Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

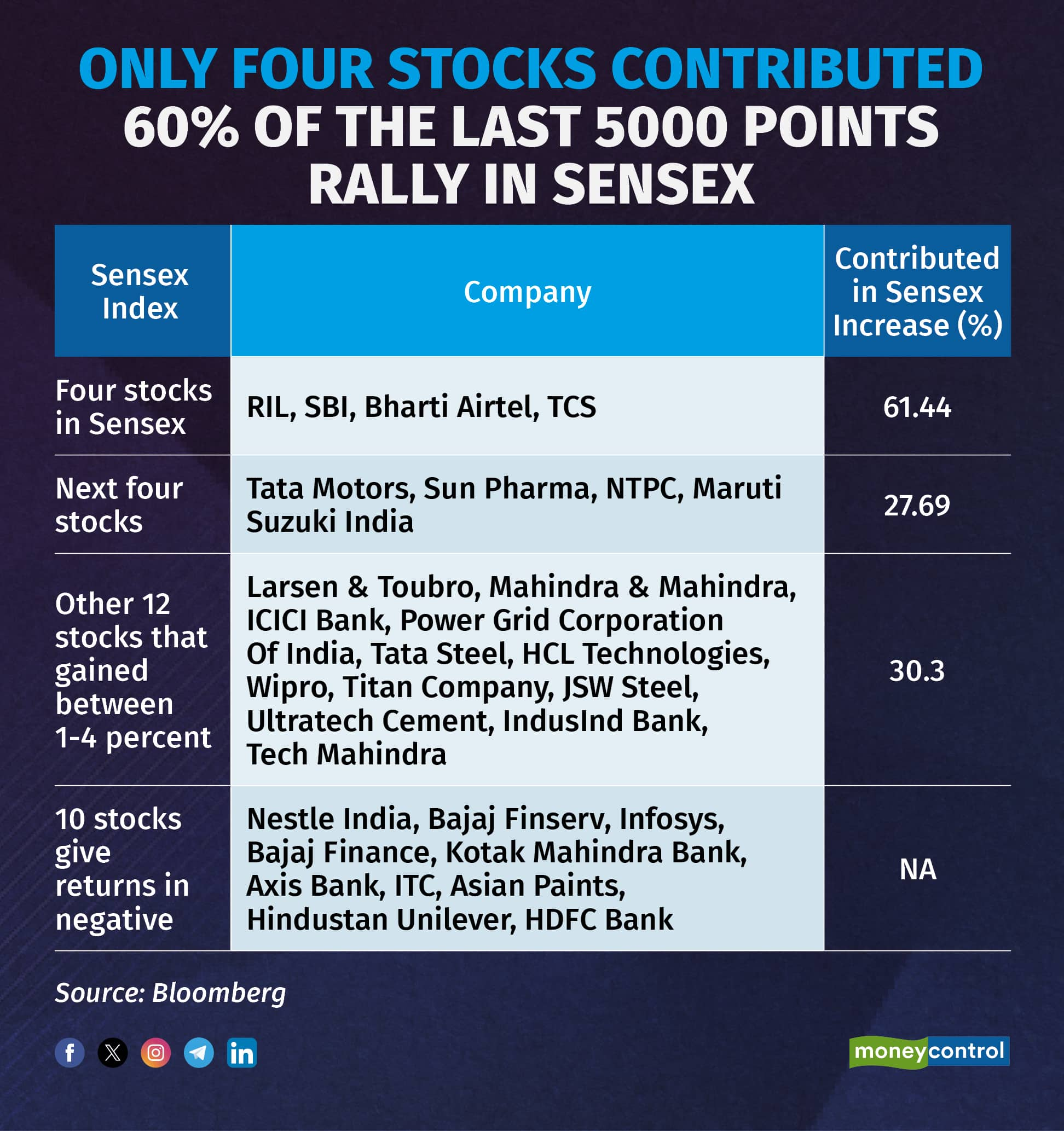

The next four stocks together contributed over 27 percent to the up move. While 12 stocks on the Sensex registered gains of between 1-5 percent during this period, 10 were in the negative.

BSE bellwether Sensex hit a record high on April 9 by scaling the 75,000-point milestone for the first time in just 82 days since it reached the 70,000 mark on December 11, 2023.

Four stocks contributed 60 percent to the 5,000-point rally in Sensex market capitalisation in the last 82 days. Since December 2023, the benchmark index has surged nearly 7.2 percent, driven primarily by Reliance Industries Ltd, State Bank of India, Bharti Airtel Ltd and Tata Consultancy Services Ltd.

The market cap of these four stocks increased by Rs 7.31 lakh crore, accounting for more than 61.43 percent of the gains in the Sensex’s market cap. Reliance Industries alone contributed over 29 percent to the rally.

The next four stocks together contributed over 27 percent to the up-move. While 12 stocks on the Sensex registered gains of 1-5 percent during this period, 10 were in the negative.

Analysts anticipate potential stock growth for RIL, which has surged nearly 21 percent since December. Factors driving this growth include expected mid-FY25 increases in telecom tariffs, initiatives to enhance 5G monetisation, and the recent rise in oil prices, which could benefit RIL's oil-to-chemicals (O2C) businesses. Additionally, analysts highlight the $10-billion investment in new energy ventures such as solar and hydrogen, which could generate short-term excitement if Reliance sells a stake at a high valuation, mirroring its previous strategies with retail and telecom.

Several analysts turn bullish on stocks following RIL's optimistic remarks on controlled spending and strong retail performance in Q3 earnings. The 22 percent drop in Q3 capital expenditure (capex) QoQ to Rs 30,100 crore is linked to decreased spending by Jio after the 5G rollout and restricted retail expansion. Analysts see the capex slowdown as 5G deployment nears completion. Despite a slight uptick in net debt, expectations of a positive trend arise from reduced capex and an enhanced EBITDA run rate, indicating favourable free cash flow for the next two years.

Both the Sensex and Nifty were trading at fresh record highs. So far the benchmark indices gained 4 percent each, while BSE MidCap and SmallCap advanced nearly 11 percent and 8 percent.

Analysts note that a key characteristic of a bull market is its tendency to reach new record highs, a trend seen in both the US and Indian markets. Notably, the recent upswing in India is driven by fundamentally strong sectors such as capital goods, automobiles, banking, and metals. The resilience of the Indian economy continued capital inflows into mutual funds, and strong domestic investor sentiment are bolstering this rally. However, valuations in the Smallcap segment appear elevated and potentially unjustified, they added.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.