APCHA to consider regulation changes over work history, retirement assets, and defining life at birth

Who counts in an APCHA household size? Currently, the regulation allows wiggle room for doctor’s notes and ultrasounds, but the housing authority is looking to update their regulations so only a birth certificate would count.

At their Wednesday meeting, APCHA staff presented a slew of potential regulation changes to ease burdens on staff, residents and applicants. Staff gave a brief overview of the suggested change, and the Board of Directors gave feedback on whether or not they’d like to hear more during a more formal regulation change proposal at their next meeting.

The board directed staff that they may support:

- Removing the longest-work history priority for APCHA-managed rental units,

- Removing of retirement assets from total asset calculation,

- Allowing a qualification to be valid for one year without additional tax information,

- and requiring a birth certificate for a household size change.

APCHA-managed units only account for a small fraction of the deed-restricted rental stock, just around 300 units. APCAHA manages Truscott Phase I and II, Aspen Country Inn, Smuggler Mountain Apartments, and Marolt Ranch.

“This is incredibly administratively burdensome to APCHA staff. It also we feel usually trickles down quite far (the applicant list),” said Bethany Spitz, the deputy director of housing, compliance. “We think allocating these units based upon in lottery is much fairer.”

Currently, rental units largely trade leases by word-of-mouth. APCHA-managed properties advertise a room, but APCHA staff reviews years of tax documentation to first offer the unit to someone with the longest local work history.

Spitz said APCHA staff will often do all that work just to inform the applicant they don’t meet income or asset requirements.

Changing to a lottery system for the APCHA-managed units would give newcomers a chance, motivate them to actually apply for the units, and still afford longtime locals the edge over newcomers to get into privately-managed deed-restricted rental units via word-of-mouth.

The board — particularly the board members who hold a local elected position — expressed hesitancy at taking away an advantage in the system for longtime locals.

“For me — I’m sorry, staff — but it’s more a question of what’s fair and what’s right to the to the tenants than it is a burden for for staff,” said board member and Aspen City Council member Ward Hauenstein. “Is it fair to have a policy change that we’re not taking into consideration how long somebody’s been working resident?”

Another problem staff brought up is APCHA residents saying they’re not contributing to their 401(k) or other retirement accounts because they worry about exceeding their limit. The board supported removing 401(k)s, IRAs, and potentially other savings accounts with stringent rules like 539 college funds from the asset count. The exact types of funds will be decided in future readings.

And staff said they encounter residents sending them things like ultrasounds, doctors notes, and letters from IVF or adoption agencies to justify someone’s claim that they need to bump up in household size and bid on a larger property.

“We received multiple requests to change category due to change in household based on ultrasound, photos, letters, doctors, folks considering adoption or IVF, because this has the potential for changing category for that household,” Spitz said.

Currently, the regulations allow that. But staff said it muddies the waters over when a household can claim a new member and potentially allows smaller households to access properties where they don’t meet the minimum occupancy requirement.

The IRS defines a dependent as someone who is born, and staff want to update the regulations to reflect that. APCHA models much of its regulations off federal definitions and guidelines.

“I don’t think it’s that hard,” said board member John Ward. “Good luck. I hope you have your baby. I hope it’s healthy. Come back to us when it’s (born).”

Ultimately, the board directed staff to come back with more formal language for a first reading to consider the change.

Other suggestions that the board shot down included:

- Raising the requalification rate for renters from 150% of income to 200%

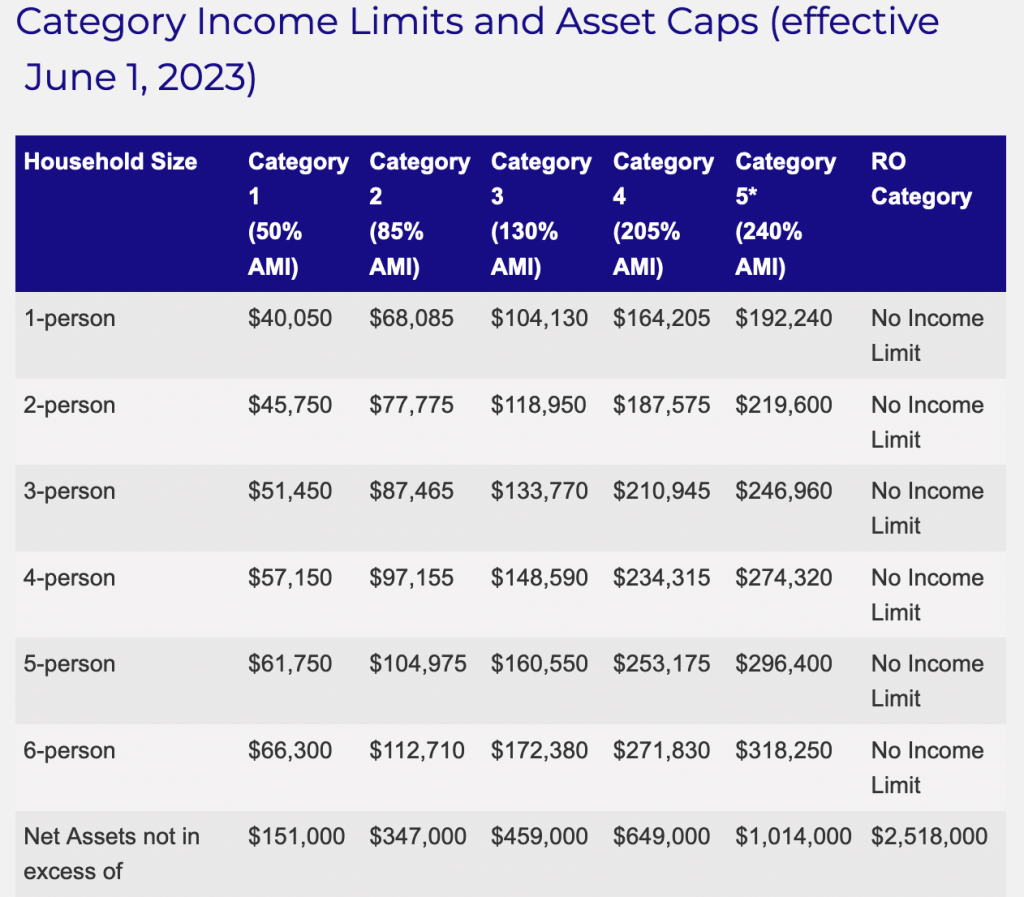

- Updating the categories based on a 4-person household standard, and no longer considering household size in the income and asset limits

Raising the requalification rate is a product of the pandemic and wages raising to reflect inflation. Staff said they hear often from tenants who turn down raises for fear of losing their housing, but the board said 200% of their original qualifying salary to stay in their current unit is just too high.

With the direction from the board, staff will come back to the next meeting on April 17 for a first reading on the regulation updates they expressed support for. Until the proposed changes pass