MidOcean Closes Acquisition of Australian LNG Assets from Tokyo Gas

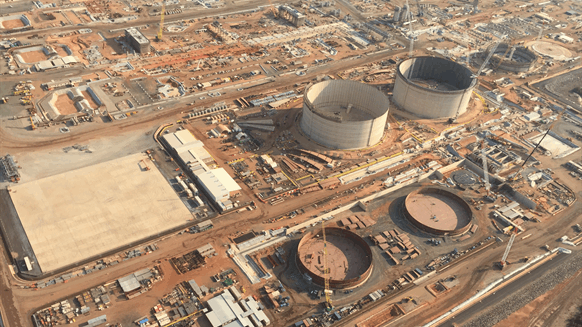

MidOcean Energy, a liquefied natural gas (LNG) company formed and managed by institutional investor EIG, has completed its acquisition of Tokyo Gas Co., Ltd’s interests in a portfolio of Australian integrated LNG projects.

The acquisition includes Tokyo Gas’ interests in the Gorgon LNG, Pluto LNG and Queensland Curtis LNG projects, MidOcean said in a recent news release. The company noted that the portfolio benefits from experienced operators, including Chevron, Woodside and Shell, and spans the LNG value chain from upstream operations to midstream, liquefaction and sales.

As part of the transaction, MidOcean said it plans to open an office in Perth, Australia, to support and oversee the projects.

“The acquisition of these high quality, cash flowing LNG projects is a significant milestone in MidOcean’s strategy to build a diversified, global ‘pure play’ integrated LNG company that supports the world’s transition to a low-carbon future,” MidOcean CEO De la Rey Venter said. “This transaction accelerates our ambition to be a leading player in the global LNG sector for decades to come, and we look forward to servicing key LNG customers in Japan, Asia and across the globe”.

“We are strong believers in the role of LNG as a key enabler of the energy transition and have formed MidOcean to provide partners and investors differentiated exposure to the asset class,” EIG Chairman and CEO R. Blair Thomas said. “With these foundational assets, MidOcean has entered key projects and markets in Asia, which form the center of gravity of the global LNG business. De la Rey and team have an ambitious growth strategy that is expected to build on this foundation and expand geographically. Our focus on integrated projects is central to the strategy and affords MidOcean the opportunity to capture value across the full LNG value chain”.

The Australian LNG asset acquisition was announced in October 2022 and originally included an interest in Ichthys LNG for a total consideration of $2.15 billion.

In February, MidOcean said it was acquiring SK Earthon’s 20 percent interest in Peru LNG (PLNG), which owns and operates the first LNG export plant in South America, located in Pampa Melchorita, 105.6 miles (170 kilometers) south of Lima, Peru.

PLNG’s assets include a natural gas liquefaction plant with a processing capacity of 4.45 million metric tons per annum, a fully-owned 253.5-mile (408-kilometer) pipeline with a capacity of 1.29 billion cubic feet per day, two 130,000-cubic-meter storage tanks, a fully-owned marine terminal and a truck loading facility with capacity of up to 19.2 million cubic feet per day.

PLNG is operated by Hunt Oil Company and is one of only two LNG production facilities in Latin America, according to a recent news release from MidOcean. The PLNG transaction is subject to customary closing conditions.

EIG describes itself as a leading institutional investor in the global energy and infrastructure sectors, with $22.9 billion under management as of December 31, 2023. EIG specializes in private investments in energy and energy-related infrastructure on a global basis. During its 41-year history, EIG has committed over $47.1 billion to the energy sector through over 405 projects or companies in 42 countries on six continents.

To contact the author, email rocky.teodoro@rigzone.com

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

- Beach Energy to Lay Off 30 Percent of Workforce

- Mitsui Oil Makes FID on Vietnam Gas Project

- SLB Buys Majority Share in Aker Carbon Capture

- Eskom Disputes Report It Is a Key Nitrogen Dioxide Emitter

- Chevron, Hess Confident Embattled Merger Will Close Mid-2024

- Adnoc Begins Crude Production in Offshore Asset

- Oil and Gas Execs Reveal Where They See Henry Hub Price Heading

- MidOcean Closes Acquisition of Australian LNG Assets from Tokyo Gas

- Oil and Gas Executives Predict WTI Oil Price

- New China Climate Chief Says Fossil Fuels Must Keep a Role

- Brand Finance Ranks Most Valuable, Strongest Oil and Gas Brands

- House Passes Protecting American Energy Production Act

- Blockchain Demands Attention in Oil and Gas

- Macquarie Sees USA Oil Production Exiting 2024 at 14MM Barrels Per Day

- Macquarie Strategists Expect Brent Oil Price to Grind Higher

- Summer Pump Prices Set to Hit $4 a Gallon Just as Americans Hit the Road

- Pennsylvania County Joins List of Local Govts Suing Big Oil over Climate

- Oman Sees Increasing Ship-to-Ship Transfers of Russian Oil Bound for India

- Oil and Gas Executives Predict WTI Oil Price

- New China Climate Chief Says Fossil Fuels Must Keep a Role

- Chinese Mega Company Makes Major Oilfield Discovery

- VIDEO: Missile Attack Kills Crew Transiting Gulf of Aden

- Norway Regulator Blasts Proposal to Halt New Oil and Gas Permits

- Chinese Mega Company Makes Another Major Oilfield Discovery

- What Is the Biggest Risk to Offshore Oil and Gas Personnel in 2024?

- Vessel Sinks in Red Sea After Missile Strike

- Equinor Makes Discovery in North Sea

- Analysts Reveal Latest Oil Price Outlook Following OPEC+ Cut Extension