Stock Market LIVE Updates: Sensex 150 pts lower, at 81,700, Nifty at 25,000; Auto, FMCG, IT drag

Stock Market Today: Indian benchmark equity indices were lower at opening bell on Wednesday, tracking weakness in global markets

Share Market Today: Foreign institutional investors (FIIs) net sold shares worth Rs 1,748.71 crore on Tuesday, October 15, while domestic institutional investors (DIIs) net bought shares worth Rs 1,654.96 crore. (Photo: Bloomberg)

Stock Market LIVE Updates, Wednesday, October 16, 2024: Benchmark Indian equity indices opened lower on Wednesday, tracking weakness in Asian and other global markets.

At opening bell, the BSE Sensex was at 81,621, down 198 points, or 0.24 per cent, while the Nifty 50 was at 25,009, down 48 points, or 0.19 per cent.

On the BSE Sensex, 11 out of the 30 stocks were trading in the green. Gains were led by Power Grid Corp (up 0.53 per cent), followed by Bajaj Finserv, Asian Paint, Bajaj Finance, and JSW Steel, while Mahindra & Mahindra (down 1.08 per cent), followed by TCS, Infosys, IndusInd Bank, and ITC, were the top drags on the index.

On the Nifty 50, 18 out of the 30 stocks were trading in the green. Gains were led by HDFC Life (up 0.87 per cent), followed by Dr Reddy's, Asian Paint, BPCL, and Power Grid Corp, while on the flip side, TCS (down 0.73 per cent), followed by Infosys, Kotak Mahindra Bank, Titan, and Cipla were the top losers.

Across sectors, the Auto index (down 0.68 per cent), followed by the FMCG and IT indices were the top laggards. Bank Nifty was marginall higher (up 0.03 per cent), while Financial Services was up 0.28 per cent.

Consumer Durables, Pharma, Healthcare, and Media indices were trading in the red, while the Oil & Gas index was up 0.57 per cent.

In the broader markets, the Nifty Midcap100 was flat and the Nifty Smallcap 100 was marginally higher by 0.03 per cent.

Benchmark equity indices BSE Sensex and Nifty 50 had pared their early gains to settle in the red on Tuesday.

The BSE Sensex closed 152.93 points lower, or 0.19 per cent down, at 81,820.12, while the Nifty 50 ended at 25,057.35, down 70.60 points, or 0.28 per cent.

In the broader markets, smallcap stocks outperformed the benchmarks, with the Nifty Smallcap 100 index ending higher by 1.11 per cent and the Nifty Midcap 100 closed 0.21 per cent ahead.

Nifty Realty index outperformed all the other sectoral indices, ending higher by 2.05 per cent. Meanwhile, FMCG, Consumer Durables, Nifty Bank, Media, and select healthcare stocks also ended in the green.

On the other hand, Financial Services, IT, Metal, PSU Bank, Auto, and OMC closed in red on Tuesday.

That apart, Japan’s Nikkei was leading the losses in lower Asia-Pacific markets, after Wall Street closed in negative territory on Tuesday.

Japan’s Nikkei 225 was down 1.8 per cent, and the broad-based Topix was lower by 1.13 per cent.

Hong Kong's Hang Seng index was marginally ahead by 0.08 per cent, while mainland China's Shanghai Composite and CSI 300 were down by 0.14 per cent and 0.86 per cent, respectively.

Australia’s S&P/ASX 200 was trading lowed by 0.2 per cent, and South Korea’s Kospi was down 0.89 per cent.

Investors will keep an eye out for more stimulus measures as the country's housing minister is scheduled to hold a press briefing on Thursday morning, as per a statement from the State Council Information Office on Tuesday.

Wall Street closed down on Tuesday, following global stocks lower as a weak sales forecast from European chip fabrication equipment maker ASML weighed on tech shares, while crude extended its slide due to easing supply worries and weakening demand.

The three major US indexes ended the session in negative territory, with the S&P 500 and the Dow easing back from Monday's record closing highs.

Financial firms Goldman Sachs, Citigroup and Bank of America all posted better-than-expected profit, while healthcare companies UnitedHealth and Johnson & Johnson results underwhelmed investors.

But Netherlands-based chip equipment maker ASML posted third quarter results that surprised markets with weak bookings and lower-than-expected sales forecasts, dour news that proved contagious to the US chip sector.

The Dow Jones Industrial Average fell 324.60 points, or 0.75 per cent, to 42,740.62, the S&P 500 fell 44.54 points, or 0.76 per cent, to 5,815.31 and the Nasdaq Composite fell 187.10 points, or 1.01 per cent, to 18,315.59.

European stocks posted their largest one-day percentage drop in over two weeks, weighed by tech stocks.

Meanwhile, investors remained focused on the European Central Bank's rate decision on Thursday.

MSCI's gauge of stocks across the globe fell 6.20 points, or 0.72 per cent, to 850.98. The STOXX 600 index fell 0.8 per cent, while Europe's broad FTSEurofirst 300 index fell 19.22 points, or 0.92 per cent.

Emerging market stocks fell 11.40 points, or 0.98 per cent, to 1,148.66.

Oil prices slid to a near two-week low, extending Monday's losses amid easing supply pressures arising from the conflict in the Middle East, amid reports Israel's Prime Minister Benjamin Netanyahu told US President Joe Biden's administration that Israel would avoid striking Iranian oil targets.

Additionally, OPEC and the International Energy Agency both lowered their global demand forecasts, mostly due to weakness in China.

US crude tumbled 4.40 per cent to $70.58 per barrel, while Brent fell to $74.25 per barrel, down 4.14 per cent on the day.

Benchmark US Treasury yields edged lower, pausing after touching a 2-1/2 month high in the wake of soft manufacturing data

from the New York Federal Reserve.

The yield on benchmark US 10-year notes fell 3.7 basis points to 4.036 per cent, from 4.073 per cent late on Friday.

The 2-year note yield, which typically moves in step with interest rate expectations, rose 1.1 basis points to 3.952 per cent, from 3.941 per cent late on Friday.

The dollar was nominally lower against a basket of world currencies amid wagers that the Federal Reserve will proceed with modest rate cuts in the near term.

The dollar index, which measures the greenback against a basket of currencies, rose 0.06 per cent to 103.24.

Gold gained traction, lifted by lower Treasury yields. Spot gold rose 0.4 per cent to $2,661.80 an ounce.

(With inputs from Reuters.)

9:31 AM

Stock Market LIVE Updates: Nifty Auto, IT lead losses

Among indices, Nifty Auto and Nifty IT were among the top losers, while Nifty Financial Services and Nifty PSU Bank advanced.

9:28 AM

Stock Market LIVE Updates: Broader indices marginally in green

The broader indices were trading marginally in green, with BSE MidCap index rising 0.05 per cent and BSE SmallCap surging 0.10 per cent.

9:24 AM

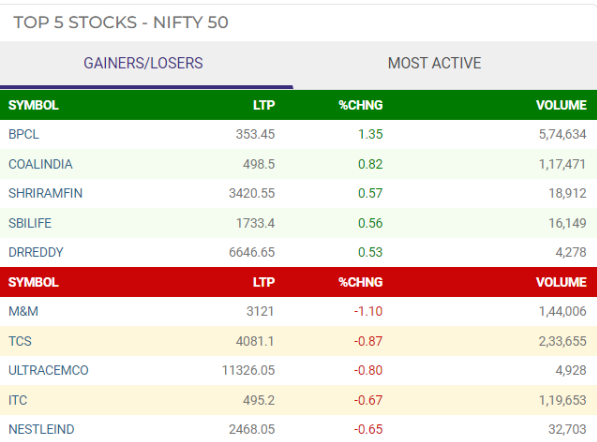

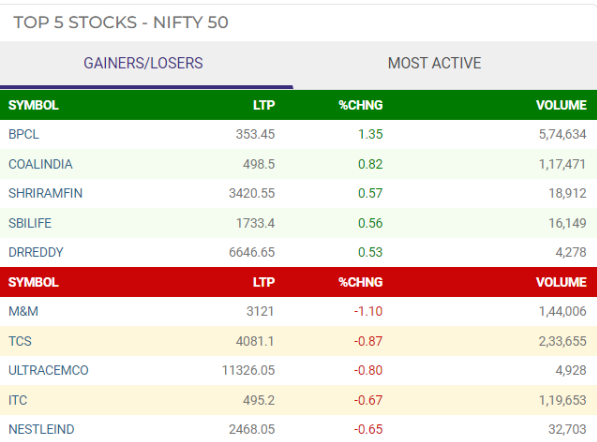

Stock Market LIVE Updates: M&M, TCS fall on NSE

26 stocks advanced on NSE, while 24 stocks were trading in red, among them M&M, TCS were the top losers.

9:21 AM

Stock Market LIVE Updates: Heatmap check

Bajaj Finserv, Axis Bank, and HDFC Bank were the top gainers on Sensex, while Nestle India, M&M and Ultratech Cement were among the top losers.

9:20 AM

Stock Market LIVE Updates: Nifty holds 25,000 mark

The NSE's Nifty fell around 35 points or 0.14 per cent to 25,021 level in early trade.

9:17 AM

Stock Market LIVE Updates: Sensex slips over 150 pts

The BSE Sensex was down around 160 points or 0.20 per cent to 81,659 level in early morning deals on Wednesday.

9:09 AM

Stock Market LIVE Updates: Nifty slips but holds fort at 25,000 mark in pre-open

The NSE's Nifty fell around 48 points or 0.19 per cent to 25,008 level in pre-opening trade.

9:08 AM

Stock Market LIVE Updates: Sensex down over 150 points in pre-open

The BSE Sensex was down around 173 points or 0.21 per cent to 81,646 level in pre-opening deals on Wednesday.

9:05 AM![]()

Stock Market LIVE Updates: Rupee opens flat at 84.05

Indian currency Rupee depreciated by 2 paise at Rs 85.05 per US dollar on Wednesday.

9:02 AM ![]()

Stock Market LIVE Updates: Derivative outlook - 'FIIs decreased future index long position holdings by 2.54%'

Stock Market LIVE Updates: "Nifty weekly contract has highest open interest at 25,200 for Calls and 25,000 for Puts while monthly contracts have highest open interest at 27,000 for Calls and 25,000 for Puts. Highest new OI addition was seen at 25,200 for Calls and 23,050 for Puts in weekly and at 26,000 for Calls and 25,300 for Puts in monthly contracts. FIIs decreased their future index long position holdings by 2.54 per cent, increased future index shorts by 0.85 per cent and in index options, 6.82 per cent increase in Call longs, 0.99 per cent decrease in Call short, 10.64 per cent increase in Put longs and 4.30 per cent decrease in Put shorts."

Views By: Anand James, Chief Market Strategist, Geojit Financial Services

9:01 AM ![]()

Stock Market LIVE Updates: Nifty outlook - 'The close back above 25,040 points to loss in bearish momentum'

Stock Market LIVE Updates: "Though turbulence played out on expected lines yesterday, the steepness of the declines did raise alarms briefly. The close back above 25,040 points to loss in bearish momentum, allowing us to retain the 25,390 view for the week. We will now position for swings within the 24,900-25,234 region initially."

Views By: Anand James, Chief Market Strategist, Geojit Financial Services

8:59 AM

In India the main driver of the bull run has been the sustained domestic flows into the market which has been absorbing all the selling by FIIs. The domestic flows will continue to support the market but elevated valuations will put a cap on the upside. Nifty is likely to consolidate around 25,000 levels. Q2 earnings will be weak except in IT, banking and pockets of autos."

Views By: Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services ![]()

Stock Market LIVE Updates: 'Domestic flows to support market but elevated valuations will cap upside'

Stock Market LIVE Updates: "The main force behind the ongoing global rally in stocks has been the steadily climbing US market. The fact that S&P 500 made 46 new highs this year indicates the strength of this bull market led by the US. The rally has the fundamental support of a strong US economy and decent corporate earnings growth. Even though the Middle East geopolitics has been a dampener, it didn’t spike crude prices and therefore, there is no threat to inflation which remains under control allowing the Fed to cut rates. The consensus now is the soft landing scenario for the US economy and, this is the strong support to this bull market.

In India the main driver of the bull run has been the sustained domestic flows into the market which has been absorbing all the selling by FIIs. The domestic flows will continue to support the market but elevated valuations will put a cap on the upside. Nifty is likely to consolidate around 25,000 levels. Q2 earnings will be weak except in IT, banking and pockets of autos."

Views By: Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services

8:56 AM

Godrej Properties today announced that it has emerged as the highest bidder to develop a group housing project at a premium location in Sector 5-A, Kharghar, according to e-auction portal of City and Industrial Development Corporation of Maharashtra (CIDCO).

The plots, measuring 6.54 acres, will offer a development potential of around 2 million square feet, comprising premium residential apartments of varied configurations, with an estimated combined revenue potential of approximately Rs 3,500 crore. ![]()

Stock Market LIVE Updates: Godrej Prop to develop group housing project with revenue potential of Rs 3,500 cr

Stock Market LIVE Updates: The land parcels located in Kharghar will have a combined revenue potential of ~ INR 3,500 crore*

Godrej Properties today announced that it has emerged as the highest bidder to develop a group housing project at a premium location in Sector 5-A, Kharghar, according to e-auction portal of City and Industrial Development Corporation of Maharashtra (CIDCO).

The plots, measuring 6.54 acres, will offer a development potential of around 2 million square feet, comprising premium residential apartments of varied configurations, with an estimated combined revenue potential of approximately Rs 3,500 crore.

8:53 AM

The company, in an exchange filing, said, "The share subscription agreements are being executed at a pre-money equity value of $1.65 billion, delivering to Strides’ shareholders an embedded value of Rs 663 per share of Strides’ holding in OneSource, representing an approximately 82 per cent premium over the previous embedded value of Rs 364 per share as per the Scheme of Arrangement announced earlier in September’23."

On September 25, Strides had announced the creation of OneSource by integrating Stelis’ Biologics CDMO, SteriScience's Complex Injectables, and Strides' Soft Gelatine businesses in a single entity by way of Scheme of Arrangement. As part of the Scheme, Strides shareholders are to receive 1 share of OneSource for every 2 shares of Strides (Swap Ratio of 1:2). ![]()

Stock Market LIVE Updates: Strides Pharma's OneSource gets equity commitments of Rs 801 crore

Stock Market LIVE Updates: Strides Pharma Science today announced that its associate company, OneSource Specialty Pharma (formerly known as Stelis Biopharma), the group’s specialty pharma CDMO, has received confirmed commitments for fundraising of Rs 801 crore (around $ 95 mn) from marquee domestic and foreign institutional investors and family offices, in the pre-listing round.

The company, in an exchange filing, said, "The share subscription agreements are being executed at a pre-money equity value of $1.65 billion, delivering to Strides’ shareholders an embedded value of Rs 663 per share of Strides’ holding in OneSource, representing an approximately 82 per cent premium over the previous embedded value of Rs 364 per share as per the Scheme of Arrangement announced earlier in September’23."

On September 25, Strides had announced the creation of OneSource by integrating Stelis’ Biologics CDMO, SteriScience's Complex Injectables, and Strides' Soft Gelatine businesses in a single entity by way of Scheme of Arrangement. As part of the Scheme, Strides shareholders are to receive 1 share of OneSource for every 2 shares of Strides (Swap Ratio of 1:2).

8:42 AM ![]()

Stock Market LIVE Updates: Canada minister assures businesses to support commercial ties with India

Stock Market LIVE Updates: Amidst unprecedented diplomatic row between India and Canada, Canadian Trade Minister Mary Ng on Tuesday sought to assure the country's business community that she is committed to supporting the well-established commercial ties between the two countries.

I want to reassure our business community that our government remains fully committed to supporting the well-established commercial ties between Canada and India, Ng, the minister of export promotion, international trade and economic development, said in a statement. READ MORE

Topics : MARKETS LIVE MARKET LIVE MARKETS TODAY stock market trading Markets Sensex Nifty S&P BSE Sensex share market global stock market Global stock markets Indian stock market Indian stock markets US markets Asian markets Asia Markets Nifty50 Nifty 50 NSE Nifty Chinese stock market

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 16 2024 | 7:57 AM IST