Posts: 470 +2

What just happened? Intel is canceling its 20A process node for Foundry customers and reallocating resources to the 18A node, which is scheduled for production in 2025. The company also stated that it will transfer the majority of Arrow Lake production to an "external partner," believed to be TSMC.

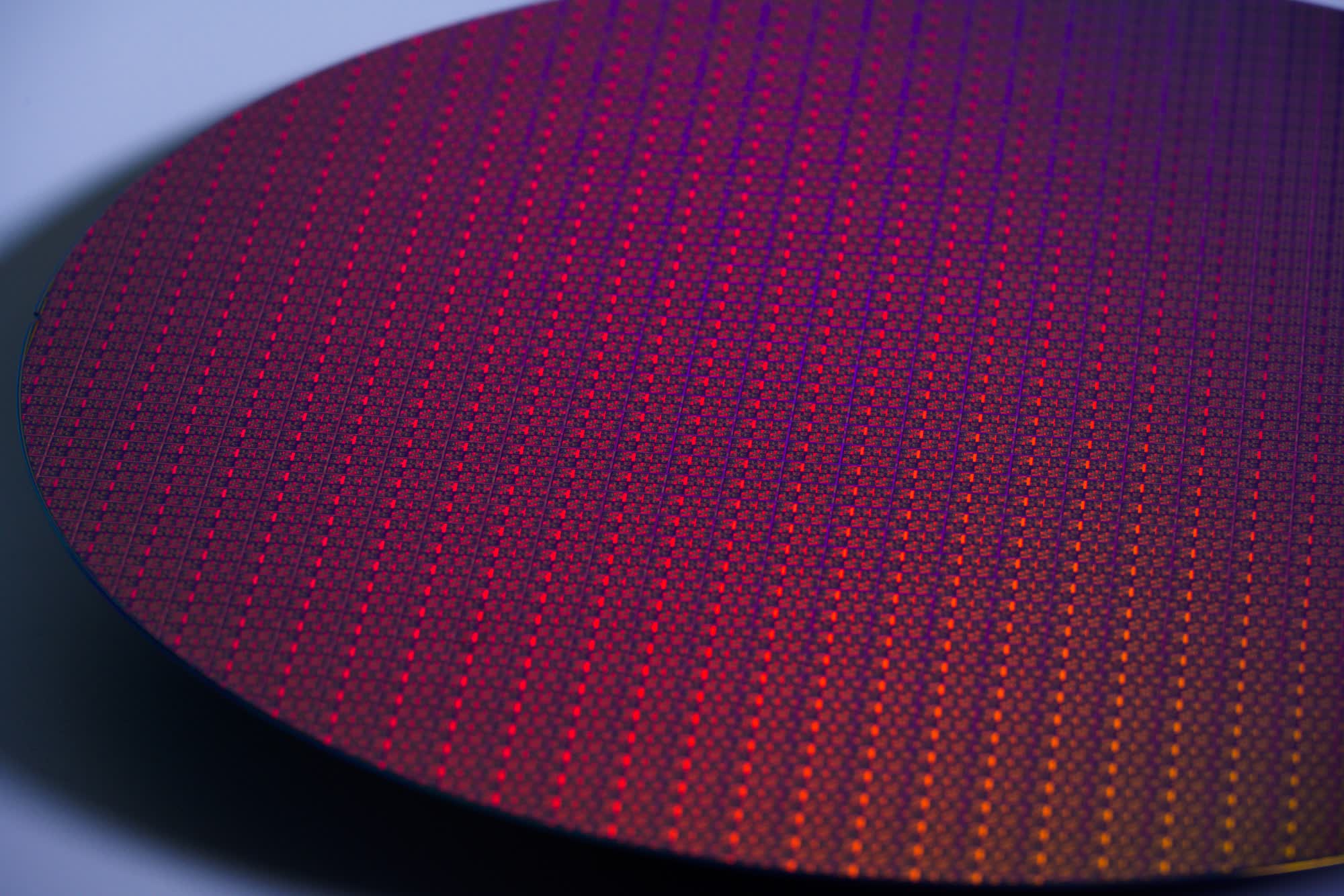

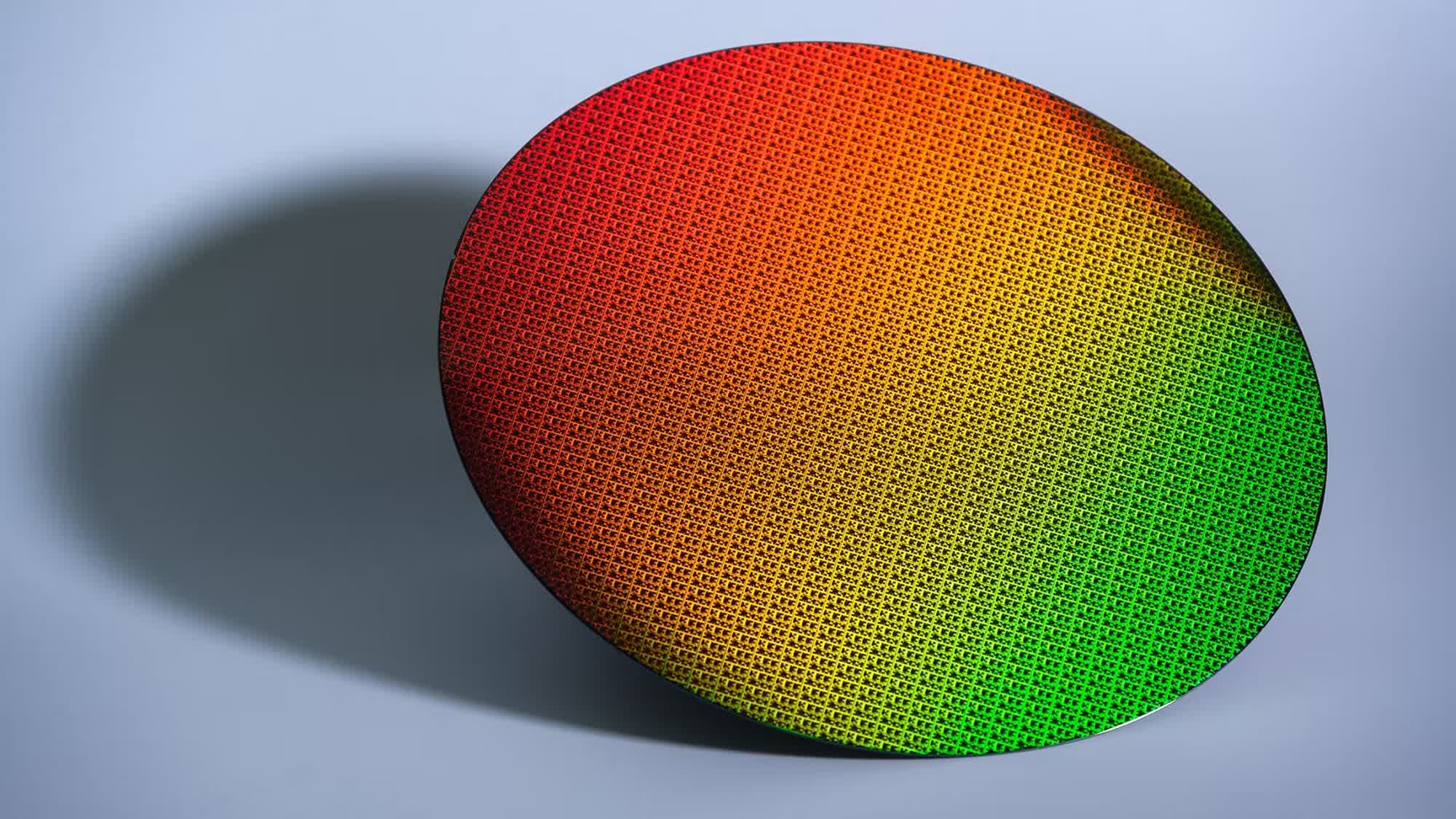

Intel noted that the lessons learned from the 20A node contributed to the success of 18A, which incorporates several techniques, materials, and transistor architectures that originally debuted with 20A. The 20A process was the first to integrate both RibbonFET gate-all-around transistor architecture and PowerVia backside power delivery technology.

RibbonFET represents Intel's first new transistor design since FinFET, while PowerVia enhances transistor performance and reduces power consumption.

Intel's 20A node, which was the foundation for Arrow Lake CPUs, was announced in 2021 by CEO Pat Gelsinger. It was intended to mark the beginning of the "Angstrom era" of semiconductors, where transistor sizes would be measured in angstroms (A) rather than nanometers (nm). Consequently, the company named its 2-nanometer chips 20A and its 1.8-nanometer chips 18A to reflect this new naming convention.

Team Blue also noted that 18A is already operational, successfully booting on operating systems and yielding positive results. According to the company, the success of 18A allowed it to shift engineering resources from 20A earlier than anticipated. Intel also claimed that despite the cancellation of 20A, it is still on track to meet its goal of delivering five nodes in four years.

Intel may be optimistic about its 18A node, but a recent Reuters report suggests that it is far from production-ready. Sources quoted by the agency indicated that Broadcom found the initial production run of 18A wafers to be highly unimpressive after extensive testing on its internal systems, including AI accelerators and networking switches.

In a statement to Reuters, an Intel spokesperson reiterated that 18A is delivering good yields and is on track to enter production next year. However, the spokesperson declined to comment on whether Broadcom's partnership with Intel remains intact despite the disappointing 18A tests or if the company is considering withdrawing from a potential manufacturing deal. For its part, Broadcom stated that it is still "evaluating the product and service offerings of Intel Foundry" and has not yet made a final decision.

Intel cancels 20A process node for Arrow Lake, shifts focus to 18A