Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty may rebound sharply if it holds 21,900 in coming sessions

The market remained uncertain while consistently taking support at the 21,900 level and resistance at the 22,200 mark for the third consecutive session on March 18 after a sharp correction on March 13, which overall indicates that the benchmark indices may be waiting for the outcome of central bank meetings (US, Japan and Bank of England) scheduled later this week.

The 21,900-21,850 zone is expected to support the Nifty 50 as breaking down of the same can bring more selling pressure, but trading consistently above 22,200 can strengthen the bulls for a move towards a record high, experts said.

On March 18, the market had a choppy session as some buying interest in the second half helped the benchmark indices close moderately higher. The BSE Sensex rose 105 points to 72,748, while the Nifty 50 gained 32 points at 22,056 and formed a small bullish candlestick pattern with upper and lower shadows on the daily charts, indicating volatility.

"It seems our market is awaiting some potent triggers to come out of the slumber phase. For now, 21,900-21,850 is likely to be seen as an intermediate and strong support zone, breaching which the technical structure might get disrupted," Osho Krishan, senior analyst - technical & derivative research at Angel One said.

On the contrary, he feels the 22,180-22,000 zone is likely to provide resilience followed by 22,300. The undertone remains bearish biases until an assertive move is seen beyond the mentioned resistances, he said.

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas also said until the support zone (21,850-21,900) is held, one can expect the positive momentum to resume.

However, the broader markets underperformed frontline indices, as the Nifty Midcap 100 and Smallcap 100 indices fell 0.4 percent and 0.6 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 is likely to take immediate support at 21,953 followed by 21,904 and 21,825. On the higher side, the index may face resistance at 22,111 followed by 22,160 and 22,239 levels.

On March 18, the Bank Nifty extended losses as well as continued lower highs and lower lows formation for seven days in a row, but showed good recovery from the day's low of around 46,000 mark and closed 18 points down at 46,576.

The banking index has formed a bullish candlestick pattern with a long lower shadow on the daily charts, indicating buying interest at lower levels.

"Bank Nifty held on to the 20-week average which is currently at 46,300," said Jatin Gedia, who expects the Bank Nifty to recover. On the upside, it can rise to 47,230-47,400, he said.

As per the pivot point calculator, Bank Nifty is expected to take support at 46,172 followed by 46,003 and 45,729. On the higher side, the index may see resistance at 46,720 followed by 46,889 and 47,163.

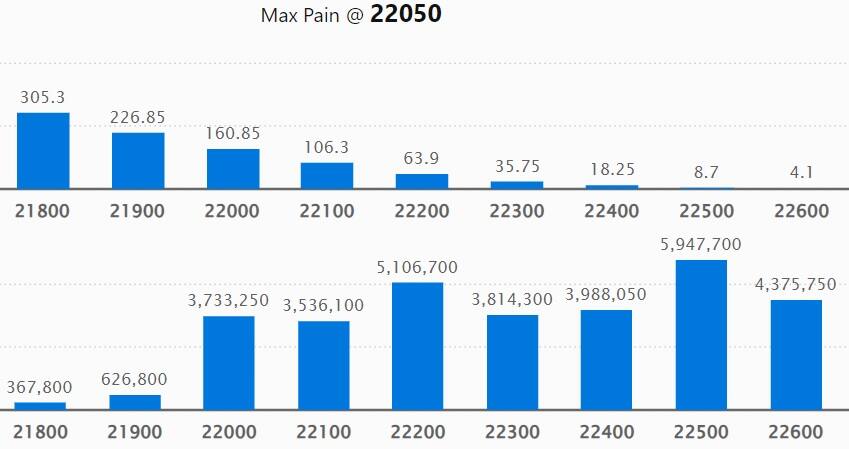

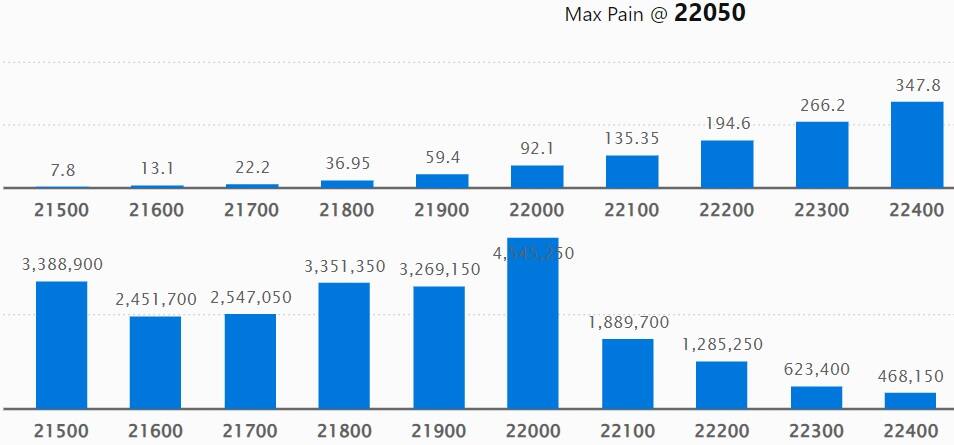

As per the weekly options data, the 23,000 strike owned the maximum Call open interest with 61.19 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 59.47 lakh contracts, while the 22,200 strike had 51.06 lakh contracts.

Meaningful Call writing was seen at the 22,700 strike, which added 17 lakh contracts followed by 22,500 strike and 22,200 strike, which added 16.05 lakh and 15.8 lakh contracts, respectively.

The maximum Call unwinding was at the 22,000 strike, which shed 4.85 lakh contracts followed by 22,300 and 23,100 strikes, which shed 1.67 lakh contracts and 37,950 contracts, respectively.

On the Put side, the maximum open interest was seen at 21,000 strike, which can act as a key support level for the Nifty, with 53.98 lakh contracts. It was followed by the 22,000 strike comprising 45.45 lakh contracts and then the 21,500 strike with 33.88 lakh contracts.

Meaningful Put writing was at the 21,900 strike, which added 10.39 lakh contracts followed by the 21,500 strike and 21,300 strike, which added 9.86 lakh and 8.32 lakh contracts.

Put unwinding was seen at 20,800 strike, which shed 2.33 lakh contracts followed by 21,800 and 21,100 strikes, which shed 1.9 lakh and 1.35 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Lombard General Insurance Company, Shree Cement, Oberoi Realty, Hindustan Unilever and Dr Lal PathLabs saw the highest delivery among the F&O stocks.

A long build-up was seen in 40 stocks, which included Balrampur Chini Mills, Godrej Consumer Products, Zydus Lifesciences, Oracle Financial Services Software and Canara Bank. An increase in open interest (OI) and price indicates a build-up of long positions.

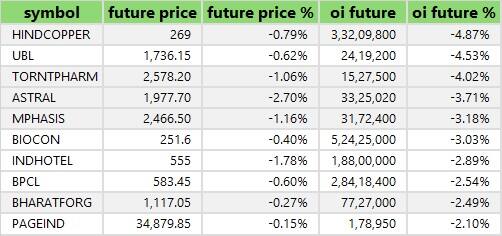

Based on the OI percentage, 33 stocks saw long unwinding. These include Hindustan Copper, United Breweries, Torrent Pharma, Astral and Mphasis. A decline in OI and price indicates long unwinding.

70 stocks see a short build-up

A short build-up was seen in 70 stocks, including Coforge, Dr Lal PathLabs, Apollo Tyres, Adani Ports & Special Economic Zone and Adani Enterprises. An increase in OI along with a fall in price points to a build-up of short positions.

40 stocks see a short covering

Based on the OI percentage, a total of 40 stocks were on the short-covering list. These included Tata Steel, Dixon Technologies, Aurobindo Pharma, Apollo Hospitals Enterprise and BHEL. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell to 0.95 on March 18, from 0.99 in the previous session. Below 1 PCR indicates that the trading volume of Call options is more than Put options, which generally suggests a gradual increase in the bullish market trend ahead.

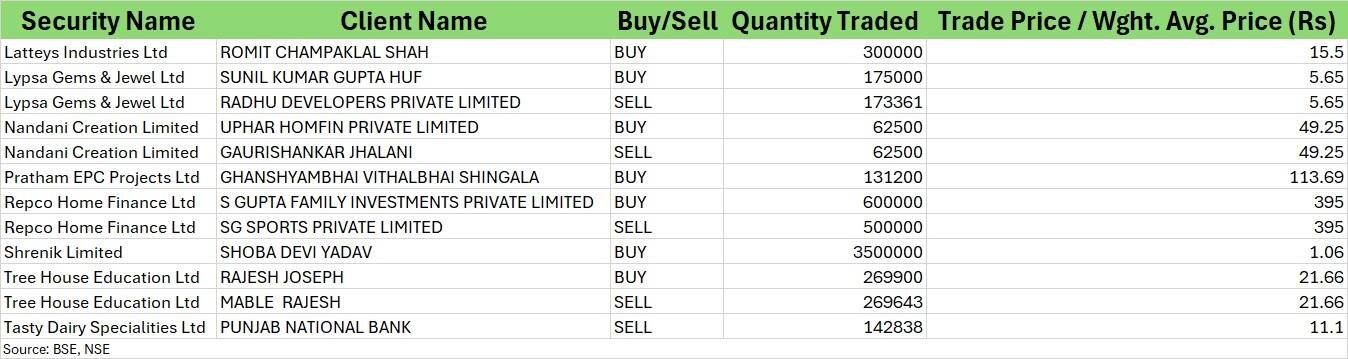

For more bulk deals, click here

Stocks in the news

Tata Consultancy Services: Tata Sons has offered to sell 2.34 crore shares of the IT major at Rs 4,001 per share through block deals to raise up to $1.1 billion, reported Bloomberg.

Aditya Birla Sun Life AMC: Promoters, Aditya Birla Capital and Sun Life (India) AMC Investments Inc will sell up to 2,01,66,293 equity shares of Aditya Birla Sun Life AMC (which is equivalent to 7 percent of the total paid-up equity) through offer-for-sale (OFS) issue, with an option to additionally sell up to 1,28,86,277 equity shares (4.47 percent of paid up equity) on March 19-20.

Tata Steel: Tata Steel UK has decided to cease operations of the coke ovens at the Port Talbot plant, in Wales, after a deterioration of operational stability. It will increase imports of coke to offset the impact of the coke oven closures.

Popular Vehicles and Services: The automobile dealer is set to list its equity shares on the bourses on March 19. The final issue price has been fixed at Rs 295 per share.

HG Infra Engineering: Jodhpur Vidyut Vitran Nigam has issued letters of award to Stockwell Solar Services JV consortium with HG Infra Engineering for four projects of solar business worth Rs 1,026 crore.

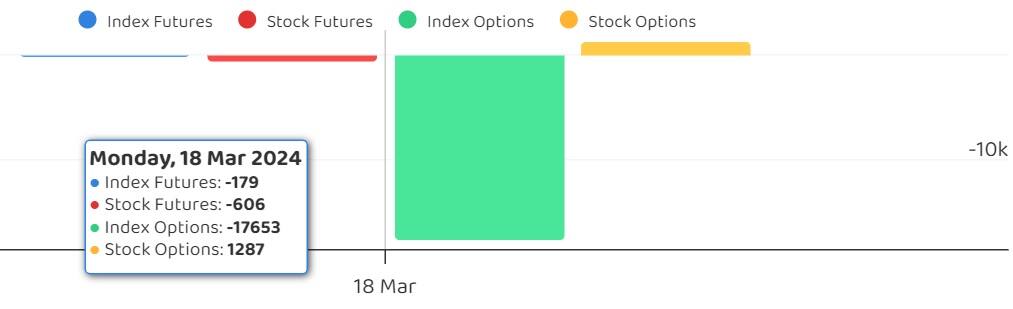

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 2,051.09 crore, while domestic institutional investors (DIIs) bought Rs 2,260.88 crore worth of stocks on March 18, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Balrampur Chini Mills to the F&O ban list for March 19, while retaining Aditya Birla Fashion & Retail, BHEL, Biocon, Hindustan Copper, Manappuram Finance, National Aluminium Company, Piramal Enterprises, RBL Bank, SAIL, Tata Chemicals and Zee Entertainment Enterprises on the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.