Commentary

Is Social Now The Largest Ad Channel -- Depends On Who You Talk To

I miss the days when McCann-Erickson’s Bob Coen was the default – if not the sole – ad industry bean-counter. It made life easier for an advertising trade journalist trying to understand -- and bucket -- shares of ad spending by medium.

While I didn’t always agree with the late Coen’s categorizations, at least they were an industry standard for benchmarking the ebb and flow of ad demand by medium.

Fast-forward to today, and four of the major holding companies -- Dentsu, Publicis’ Zenith, WPP’s GroupM, and Coen’s descendants at IPG Mediabrands’ Magna -- each have their own way of categorizing and calculating things.

Then add in a variety of third parties ranging from financial-sector analysts, to pure-play ad industry researchers like PQ Media, Brian Wieser’s Madison and Wall and Ascential plc’s WARC, and you’ve got quite a varied mix of apples and oranges.

advertisement

advertisement

That's one of the reasons MediaPost periodically publishes an industry composite of Madison Avenue's Big 4 forecasting units based on percent changes, but not absolute totals by medium.

Because, well, there is no consensus on many of the medium line items calculated in their totals.

I mean, what else can an ad-trade journalist -- much less a practicing media planner or buyer -- do? Well, if you receive a press release, as I did this morning, touting the headline above, you have to drill down into it.

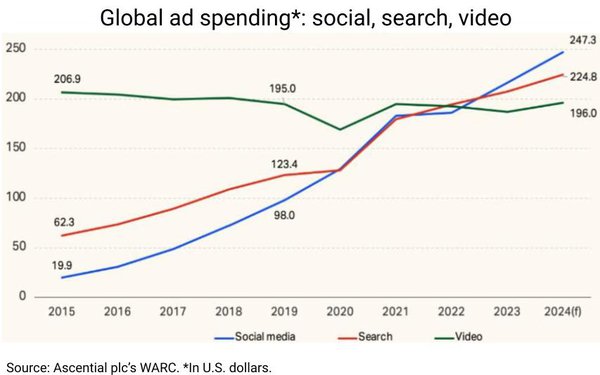

"Social media is now the largest channel worldwide by advertising investment, forecast to reach $247.3 billion in 2024," read the subject line of the press release I received this morning from WARC touting the tipping point.

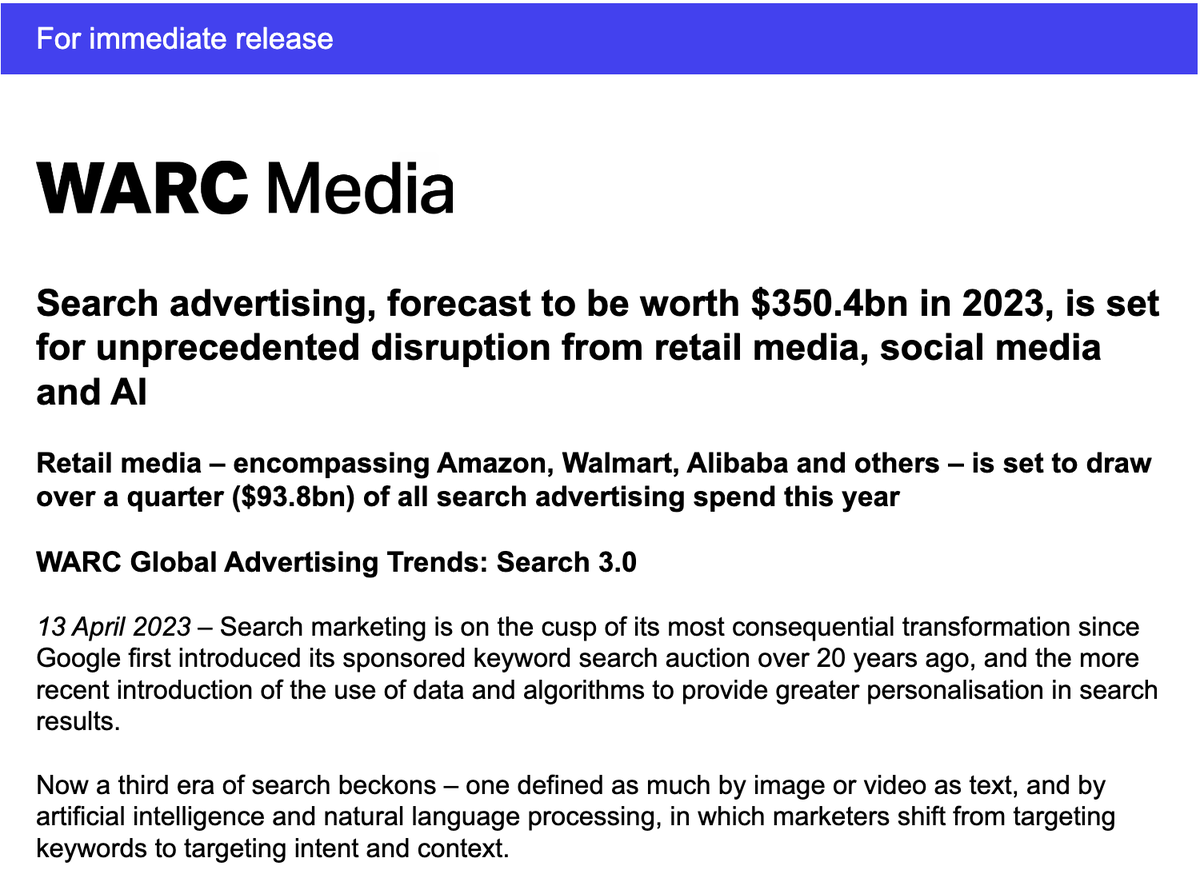

That WARC release, ironically seems to contradict one sent exactly one year ago touting that search, not social, was the largest ad channel -- by about $100 billion over social -- in the global media mix (see below).

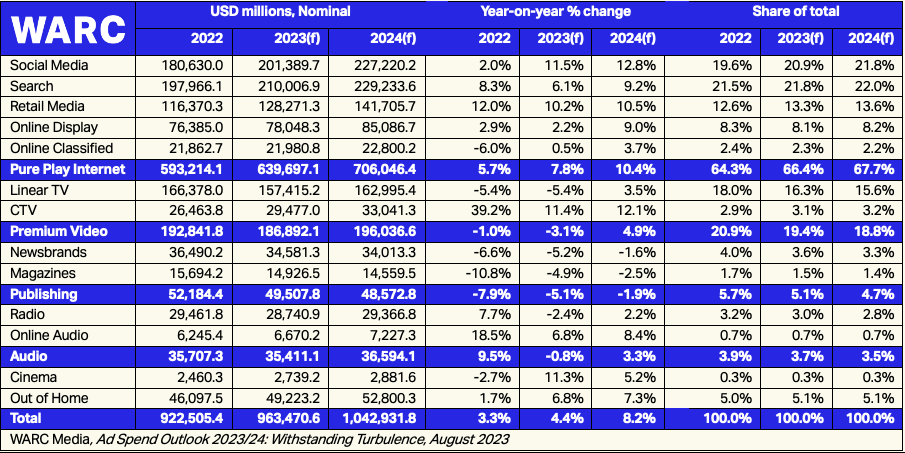

I'm not sure what led to WARC's change of heart, or calculations since last year, but it's also out of whack with an updated global forecast WARC published a couple of months later in August 2023 (see below), which still showed search -- albeit a decidedly smaller estimate for that category -- as the dominant "ad channel" vs. social. Though not by much.

“Much of social media’s success has been driven by Meta’s remarkable renaissance," WARC Head of Content Alex Brownsell states in today's social dominance release, adding, "However, social’s stronghold on budgets can also be seen in TikTok’s rise, and a return to double digit ad revenue growth at Snapchat and Pinterest."

I'll spare you the statement Brownsell issued in last year's WARC search dominance report, but you get the drift.

Look, I'm not saying things don't change in the ad forecasting biz, nor that they don't change rapidly, but I am saying it has something to do with how you categorize things. Which is why I always admired -- and tried to cover -- GroupM's now defunct "This Week, Next Week" podcast, in which former GroupM-er Wieser and current business intelligence chief Kate Scott-Dawkins, frequently opened their kimono and explained how they were rethinking and revising line items to reflect changes in the market that contributed to their underlying numbers.

By the way, I offered for MediaPost to host a re-launched version of that podcast if GroupM ever wanted to, and I'm offering the same deal to anyone else who wants to speak regularly on this topic. It need not be weekly, but we can figure out the frequency based on what makes sense.

In the meantime, I tried digging through the Big 4's most recent global ad forecasts to see if I could put an agency holding company perspective on WARC's breaking social dominance news today.

Interestingly, the only one that has discrete search and social line items published for comparison is Magna, whose most recent global forecast gives social a 22.2% share of global ad spending, a distant second to search's 35.6% share.

"Keyword Search remains the most popular ad format, approaching the $300 billion milestone this year (+9% to $298 billion)," Magna stated in December, noting, "Social media owners (e.g., Meta, Tiktok) re-accelerate (+15% to $182 billion), while short-form pure-play video platforms (e.g., Youtube, Twitch) grow by +9% to $70 billion."

So there you have it.

I miss Bob Coen.