China Should Explain Growing Anomaly in Trade Numbers, US Says

(Bloomberg) --

Most Read from Bloomberg

CDK Tells Car Dealers Their Systems Will Likely Be Down for Days

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

At Blackstone's $339 Billion Property Arm, the Honeymoon Is Over

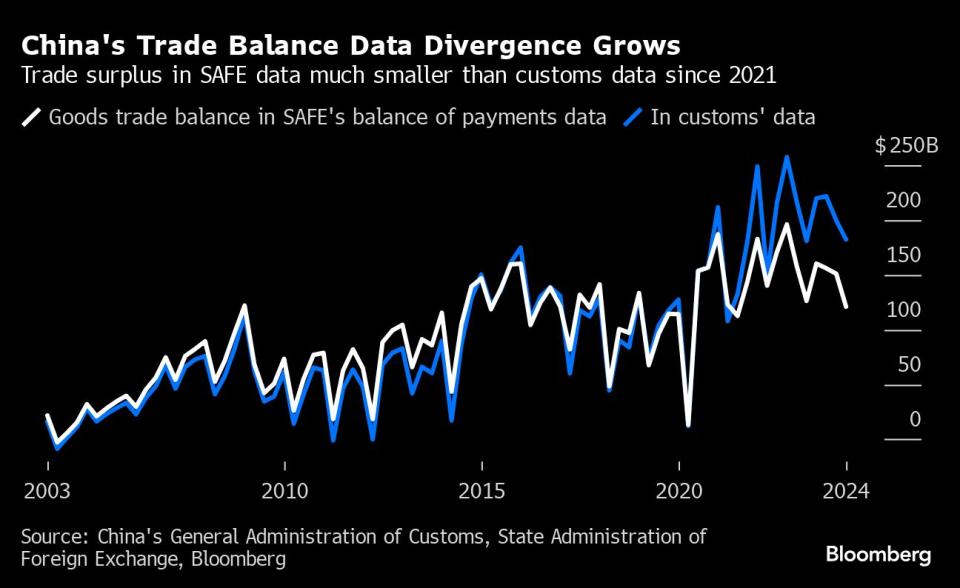

Chinese customs data suggest the country is running a trade surplus that’s much bigger than the one reported in its balance of payments, and Beijing should clarify why the numbers are different, the US Treasury said.

The surplus according to the customs figures was almost $230 billion bigger in 2023 than the one reported by the State Administration of Foreign Exchange, the Treasury said in its semiannual foreign-exchange report on Thursday. The average gap between the two datasets since 2000 has been just $7 billion, it said.

The growing discrepancy has drawn attention from various economists and international organizations in recent years. The true size of the surplus is a key question right now because Beijing is relying on foreign trade to drive growth, after a housing bust lowered consumption at home — raising objections from trade partners who say their markets are getting swamped by Chinese exports.

The difference between the two sets of numbers in 2023 was equivalent to more than 1% of China’s gross domestic product.

A year earlier, the SAFE attributed some of the gap to increased use by multinational companies of a special type of free trade zone, where they outsource the manufacture of goods to Chinese firms. But the Treasury said it’s “not clear what trends would drive these differences to expand over the last three years,” and called on China to provide further quantitative evidence to clarify it.

The International Monetary Fund has also been monitoring the issue “closely” since last year, an official said during a May press briefing. It’s due to address the matter in a forthcoming report.

The numbers diverge because customs data is based on physical movement of goods across borders, while the SAFE figures cover transactions between residents and non-residents when ownership changes hands, according to Sonali Jain-Chandra, IMF mission chief for China. She said such gaps exist in other countries too, but didn’t explain why in China’s case it suddenly began to widen after 2021.

The SAFE report gave examples. If goods owned by a foreign company are warehoused in a so-called comprehensive bonded zone, for instance, and then sent to an overseas company in another country, this would count as an export in the customs data. But because the ownership change is between two foreign entities, it’s not included in SAFE’s balance-of-payments numbers.

The comprehensive foreign bonded zones, which have special tariff privileges, accounted for some 15% of China’s goods trade in 2023, almost doubling from five years earlier, according to a report in the state-run People’s Daily.

Another anomaly highlighted by the Treasury is that China reported a decline in investment income from abroad in both 2022 and 2023 — even though in that period there was a sharp rise in interest rates in most advanced economies, and there was no apparent drop in the interest-bearing foreign assets held by Chinese residents. That also had the effect of lowering China’s reported current-account surplus, the Treasury said.

--With assistance from James Mayger.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.