3 Min Read

This analyst believes Zomato's Blinkit will stay ahead in quick commerce in the near term—here's why

Karan Taurani, Senior Vice President and Research Analyst at Elara Capital, shared his outlook on the quick commerce space amid intensifying competition from existing players like Swiggy Instamart and new entrants such as Amazon Tez. .

Karan Taurani, Senior Vice President and Research Analyst at Elara Capital, expects Blinkit, Zomato’s quick commerce arm, to retain its leadership in the rapidly growing quick commerce market over the short to medium term.

While Swiggy Instamart and new entrants like Amazon India present competition, Taurani believes Blinkit's robust strategy such as diverse stock-keeping units (SKUs) and dominance in key markets give it a significant edge.

Amazon India is likely to launch its quick commerce service, codenamed Tez, by late December or early 2024, intensifying competition in the space.

“Blinkit could sustain their market leadership over the near to medium term given the kind of strategic markets that they have, with Delhi NCR market, where they are phenomenally strong, and they are trying to dig deep into the non-Delhi-NCR markets as well. So there is very low probability that some other player emerges as a market leader, “ he noted.

Swiggy Instamart, he believes, still needs to improve its average order value (AOV), which are currently 25–30% lower than Blinkit and others.

He also pointed out that take rates is another critical area where Blinkit has an advantage over Instamart.

Take rate refers to the percentage of the total order value that a platform retains as revenue after paying suppliers or partners.

Blinkit has also been proactive in generating ad revenue by leveraging strategies similar to Zomato’s food delivery business, This revenue stream, influenced by factors such as customer traffic, market share, and order volume, directly supports profitability, growth, and improved take rates.

According to Taurani, Blinkit’s scale and bargaining power with brands allow it to secure better terms than competitors, supported by additional levers like ad rates and platform fees.

While Swiggy’s discounting efforts may address some of these gaps over time, achieving substantial improvements in these metrics will likely be a gradual process.

Taurani believes Zomato's ₹8,500 crore QIP is also a strategic move that will help prepare it for increased competition and capture the potential growth in the segment.

“All players will likely coexist in this market. Growth rates may vary across competitors, but the market’s untapped potential offers opportunities for three to five players to thrive over the next three to five years,” Taurani added.

Quick commerce will evolve differently from the food delivery sector, where Zomato and Swiggy dominate as a duopoly.

Unlike food delivery, the quick commerce market is still nascent, offering space for multiple players to coexist and flourish.

While Swiggy Instamart and new entrants like Amazon India present competition, Taurani believes Blinkit's robust strategy such as diverse stock-keeping units (SKUs) and dominance in key markets give it a significant edge.

Amazon India is likely to launch its quick commerce service, codenamed Tez, by late December or early 2024, intensifying competition in the space.

“Blinkit could sustain their market leadership over the near to medium term given the kind of strategic markets that they have, with Delhi NCR market, where they are phenomenally strong, and they are trying to dig deep into the non-Delhi-NCR markets as well. So there is very low probability that some other player emerges as a market leader, “ he noted.

Swiggy Instamart, he believes, still needs to improve its average order value (AOV), which are currently 25–30% lower than Blinkit and others.

He also pointed out that take rates is another critical area where Blinkit has an advantage over Instamart.

Take rate refers to the percentage of the total order value that a platform retains as revenue after paying suppliers or partners.

Blinkit has also been proactive in generating ad revenue by leveraging strategies similar to Zomato’s food delivery business, This revenue stream, influenced by factors such as customer traffic, market share, and order volume, directly supports profitability, growth, and improved take rates.

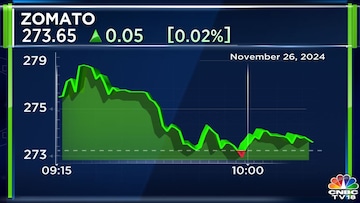

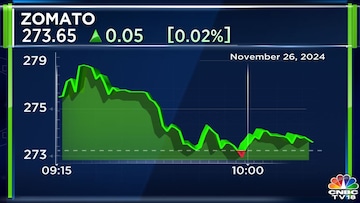

At 10:30 am the stock was trading at ₹274.18, up by 0.32%.

According to Taurani, Blinkit’s scale and bargaining power with brands allow it to secure better terms than competitors, supported by additional levers like ad rates and platform fees.

While Swiggy’s discounting efforts may address some of these gaps over time, achieving substantial improvements in these metrics will likely be a gradual process.

Taurani believes Zomato's ₹8,500 crore QIP is also a strategic move that will help prepare it for increased competition and capture the potential growth in the segment.

“All players will likely coexist in this market. Growth rates may vary across competitors, but the market’s untapped potential offers opportunities for three to five players to thrive over the next three to five years,” Taurani added.

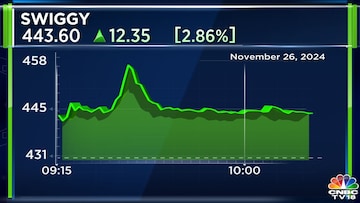

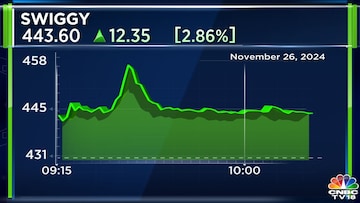

At 10:30 am the stock was trading at ₹444.60, up by 3.26%.

Quick commerce will evolve differently from the food delivery sector, where Zomato and Swiggy dominate as a duopoly.

Unlike food delivery, the quick commerce market is still nascent, offering space for multiple players to coexist and flourish.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Live TV

Loading...