Posts: 1,600 +47

The big picture: As TSMC and other semiconductor manufacturers prepare to transition toward bleeding-edge 2nm transistors, more reports regarding the Taiwanese giant's plans have emerged. Although unconfirmed, claims of higher prices would align with prior analysis and the company's trends from recent years.

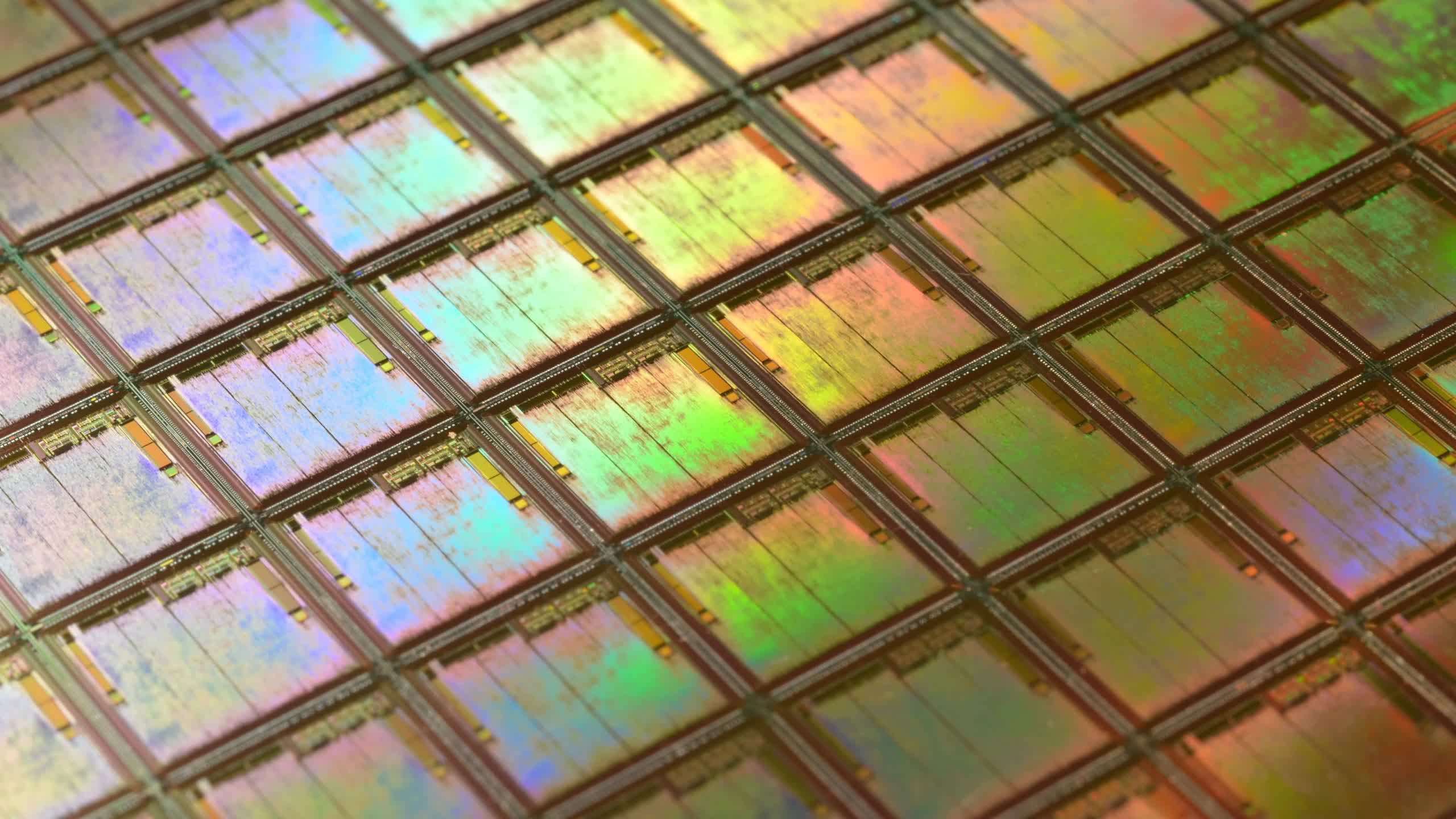

Semiconductor industry sources recently told the Taiwan-based Commercial Times that TSMC plans to charge over $30,000 for wafers built on its upcoming 2nm N2 process node. The move would continue the price increases that have escalated for a decade.

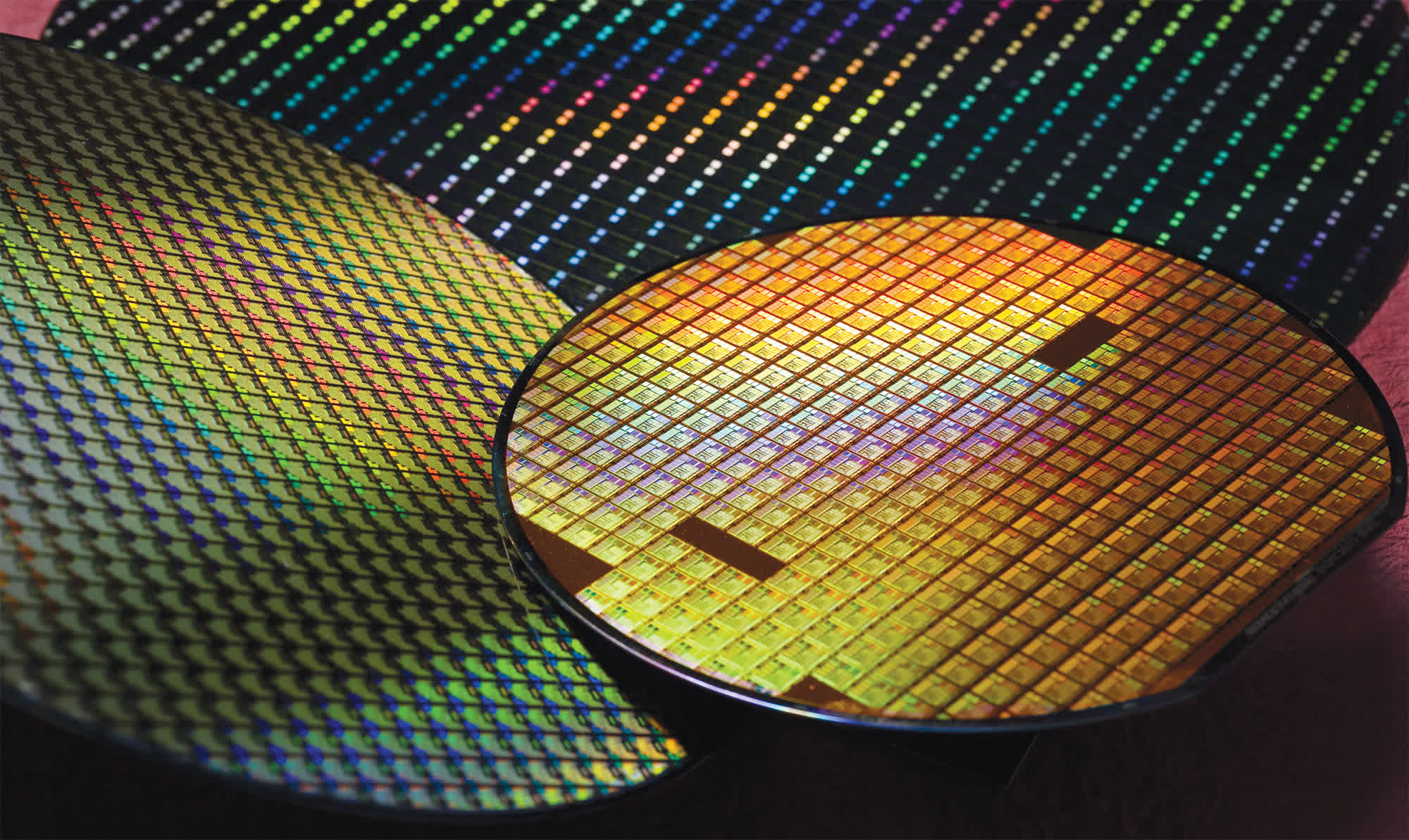

The reason behind the hike is unsurprising. Manufacturing 2nm semiconductors is expected to be more complex and precise than the 3nm wafers that currently represent the cutting edge. The rising costs account for software, manpower, and increased reliance on expensive EUV lithography. However, an AI-assisted design process is expected to soften the blow.

If the reports prove accurate, they would support last year's analysis from consulting firm IBS. The group estimated that building a 2nm semiconductor manufacturing plant that produces 50,000 wafers per month would cost around $28 billion. That's about $8 billion more than a 3nm fab. Furthermore, the estimated per-wafer cost presents a 50 percent increase over 3nm and a doubling over 4 or 5nm.

Although prices will vary among TSMC's clients, they have come a long way from 2014's roughly $3,000 28nm transistors. In response to the trend, some have noted that, in some respects, the cost per transistor has stagnated since 28nm, effectively freezing the cost aspect of Moore's Law and driving the prices of advanced computer chips upwards.

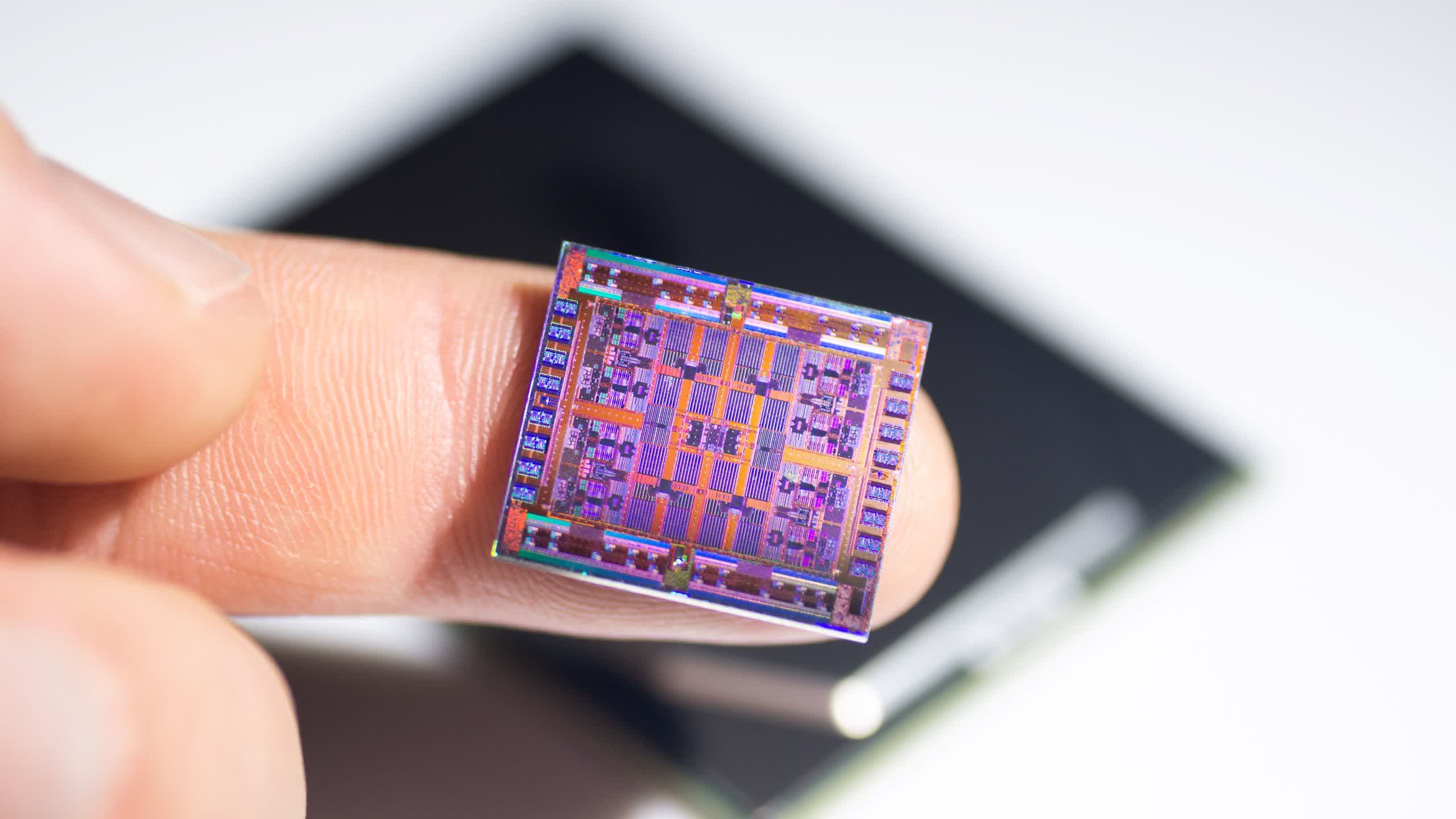

With nanosheet gate-all-around transistors and other innovations, N2 promises a 25-to-30 percent reduction in power consumption compared to 3nm, a 10-to-15 percent performance boost, and roughly 15 percent more transistor density. TSMC plans to begin mass-producing N2 in the second half of 2025. Apple has reportedly claimed all of TSMC's initial 2nm supply, which is expected to power the iPhone 17 Pro.

Samsung, Intel, and Japanese firm Rapidus have similar semiconductor manufacturing plans but are unlikely to exert market pressure on TSMC. Samsung is seeing yields below 20 percent, putting the company far behind TSMC.

Meanwhile, Intel recently canceled its 20A (2nm) node – originally planned for this year – and will introduce an 18A process next year instead. The company will also use transistors from competitor TSMC for its latest generation of CPUs. Rapidus, collaborating with IBM, aims to introduce its 2nm process next year but won't begin mass production before 2027.