Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Stock market Trend

The market expectedly reached the upward-sloping resistance trendline and hit the target of the 22,750-22,800 zone, but could not sustain record high levels due to profit booking. If the index manages to climb above the said zone, then 23,000 can't be ruled out in coming sessions, but till then the said zone is expected to be a hurdle on the higher side and the index may consolidate with support at the 22,500 level, experts said.

On April 9, the BSE Sensex was down 59 points at 74,684, while the Nifty 50 declined 24 points to 22,643 and formed a bearish candlestick pattern at the new all-time highs, on the daily charts with below-average volumes.

Technically, "this pattern indicates tiredness for the market at the new highs. Nifty is currently placed near the crucial overhead resistance of ascending resistance line and also important Fibonacci extension around 22,750-22,800 levels," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels though, Nifty placed at new highs and showing consolidation, there is still no confirmation of any significant top reversal pattern forming at the highs.

At the same time, the upper area of 22,750-22,800 is expected to be a crucial overhead resistance for the short term, he said, adding immediate support is at the 22,500 level and a decisive break below this support could trigger short-term downward correction in the market.

According to Ashwin Ramani, derivatives & technical analyst at Samco Securities, strong Put writing was observed at the 22,500 strike, which will act as strong support for the Index. However, unless Call writers exit from the 22,800 strikes, further upmove in the index is unlikely, he feels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may face resistance at the 22,657 level followed by the 22,771 and 22,831 levels. On the lower side, the index may take immediate support at the 22,615 level followed by 22,578 and 22,518 levels.

On April 9, the Bank Nifty extended its northward journey for the fifth consecutive session, rising 149 points to end at a new closing high of 48,731, though there was profit-taking at the top.

The index has formed small small-bodied bearish candlestick pattern with upper and lower shadows which resembles the High Wave kind of candlestick pattern on the daily charts (followed by Doji pattern in the previous session), indicating indecision among bulls and bears. The index continued higher highs, and higher lows formation four days in a row, indicating the trend remains positive but the indecision pattern for yet another session at the top may be suggesting the possible reversal in trend due to profit taking.

"Bank Nifty is inching higher but continuous Doji formation in the daily chart would be concerning in the short term," Om Mehra, technical analyst at Samco Securities said.

He feels the key technical indicator MACD (moving average convergence divergence) remains positive but a sharp correction cannot be ruled out. "Interestingly, the volume profile highlights the 48,000 level as a key support zone. As long as the index remains above this pivot level, the prevailing indication remains for an upward trajectory in the near term," he said.

According to the pivot point calculator, the Bank Nifty index may see resistance at 48,767, followed by 48,996 and 49,146. On the lower side, it is expected to take support at 48,603 followed by 48,511 and 48,361.

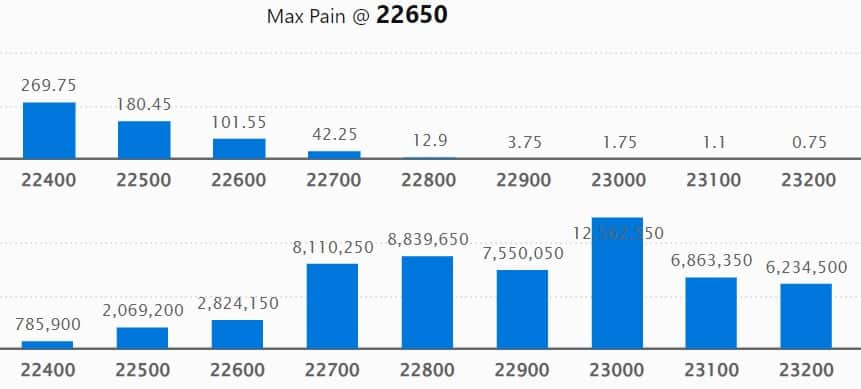

As per the weekly options data, the maximum Call open interest was seen at 23,000 strikes, with 1.25 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,800 strikes, which had 88.39 lakh contracts, while the 22,700 strike had 81.1 lakh contracts.

Meaningful Call writing was seen at the 22,800 strike, which added 40.51 lakh contracts followed by 22,700 strike and 22,900 strike, which added 35.24 lakh and 30.95 lakh contracts, respectively.

The maximum Call unwinding was at the 22,600 strike, which shed 8.12 lakh contracts followed by 22,500 and 22,400 strikes, which shed 3.87 lakh contracts and 1.84 lakh contracts, respectively.

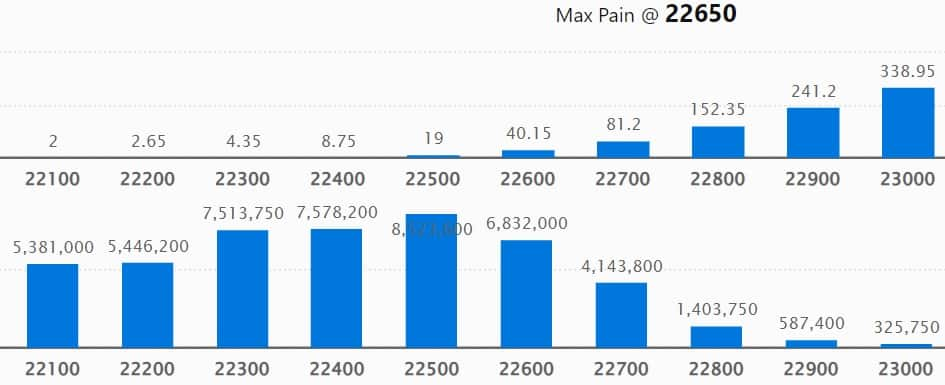

On the Put side, the 22,500 strikes owned the maximum open interest, which can act as a key support level for the Nifty with 85.23 lakh contracts. It was followed by the 22,400 strike comprising 75.78 lakh contracts and then the 22,300 strike with 75.13 lakh contracts.

Meaningful Put writing was at the 22,300 strike, which added 16.27 lakh contracts followed by the 22,200 strike and 22,100 strike adding 12.78 lakh and 12.6 lakh contracts, respectively.

Put unwinding was seen at 22,000 strike, which shed 11.26 lakh contracts followed by 21,500 and 22,600 strikes, which shed 8.93 lakh and 8.35 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Axis Bank, Abbott India, Cipla, Larsen & Toubro, and Bosch saw the highest delivery among the F&O stocks.

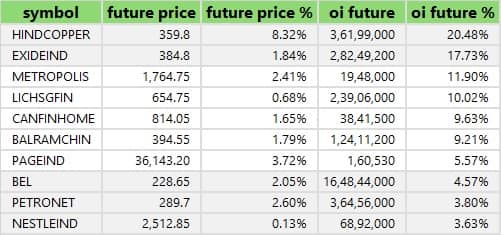

A long build-up was seen in 34 stocks, which included Hindustan Copper, Exide Industries, Metropolis Healthcare, LIC Housing Finance, and Can Fin Homes. An increase in open interest (OI) and price indicates a build-up of long positions.

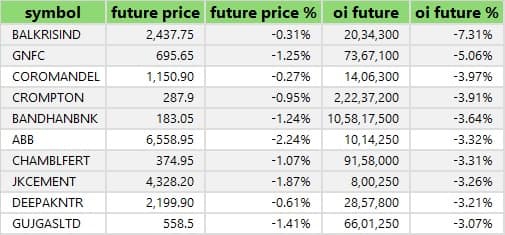

Based on the OI percentage, 42 stocks saw long unwinding, which included Balkrishna Industries, GNFC (Gujarat Narmada Valley Fertilisers, and Chemicals), Coromandel International, Crompton Greaves Consumer Electricals, and Bandhan Bank. A decline in OI and price indicates long unwinding.

76 stocks see a short build-up

A short build-up was seen in 76 stocks, including Bata India, REC, L&T Technology Services, Wipro, and Sun TV Network. An increase in OI, along with a fall in price points to a build-up of short positions.

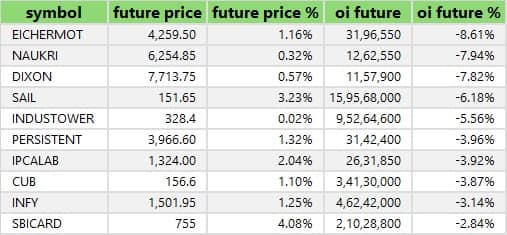

Based on the OI percentage, a total of 32 stocks were on the short-covering list. These included Eicher Motors, Info Edge India, Dixon Technologies, SAIL, and Indus Towers. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 1.09 on April 9, from 1.29 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

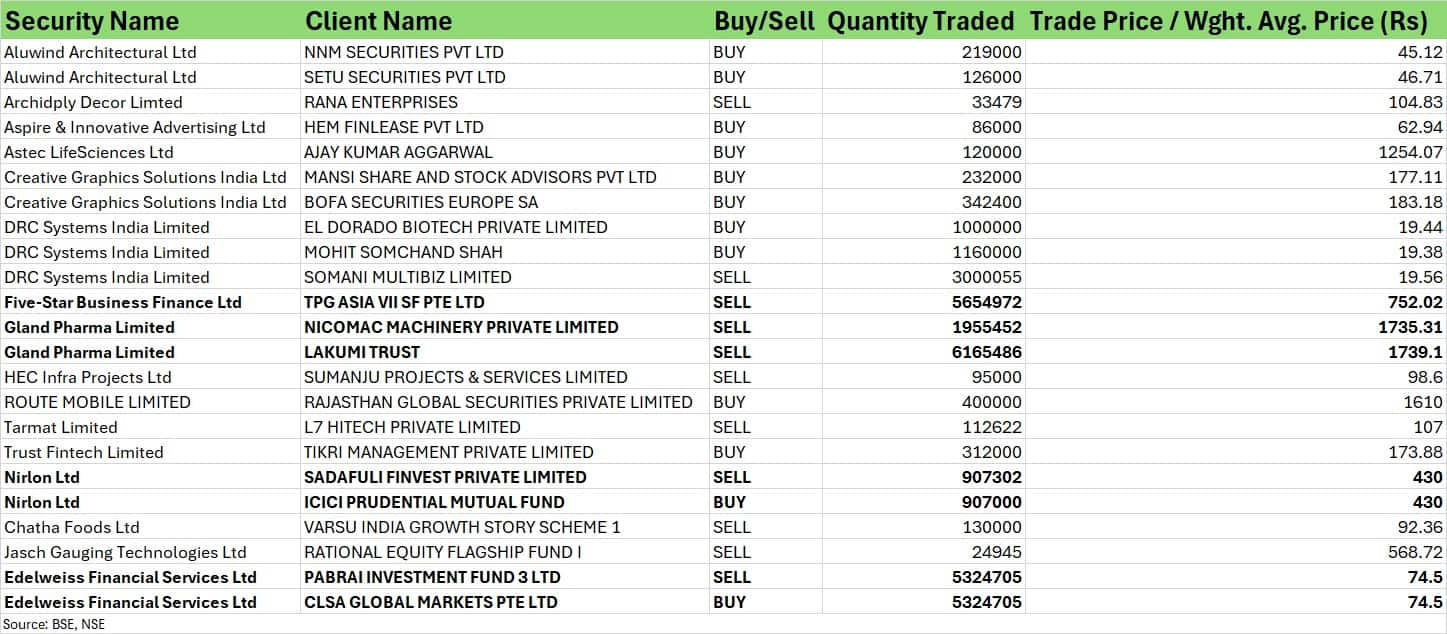

For more bulk deals, click here

Stocks in the news

One 97 Communications: Associate entity Paytm Payments Bank informed One 97 Communication that Surinder Chawla has resigned as Managing Director and CEO of Paytm Payments Bank due to personal reasons.

Lupin: The pharma company has launched its first generic version of Oracea (Doxycycline capsules, 40 mg), in the United States, after receiving approval from the United States Food and Drug Administration (US FDA).

Exide Industries: The automotive battery manufacturer has entered into an agreement for acquiring a 26 percent equity stake in Clean Max Arcadia, a special purpose vehicle (SPV) promoted and incorporated by Clean Max Enviro Energy Solutions, for the generation and supply of solar power.

Paisalo Digital: The company said assets under management (AUM) grew by 32 percent to Rs 4,622 crore at the end of March FY24 quarter, while disbursements increased 38 percent to Rs 3,588 crore, and the co-lending loan disbursement grew by 100 percent to Rs 1,128 crore during the same period.

Shivalik Rasayan: The United States Food and Drug Administration (US FDA) inspected the API facility of the company at Dahej in Gujarat, during April 1 and April 9 this year. The US FDA closed inspection with 7 observations. These observations are procedural in nature.

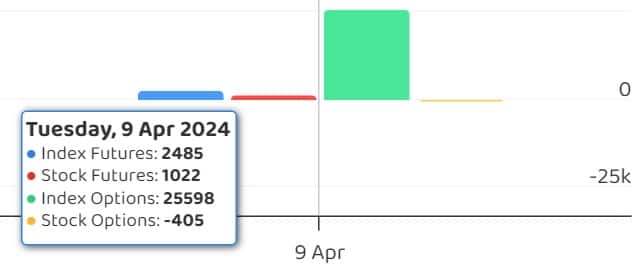

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 593.20 crore, while domestic institutional investors (DIIs) bought Rs 2,257.18 crore worth of stocks on April 9, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Exide Industries, Hindustan Copper, Vodafone Idea, and India Cements to the F&O ban list for April 10, while retaining Bandhan Bank, SAIL, and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.