Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Eventually, the Nifty is likely to hit 22,800-23,000 in coming days, experts said

The market recorded healthy gains on the first day of April series and formed Doji candlestick pattern on the daily charts. Given the formation of such pattern at the record high levels, the market may either reverse some gains or consolidate at current levels, with immediate support at 22,300-22,200 levels, but in case of continuation of uptrend, 22,500-22,600 will be levels to watch on the higher side, experts said, adding the overall trend remains positive.

On April 1, the benchmark indices gained for a third consecutive session. The BSE Sensex rallied 363 points to 74,015, while the Nifty 50 rose 135 points to 22,462.

"Such Doji formation at new highs/after a reasonable upmove signal chances of consolidation or minor dip from the higher levels," said Nagaraj Shetti, senior technical research analyst at HDFC Securities.

Any consolidation or dip could be a buying opportunity, he advised.

The overall chart pattern remains positive, hence eventually, the Nifty could show a decisive upside breakout of 22,500 levels and the near-term upside target would be around 22,800, he said, adding immediate support is at 22,200 level.

To maintain the upward momentum, Kunal Shah, senior technical & derivative analyst at LKP Securities also feels the index must decisively breach the 22,500 mark, paving the way for further gains towards 22,700/22,800 levels.

Meanwhile, the volatility fell sharply during the day, making the trend favourabe for bulls. The India VIX, the fear index, dropped 5.84 percent to 12.08, the lowest level since December 13, 2023.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may face resistance at the 22,471 level followed by the 22,536 and 22,575 levels. On the lower side, the index may take immediate support at the 22,434 level followed by 22,410 and 22,371 levels.

On April 1, the Bank Nifty rallied 454 points or 0.96 percent to 47,578, and formed bullish candlestick pattern on the daily charts, making higher highs, higher lows formation for third consecutive session. The index continued to trade above all key moving averages.

Bank Nifty has broken out of the sideways consolidation on the way up and is witnessing follow through buying interest. It is likely to continue the momentum towards 47,850 – 48,000 from a short-term perspective, Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

So the minor degree pullbacks should be used as a buying opportunity, he advised.

According to the pivot point calculator, the Bank Nifty index may see resistance at 47,603, followed by 47,702 and 47,806. On the lower side, it is expected to take support at 47,428 followed by 47,364 and 47,259.

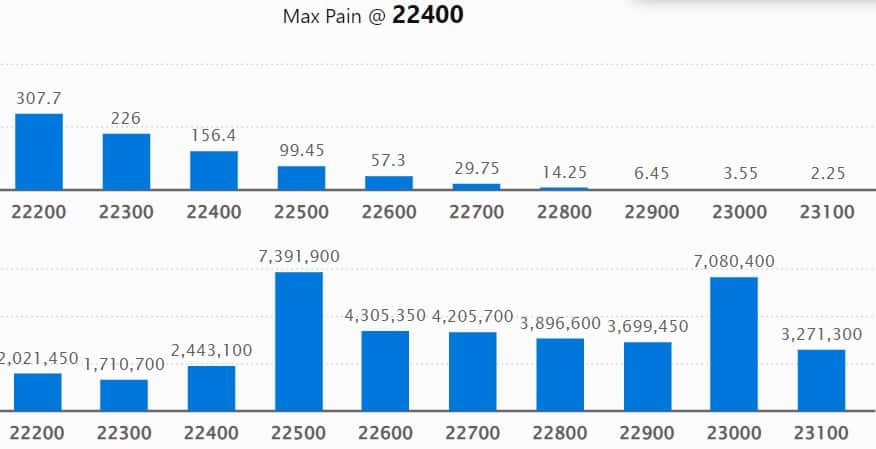

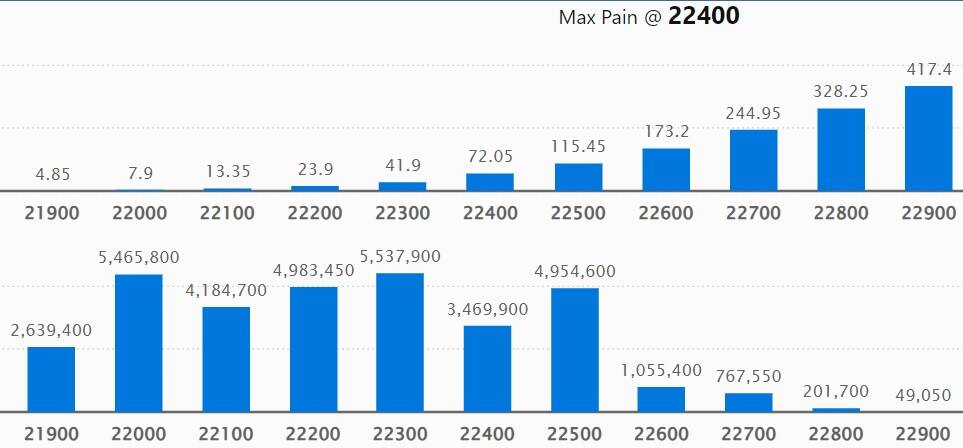

As per the weekly options data, the 22,500 strike owned the maximum Call open interest, with 73.91 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 23,000 strike, which had 70.8 lakh contracts, while the 22,600 strike had 43.05 lakh contracts.

Meaningful Call writing was seen at the 22,500 strike, which added 30.19 lakh contracts followed by 23,000 strike and 22,800 strike, which added 27.5 lakh and 24.46 lakh contracts, respectively.

The maximum Call unwinding was at the 22,000 strike, which shed 6.1 lakh contracts followed by 22,300 and 21,500 strikes, which shed 5.47 lakh contracts and 4.34 lakh contracts, respectively.

On the Put side, the maximum open interest was seen at 22,300 strike, which can act as a key support level for the Nifty with 55.37 lakh contracts. It was followed by the 22,000 strike comprising 54.65 lakh contracts and then the 22,200 strike with 49.83 lakh contracts.

Meaningful Put writing was at the 22,500 strike, which added 25.85 lakh contracts followed by the 22,300 strike and 21,800 strike adding 23.35 lakh and 20.36 lakh contracts, respectively.

Put unwinding was seen at 23,000 strike, which shed 3.33 lakh contracts followed by 21,400 and 23,100 strikes, which shed 2.36 lakh and 15,200 contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Dr Lal PathLabs, Tata Consumer Products, Bharti Airtel, SBI Life Insurance Company, and Dalmia Bharat saw the highest delivery among the F&O stocks.

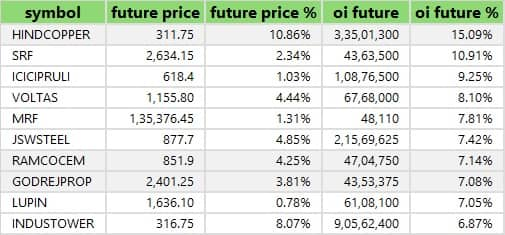

A long build-up was seen in 90 stocks, which included Hindustan Copper, SRF, ICICI Prudential Life Insurance Company, Voltas, and MRF. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 4 stocks saw long unwinding, which were Maruti Suzuki India, ITC, Godrej Consumer Products, and Hero MotoCorp. A decline in OI and price indicates long unwinding.

26 stocks see a short build-up

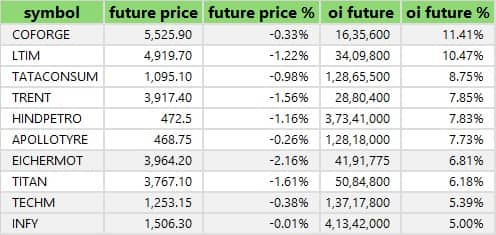

A short build-up was seen in 26 stocks, including Coforge, LTIMindtree, Tata Consumer Products, Trent, and Hindustan Petroleum Corporation. An increase in OI, along with a fall in price points to a build-up of short positions.

66 stocks see a short covering

Based on the OI percentage, a total of 66 stocks were on the short-covering list. These included Adani Enterprises, Adani Ports, MCX India, Tata Steel, and Ambuja Cements. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 1.07 on April 1, from 1.18 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

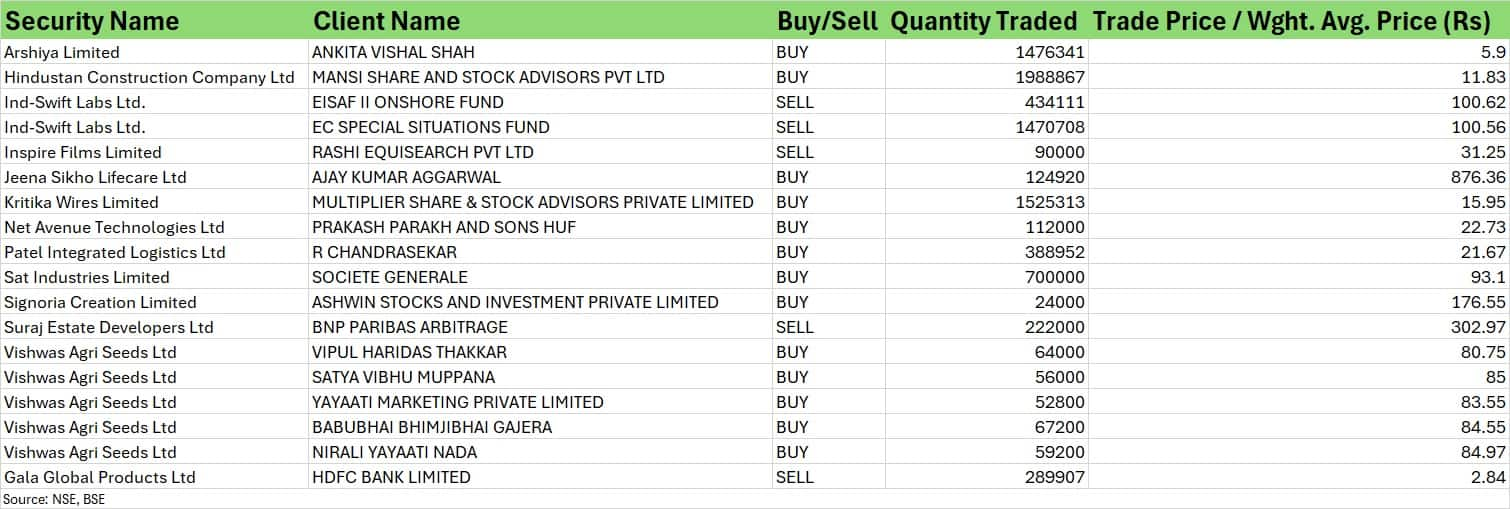

For more bulk deals, click here

Stocks in the news

Ashok Leyland: The commercial vehicles maker has recorded a 4 percent on-year decline in total vehicle sales at 22,866 units, with domestic sales falling 7 percent to 21,317 units during the same period. The medium and heavy commercial vehicle sales dropped 7 percent YoY to 15,562 units in March 2024.

Bharat Dynamics: The state-owned defence company recorded a turnover of Rs 2,350 crore for the financial year ended March 2024, declining 5.6 percent from Rs 2,489.4 crore in previous year, due to current geopolitical situation prevailing in Europe and Middle East which has affected the supply chain of the company. The order book of the company as of April 1, 2024 stands at Rs 19,468 crore.

Uflex: Flex Films Rus LLC, Russia, a step-down subsidiary of the company, has commissioned CPP film production line with its installed capacity of 18,000 MT per year.

HDFC Bank: The private sector lender said the board has appointed Suketu Kapadia as Group Head – Internal Audit with effect from April 1, 2024. Kapadia has been appointed in place of V Chakrapani.

Hero MotoCorp: The world's largest two-wheeler manufacturer sold 4.9 lakh units in March 2024, declining 5.6 percent compared to year-ago period. Domestic sales fell 8.6 percent year-on-year to 4.59 lakh units, but exports grew by 87.6 percent YoY to 31,158 units in March.

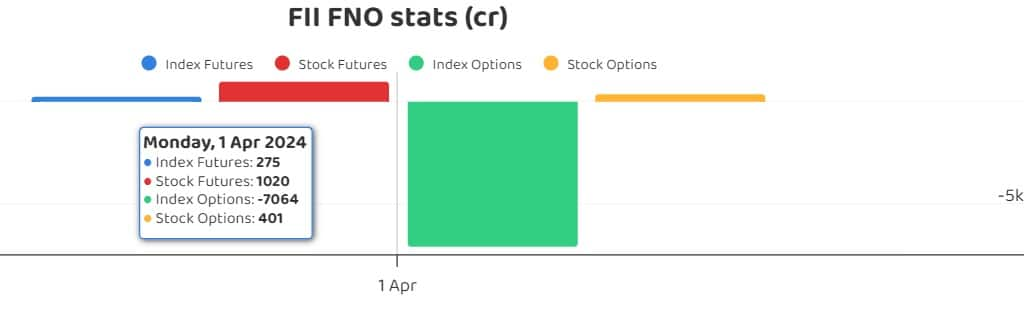

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 522.30 crore, while domestic institutional investors (DIIs) purchased Rs 1,208.42 crore worth of stocks on April 1, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has not added any stock to the F&O ban list for April 2. Zee Entertainment Enterprises was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.