Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Indian mutual funds have currently about 8.20 crore SIP accounts through which investors regularly invest.

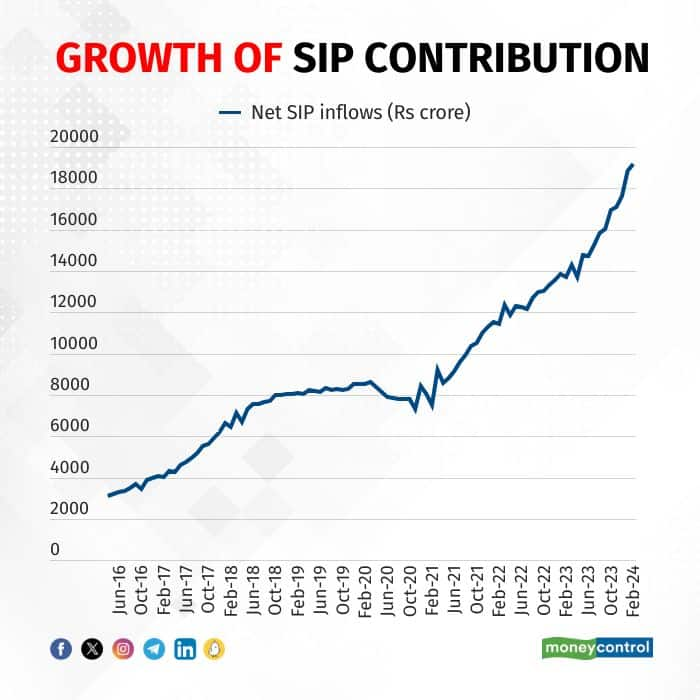

Systematic Investment Plan, or SIP, where one can invest a fixed amount in a mutual fund scheme periodically at fixed intervals, has seen an over six-fold surge in monthly contribution in the last eight years.

Data available from the Association of Mutual Funds in India (AMFI), an industry body, showed that SIP contributions have grown from Rs 3,122 crore at the end of April 2016 to Rs 19,187 crore at the end of February 2024.

Mutual funds today have about 8.20 crore SIP accounts through which investors regularly invest. The number of SIP accounts stood at 73 lakh at the end of March 2015.

The Indian mutual fund industry’s total assets under management (AUM) crossed the Rs 50-trillion mark in December 2023 in the 60th year of its existence.

Experts believe that the ‘Mutual Funds Sahi Hai’ campaign has single-handedly taken them to every corner of the country. The investor education and awareness initiative was started in March 2017.

Source: AMFI

Source: AMFI

It is estimated that SIP as a concept was first introduced in India in early 1990s. However, the campaign ‘Mutual Funds Sahi Hai’ has made SIP and mutual funds popular words in the country.

According to industry experts, a surge in stock market rallies and heightened involvement from retail investors has facilitated increased investments in the mutual fund industry through the systematic investment route.

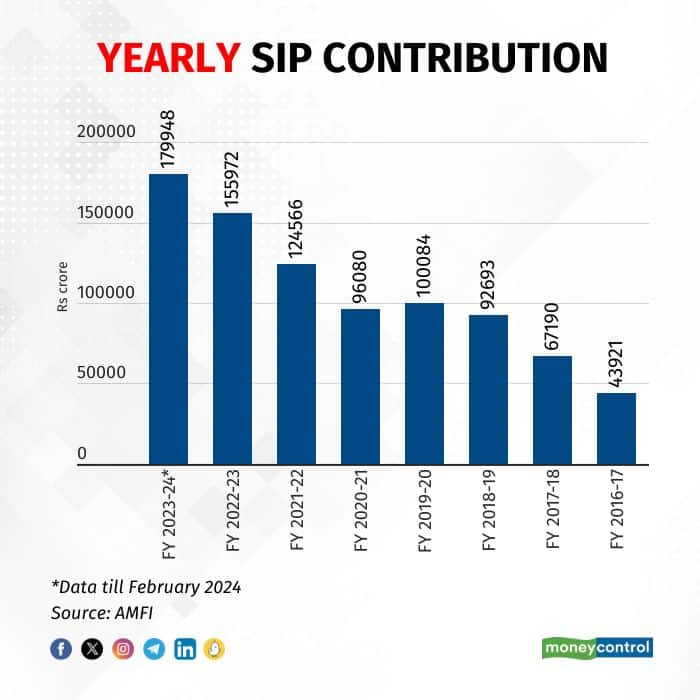

Data available with AMFI also showed that yearly contributions through SIPs have also seen a continuous uptick.

From Rs 43,921 crore in 2016-17, the yearly SIP book has grown to Rs 1,79,948 crore in FY 2023-24 till February.

SIP, favoured by small investors, enables the investment of a fixed and modest amount on a monthly basis or at regular intervals into mutual fund schemes.

A SIP instalment can be as minimal as Rs 500 a month. SIP operates akin to a recurring deposit, where you contribute a small or fixed amount every month.

SIPs bring in a disciplined approach to investing by requiring regular contributions, which helps investors avoid impulsive decisions driven by market fluctuations. Investors can with small amounts, making it accessible even to those with limited capital, according to experts.

A key benefit of SIPs is that it enables investors to buy more units when prices are low and fewer units when prices are high, thus averaging out the cost of investments over time.