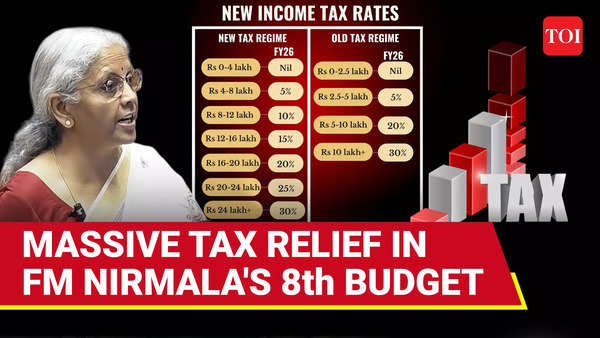

The revised tax slabs proposed in the Union Budget bring welcome financial respite to the salaried class. Employees in the tech sector say the proposal will help them manage their financial goals and facilitate better planning.

"Bengaluru is an expensive city, and every bit of extra savings helps. With this additional money, I can pay off my EMIs faster," said Ratnakar Kulkarni, a technical lead at a global capability centre (GCC).

For many young professionals, the new tax system offers an opportunity to boost their savings and make more informed investment choices.

Budget 2025 Updates

Rohan Parvatiyar, a senior firmware engineer, plans to split his additional savings between loan repayments and stock market investments. "These exemptions give me more flexibility in managing my family's finances," he said.

Others see this as a chance to secure their future. Business data analyst Abhinav Prakash intends to use the extra funds to purchase health insurance for himself and his wife.

"The current budget provisions have given me the confidence to plan ahead," he said.

Tanya P, a project manager in an IT firm, believes the incentives encourage long-term financial stability. "Knowing that my savings are working for me instead of being eroded by excessive taxes brings me peace of mind," she said, adding that the new structure makes it easier to plan for retirement and unforeseen healthcare expenses.

However, not all tech professionals are completely satisfied. While the exemption threshold has been raised, those earning above Rs 12 lakh still face double-digit income taxes and additional levies. "True reform should focus on simplifying taxation and reducing indirect levies, rather than shifting the financial burden onto those striving for growth," said Upendra Singh, a software consultant.

While the new slabs provide some respite, the debate continues on whether they truly benefit all income groups or merely redistribute the tax burden.

The revised tax slabs proposed in the Union Budget bring welcome financial respite to the salaried class. Employees in the tech sector say the proposal will help them manage their financial goals and facilitate better planning.

"Bengaluru is an expensive city, and every bit of extra savings helps. With this additional money, I can pay off my EMIs faster," said Ratnakar Kulkarni, a technical lead at a global capability centre (GCC).

For many young professionals, the new tax system offers an opportunity to boost their savings and make more informed investment choices. Some individuals can benefit from increased disposable income, particularly those planning to purchase property or automobiles, which is notable given that vehicle sales remained low through most of last year, showing the poorest growth figures in four years.

Rohan Parvatiyar, a senior firmware engineer, plans to split his additional savings between loan repayments and stock market investments. "These exemptions give me more flexibility in managing my family's finances," he said.

Others see this as a chance to secure their future. Business data analyst Abhinav Prakash intends to use the extra funds to purchase health insurance for himself and his wife.

"The current budget provisions have given me the confidence to plan ahead," he said.

Tanya P, a project manager in an IT firm, believes the incentives encourage long-term financial stability. "Knowing that my savings are working for me instead of being eroded by excessive taxes brings me peace of mind," she said, adding that the new structure makes it easier to plan for retirement and unforeseen healthcare expenses.

However, not all tech professionals are completely satisfied. While the exemption threshold has been raised, those earning above Rs 12 lakh still face double-digit income taxes and additional levies. "True reform should focus on simplifying taxation and reducing indirect levies, rather than shifting the financial burden onto those striving for growth," said Upendra Singh, a software consultant.

While the new slabs provide some respite, the debate continues on whether they truly benefit all income groups or merely redistribute the tax burden.

Get real-time updates on Budget 2025 and Income Tax Slabs on Times of India. Check out the latest income tax slabs FY 2025-26.

End of Article

FOLLOW US ON SOCIAL MEDIA