Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Buy

Given the escalating geopolitical crisis and stretched valuations, experts are turning more and more cautious on the sustainability of a bull run on Dalal Street. The breadth of the market was in favour of bears at the close on Friday with 2,448 stocks trading down for 1,405 advancing peers.

Volatility is expected to return to the markets which has been declining steadily since February 2024, according to the observers. After slipping by 30 percent from February highs, the India VIX gained 3 percent on Friday, when the BSE Sensex lost nearly 800 points. FIIs were net sellers, offloading equities worth over $1 billion as the tweak in the India-Mauritius tax treaty and hotter-than-expected US Inflation data played on their minds.

The market was hovering on its life highs when the downfall began. “Near their all-time highs, the markets are always sensitive to any events. With a spike expected in crude oil owing to the Iran–Israel geopolitical situation, the market sentiment may weaken, leading to a buy-on-dip opportunity,” says Prashant Sawant, founder of Catalyst Wealth.

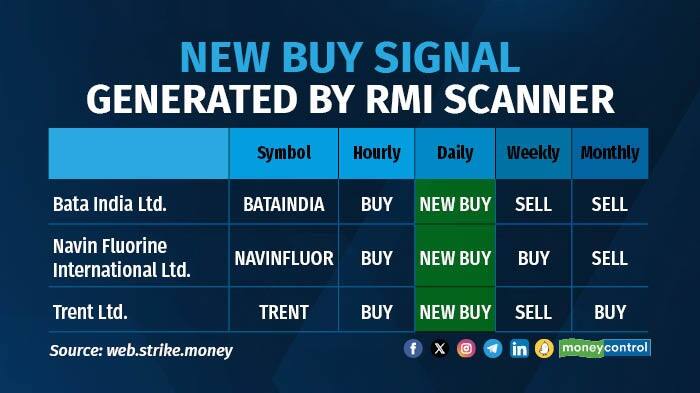

In a weak market condition, there are a few stocks that have shown positive momentum build-up. New 'buy' signal was generated on daily time frame in these stocks, according to the RMI scanner. Rohit momentum indicator (RMI) is a non-range bound indicator.

Momentum Buy

Momentum Buy

Navin Flourine: Navin Flourine shares are down by more than 14 percent on a year-to-date basis. In one month, the shares of Navin Flourine are up by more than 9 percent. Trading above its short-term daily simple moving average of 10 days and 20 days, Navin Flourine in indicating bullish trend in the near term.

Bata: The shares of Bata are trading above their 10-day and 20-day SMA, showcasing near-term bullishness. On a year-to-date basis, the shares of Bata shed more than 15 percent, but gained more than 2 percent in the previous week.

Trent: Trent shares are up by 35 percent on a year-to-date basis. After gaining nearly 200 percent, the shares of Trent are trading near life highs. Trent shares are trading above their 10 days and 20 days daily moving average.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.