Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Wipro

Information technology major Wipro’s fourth-quarter earnings for the three months to March 31, 2024 will be subdued as discretionary demand is not out of the woods yet. The Bengaluru-headquartered firm will report its Q4 earnings on April 19.

Amid economic uncertainty and company-specific challenges, the Street will await management commentary on Wipro's performance.

With tepid growth, top leadership churn, including the chief executive officer (CEO), dwindling market share, and organisational reshuffle, the company is dealing with multiple issues amid a challenging demand environment.

As stakeholders await the earnings report and commentary, here are the top five themes that might play out in Q4.

Revenue

Analysts anticipate a decline in revenue year-on-year (YoY), as a challenging demand environment persists, particularly in sectors like consulting and hi-tech, brokerages said. Wipro's exposure to the BFSI (Banking, Financial Services, and Insurance) sector, which stands at over 30 percent, might affect the revenue outlook.

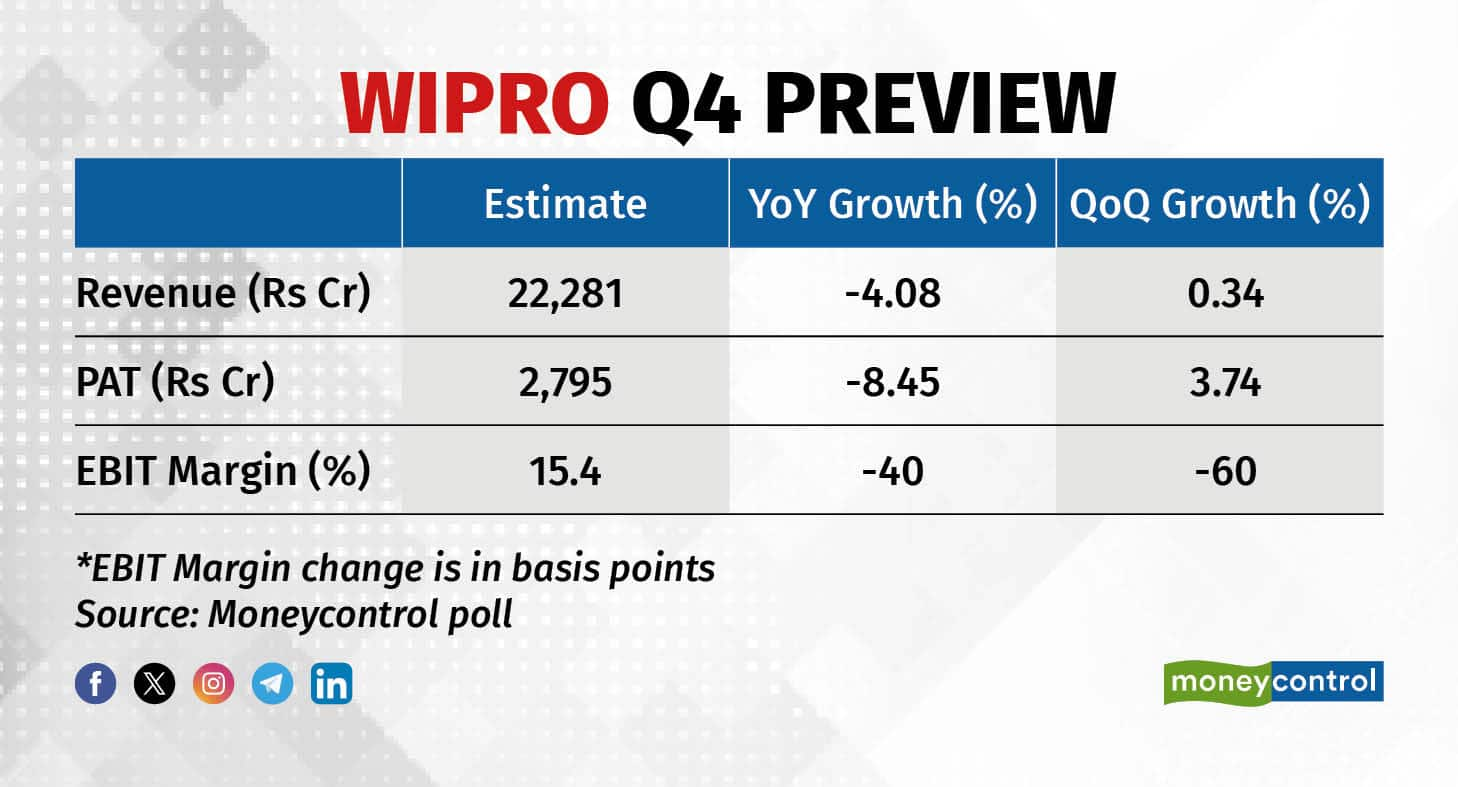

According to Moneycontrol’s average estimate from 11 brokerage houses, Wipro is expected to post a revenue of Rs 22,281 crores for Q4FY24, increasing marginally by 0.3 percent sequentially and declining over 4 percent YoY.

Nonetheless, revenue will be within the guided range of -1.5 to 0.5 percent, as projected by Wipro for Q4.

Net profit is expected to rise sequentially by 3.7 percent to Rs 2,795 crores, but decline over 8.4 percent YoY, according to an average estimate from 10 brokerage houses.

“We expect -0.2 percent constant currency revenue growth with a 25 bps (basis point) cross-currency tailwind translating into flat QoQ dollar-revenue growth for IT Services,” brokerage JM Financial said in a pre-earnings research note.

Wipro has been struggling with IT services revenue in the past couple of quarters. For the October-December quarter, the company reported a 12 percent YoY fall in net profit at Rs 2,694 crore, the fourth consecutive YoY quarterly decline.

Analysts will keep an eye on this metric of the company when the company reports on Friday.

Margins Picture

Wipro's EBIT (Earnings Before Interest and Taxes) margins are expected to be under pressure, with projections indicating contraction ranging from 15 to 60 bps sequentially. Factors such as the impact of recent wage hikes and the overall flat revenue growth will contribute to the decline.

At 15.4 percent, Wipro’s operating margin is expected to decline by 60 bps sequentially and 40 bps YoY, according to an average of estimates by 11 brokerage houses.

“Expect EBIT margins to decline 15 bps to 15.9% due to two-month incremental impact of wage hike; we expect cost efficiency program to largely offset wage hike impact,” JM Financial said in a note.

Brokerages are divided in the case of margins, with Antique Stock Broking, Dolat Capital, Sharekhan, and JM Financial expecting the metric to decline. However, analysts at ICICI Securities, Jefferies, and Nomura expect a marginal expansion in EBIT margins, driven by ongoing cost-efficiency deals.

“We expect EBIT margin to move up 20 bps QoQ as wage hike is over in Q3FY24,” ICICI Securities said in a research note, taking a contrarian view on wage hike impact.

Taking the middle ground, brokerage Emkay Global and Philip Capital expect the metric to remain flat.

Analysts would want to know from the management where Wipro sees margins going forward.

Revenue Projection

Revenue guidance varies for the first quarter of the fiscal year 2024-25 ending June 30 (Q1FY25), and hover between 0 percent and 2 percent sequentially.

JM Financial, Nomura, and Dolat Capital are the most optimistic brokerages on revenue guidance, pegging the number between 0 percent to 2 percent growth for Q1FY25. Whereas, Emkay Global expects Wipro to spell out a revenue guidance range of -1 percent to 1 percent.

“Focus would be on 1QFY25 revenue growth guidance and commentary on the demand environment and any green shoots,” said Jefferies in a pre-earnings research note.

The management outlook on future revenue streams, particularly in the backdrop of the ongoing economic uncertainties and sector-specific challenges, will be a key theme to look out for.

Last month, Wipro’s larger rivals Accenture and Cognizant declared weak full-year revenue growth guidance. Although these are US-based companies, their projections are a reflection of the market sentiment, since their key markets are similar to that of Indian IT companies.

Leadership Churn

Another area of concern is the recent churn in Wipro's leadership. The company has witnessed key exits in senior executive positions, necessitating questions about stability and direction.

The most notable exit was the sudden resignation of the then chief executive officer Thierry Delaporte on April 6. In September last year, chief financial officer Jatin Dalal resigned.

In fact, in 2023 alone, Wipro lost over 10 of its senior leaders including chief growth officer Stephanie Trautman, chief operations officer Sanjeev Singh, India head Satya Easwaran, iDEAS business head Rajan Kohli, among others.

When the new CEO, Srinivas Pallia, speaks on April 19 to the media and analysts, the Street will be eager to seek reassurance regarding the company's leadership exits, succession planning strategies, and realignment of teams.

Consultancy Business

Wipro's consultancy business, which accounts for a significant portion of its revenue, has been underperforming. This is because, during uncertain economic environments, consulting businesses take a hit first as they are discretionary.

“Wipro may also be affected in particular given its high exposure to consulting business,” said ICICI Securities. The company’s recent big-ticket acquisitions such as Capco and Rizing are yet to pay off.

The consulting vertical business accounts for about 12-14 percent of the total revenue stream.

“Key things to watch out for… consulting business outlook and potential uptick in discretionary spending with anticipated reversal of the US interest-rate cycle in CY24,” said brokerage Emkay Global in a report.

Analysts would be keen to hear management's plans to mitigate risks and capitalise on growth opportunities.