Spottoday: The Ultimate Digital Platform for Entertainment, Lifestyle, and News by WideEyes Digital

Meet 'Spider Woman', who climbed 108-meter cliff without safety gears, she lives in...

Beyond the Headlines: The Hidden Missile Race Between Israel and Iran

Ratan Tata's TCS to set up new IT facility for 10000 employees in...

Haryana Election Result: Congress demands probe into complaints of 'discrepancies' in EVMs

IAS Tina Dabi raids Rajasthan spa centre under suspicion of...

Azim Premji to support THIS college with Rs 5000000000 grant to set up new...

Delhi CM Atishi’s belongings thrown out from official residence, claims AAP

Manoj Punamiya Marking Milestones In India’s Real Estate Future

How an SIP calculator can help you reach your financial goals faster

Tips on Festive Eye and Lip Makeup Using High-Quality Products

Ratan Tata in critical condition, under intensive care in Mumbai hospital: Report

Mukesh Ambani once spent Rs 10000000 on his car only to get it...

Major setback for New Zealand as star player set to miss start of Test series against India

This train suffered Rs 6 crore loss since its launch, has 200-250 seats vacant daily, it runs from…

'Some ants are...': Harbhajan Singh's cryptic post leaves internet confused

Mastering the Art of Digital Transformation: The Journey of Rahul Saoji

This Apple watch feature saves woman's life, know how it happened

The Innovator's Journey: Ashok Choppadandi's Quest for Technological Excellence

Vedaa OTT release date: When, where to watch John Abraham, Sharvari-starrer action thriller

Hyundai Motor India Rs 27870 crore IPO: Check price band, subscription date and other details

Bhanu Devaguptapu: Navigating the future of health tech and enterprise solutions

Nobel Prize 2024 in Chemistry goes to David Baker, Demis Hassabis, John M Jumper

Breaking the Mold: BHP is Revolutionizing the Supercar Experience

Transforming Test Automation: Narendra Kumar Ale’s Innovative Approach to Integrating AI and ML

This man resigns on first day after joining office, says, 'repeated remarks about my…'

'It’s all about making that unique difference,' says director Ryan Shah

Meet IIT graduate who has joined Ratan Tata's company, to play key role in advancing...

Bigg Boss 18: Meet most educated contestant in Salman Khan's show; was threatened, attacked, jailed

Bigg Boss 18 Grand Premiere: PETA asks Salman Khan to surrender donkey

When Bigg Boss 18's Shilpa Shirodkar made a bold statement in support of sexy dance numbers

Video of leopard trying to enter safari bus after leaping through window goes viral, watch

'October 7 will never happen again': Israel Foreign Ministry vows to 'hunt' every terrorist

Malayalam actor T P Madhavan passes away at 88

Bangladesh Skipper Shanto takes a dig at India speedster Mayank Yadav ahead of 2nd T20i

EPFO to introduce instant SMS alerts to safeguard PF deposits from fraud

RG Kar case: CBI cites blood stain, DNA report as evidence in chargesheet against accused Sanjay Roy

Nagarjuna records statement in Rs 100 crore defamation case against Konda Surekha

Indian man swims 'butt naked' for two hours in Google Maps untraced Australian waterbody

Good news for UPI users as RBI increases UPI Lite wallet limit to Rs...

Mukesh Ambani's Jio offers mega plan, 2GB data per day, unlimited calls at just Rs...

Teacher faces backlash for giving extra marks to students for THIS reason

Woman in wedding dress rides sports bike viral video divides social media

PM Modi launches all-out attack on Congress, calls it 'parasitic party that...'

Baden Bower's PR Services drive EB1A visa success through high-impact publications

Vada Pav vendor claims to earn Rs 2.8 lakh monthly, social media says time to switch careers; watch

Top 10 Indian cities for UPSC preparation

A sweet revenge: BJP orders 1 kg 'Jalebi' for Rahul Gandhi, Congress workers after mega Haryana win

Influencer PERFECTLY copies Deepika Padukone's Singham Again accent, video goes viral

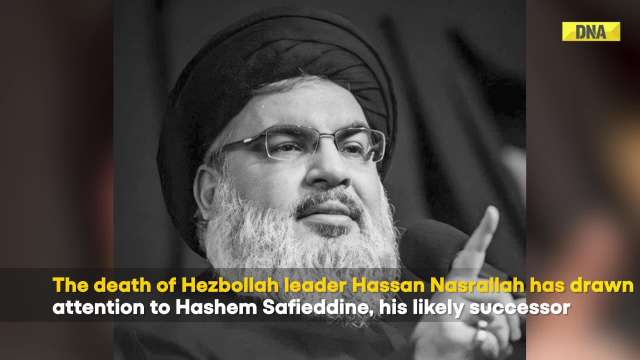

'Fate like Gaza': Israeli PM Netanyahu issues dire warning to Lebanon as Hezbollah continues firing

Omar Abdullah's BIG statement after winning J-K assembly polls, says 'whoever becomes CM...'

Not Anant Ambani but Mark Zuckerberg attended this wedding in India for the first time

'Kha gaye na dhokha'? This metro-themed Durga Puja Pandal is talk of the town! WATCH viral video

Meet man, who quit studies after school, learnt coding, established company worth Rs...

Bigg Boss 18 contestants Vivian Dsena, Chahat Pandey get into UGLY fight, watch video

Shares of this Mukesh Ambani company surged by 12000% in 60 months, market cap rose to...

RG Kar rape-murder case: Doctor’s association to hold nationwide hunger strike today

IND vs BAN, 2nd T20I Dream11 prediction: Fantasy cricket tips for India vs Bangladesh

- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

How an SIP calculator can help you reach your financial goals faster

Planning to invest in mutual funds but want a structured approach that allows you to contribute each month automatically? Many investors prefer the simplicity of a disciplined investing strategy where they don't have to manually pick investments every time to earn good returns.

TRENDING NOW

A Systematic Investment Plan (SIP) offers that much-needed structure and helps you to build wealth steadily over time. The growing popularity of SIPs is highlighted by the surge in the number of SIP accounts, which reached a record 9.61 crore in August 2024, up from 9.33 crore in July.

But how do you determine if your SIP contributions are sufficient to meet your future goals? That is where an SIP calculator helps. This free online tool removes the guesswork and helps you map out your SIP strategy with more clarity.

Understanding the SIP calculator

An SIP calculator is an automated tool through which you estimate the future returns of your SIP investments. In simple words, you can gauge how much wealth you can accumulate by making fixed regular investments in mutual fund schemes.

The tool asks for only three basic details:

- The target amount you plan to achieve (₹50 lakh, ₹1 crore, etc.)

- The expected annual return rate

- The investment horizon (the duration for which you plan to invest through SIPs)

Once you enter these details, the SIP calculator computes the monthly investment required to achieve your goal.

Aligning SIPs with financial goals

Financial goals are diverse and can include buying a new property, funding your children's education, buying a luxurious car, or even building a retirement fund. SIP is versatile in nature and can be customised to meet different financial objectives.

To start, assess your goals and categorise them as short-term (less than 3 years), medium-term (3-5 years), or long-term (more than 5 years). This categorisation helps in picking the schemes that align with the tenure and risk associated with each goal.

For example, equity mutual funds could be ideal for long-term goals due to their ability to deliver higher returns, whereas debt funds or hybrid funds might be better for short or mid-term targets due to their stability.

After you finalise the goal, an SIP calculator comes into play. It gives you an estimate of how much needs to be contributed every month to meet your target. For example, if you want to create a corpus of ₹1 crore over 20 years (assuming a 12% return rate p.a.), the calculator may suggest investing about ₹10,109 every month. For ₹1 crore for 15 years, you can expect the contributions to come around ₹19,819 per month.

Maximising returns with an SIP calculator

By investing regularly over time, your returns start earning additional returns, and the longer you stay invested, the higher your total gains become. However, knowing how to optimise this compounding effect is where an SIP mutual fund calculator becomes useful.

You can use the tool to visualise different scenarios, like adjusting the duration or monthly contributions, and see how small tweaks affect your final corpus. This insight helps you align your SIP investments with your goals more precisely.

Common mistakes to avoid

Look at the 4 common mistakes to avoid when using an SIP calculator to plan your investments:

1. Not reviewing the tenure: Many investors either underestimate or overestimate the period needed to reach their goals. The investment duration you enter in the SIP calculator should reflect your actual time frame for achieving your targets. Generally, the longer tenures yield better outcomes.

2. Misjudging monthly contributions: Entering unrealistic monthly investment amounts can distort the outcome and complicate your financial planning. The sum you plan to invest in SIP mutual funds should be within your current financial capacity.

3. Using unrealistic rates: Focus on both current market trends and the past performance of chosen mutual funds when estimating rates. By doing so, you can align your expectations with achievable targets. For example, realistic rates, such as 10-12% for equity funds, can offer a more accurate estimation of future returns.

4. Ignoring external factors: An SIP calculator only factors in your investment amount, tenure, and expected rate. It doesn't consider taxation, inflation, or market volatility. Therefore, besides relying on the tool’s estimates, also consider other external factors to make your mutual fund investment plan more accurate and realistic.

Tips for optimising SIP investments

To optimise your SIP investments, consider these tips:

Start early: The sooner you begin, the longer your hard-earned money gets to compound, which means larger returns. So, start investing as early as possible, even if you begin with ₹500 initially.

Be goal-specific: Link every financial goal to an SIP in the appropriate mutual fund. For example, a small-cap fund may be suitable if you are seeking high growth and can tolerate higher risk, whereas a large-cap fund is better if you prioritise stability. Use an SIP calculator to allocate the right amount for each goal.

Increase contributions: As your financial capacity improves, you can step up your SIP on a percentage basis. This strategy can help you reach your goals faster and accumulate a larger corpus over time.

Diversify: It’s not wise to rely on a single asset class or fund type. Invest across different types of mutual fund schemes to offset risk and improve returns over the long term.

Stay disciplined: Markets fluctuate, but the real advantage of an SIP is rupee-cost averaging. By investing consistently, regardless of market highs or lows, you buy more units when prices are low and fewer when they are high. This strategy equalises your unit expenses and reduces the impact of market fluctuations on your portfolio.

Ending note

Reaching financial goals can sometimes feel difficult, but tools like the SIP calculator make it easier to plan and execute. With just basic details, you can figure out how much to invest through SIPs and how long it will take to meet your targets. It helps you experiment with multiple scenarios and make calculated tweaks to improve your SIP strategy. Simply put, this free online tool gives you the direction needed to stay disciplined and meet your goals.

Start your SIP journey today and use the SIP calculator to boost your investment outcomes!

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)