- News

- Business News

- India Business News

- Zomato share price crash: Why have Zomato shares tanked over 30% from all time highs & what should investors do?

Trending

Zomato share price crash: Why have Zomato shares tanked over 30% from all time highs & what should investors do?

Shares of Zomato have plunged over 30% since early December 2024, mainly due to a 57% year-on-year drop in consolidated net profit for the December quarter.

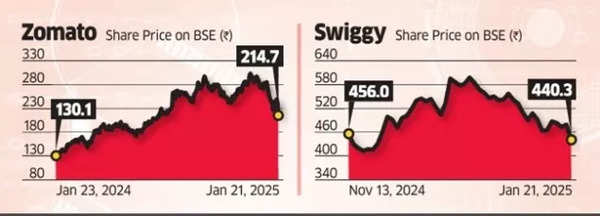

Zomato share price: Shares of Zomato, an online food delivery and quick-commerce platform operator, have plunged over 30% since early December 2024 when they had surged to a record high. In 2024, Zomato shares surged as much as 145%.

On Tuesday, Zomato shares plummeted by over 10% after the company reported a 57% year-on-year drop in consolidated net profit for the December quarter. The disappointing earnings also affected its smaller rival, Swiggy, whose shares declined by 8%.

Poll

What Do You Think Contributes Most to a Share Price Crash?

On Wednesday, Zomato's stock witnessed a sharp decline of 5.1% to reach Rs 203.80 on the BSE, seeing a total fall of 18.1% across three consecutive trading sessions.

Zomato and Swiggy Shares

Why have Zomato shares tanked?

The food delivery platform's financial results showed a consolidated net profit of Rs 59 crore in Q3 FY25, showing a 57% reduction compared to Rs 138 crore in the previous year. While operational revenue increased by 64% year-on-year to Rs 5,405 crore, the sequential growth of 13% failed to meet market projections.

Brokerages displayed varied responses to Zomato's results. Nomura adjusted its price target downward to Rs 290 from Rs 320, pointing to immediate difficulties in Blinkit operations, while Jefferies lowered its target estimation to Rs 255 from Rs 275.

Also Read | Top stock recommendations for January 22, 2025

According to Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services, “Zomato has been trying to scale up its quick-commerce business along with its competition by front-loading capex, as all of them have raised capital recently. This has raised its operational expenses and will impact its profits for the next two quarters, and there will be short-term pain in the stock.

Zomato attributed the weaker numbers to increased investments in accelerated new dark-store openings and customer acquisition efforts in the quick commerce (QC) business. Swiggy has not yet reported its October-December results.

Khemka also noted that such worries have affected Swiggy's shares, stating, "Swiggy's path to profitability will also be extended further because unlike Zomato it isn't profitable in its food delivery business yet."

Motilal Oswal maintained its 'Buy' rating on Zomato but reduced the price target from Rs 330 to Rs 270, while remaining neutral on Swiggy.

According to an ET report, brokerage Macquarie has retained its 'underperform' rating and price target of Rs 130 on Zomato, citing a limited margin of safety for the shares. "We see rising competition in Q-Com (quick commerce) denting consensus forecasts," said Macquarie's analysts.

JM Financial's note suggests that long-term investors should use the opportunity to build "sizable" positions in Zomato, despite near-term uncertainties in Blinkit's profitability trend. They have a 'buy' rating and a price target of Rs 280, indicating a 30% upside from Tuesday's close.

Dharan Shah, founder of Tradonomy.com, Mumbai-based investment research advisor is of the view that as Zomato pursues its growth strategy, particularly in rapid delivery services, it positions itself for future expansion. However, maintaining equilibrium between scaling operations and financial sustainability remains vital, he says.

Stay informed with the latest Business News on Times of India. Explore the list of Bank Holidays, stay informed about Budget 2025, discover the new Income Tax Slabs, and use the Income Tax Calculator for hassle-free tax planning.

Unlock Investment Potential: Enroll in ET's Stock Valuation Workshop - Batch 3. Secure Your Spot Now!

End of Article

FOLLOW US ON SOCIAL MEDIA