3 Min Read

The Central Economic Work Conference (CEWC) is a two-day meeting of two of China's biggest decision-making bodies: the Central Committee of the Chinese Communist Party and the State Council of the People's Republic of China. At the end of this meeting on December 12, global markets will watch out for decisions and signals to revive the world's second-largest economy from a prolonged slump. File photo: Reuters

The consensus among China watchers this year is that China will likely keep the economic growth target unchanged at 5%. "If history is any guide, policymakers may leave the 2025 growth target unchanged at around 5% or lower it to 4.5-5%," Larry Hu, chief China economist at Macquarie, told CNBC International. However, he added that policymakers rarely cut the growth target by more than 50 basis points.

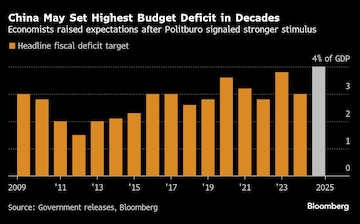

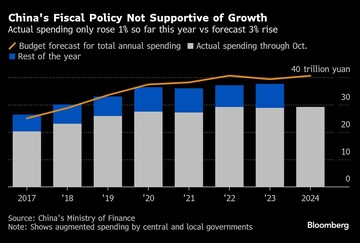

Analysts also believe that the politburo's focus on a "loose" monetary policy and an expansionary fiscal policy shows that the Xi administration will discuss domestic consumption at the CEWC. At least six brokerages expect China to allow its budget deficit to expand to 4%, the widest in three decades, according to Bloomberg. The government is expected to spend more to boost domestic demand, and in the process, take on a bigger deficit.

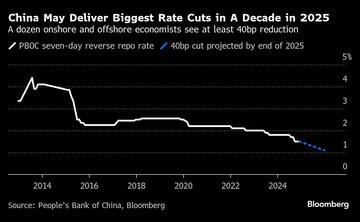

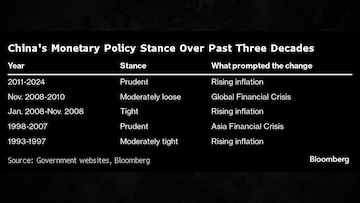

The politburo meeting on Monday, which effectively laid the groundwork for the two-day conference, hinted at a 'moderately loose' monetary policy and more proactive fiscal policy in 2025. Expectations include rates cuts between 40 basis points to 60 basis points in 2025.

Domestic consumption, a key driver of the Chinese economy, has been battered by deflation. Wholesale inflation declined for the 26th month in November, indicating that consumption is yet to pick pace. While retail sales showed a slight uptick in October, real estate sales continued to disappoint. Continued deflationary pressure has hit industrial profits, which fell 10% year-on-year in October. The mixed data highlights that stimulus measures have not had the intended impact so far. Photo: AP

In the past, the Chinese leadership has used the CEWC to signal its willingness to safeguard the economy from external threats. In 2008, amid the Global Financial Crisis, erstwhile President Hu Jintao promised sustained economic growth by boosting domestic demand. Similarly, in 2022, the conference signalled domestic consumption could lift the economy from its COVID-19-induced slowdown.

However, the incoming Trump administration, which has promised tariffs of up to 60% on Chinese goods, could derail the country's export-driven recovery. According to Macquarie Group, China will need at least $800 billion in stimulus to offset the impact of a 60% tariff by stimulating domestic demand. (AP Photo/Kiichiro Sato, File)

The pre-conference indications suggest that the 2024 meeting could go the 2008 and 2022 way. Analysts like Xing Zhaopeng, ANZ's senior China strategist, told Reuters that the politburo's latest tone "points to strong fiscal stimulus, big rate cut and asset buying in 2025." "The policy tone shows strong confidence against Trump's threats of tariffs," he added.

(Edited by : Sriram Iyer)

Live TV

Loading...

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!