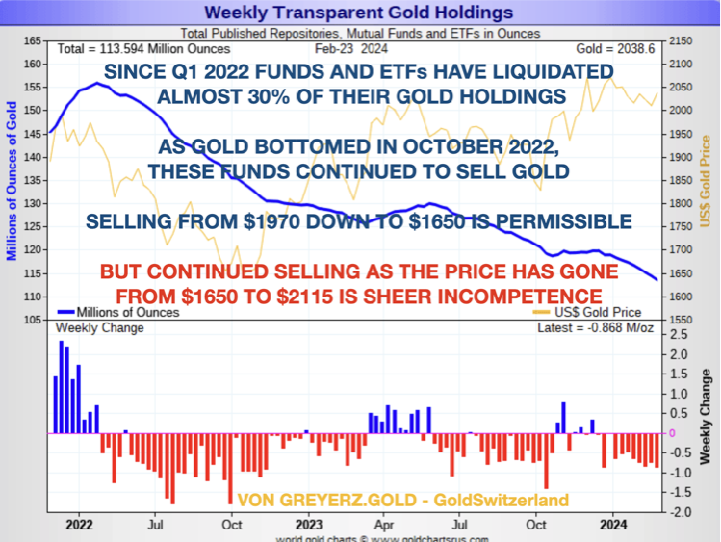

Gold has performed exceedingly well, touching a new record high of $2,286 per ounce today, after setting a series of peaks in recent sessions. Fueled by growing investor confidence in a potential rate cut and a weakening U.S. dollar, the yellow metal has surpassed key resistance levels, exhibiting bullish momentum. Global central bank demand for gold has shown no signs of abating, while a potential rebound in demand from gold-related exchange-traded funds (ETFs) could provide additional support for the precious metal. A host of positive drivers have pushed up bullion by around 14% since the middle of February. The prospect of monetary easing by major central banks, and elevated tensions in the Middle East and Ukraine have underpinned the rally. There’s also been strong buying by central banks, particularly in China, while consumers there have been loading up on bullion amid ongoing problems in Asia’s largest economy. Still, gold’s ascent has yet to strike a chord among investors who favor exposure to the metal through exchange-traded funds. Worldwide holdings in bullion-backed ETFs shrank by more than 100 tons in the first quarter, hitting the lowest level since 2019 in mid-March, before a small uptick, according to a Bloomberg tally.

While the U.S. stock market’s solid performance and interest rates above 5% may raise questions about the allure of non-interest-bearing gold, the potential for a reversion in these assets could partially explain the metal’s record and near-record-high prices. Historically, wars have been catalysts for gold price appreciation, and the current geopolitical landscape appears to be no exception. As investors grapple with the challenges of the current economic landscape, the precious metal’s resilience and potential for further gains may offer a glimmer of hope.

Gold has a key role as a strategic long-term investment and as a mainstay allocation in a well-diversified portfolio. Yet only a few investors have been able to recognize much of gold’s value over time by maintaining a long-term allocation and taking advantage of its safe-haven status during periods of economic uncertainty. Most of the investors get attracted towards gold and think about gold investments only after the price hits a new record high.

Why do Investors wait for New Highs in GOLD in order to Buy?

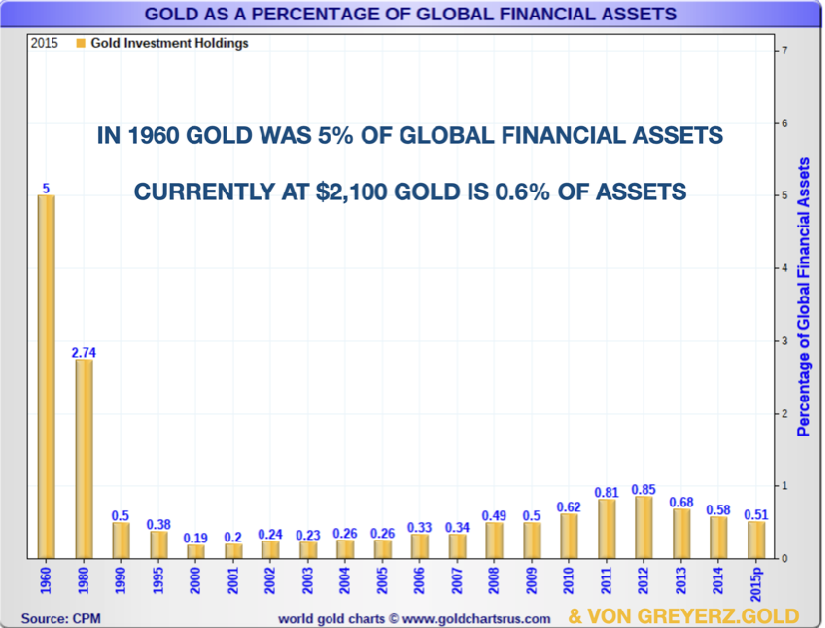

For almost 25 years I have been standing on a soapbox to inform investors of the importance of wealth preservation says Egon von Greyerz. Still only just over 0.5% of global financial assets have been invested in gold. In 1960 it was 5% in gold and in 1980 when gold peaked at $850, it was 2.7%.

For a quarter of a century, gold has gone up 7- 8X in most Western currencies and exponentially more in weak currencies like the Argentine Pesos or Venezuelan Bolivar. In spite of gold outperforming most asset classes in this century, it remains at less than 1% of Global Financial Assets – GFA. Currently at $2,100 gold is at 0.6% of GFA.

So gold has now broken out and very few investors are participating.

This stealth move that gold has made has left virtually every investor behind as this table shows:

The clever buyers are of course the BRICS central banks. Almost all of their purchases are off market so in the short term it has only a marginal effect on the gold price.

But now the squeeze has started as my good friend Alasdair Macleod explains so well on King World News. The Comex was never meant for physical deliveries but only for cash settlements. But now buyers are standing for physical delivery. We have also seen last month major exports of gold from the US to Switzerland. These are either Comex 400 ounce bars or US government bars sold/leased and sent to the Swiss refiners and broken down to 1 kg bars for onwards export to the BRICS. These bars will never return again even if they are only leased and not sold.

The above process will one day bring panic to the gold market as there will be nowhere near enough physical gold for all the paper claims.

So for any gold investors who don’t hold physical gold in a safe jurisdiction (NOT USA), I suggest that they quickly move their gold to a private vault where they have personal access, preferably in Switzerland or Singapore.

So NO FRACTIONAL GOLD OWNERSHIP, NO GOLD ETFs or FUNDS and NO GOLD IN BANKS!

At least not if you want to be sure to get hold of your gold as the gold squeeze starts.

GOLD IS ON THE CUSP OF A MAJOR MOVE

Having just broken out, gold is now on its way to much, much higher levels.

As I keep on saying, forecasting the gold price is a mug’s game. What is the purpose of predicting a price level when the unit you measure gold in (USD, EUR, GBP etc) is continually debasing and worth less every month.

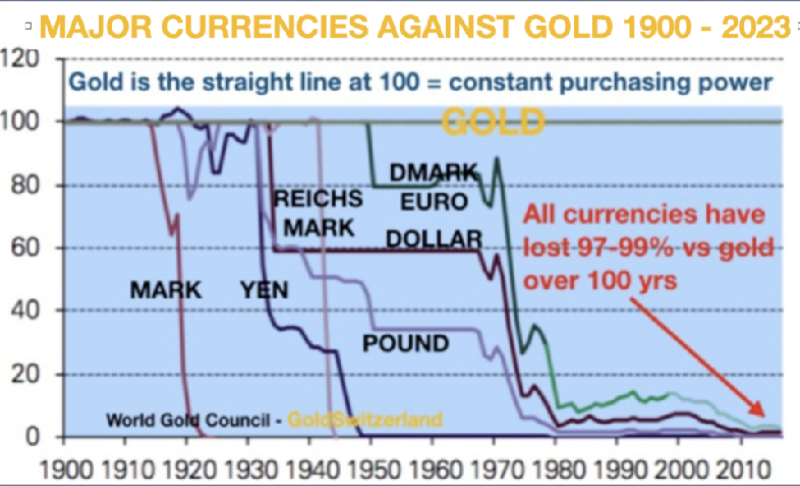

All investors need to know is that every single currency in history has without fail gone to ZERO as Voltaire said already in 1727. Since the early 1700s, over 500 currencies have become extinct, most of them due to hyperinflation.

Only since 1971 all major currencies have lost 97-99% of their purchasing power measured in gold. In the next 5-10 years they will lose the remaining 1-3% which of course is 100% from here.

But gold will not only continue to maintain purchasing power, it will do substantially better. This is due to the coming collapse of all bubble assets – Stocks, Bonds, Property etc.

YES, THE YELLOW METAL IS ON THE CUSP OF A MAJOR MOVE AS:

- Wars continue to ravage the world.

- Inflation rises strongly due to ever increasing debts and deficits.

- Currency continues their journey to ZERO.

- The world flees from stocks, bonds, and the US dollar.

- The BRICS countries continue to buy ever bigger amounts of gold.

- Central Banks buy major amounts of gold as currency reserves instead of US dollars.

- Investors rush into gold at any price to preserve their wealth.

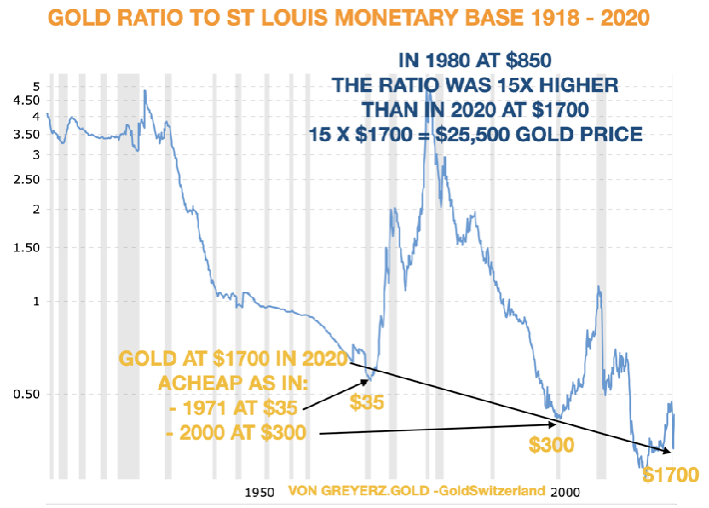

GOLD AS CHEAP AS IN 1971 OR 2000

The chart below indicates that gold in early 2020 at $1700 was as cheap as in 1971 at $35 and in 2000 at $300 in relation to money supply.

At this point we do not have an updated chart but it is our estimate that the monetary base has probably kept pace with the gold price meaning that the level in 2024 is similar to 2020.

So let me repeat my mantra:

Please jump on the Gold Wagon while there is still time to preserve your wealth. The coming surge in gold demand cannot be met by more gold because more than the current 3000 tonnes of gold per annum cannot be mined.

THUS THE ONLY MEANS TO SATISFY THE COMING GOLD MANIA IS THROUGH MUCH HIGHER PRICES.

Please check back for new articles and updates at Commoditytrademantra.com

request your views on the above article