Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty likely to consolidate with support at 22,300

The market has consolidated after three-day gains and closed moderately lower on April 2. The consolidation is likely to continue in the coming days too, especially ahead of the RBI policy meeting, with the Nifty 50 likely taking support at 22,300-22,200 in coming days, experts said, adding on the higher side, 22,500 is expected to be a key hurdle for the index as breaking of the same may take the index towards 22,700-23,000 levels.

On April 2, the BSE Sensex was down 111 points at 73,904, while the Nifty 50 fell 9 points to 22,453, and formed a small bearish candlestick pattern with upper and lower shadows, which resembles Doji kind of candlestick pattern on the daily charts, indicating an indecisiveness among buyers and sellers about the future market trend.

"There are no negative signs as of now as the short-term uptrend remains intact. It’s just that Monday’s record high is around the previous high of 22,525 and there has been open interest addition seen in the 22,500 Call option. Thus, the index consolidated for the day and it could trade within a range for one or two sessions," Ruchit Jain, lead research at 5paisa.com said.

On dips, he feels 22,300 would be seen as the immediate support while a move above 22,530 could lead to a continuation of the upmove towards 22,700-22,750. Hence, "traders are advised to trade with a positive bias and look for stock-specific buying opportunities," he said.

Rupak De, senior technical analyst at LKP Securities also believes the sentiment remains positive, with the Nifty closing above the important moving averages. "Momentum also remains positive, as indicated by the RSI (relative strength index) in bullish crossover."

The volatility hit a fresh 2024's closing low, giving more support to the bulls. The India VIX, the fear index, dropped 3.56 percent to 11.65, the lowest level since November 24, 2023.

The broader markets outperformed benchmark indices and extended upward journey for yet another session. The Nifty Midcap 100 and Smallcap 100 indices gained 1.2 percent each.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may face resistance at the 22,488 level followed by the 22,514 and 22,556 levels. On the lower side, the index may take immediate support at the 22,405 level followed by 22,379 and 22,337 levels.

On April 2, the Bank Nifty has also seen consolidation and closed at 47,545, down 33 points. The index has formed small-bodied bullish candlestick pattern with upper shadow on the daily charts.

"The banking index is likely to resume its up-move towards 47,850 – 48,000 from a short-term perspective. So the minor degree pullbacks should be used as a buying opportunity," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

According to the pivot point calculator, the Bank Nifty index may see resistance at 47,668, followed by 47,738 and 47,853. On the lower side, it is expected to take support at 47,440 followed by 47,369 and 47,255.

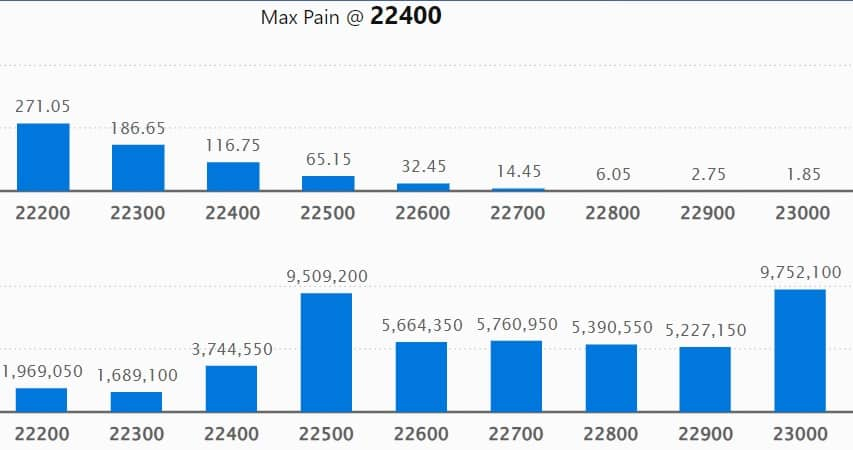

As per the weekly options data, the maximum Call open interest was seen at 23,000 strike, with 97.52 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 95.09 lakh contracts, while the 22,700 strike had 57.6 lakh contracts.

Meaningful Call writing was seen at the 23,000 strike, which added 26.71 lakh contracts followed by 22,500 strike and 22,700 strike, which added 21.17 lakh and 15.55 lakh contracts, respectively.

The maximum Call unwinding was at the 23,500 strike, which shed 4.28 lakh contracts followed by 23,400 and 22,000 strikes, which shed 1.17 lakh contracts and 71,600 contracts, respectively.

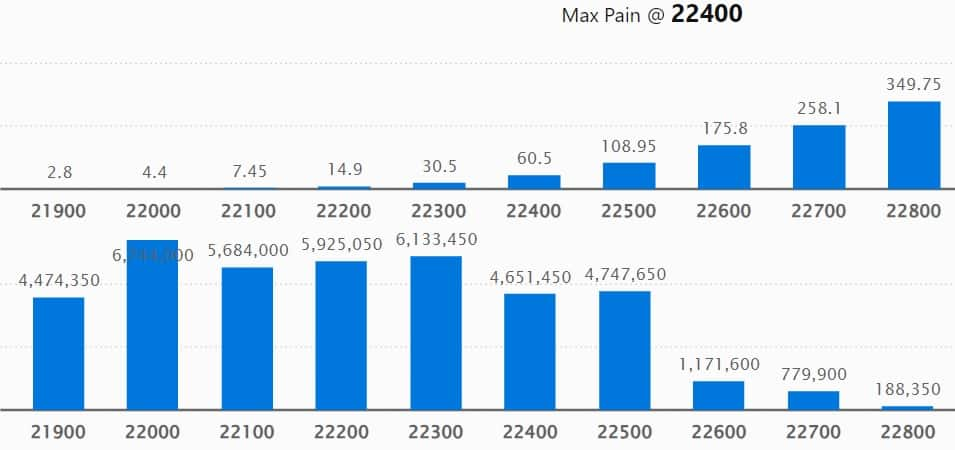

On the Put side, the 22,000 strike owned the maximum open interest, which can act as a key support level for the Nifty with 67.44 lakh contracts. It was followed by the 22,300 strike comprising 61.33 lakh contracts and then the 22,200 strike with 59.25 lakh contracts.

Meaningful Put writing was at the 21,900 strike, which added 18.34 lakh contracts followed by the 22,100 strike and 21,800 strike adding 14.99 lakh and 14.02 lakh contracts, respectively.

Put unwinding was seen at 21,500 strike, which shed 4.8 lakh contracts followed by 22,500 and 21,600 strikes, which shed 2.06 lakh and 48,500 contracts, respectively.

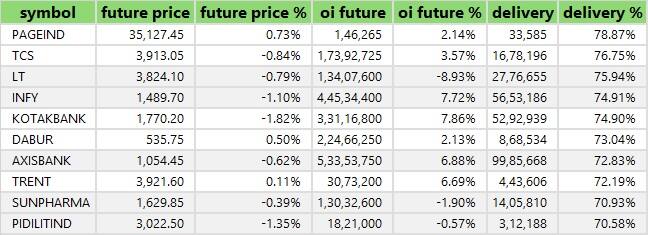

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Page Industries, Tata Consultancy Services, Larsen & Toubro, Infosys, and Kotak Mahindra Bank saw the highest delivery among the F&O stocks.

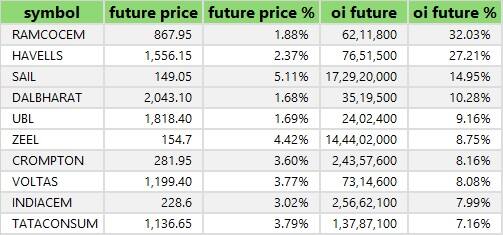

A long build-up was seen in 77 stocks, which included Ramco Cements, Havells India, Steel Authority of India, Dalmia Bharat, and United Breweries. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 14 stocks saw long unwinding, which included Gujarat Gas, Larsen & Toubro, Apollo Hospitals Enterprise, Aurobindo Pharma, and Sun Pharmaceutical Industries. A decline in OI and price indicates long unwinding.

38 stocks see a short build-up

A short build-up was seen in 38 stocks, including Hindustan Copper, IndiaMART InterMESH, Kotak Mahindra Bank, Infosys, and Axis Bank. An increase in OI, along with a fall in price points to a build-up of short positions.

56 stocks see a short covering

Based on the OI percentage, a total of 56 stocks were on the short-covering list. These included Aditya Birla Fashion & Retail, Adani Enterprises, L&T Technology Services, Godrej Properties, and Coal India. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 1.00 on April 2, from 1.07 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

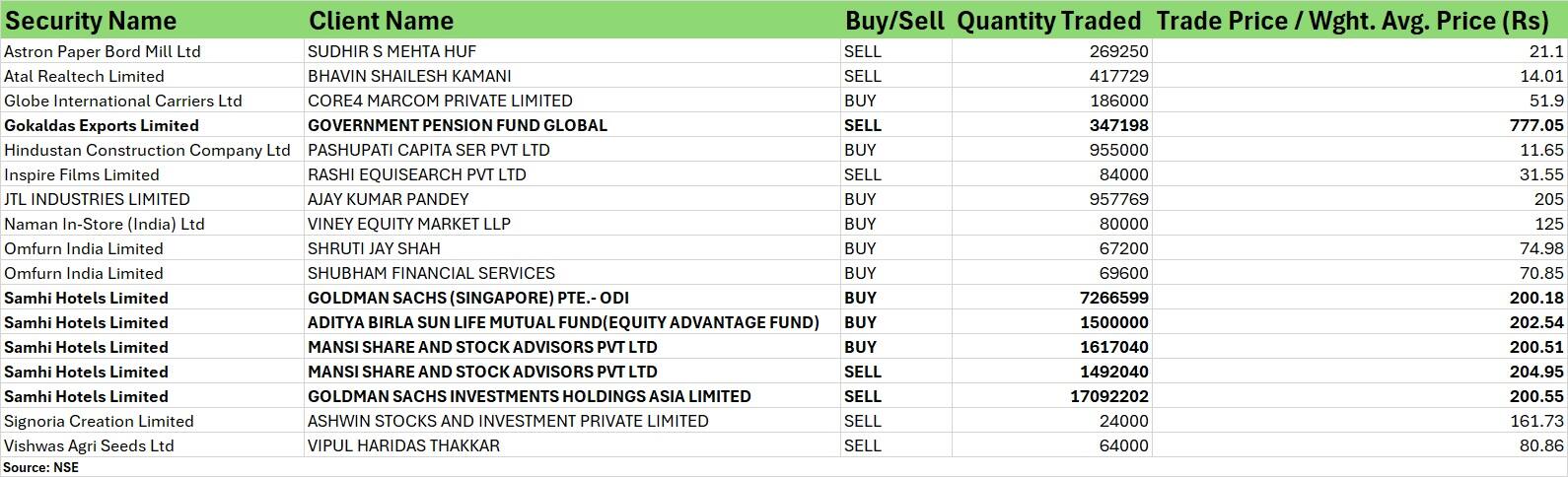

For more bulk deals, click here

Stocks in the news

JSW Energy: The JSW Group company has received approval from the board of directors for raising funds up to Rs 5,000 crore via qualified institutions placement (QIP) in one or more tranches.

Biocon: Subsidiary Biocon Biologics has completed the transfer of branded formulations business in India, to Eris Lifesciences on a slump sale basis, for Rs 1,242 crore. The branded formulations business comprises of metabolics, oncology and critical care diagnostic.

HCL Technologies: The IT services company said HCL Investments UK, a step-down wholly owned subsidiary of the company, has completed the divestment of 49 percent equity stake in its joint venture (JV) with US-based State Street International Holdings. The subsidiary has received $172.5 million for divestment of joint venture and termination of agreement for related services.

MOIL: The manganese ore mining company has recorded best ever production of any financial year since inception, at 17.56 lakh tonnes, growing sharply by 35 percent year-on-year. This is 29 percent higher than the previous best ever production of 13.64 lakh tonnes in FY08.

ESAF Small Finance Bank: The bank has operationalised the Authorised Dealer Category 1 licence (foreign exchange operations) with effect from April 2.

SRM Contractors: The Jammu and Kashmir-based EPC contractor will list its equity shares on the bourses on April 3. The final issue price has been fixed at Rs 210 per share.

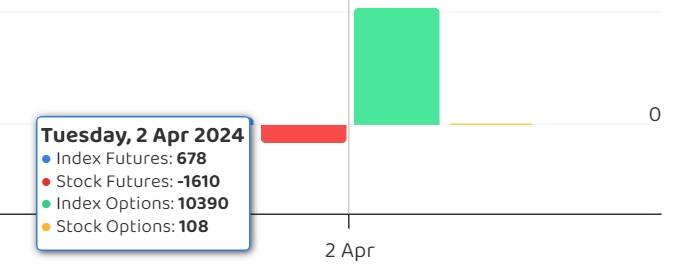

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 1,622.69 crore, while domestic institutional investors (DIIs) purchased Rs 1,952.72 crore worth of stocks on April 2, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Hindustan Copper to the F&O ban list for April 3.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.