Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Three themes according to Bhatia that investors should keep an eye out for are: Premiumisation, Indigenisation and Infrastructure.

Rajesh Bhatia, CIO- Equity at ITI AMC, is bullish on insurance, telecom, domestic and global pharma, power utility and power finance companies and defence.

Bhatia sees the current breadth of participation in the market as proof of the good market quality. "A high quality market like this doesn't get disrupted very easily,” he said speaking on the sidelines of a media interaction to share his outlook on the market.

“You can have corrections from time to time, but to disrupt this you will require some significant risk," he said.

Three themes according to Bhatia that investors should keep an eye out for are: Premiumisation, Indigenisation and Infrastructure.

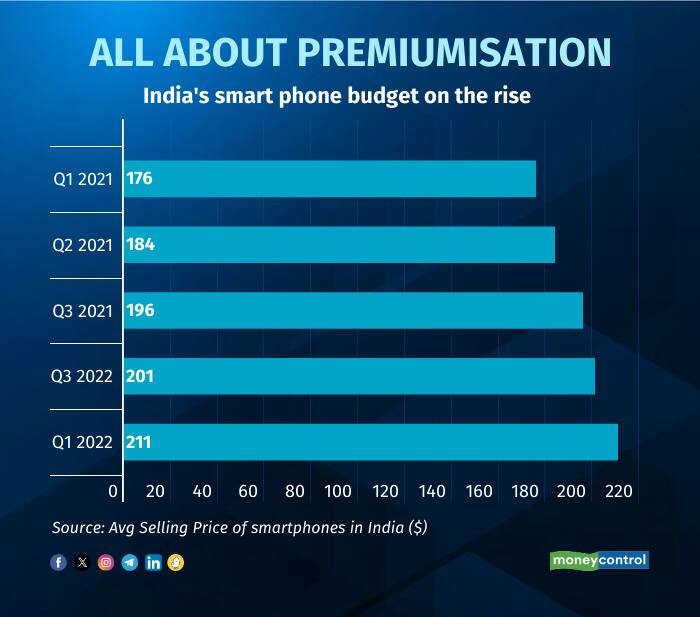

Premiumisation

As India’s economy grows and disposable incomes rise, Bhatia noted that more and more people are willing to spend on luxury products, a trend that has been gaining momentum after the pandemic. This is being driven by an increasing number of high networth individuals (HNIs) in India and growth in lifestyle products, changing the preferences in India. "As the country's economy grows, so does the appetite for upscale goods and services improve," he said.

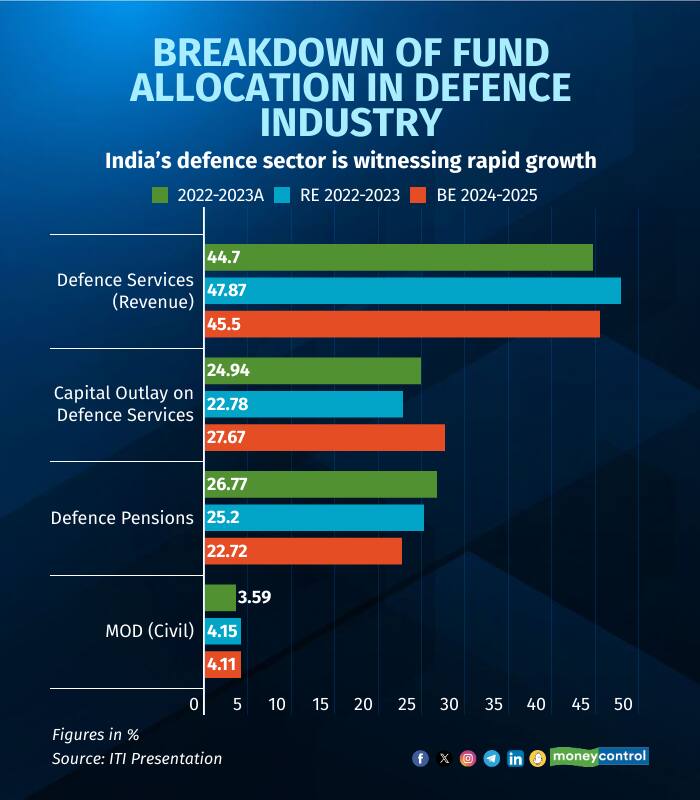

Indigenisation

The government has been focusing on Atmanirbhar Bharat, or self-reliant India, in order to promote self-sufficiency in all sectors of the economy. A key area is defence. India is currently the fourth largest spender in the defence space, but reliance on imports is high. This makes India vulnerable to supply-chain disruptions and geopolitical pressures. To address this issue, Bhatia says that the Indian government has been taking measures to support self-reliance in defence manufacturing.

"One of the primary strategies adopted is indigenisation, which is aimed at reducing India’s dependence on imports and promoting the domestic defence industry. Indigenisation efforts in the defence sector have been accelerated in the ‘Make in India’ program," Bhatia said.

While around 2,500 items have already been indigenised so far, it is expected that around 351 more components will be indigenised by the defence PSUs in the next 3 years.

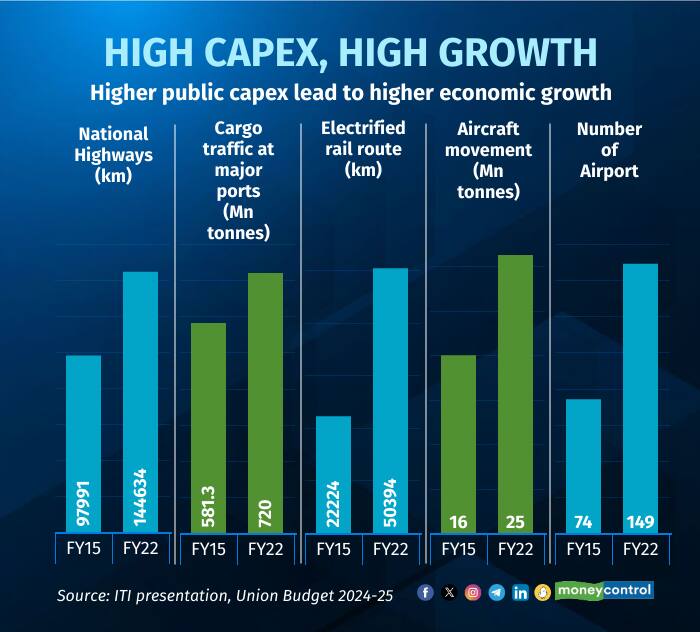

Infrastructure

According to Bhatia, higher public capex in infrastructure will lead to higher economic growth by fuelling the core sectors which are already growing. Within the infrastructure segment this growth has been noted in highways, ports, railways, airports, etc.

Bhatia noted that India will spend nearly Rs 143 lakh crore on infrastructure in seven fiscals through 2030, more than twice the Rs 67 lakh crore spent in the previous seven fiscals starting fiscal 2017, with the next phase of infrastructure development being marked by growth in the average ticket size of projects and a significant number of mega-scale projects. "Appropriate and consistent policy and regulatory interventions and focus on timely execution build an attractive case for various stakeholders to accelerate investments across infrastructure sectors," he added.

While these are expected to be the three big themes, Bhatia believes that one should also be looking at financialisation. " We see it as a very clear trend over the coming decade. The Indian household still is over-indexed in terms of the amount of savings that are going into fixed deposits, gold and physical real estate. We have seen clear trends of financialisation of savings over the last five or seven years, we can see this across the number of demat accounts being opened, and the way SIP books of mutual funds have increased, you can see it in the growth of the PMS of the AIF industry," he said, adding that the trend is still in its very early stages.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.