Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

In FY24 Indian equity market witnessed significant gains, with Mid and Smallcap indices soaring by 60% and 63% respectively, while the Largecap Nifty 50 increased by 28.6%

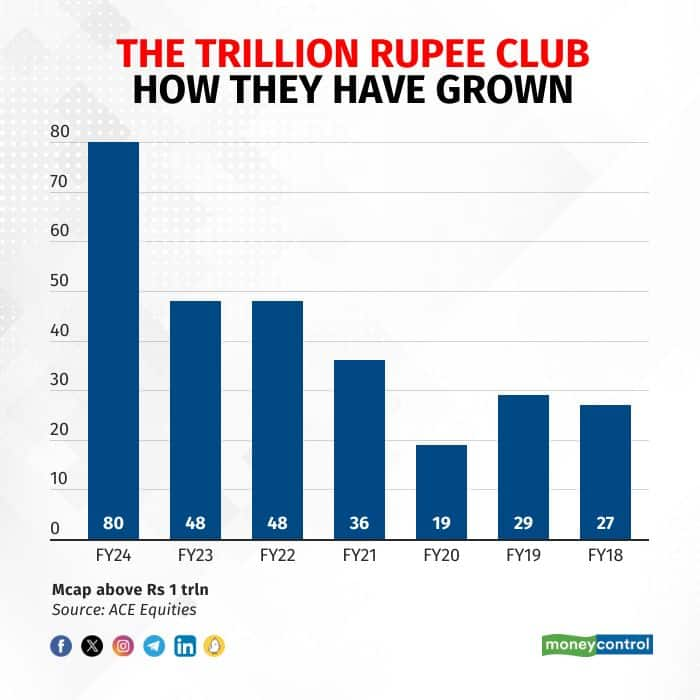

Thanks to the sustained momentum in stock markets, the number of companies with market cap in excess of Rs 1 trillion has burgeoned to 80 over the past fiscal.

This figure marks a notable increase from FY23 when there were 48 firms with market cap above Rs 1 trillion. Between FY22 and FY23, this number remained constant as the market was more or less static, although it was dotted by intermittent volatility. In FY21, the count stood at 36, sharply higher from the FY20 number of 19 when the market saw huge erosion in value, hammered by the Covid woes.

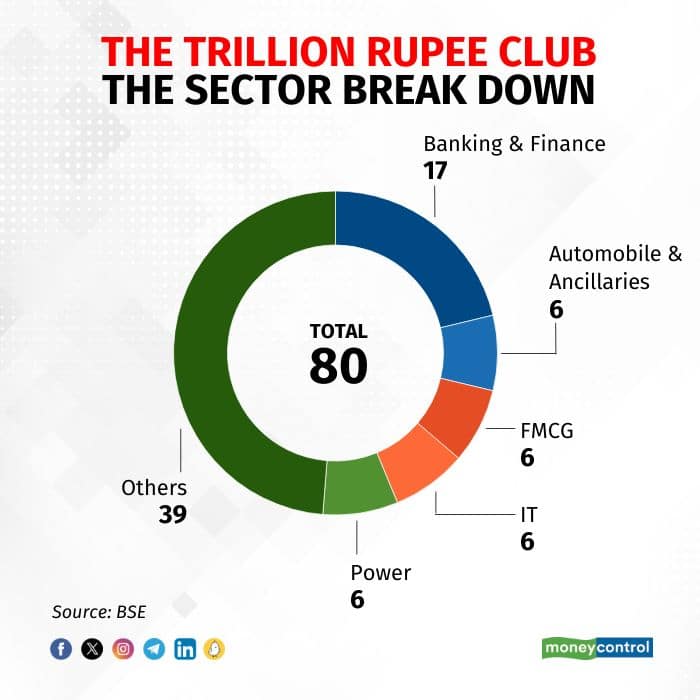

In FY24, Zydus Lifesciences, TVS Motor Co, Tata Consumer Products, Canara Bank, Indian Overseas Bank, Union Bank of India, and many more mid to small firms entered the Rs 1 trillion mcap club. Billionaire Mukesh Ambani’s Reliance Industries was the most valuable company with a market value of Rs 20.15 trillion, followed by Tata Consultancy Services at Rs 14.05 trillion, HDFC Bank at Rs 11 trillion, ICICI Bank at Rs 7.7 trillion and Bharti Airtel at Rs 7.44 trillion.

There are at least 10 other companies that are within the striking distance of entering the exclusive club if the market rally sustains in 2024. These include Cholamandalam Investment and Finance with a market cap of Rs 97,151 crore, Havells India at Rs 94,934 crore, Hero MotoCorp at Rs 94,307 crore, Shree Cement at Rs 92,741 crore, Dabur India at Rs 92,704 crore, Bajaj Holdings & Investment at Rs 92,260 crore, Mankind Pharma at Rs 92,030 crore, Apollo Hospitals Enterprise at Rs 91,330 crore, Divi's Laboratories at Rs 91,034 crore and NHPC at Rs 90,034 crore.

"This surge in megacap companies stems from a mix of factors, including companies’ aiming for expansion. Market capitalisation has notably grown to $4 trillion from $3 trillion, with government investment in infrastructure likely driving increased business activity and performance improvement. It's intriguing to see how these 80 companies are evolving amidst the broader economic growth," said Deven Choksey, MD, DRChoksey FinServ.

Gaurang Shah, senior vice-president at Geojit Financial Services, noted that with the market reaching record highs and improved macroeconomic conditions, investor participation has expanded beyond largecaps to include broader segments. Analysts are now covering more companies due to earnings improvements, providing more analysis and higher target prices, and thus contributing to the broad-based rally.

The broad-based rally in Indian markets since April 2023 was fuelled by several factors: enhancement in high-frequency indicators, strong growth in Indian corporate earnings, positive investor sentiment due to policy continuity, and robust domestic and foreign inflows.

During this period, the Indian equity market witnessed significant gains, with mid and smallcap indices soaring by 60 percent and 63 percent, while the largecap Nifty 50 increased by 28.6 percent. Sectors such as realty, PSU banks, auto, energy, infra, and pharma outperformed, whereas media, private banks, and FMCG sectors showed subdued returns. However, in the last month, the market has corrected from this overbought state and now 68 percent of the stocks are trading above the 200-day moving average versus 84 percent of the stocks during Mid Feb 2024.

Brokerage Axis Securities foresee market fundamentals being driven by "narrative" in the near term, especially without major triggers. Key factors shaping market direction include macroeconomic developments, bond yields, oil prices, dollar index, Q4FY24 earnings, and pre-election cues. Amid these factors, analysts emphasise the significance of style and sector rotation for alpha generation. Despite recent gains in midcaps and smallcaps, analysts caution that valuations may not offer as much safety as in largecaps. Consequently, certain segments of the broader market may experience time correction in the near term, with flows potentially shifting towards largecaps.

Axis report further expect that the Indian economy will maintain its growth trajectory in 2024 among emerging markets amid global economic volatility. Strengthened corporate balance sheets and a healthier banking system are seen as catalysts by Axis Securities, projecting double-digit returns in Indian equities over the next 2-3 years, supported by robust earnings growth.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.