Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty likely to hit 22,800 in coming sessions

Given the market climbing decisively above the previous week's record high and closing above the upward-sloping resistance trendline, experts seem to be looking hopeful for further rally towards the 22,800 level on the Nifty 50 as surpassing the same can take the index to the much-awaited psychological 23,000 mark in coming sessions, with immediate support at 22,500 and key support at 22,300 level, experts said.

On April 8, the market had a strong start to the week, though the trading volume remained below the average for yet another session. The benchmark indices ended at a new closing high with the BSE Sensex rising 494 points to 74,743, while the Nifty 50 jumped 153 points to 22,666 and formed a bullish candlestick pattern on the daily charts with the gap-up opening.

"Technically, this pattern indicates a positive bias for the market ahead. Though Nifty placed at the new highs, still there is no signal of any reversal pattern building up at the highs," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

Positive chart patterns like higher tops and bottoms are intact as per the daily chart and the present upmove is in line with the new higher top formation of the pattern.

"Still, there is no confirmation of any higher top reversal completing at the highs. The short-term uptrend of the Nifty remains intact and the next upside levels to be watched are around the 22,800 mark (1.618 percent Fibonacci projection)," he said, adding immediate support is at the 22,520 level.

The daily and hourly momentum indicator has a positive crossover which is a buy signal. "The daily Bollinger bands are expanding indicating range expansion and with prices moving along the upper band suggests that there could be trending moves in the coming trading sessions," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may face resistance at the 22,680 level followed by the 22,729 and 22,785 levels. On the lower side, the index may take immediate support at the 22,582 level followed by 22,547 and 22,491 levels.

On April 8, the Bank Nifty also hit a fresh record high, at 48,717, but saw some profit booking at higher levels. The banking index rose 89 points to 48,582 and formed a Doji candlestick pattern on the daily timeframe, as the closing was near opening levels, indicating indecisiveness among bulls and bears about future market trends. Given the Doji formation at the top, the index may see a trend reversal but that would be a buying opportunity, experts said.

"Bank Nifty is now poised for a further upside till 49,000 – 49,300. The zone of 48,270 - 48,200 shall act as a crucial support zone from a short-term perspective. Minor degree pullbacks should be used as a buying opportunity," Jatin Gedia said.

According to the pivot point calculator, the Bank Nifty index may see resistance at 48,608, followed by 48,755 and 48,867. On the lower side, it is expected to take support at 48,463 followed by 48,394 and 48,282.

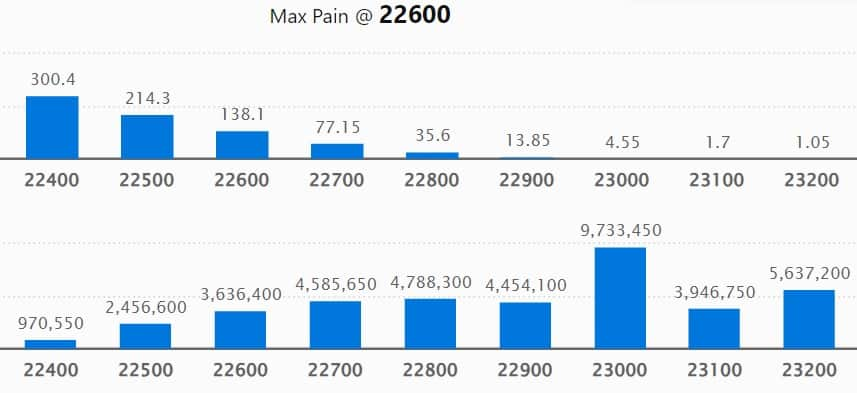

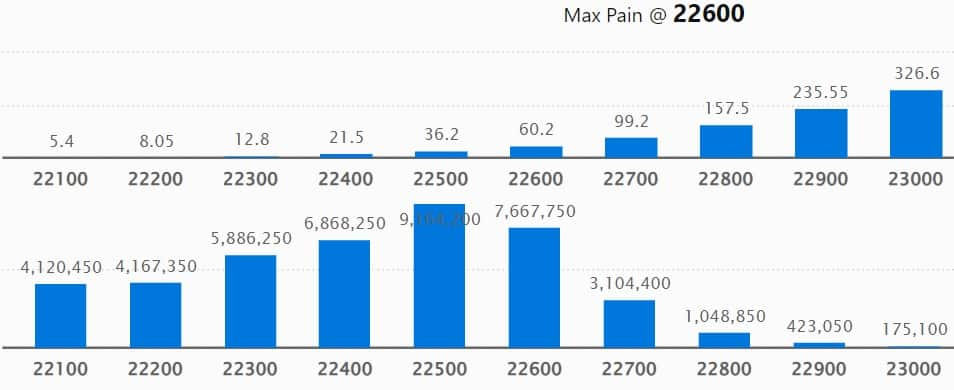

As per the weekly options data, the 23,000 strike owned the maximum Call open interest, with 97.33 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 23,200 strike, which had 56.37 lakh contracts, while the 22,800 strike had 47.88 lakh contracts.

Meaningful Call writing was seen at the 23,000 strike, which added 13.7 lakh contracts followed by 23,200 strikes and 22,700 strikes, which added 12.8 lakh and 10 lakh contracts, respectively.

The maximum Call unwinding was at the 22,500 strike, which shed 26.93 lakh contracts followed by 23,500 and 22,800 strikes, which shed 22.2 lakh contracts and 12.07 lakh contracts, respectively.

On the Put side, the maximum open interest was seen at 22,500 strike, which can act as a key support level for the Nifty with 91.64 lakh contracts. It was followed by the 22,000 strike comprising 83.75 lakh contracts and then the 22,600 strike with 76.67 lakh contracts.

Meaningful Put writing was at the 22,600 strike, which added 62.38 lakh contracts followed by the 22,000 strike and 22,500 strike adding 39.3 lakh and 32.46 lakh contracts, respectively.

Put unwinding was seen at 21,400 strike, which shed 7.05 lakh contracts followed by 21,500 and 21,800 strikes, which shed 6.84 lakh and 6.68 lakh contracts, respectively.

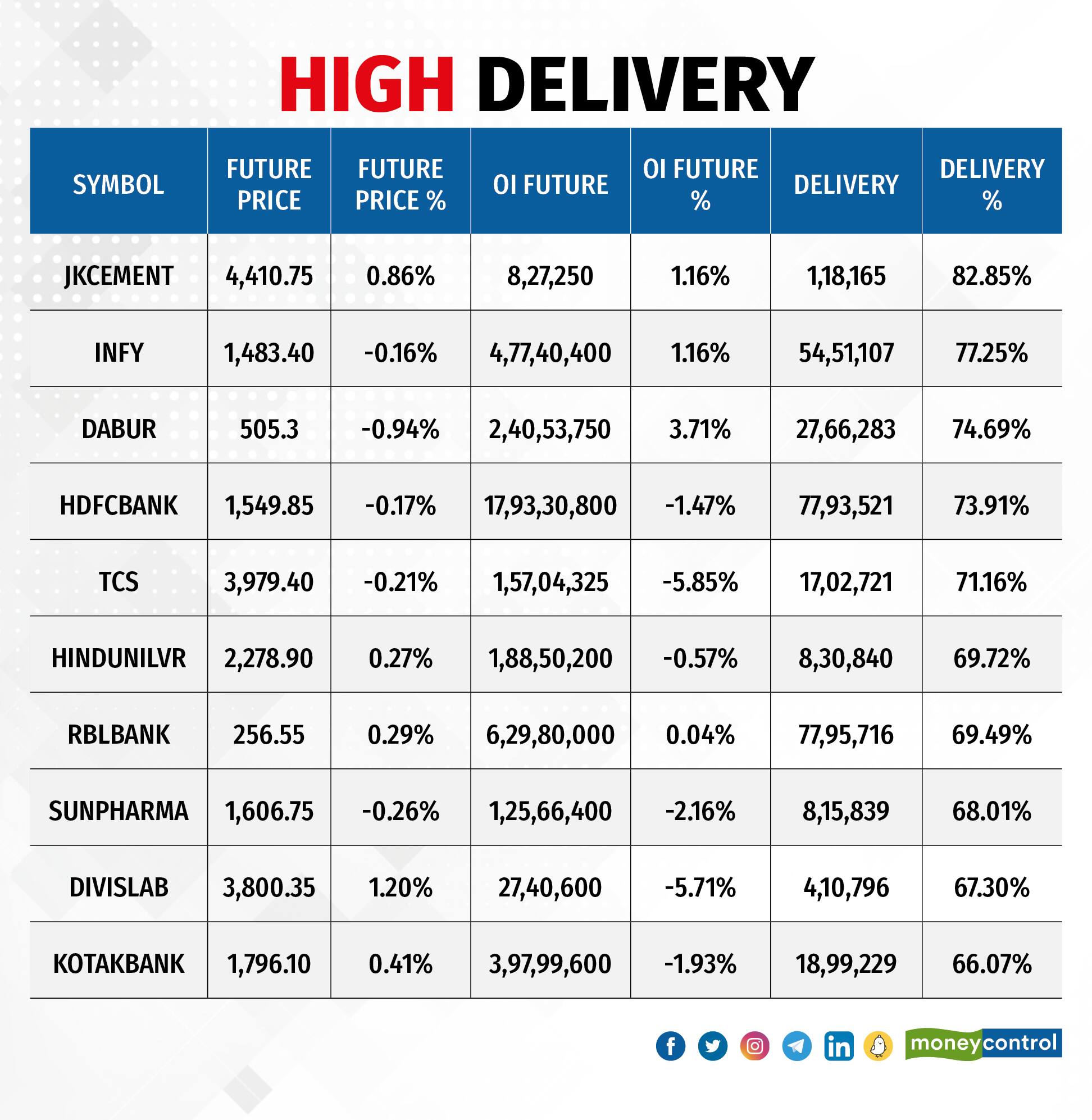

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. JK Cement, Infosys, Dabur India, HDFC Bank, and Tata Consultancy Services saw the highest delivery among the F&O stocks.

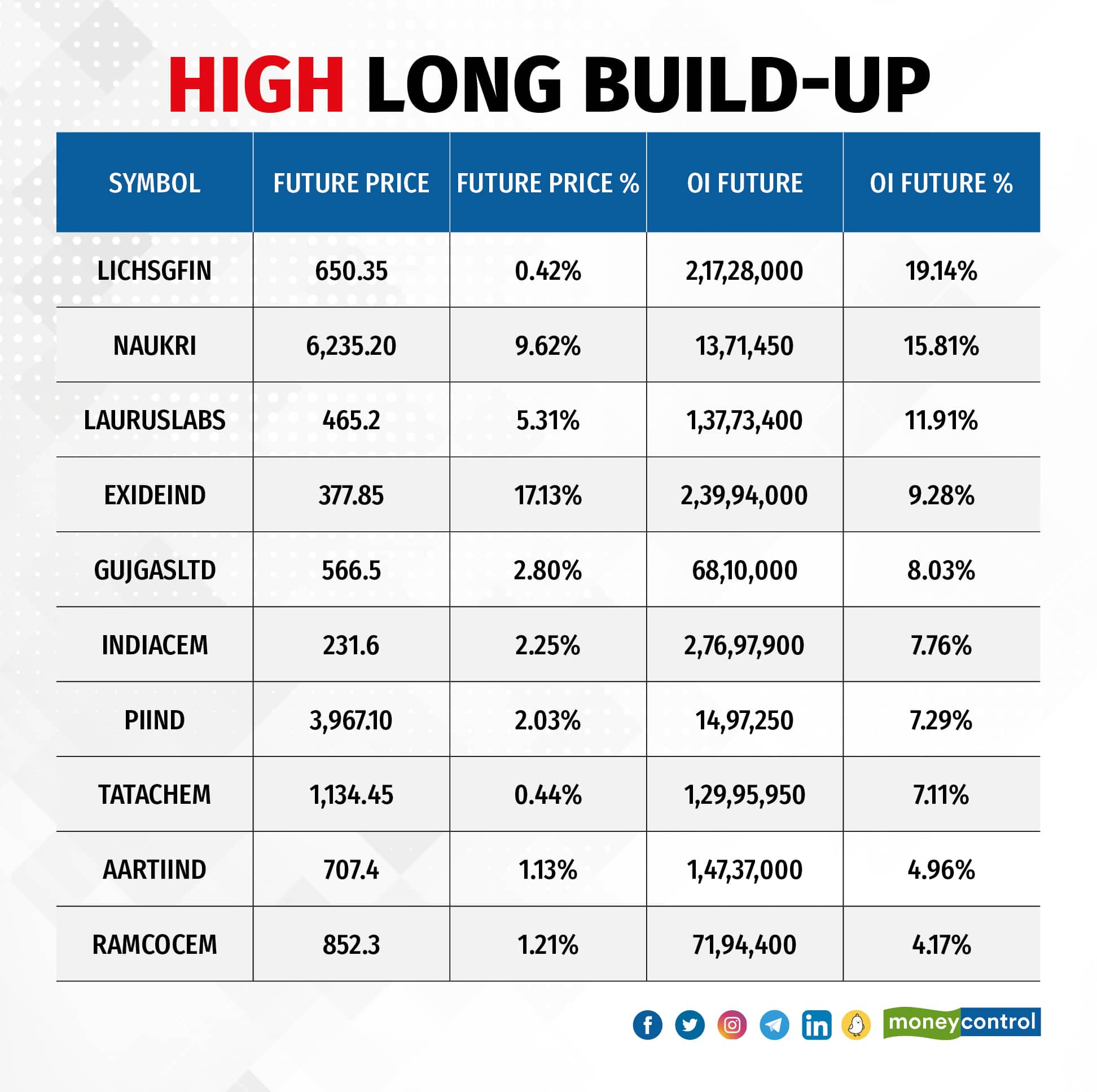

A long build-up was seen in 52 stocks, which included LIC Housing Finance, Info Edge India, Laurus Labs, Exide Industries, and Gujarat Gas. An increase in open interest (OI) and price indicates a build-up of long positions.

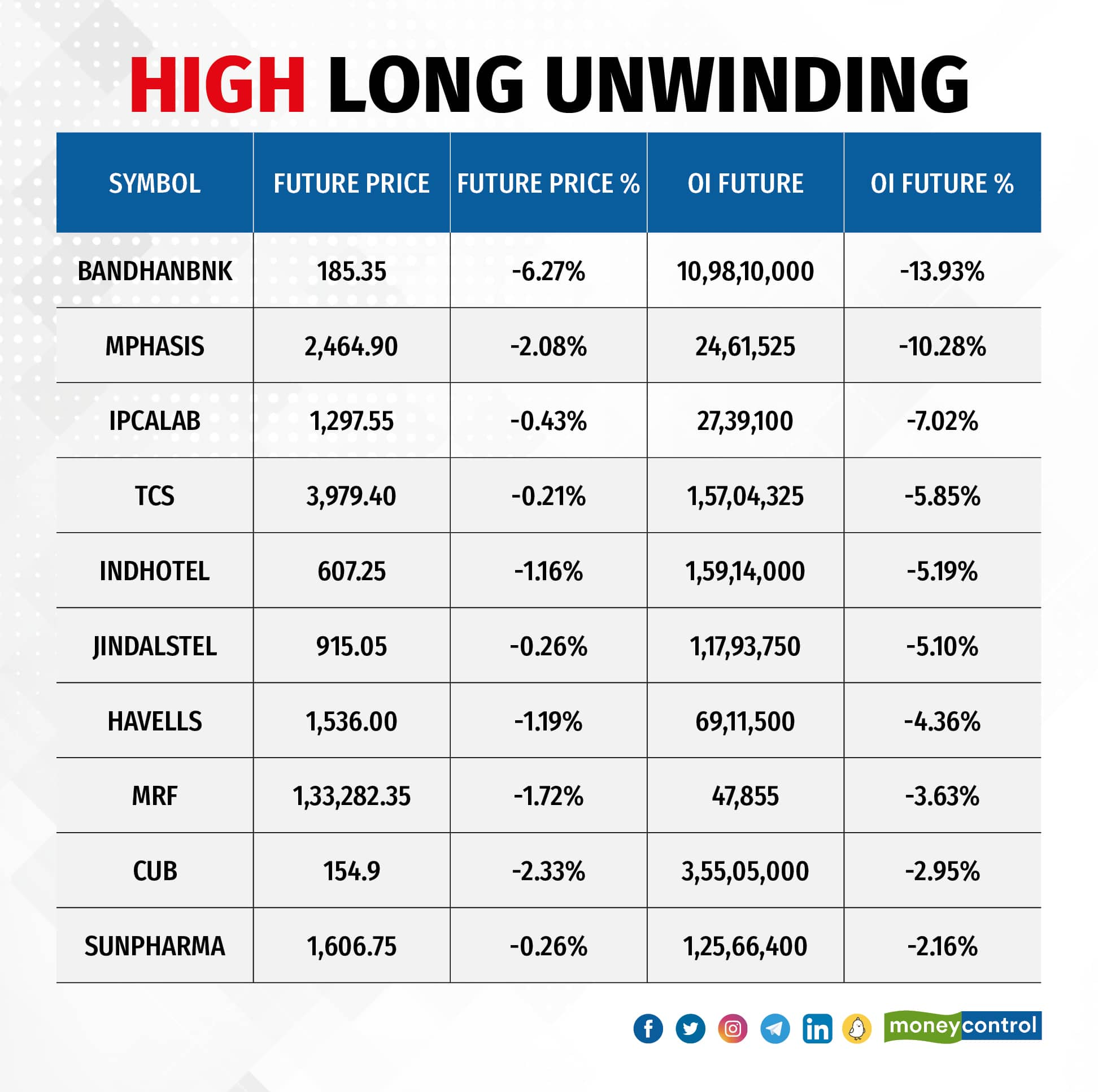

Based on the OI percentage, 41 stocks saw long unwinding, which included Bandhan Bank, Mphasis, Ipca Laboratories, Tata Consultancy Services, and Indian Hotels. A decline in OI and price indicates long unwinding.

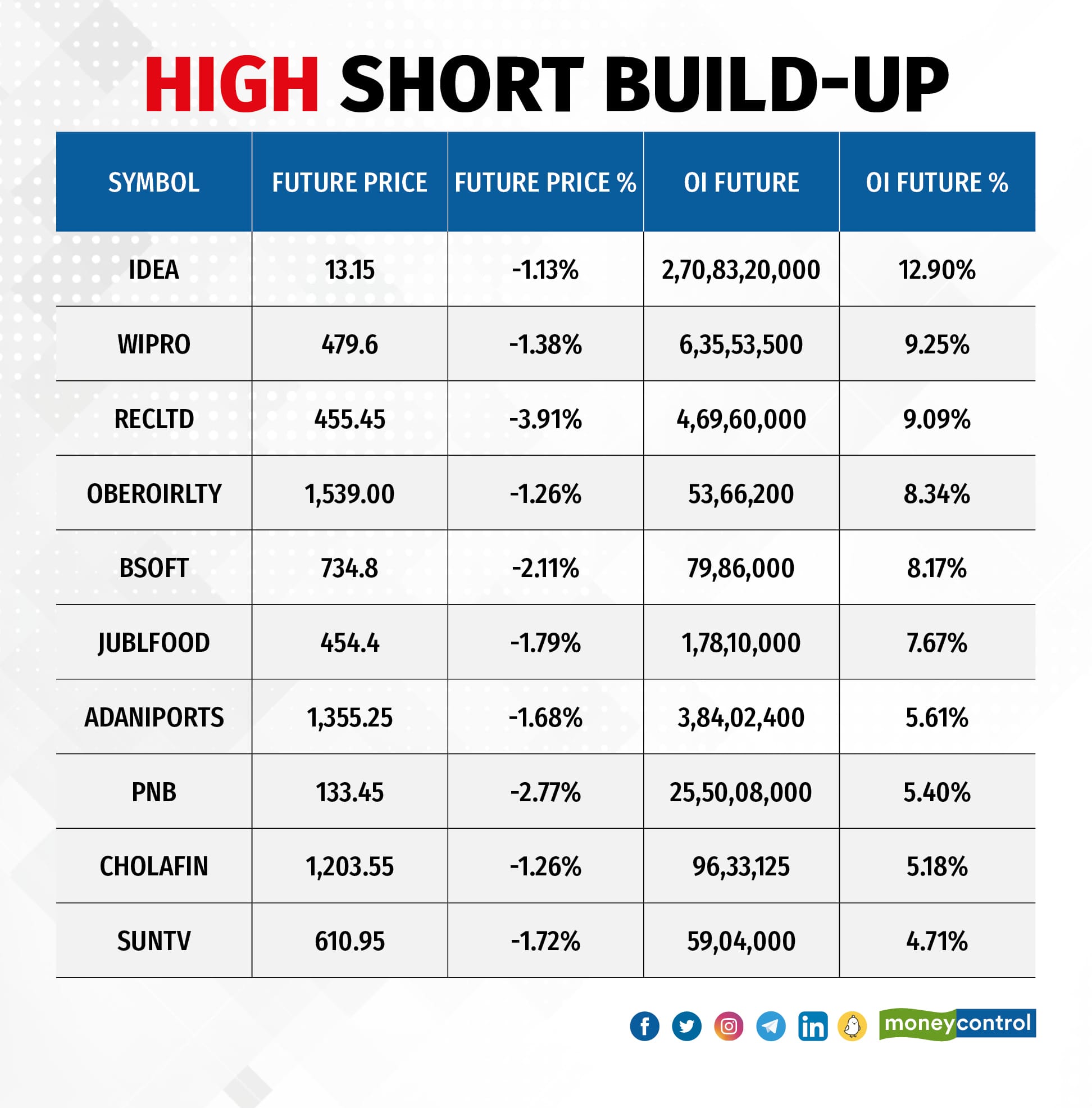

31 stocks see a short build-up

A short build-up was seen in 31 stocks, including Vodafone Idea, Wipro, REC, Oberoi Realty, and Birlasoft. An increase in OI, along with a fall in price points to a build-up of short positions.

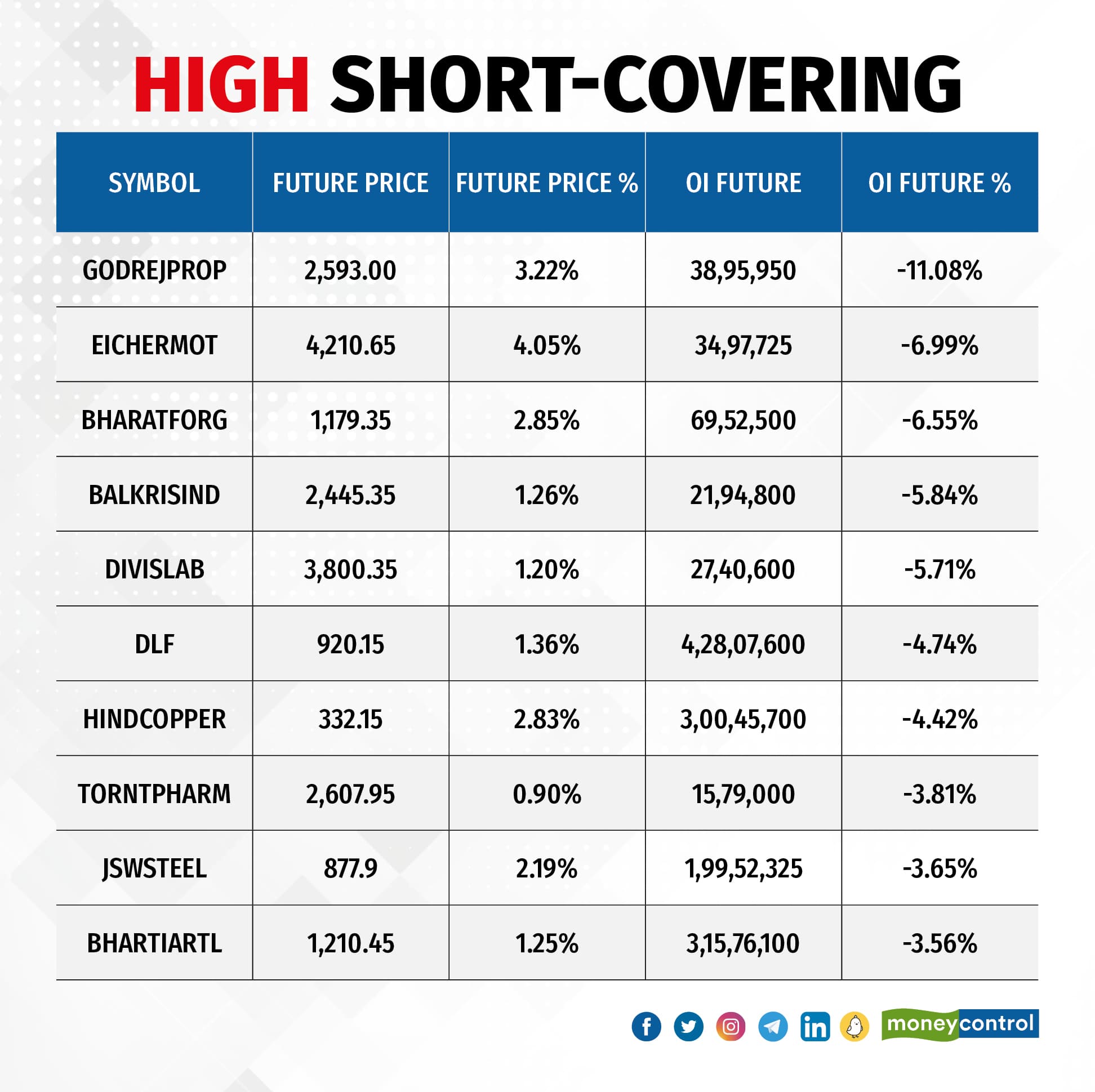

Based on the OI percentage, a total of 60 stocks were on the short-covering list. These included Godrej Properties, Eicher Motors, Bharat Forge, Balkrishna Industries, and Divis Laboratories. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, jumped to 1.29 on April 8, from 1.03 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

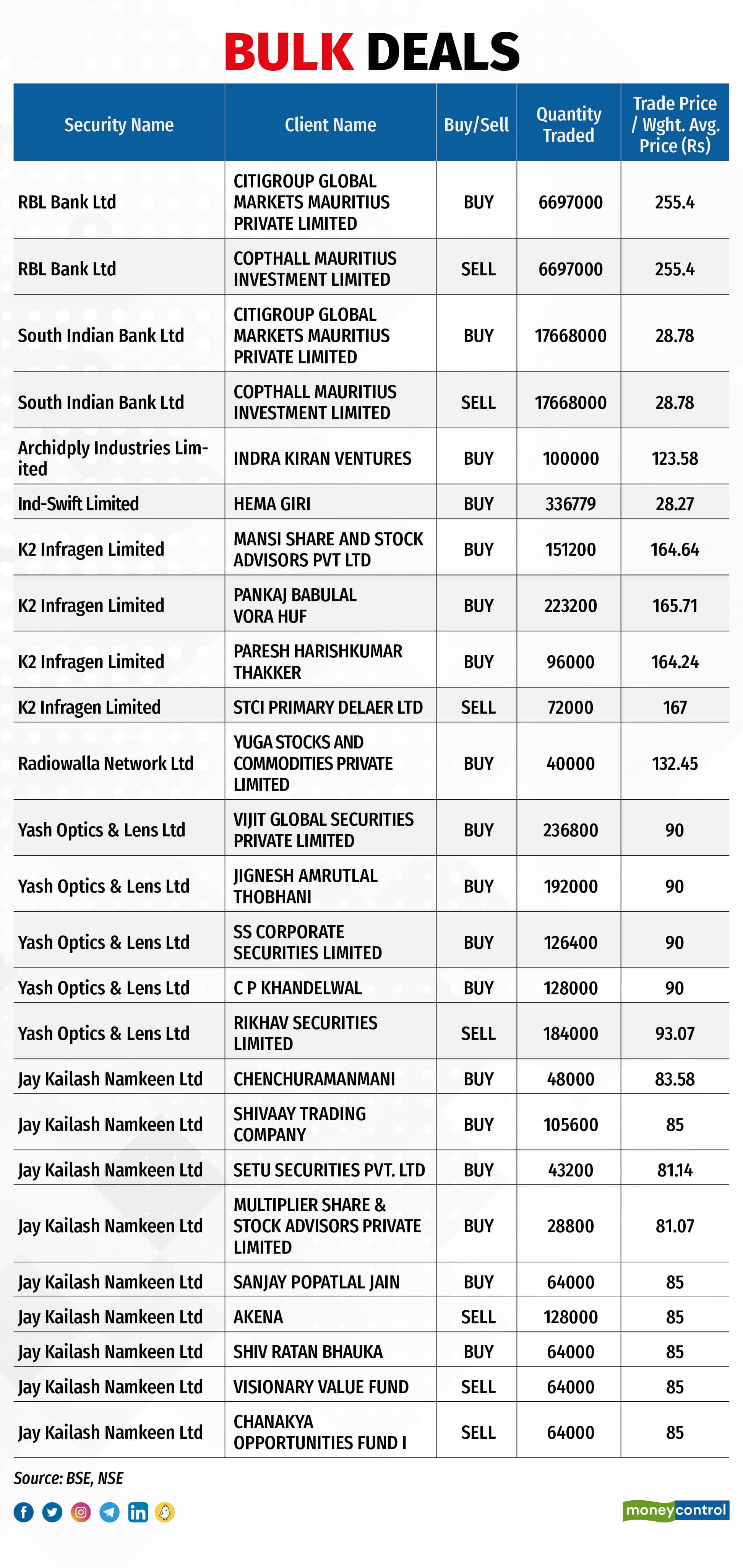

For more bulk deals, click here

Stocks in the news

Dilip Buildcon: The infrastructure company has declared as L-1 bidder for the project worth Rs 1,092.46 crore by the Haryana Rail Infrastructure Development Corporation on EPC mode in Haryana.

Axis Bank: Bain Capital is all set to make a complete exit from the private sector lender, as the US private equity major looks to dilute its balance stake and launch a fresh block deal of around $430 million, three people in the know told Moneycontrol.

Gland Pharma: Two entities, namely Nicomac Machinery, and RP Advisory Services, which are connected to Dr Ravi Penmetsa, the former promoter of Gland Pharma, have launched a block deal of around $150 million with an upsize option to sell part stake in the drugmaker, three persons in the know of the development told Moneycontrol.

Tata Motors: Jaguar Land Rover (JLR) reported over 20 percent year-on-year growth in its full year sales on improved production and sustained global demand. Wholesale volumes of 1.1 lakh units in Q4FY24 (excluding the China JV) were up 16 percent compared to the same quarter a year ago and the same in FY24 increased 25 percent YoY to 4.01 lakh units.

Shilpa Medicare: The pharma company has opened its qualified institutions placement (QIP) issue on April 8, with a floor price at Rs 477.33 per share.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 684.68 crore, while domestic institutional investors (DIIs) bought Rs 3,470.54 crore worth of stocks on April 8, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has retained Bandhan Bank, SAIL, and Zee Entertainment Enterprises to the F&O ban list for April 9. However, Hindustan Copper was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.