- News

- City News

- Hyderabad News

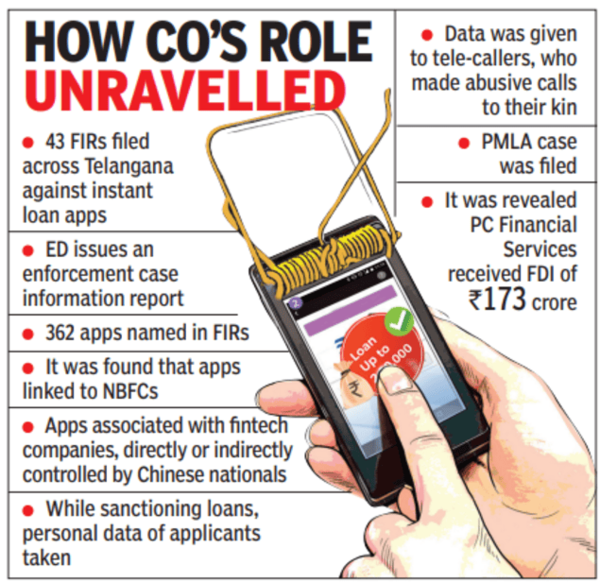

- NBFC fined Rs 2000 crore for running loan app with Chinese links

Trending

NBFC fined Rs 2000 crore for running loan app with Chinese links

The Enforcement Directorate fined PC Financial Services Private Limited, tied to Chinese and Norwegian entities, Rs 2,146 crore for FEMA violations. The investigation revealed fraudulent remittances and unauthorized charges, leading to the revocation of its NBFC certification and confiscation of properties worth Rs 252 crore.

This is the first such instance of an NBFC running a loan app being penalised with a huge fine in the country.

The adjudication proceedings concluded on Oct 7 with ED's adjudicating authority ordering confiscation of PCFS's properties worth 252 crore in India.

An ED official said: "After carefully examining alleged violations levelled against the notices and their written submissions made during personal hearings, it has been found that alleged FEMA violations have been clearly proved."

PCFS, a subsidiary of Norway's Opera Group, came under scrutiny after ED Hyderabad unit's investigation revealed that the company, allegedly under the control of Chinese owners, was involved in lending money to people in India through its mobile app ‘CashBean'. The investigation found that PCFS had made remittances of 429 crore to related overseas group companies under the guise of importing software licences and services, which were found to be fraudulent.

The investigation culminated in seizure of various properties of PCFS held in India, totaling 252 crore, in terms of three seizure orders passed during 2021. The seizure orders were confirmed by the competent authority in Feb 2022, against which PCFS filed an appeal before the appellate forum.

RBI in Feb two years ago said: "PCFS was found to be charging usurious rates of interest and other charges to its borrowers apart from indulging in unauthorised use of logos of RBI and CBI for recovery from the borrowers in violation of the fair practices code." RBI cancelled the certificate of registration of PCFS and debarred it from acting as an NBFC.

End of Article

FOLLOW US ON SOCIAL MEDIA