Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

HUL shares have sank around 8.5 percent over the past six months.

Hindustan Unilever (HUL) is expected to report subdued Q4 earnings, as rural demand remained muted, dragging volume growth during the quarter.

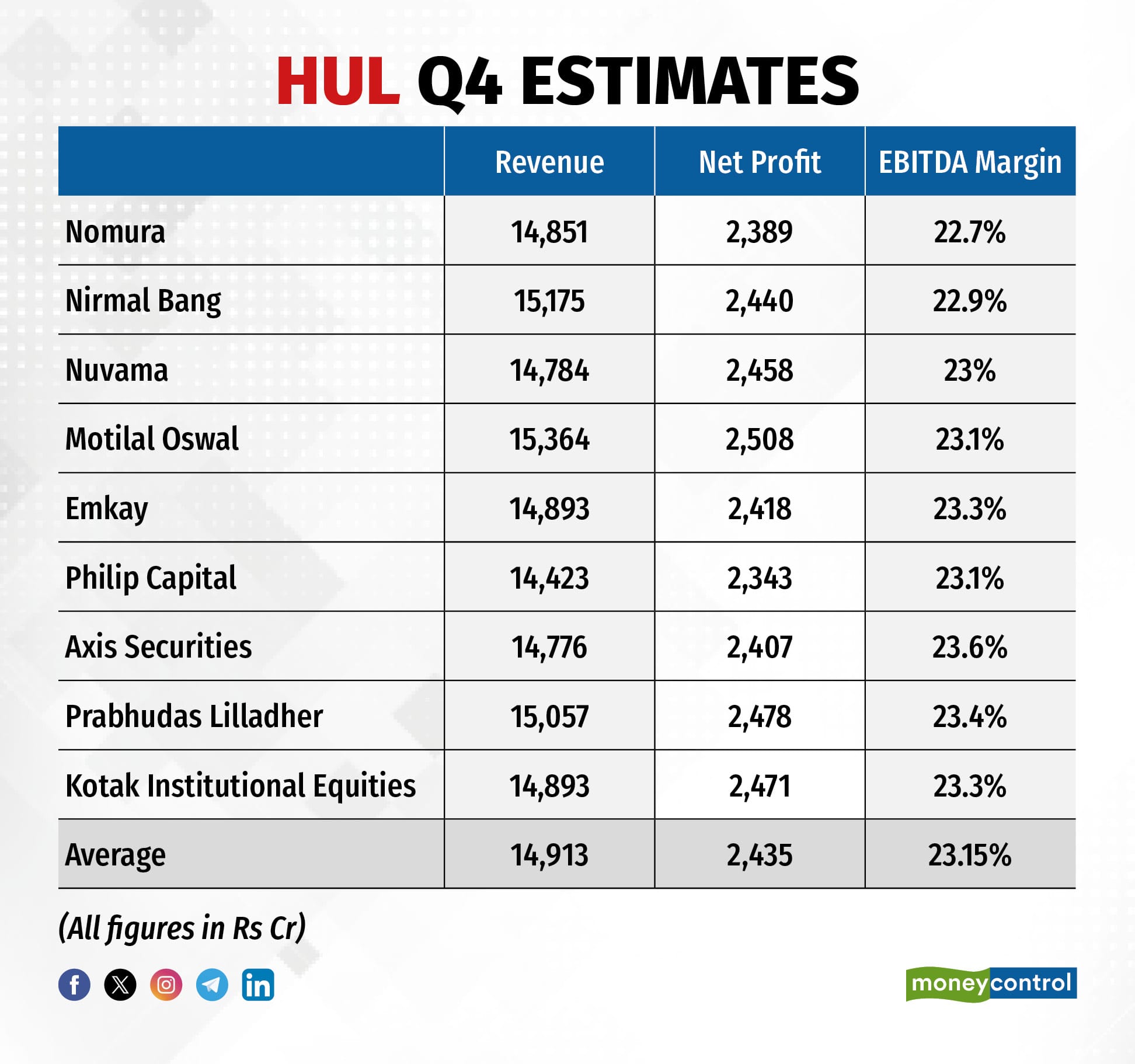

According to a Moneycontrol poll of nine brokerage estimates, the FMCG major is likely to report a revenue of Rs 14,913 crore, clocking an on-year fall of around one percent from Rs 15,053 crore in the same quarter of the previous year.

As per the poll, the consumer staples giant will see a profit of Rs 2,435 crore, down by almost four percent from the year-ago quarter.

The EBITDA margin expected to decline owing to higher royalty pay-outs, rising ad spends and lower sales growth, as per experts.

Hindustan Unilever will announce on April 24 its results for the fiscal year and fourth quarter ended March, 2024. Over the past six months, its share price has sunk around 8.5 percent. In comparison, the Nifty 50 index has gained around 15 percent during the same time period.

Rural demand, price cuts to affect volumes, topline

Many players in the FMCG space have undertaken price cuts to boost volumes and increase market share. The price cuts are expected to negatively impact topline growth.

Due to lower realisation growth and lack of a sustainable recovery in the rural sector, Hindustan Unilever is expected to see volume growth between 2.5-3 percent for the quarter. Currently, the urban sector is outpacing the rural areas.

Additionally, as a result of benign raw material costs, increased competition from unorganised, regional players, larger firms such as HUL’s volumes will be impacted.

Royalty payment, GSK deal expiration to impact margins

Nuvama Institutional Equities noted that Hindustan Unilever will see an adverse impact of 75 crore on sales for the quarter, as a result of the expiration of GSK consignment arrangement.

Hindustan Unilever and GSK Consumer decided to terminate their distribution agreement in 2022. From November 2023, HUL stopped selling GSK Consumer's products, such as Sensodyne, Crocin, Otrivin and Eno brands in India.

HUL shall also pay higher royalty payments to Unilever. HUL decided to increase its payout to parent Unilever. According to the new arrangement, the royalties will see an increase of 80 bps over a period of 3 years from 2.65 percent to 3.45 percent of the total turnover.

The first increase of 45 bps was put in effect for February to December 2023. The second increase of 25 bps was put in effect from January 2024 and will continue until December 2024. This is the first quarter to see an impact from the second hike in royalty payments, which will add pressure to the EBITDA margin.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.