Qantas to pay €74m to settle ticket scandal that saw Alan Joyce quit

Lawsuit brought over sale of tickets for flights that had been cancelled

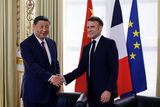

Alan Joyce, ex-CEO at Qantas

Australia’s Qantas Airways has agreed to pay A$120m (€74m) to settle a regulator lawsuit over the sale of thousands of tickets on already cancelled flights, in an attempt to end a reputational crisis that has engulfed the airline.

The scandal effectively brought an end to the 15-year tenure of Alan Joyce as CEO of Qantas. The Dublin native stepped down last September, two months earlier than planned, due to the furore in Australia over the ticket scandal.

Qantas will now split A$20m among more than 86,000 customers who booked tickets on the so-called “ghost flights” and pay a A$100m fine, instead of defending the lawsuit it had previously vowed to fight, the airline and the Australian Competition and Consumer Commission (ACCC) announced yesterday.

The fine is the biggest for an Australian airline and among the largest globally in the sector, although some Australian banks and casino operators have faced higher penalties for breaches of the law.

“We recognise Qantas let down customers and fell short of our own standards,” CEO Vanessa Hudson said in a statement. Ms Hudson became the first woman to lead the airline when she succeeded Mr Joyce last year.

The settlement “means we can compensate affected customers much sooner than if the case had continued in the Federal Court”, added Ms Hudson.

If the court approves it, the settlement will resolve a dispute that had featured prominently at a time when Qantas’s brand value tanked in consumer surveys amid a spike in complaints about cancellations.

After the ACCC filed its lawsuit last August, Mr Joyce brought forward his retirement. He had led the airline through the 2008 financial crisis and the pandemic.

“This penalty... will send a strong deterrence message to other companies,” said ACCC chair Gina Cass-Gottlieb.

The payout, however, would pale against the A$1.47bn net profit that analysts on average forecast Qantas to report in the year to end-June, according to LSEG data. People who bought tickets on non-existent domestic flights would get A$225 and people with international fares would get A$450, on top of a refund, the airline and regulator said.

Qantas shares were flat in late trading, against a 0.6pc gain in the broader Australian market.

“We see today’s outcome as incremental positive, removing another post-Covid brand and valuation overhang from the stock,” RBC Capital Markets analyst Owen Birrell said in a client note.

Qantas is waiting to learn how much it must pay nearly 1,700 ground handling staff it sacked in 2020 after a court found the job cuts were illegal since they were intended to stop industrial action.

The ACCC lawsuit centred on the months after Australia’s border reopened in 2022 following two years of Covid restrictions, and airline cancellations and lost-luggage complaints spiked globally amid staffing shortages.

Qantas had argued it faced similar challenges to airlines around the world, but the ACCC said its actions broke consumer law.

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news