Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

In India, the prices have hit an all-time high of Rs 70,248 per 10 grams

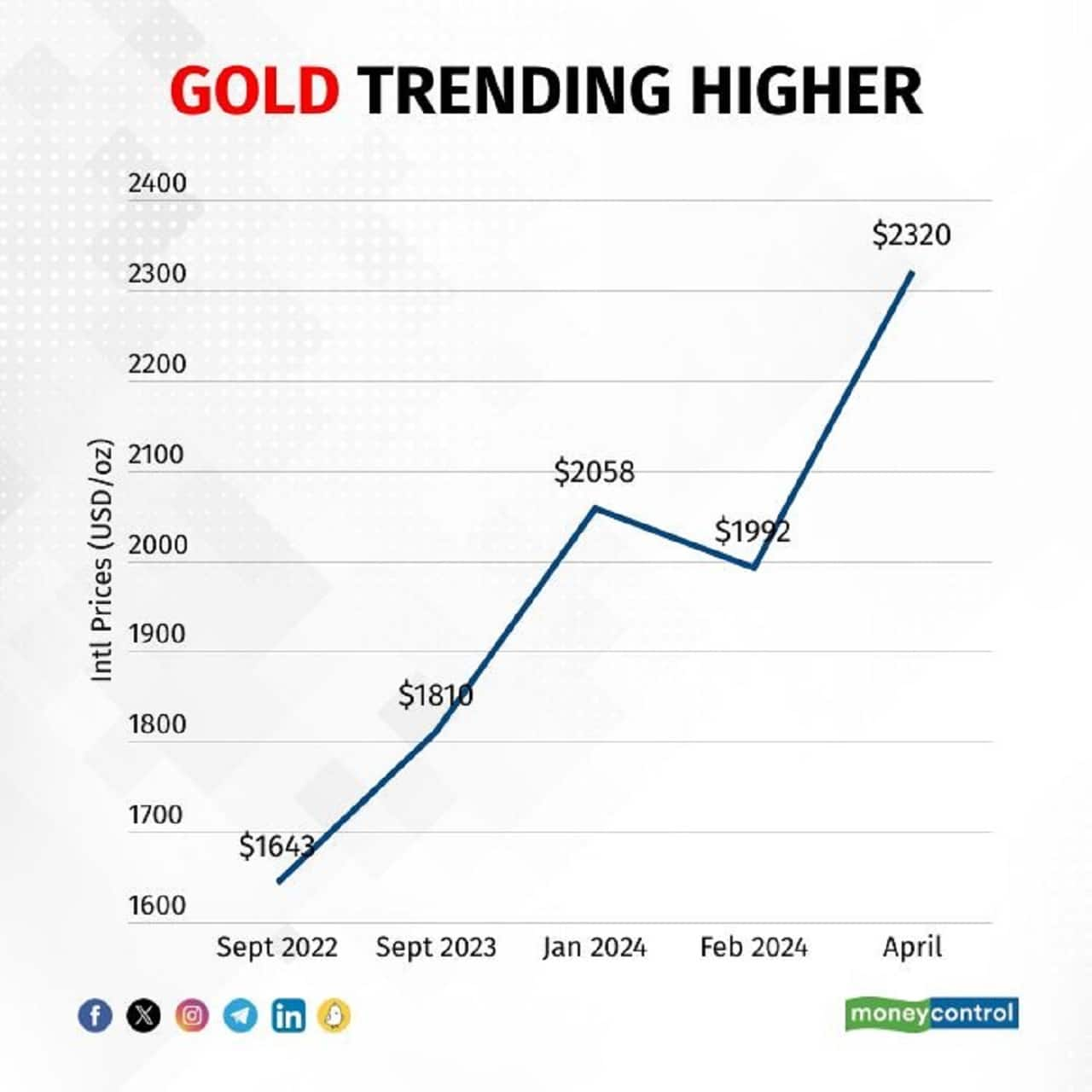

Gold prices jumped above $2,300 an ounce on April 4, posting record highs for the 8th straight day on the expectations that the US Federal Reserve will cut rates in 2024 and continuous demand from central banks.

The yellow metal touched a peak of $2,304.96 an ounce as the Fed boss Jerome Powell on April 3 said that it will be appropriate to cut borrowing costs “at some point this year”.

Bullion has gained $500 an ounce in recent months after hitting a low of $1,810 in September 2023.

Moreover, in India, the prices of the precious metal have hit an all-time high of Rs 70,248 per 10 grams. Its price was hovering in the range of Rs 56,000 to Rs 57,000 per 10 grams during this time past year.

Geopolitical tensions in Ukraine and the Middle East as well as record buying by global central banks have contributed to the support for gold. According to the World Gold Council, central banks have continued adding to their gold holdings. They bought record gold in 2022 with 1,136 tons, it slipped marginally to 1,037 tons and the trend is heading in a similar direction in the first quarter of 2024. China has dominated the purchases in Asia, while the Reserve Bank of India’s gold reserves stand at 817 tons.

Who is buying so much gold?

Gold‘s global market capital is estimated at a massive $15.57 trillion. It’s not easy to manipulate markets but experts say they are unable to analyse the one-way direction of gold and many believe that it is because of buying in paper gold. Remember, while gold ETF in India needs to be backed by physical gold, in most other countries this is not mandatory.

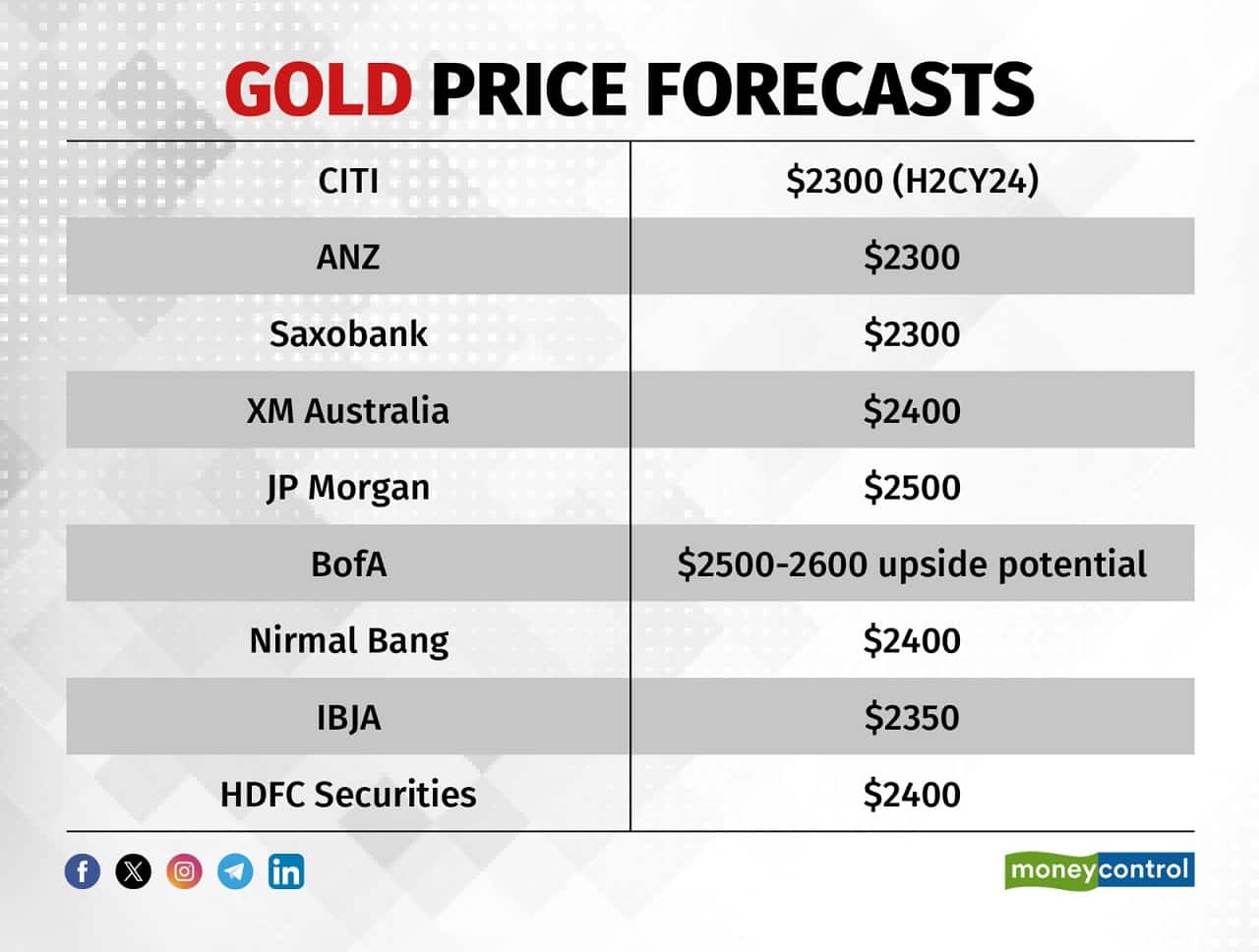

The Citi Group has predicted gold the price to hover around $2,300 per ounce in the second half of 2024, while JPMorgan believes it will hit $2,500 an ounce.

Where is gold headed?

The gold targets set for the end of this year have all been achieved in the 4th month of 2024 already with the precious metal at an all-time high of $2,300 per ounce. Experts believe that gold prices can continue to stay firm until the second half of 2025 before heading into a correction.

Should you buy or sell?

India usually buys major chunk of its gold in physical form and good returns are made on that. Not many holders are encashing gold at the current levels as they expect the metal to go higher. It is also being reported that jewelry buyers are exchanging old for new or buying according to their budget. In India, it is seen that investors buy gold for longer period of time and while that doesn’t give them dividend or bonus, it is a good portfolio diversifier. So, if you are looking to buy physical gold for long term, go ahead and buy any dips. Sell your gold only if you need money. However, if you are trading gold then shorting it is still not the way to go amid the kind of sustainable momentum that is being witnessed. Though, a correction after this run isn’t ruled out.

With inputs from Reuters

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.