Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Time to raise the overseas investment limits for mutual funds?

In a directive to the Association of Mutual Funds in India (AMFI), the Securities and Exchange Board of India (SEBI) on March 20 asked mutual funds to stop accepting subscriptions for investments in overseas ETFs from April 1, 2024. This is to prevent a breach of the $1-billion limit on such investments.

Moneycontrol was the first publication to report on SEBI’s action on March 21.

This comes at a time when there is growing clamour for increasing the Reserve Bank of India (RBI) imposed ceiling, which was last set in 2007-08.

The deadlock continues

It has been over two years since the limit available to mutual funds (MF) to invest in overseas markets ($7 billion) has been exhausted. And the RBI hasn’t increased this limit ever since. Meanwhile, Nvidia Corporation — the American headquartered graphics chipmaker — saw its share price shoot up by 245 percent in just last one year; a missed opportunity for those who could have invested and increased their allocation during the period.

Many Indian investors – including individual ones– are also keen on getting a slice of the international equities pie by investing in themes (such as AI, emerging technologies, semiconductors, electric vehicles, etc) and regions (US, China, Taiwan and so on).

At present, Indian mutual funds’ overseas equity assets across international fund of funds (FoFs), direct equities, international ETFs and domestic equity schemes are valued at over Rs 70,000 crore.

The question on everyone’s mind is this: When will RBI ease the overseas limits for mutual funds to invest abroad?

RBI limits queer the pitch for international funds

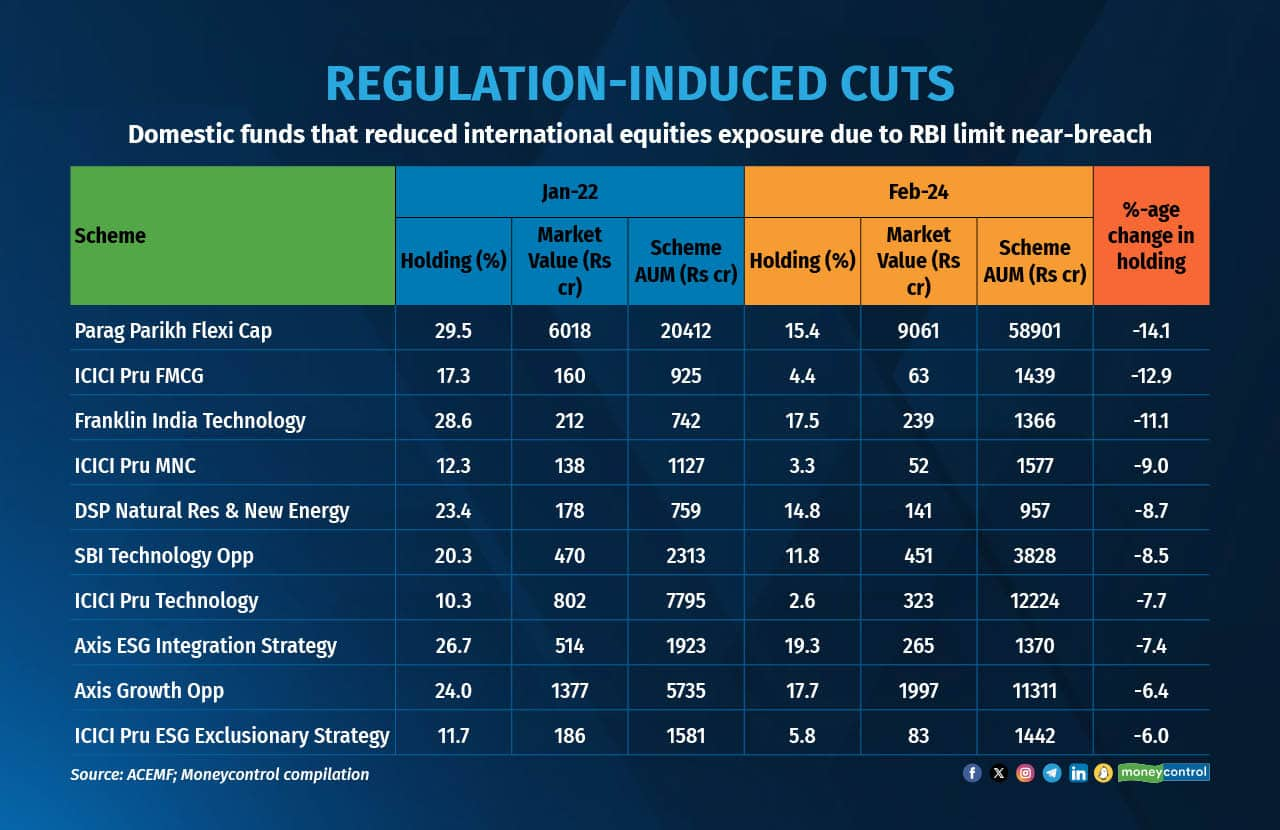

Mutual fund investments in foreign securities came to a screeching halt in February 2022 when the market regulator asked asset management companies to stop further investments in foreign stocks.

This was to avoid a breach of industry-wide overseas limits imposed by the RBI. For one, there’s an overall industry-level limit imposed by the Reserve Bank of India (RBI) of $7 billion for mutual funds to invest in overseas securities and funds. In addition, it has also specified a cap of $1 billion on individual fund houses, besides a separate limit of $1 billion for investing in overseas exchange-traded funds (ETFs).

There was a small respite in June 2023, when SEBI permitted mutual funds to invest in foreign stocks again, after a correction in the US markets created headroom for the deployment of funds within the overall $7 billion limit. On February 26 this year, four of Nippon India AMC’s funds stopped taking lump-sum investments, even as systematic investment plans (SIPs) continued, as it had hit its individual ceiling.

Despite multiple requests from the mutual fund industry to raise the limits, the RBI has not revised its stance. “When the overseas investment limit was reached by mutual funds and the cap was not enhanced, foreign exchange reserves were in a falling trajectory from a high of about $650 billion to $520 billion. The reluctance of the RBI was understandable. Now there is a case to enhance the limit as forex reserves are on an upward trajectory,” says Nilesh Shah, Managing Director, Kotak Mutual Fund.

On multiple occasions in the last two years, India’s central bank has acknowledged that it has received such requests from the mutual fund industry, but has not given any commitment on revising the limit. Emails sent to the RBI and SEBI had not elicited any response until the time of publication of this report. It will be updated as and when the regulators respond.

The mutual fund industry’s case for increase in limits

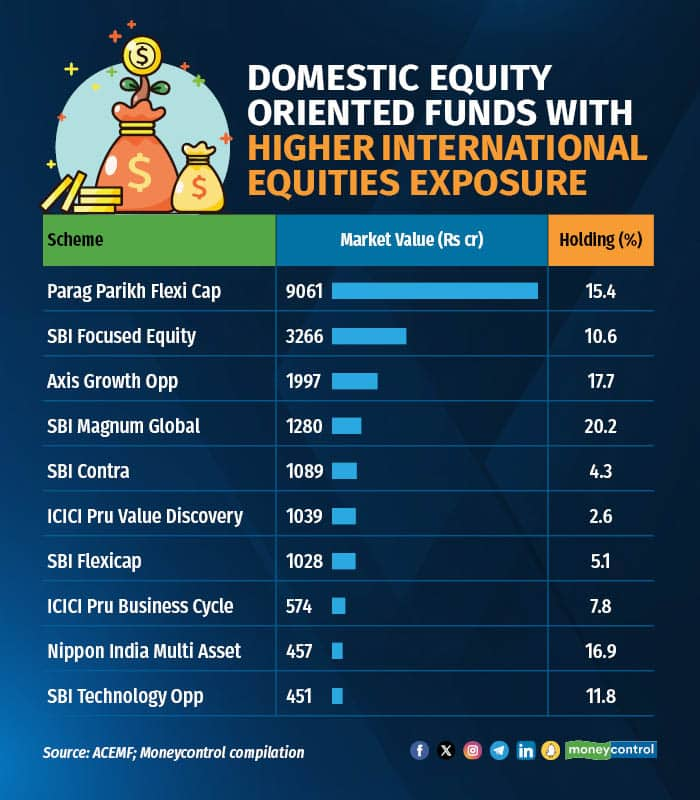

On its part, the mutual fund industry believes that there is a strong case for the relaxation of these caps. At present, the top three Indian mutual fund schemes with higher international equity exposure include Parag Parikh Flexicap (Rs 9,061 crore), Motilal Oswal Nasdaq 100 ETF (Rs 7,435 crore) and Franklin India Feeder - Franklin U.S. Opportunities (Rs 3,568 crore).

“The RBI is allowing overseas investment for individuals through the Liberalised Remittance Scheme (LRS) and family offices through its August 22, 2023 circular,” says Shah.

Fund managers speaking on the condition of anonymity told Moneycontrol that money that leaves Indian shores through the LRS route will not necessarily come back to India. On the other hand, this money can always make its way back into India if it were invested in overseas securities through mutual funds.

“The enhancement of limit for mutual funds will result in professional management of money and will give the option to bring the money back quickly in case the need arises,” says Shah.

Pratik Oswal, head of passive funds at Motilal Oswal AMC, concurs. “From a diversification perspective, it makes sense to invest in international stocks, which is where mutual funds come in. They offer a lot more transparency. (Investing in overseas securities through) LRS is the alternative option, but it is more expensive and involves cumbersome paperwork. Tax collected at source (TCS) will also come into the picture,” he says, calling for a “calibrated” increase in the limits.

The fund house, which manages India’s largest international fund NASDAQ 100 ETF with a corpus size of Rs 7,435 crore, had plans to launch 8-10 international funds. These included broad-based thematic – for instance, artificial intelligence (AI) – international funds as also schemes with a focus on emerging markets. However, it has had to put them on hold due to the limit.

The limits have not been revised since 2007-08 and a lot has changed in terms of economic growth and increase in foreign reserves since then, say fund houses. “If you count India's population at 1 billion, then this limit comes to only $7 per person cumulatively since 2007! In contrast, Indians are allowed to remit $250,000 per year per person under the LRS scheme. This is a huge gap and needs to be narrowed,” says Neil Parikh, CEO, PPFAS Mutual Fund, which offers a flexi-cap fund with the highest exposure to international equities among equity-oriented schemes in India.

Why the RBI may not play ball

Mutual fund industry officials who spoke to Moneycontrol on the condition of anonymity said that SEBI was on board their proposal to increase the limits and the ball was now firmly in the RBI’s court. “It might be a regulatory co-ordination issue,” says a top mutual fund official who did not wish to be named.

Economists, on the other hand, point out that the RBI has always been a conservative regulator that has to guard against the flight of capital as well as keep retail investors’ protection in mind. “We have a conservative central bank. The RBI’s line of thinking could be that if more investments were to be allowed into overseas stocks, then we could be inviting global shocks of greater intensity into the domestic market. There are concerns around global factors impinging on the local markets. Local portfolios will be directly impacted by global market movements. Ultimately, the RBI’s focus is on protecting the interests of retail investors and depositors,” says Abheek Barua, Chief Economist, HDFC Bank.

Market volatility, both international and domestic, could be playing on the RBI’s mind, feel economists. “I do not think the concern is around depletion of forex reserves, but RBI wants to maintain the stability of the system. From the regulator’s perspective, if the limit is raised from $7 billion to, say, $10 billion resulting in an additional $3 billion outflow will not be significant from the balance of payments lens. The bigger concern seems to be that a correction in international markets could have repercussions for Indian investors,” says Madan Sabnavis, Chief Economist, Bank of Baroda.

Are investors better or worse off with the status quo?

Mutual fund top officials believe retail investors will benefit from an increase in limits. “Rich Indians enjoy fruits of overseas investment. Many upper-class Indians want to send their kids abroad for education or want to travel abroad. Giving the option to invest overseas through mutual funds will help them achieve their financial objectives,” says the head of a mutual fund house who did not wish to be named. He feels the RBI’s refusal to raise limits is detrimental to the interests of Indian students studying abroad as well as those who are planning to fly out. “Shouldn’t their parents and families get an opportunity to invest in professional fund managers, rather than take the LRS route?” he asks.

Even from investors’ perspective, any volatility in global markets will not wreck their portfolios as the allocation will be limited. “Increasing or opening up this limit doesn't pose any potential risks at this point because these funds typically make up only a small portion of Indian investors' overall portfolios. Instead, it will only benefit investors,” says Radhika Gupta, MD and CEO, Edelweiss Asset Management.

Yet, some experts do point to the flip side of the argument. “As manufacturers, fund houses would want higher limits that can enable more and more money to pour into their schemes. However, is there a lot of demand from retail investors to invest internationally? Not yet. With the kind of returns Indian markets are yielding currently, no one is complaining about limited investment avenues and lack of diversification due to the RBI ceiling. There are enough opportunities available domestically, so international markets are not all that lucrative,” says Kirtan Shah, Founder, Credence Wealth Advisors.

He believes that given the meltdown in the Chinese markets witnessed earlier this year, not raising the limits was a blessing in disguise. “There is some talk that the Nikkei will do well in the backdrop of Japan increasing interest rates. However, most global funds are largely US and China-focused. Investors should thank the RBI, else many investors would have lost money when the Chinese markets took a beating,” he says.

But that also meant a loss of opportunity to buy more shares of Nvidia, leading up to the rally that reached dizzying heights on the day its latest quarterly results were out in February 2024. “We don’t really know what would have happened. Nvidia shares did go up substantially and China stock markets fell sharply. But we don’t know what fund managers would have done. Maybe the fund managers might not have put more money in China knowing the economy there. You have to give opportunity to fund managers to take their own call,” says a mutual fund CEO who spoke on the condition of anonymity.