Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Stock Market News

The market is expected to be volatile in the coming session with focus on the 22,550-22,600 area, the hurdle on the higher side, as closing decisively above the same zone may take the Nifty 50 towards 22,800, and then 23,000 mark, while 22,300-22,200 is the key support zone for the index, experts said, adding the declining volatility has been acting as a major comfort for the bulls.

On April 5, the BSE Sensex was up 21 points at 74,248 after the Monetary Policy Committee maintained repo rate at 6.5 percent for seventh consecutive time, while the Nifty 50 fell 1 point to 22,514 and formed bullish candlestick pattern with lower shadow on the daily charts, indicating buying interest at lower levels. The Friday's trade indicated that the market seemed to have already discounted the RBI policy meeting outcome.

The index gained 0.84 percent for the week. "The current consolidation is likely to continue in the range of 22,200 to 22,550 levels for the next couple of days. A level of 22,300 is an immediate support to watch out for in the Nifty, while the bigger area of support zone stands at 22,150-22,200," Tejas Shah, technical research at JM Financial & BlinkX said.

Amol Athawale, vice president – technical at Kotak Securities is also of the view that, 22,200 or 20-day SMA would be the crucial support level for the traders. Above the same, the positive momentum is likely to continue.

On the higher side, the market could find the resistance at 22,600-22,800, he said, adding on the other side, below 22,200 the sentiment could change.

The India VIX, the fear gauge, gained 1 percent after declining for previous four consecutive sessions, while for the week, it was down 11.65 percent at 11.34, the lowest level since November 2023.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may face resistance at the 22,524 level followed by the 22,561 and 22,603 levels. On the lower side, the index may take immediate support at the 22,451 level followed by 22,425 and 22,383 levels.

On April 5, the Bank Nifty reacted positively to the outcome of RBI policy meeting outcome and rallied 432 points to 48,493, continuing uptrend for third consecutive session with above average volumes. The index is just 143 points away from its record high of 48,636 of December 28, 2023.

During the week, the index has formed long bullish candlestick pattern on the weekly charts and gained 2.9 percent.

"For the trend following traders now, 47,800 and 47,500 would be the key supports zones while 49,000-49,300 could be important resistance areas for the traders. However, below 47,500, traders may prefer to exit from the trading long positions," Amol Athawale of Kotak Securities said.

According to the pivot point calculator, the Bank Nifty index may see resistance at 48,554, followed by 48,725 and 48,978. On the lower side, it is expected to take support at 48,062 followed by 47,905 and 47,652.

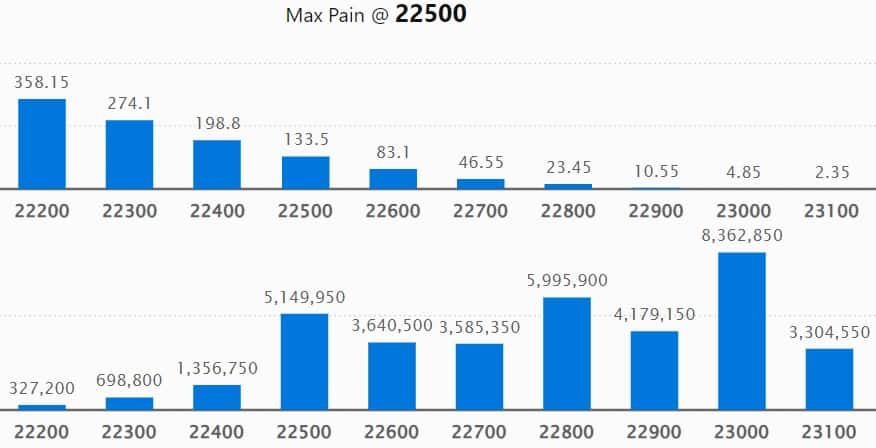

As per the weekly options data, the maximum Call open interest was seen at 23,000 strike, with 83.62 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 23,500 strike, which had 64.76 lakh contracts, while the 22,800 strike had 59.95 lakh contracts.

Meaningful Call writing was seen at the 22,800 strike, which added 38.4 lakh contracts followed by 23,000 strike and 23,500 strike, which added 37.06 lakh and 33.39 lakh contracts, respectively.

The maximum Call unwinding was at the 22,400 strike, which shed 1.73 lakh contracts followed by 22,300 and 21,500 strikes, which shed 23,450 contracts and 7,050 contracts, respectively.

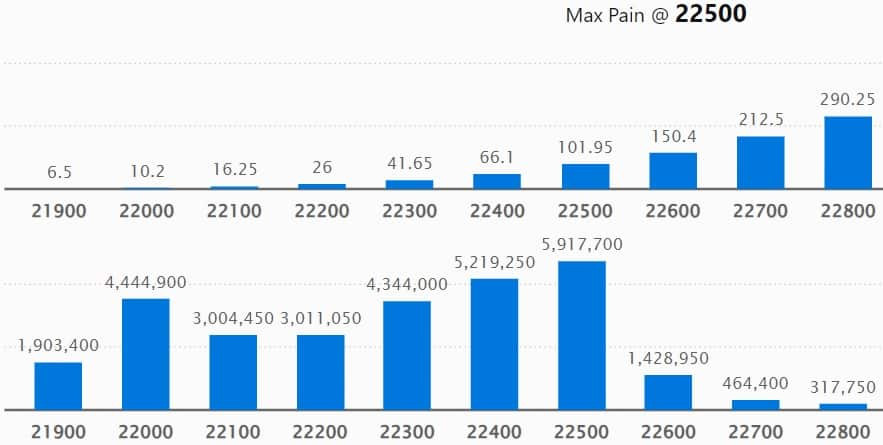

On the Put side, the 22,500 strike owned the maximum open interest, which can act as a key support level for the Nifty with 59.17 lakh contracts. It was followed by the 21,500 strike comprising 55.05 lakh contracts and then the 22,400 strike with 52.19 lakh contracts.

Meaningful Put writing was at the 22,400 strike, which added 24.53 lakh contracts followed by the 21,500 strike and 22,500 strike adding 23.71 lakh and 23.39 lakh contracts, respectively.

Put unwinding was seen at 23,200 strike, which shed 3,250 contracts followed by 23,100 strike, which shed 950 contracts.

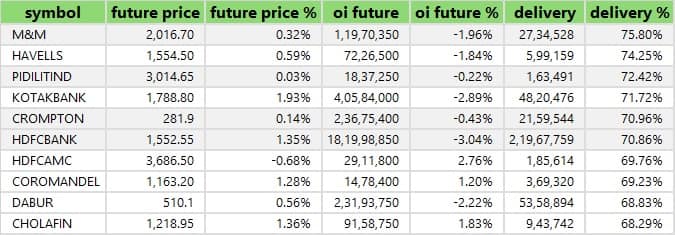

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Mahindra and Mahindra, Havells India, Pidilite Industries, Kotak Mahindra Bank, and Crompton Greaves Consumer Electricals saw the highest delivery among the F&O stocks.

A long build-up was seen in 60 stocks, which included Tata Chemicals, Gujarat Gas, Mahanagar Gas, ICICI Lombard General Insurance Company, and Metropolis Healthcare. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 26 stocks saw long unwinding, which included Birlasoft, Muthoot Finance, Indian Hotels, Aditya Birla Capital, and SRF. A decline in OI and price indicates long unwinding.

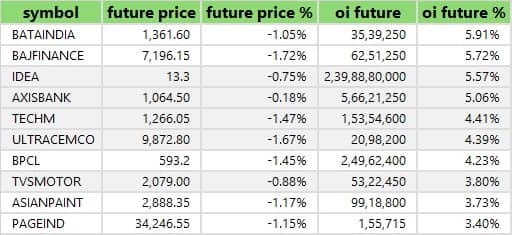

49 stocks see a short build-up

A short build-up was seen in 49 stocks, including Bata India, Bajaj Finance, Vodafone Idea, Axis Bank, and Tech Mahindra. An increase in OI, along with a fall in price points to a build-up of short positions.

Based on the OI percentage, a total of 50 stocks were on the short-covering list. These included Hindustan Copper, City Union Bank, Eicher Motors, Divis Laboratories, and AU Small Finance Bank. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell to 1.03 on April 5, from 1.17 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

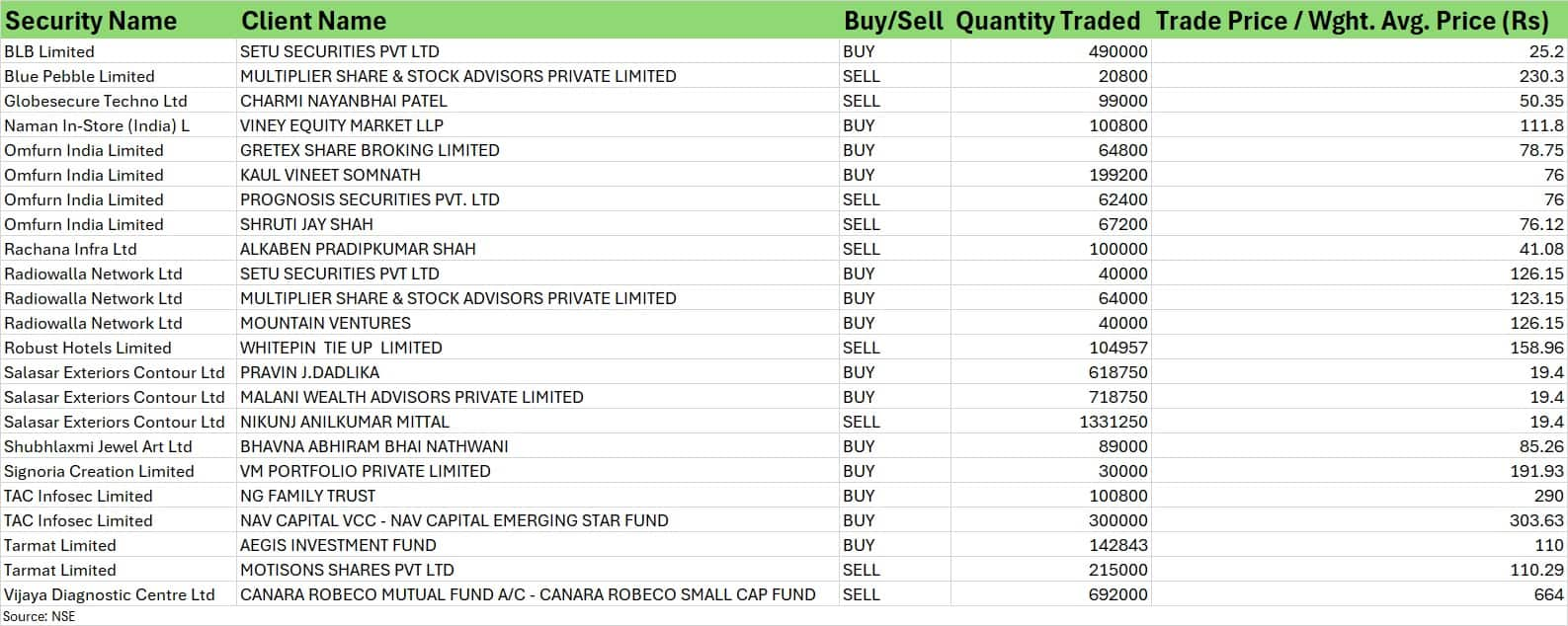

For more bulk deals, click here

Stocks in the news

Wipro: Chief Executive Officer and Managing Director Thierry Delaporte of the IT services company has resigned from his position on April 6. The software major has appointed Srinivas Pallia as the CEO and MD of the company.

Vodafone Idea: The telecom operator has received approval from the board of directors for fund raising up to Rs 2,075 crore from Oriana Investments, an Aditya Birla Group entity.

Tata Steel: The Tata Group company said India's crude steel production grew by 4.5 percent year-on-year to 5.38 million tonnes (MT), while deliveries increased by 5 percent YoY to 5.41 MT and were the highest ever quarterly deliveries.

Gland Pharma: The generic injectable-focused pharmaceutical company has received approval from the United States Food and Drug Administration (USFDA) for Eribulin Mesylate injection.

Cochin Shipyard: The company has signed the Master Shipyard Repair Agreement (MSRA) with United States Navy. The MSRA is a non-financial agreement and is effective from April 5. This will facilitate repair of US Naval vessels under Military Sealift Command in Cochin Shipyard.

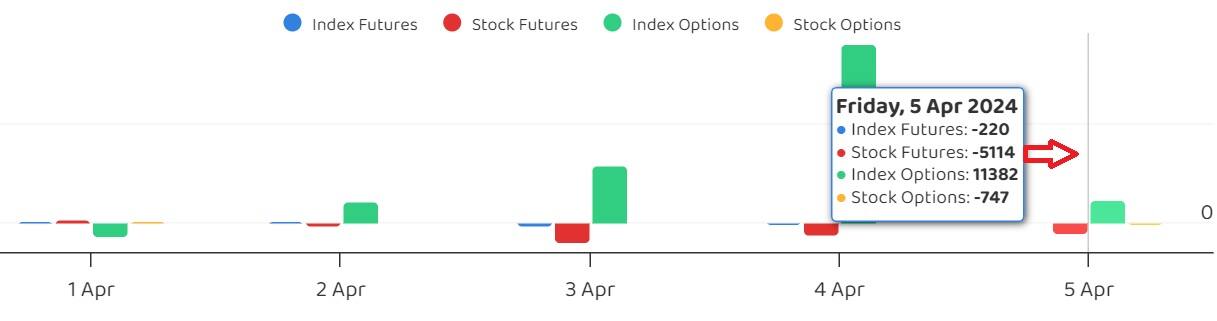

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 1,659.27 crore, while domestic institutional investors (DIIs) sold Rs 3,370.42 crore worth of stocks on April 5, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Bandhan Bank to the F&O ban list for April 8, while retaining Hindustan Copper, SAIL and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.