Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

The bull call spread is a type of options trading strategy that involves two (2) call options. This type of strategy is used when the trader expects a moderate rise in the price of an underlying asset.

Shriram Finance has broken out from a sideways consolidation with a bullish crossover in its short-term momentum indicators point at a positive trend.

According to Jay Thakkar, Head of Derivative and Quantitative Research at ICICI Direct, to capture the upside, one can implement a bull call option spread strategy.

The derivative strategy recommended by Thakkar is a Bull Call spread:

Position: Buy 1 lot of 2500 CE at Rs 89

Sell 1 lot of 2,600 CE at Rs 49

Risk reward ratio: 1:1.5

Maximum profit: The maximum profit will be 60 points at or above Rs 2,600 levels. However, if it closes below Rs 2,500, the maximum loss will be 40 points.

Net outflow

"The net outflow for the strategy will be 40 points, which is the maximum risk, while the maximum gain will be 60 points. Hence, the risk-to-reward ratio will be 1:1.5," said Thakkar.

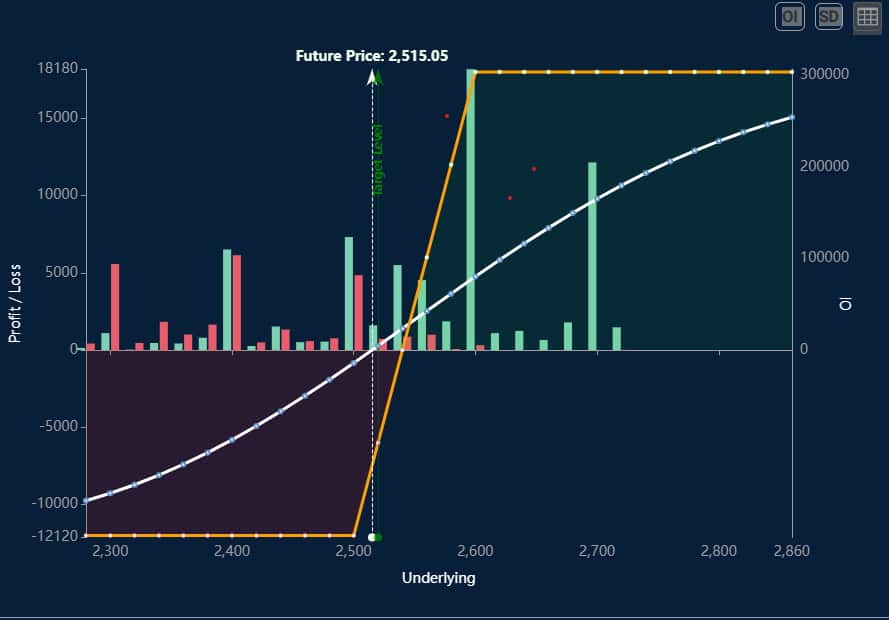

Payoff Chart of Bull Call spread strategy recommended| Source: ICICI Direct

Payoff Chart of Bull Call spread strategy recommended| Source: ICICI Direct

Technical set up

"Shriram Finance has broken out from a sideways consolidation with a bullish crossover in its short-term momentum indicators, thus indicating that the short-term trend is positive. The previous range was 2,500-2,250, approximately 10 percent. Now, with this breakout above the 2,500 levels, it is expected to move up to 2,700 and above levels in the short term," said Thakkar.

On the derivative front, the stock has seen good short covering since the last week of March, and with this breakout, it is expected to see some good long build going forward as the risk-to-reward is well in favor of the bulls. "Now, as per the options chain data, the stock has surpassed its crucial resistance of 2,500, and above those levels, it has the next resistance at 2,600 levels, where there is the highest concentration on the call front. Therefore, a bull call spread is recommended," he added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.