Gold prices hit record high

- Gold prices have reached continuous highs in March trading close to US$2,200/oz

- Gold prices increase of 6.5% m-t-d can, in part, be explained by a weaker USD, as well as higher risk and momentum…

- …but other factors such as ‘technicals’ and over-the-counter (OTC) activity likely accelerated the move

- Looking forward, a sustained rally could trigger further investment flows but gold prices remain sensitive towards bond yield volatility in the short term.

What next and how sustainable is this rally in gold prices?

Everyone seems to be pondering over just one question – What in the world is happening with gold? The markets seem to be in search for the one trigger that exploded gold prices to the upside. Many different versions poured in as we keep searching for the truth…

Even the most insightful gold analysts have been left puzzled by gold’s amazing rally this month. No one can pinpoint one single issue that sparked the run. I’ve been puzzling over this myself… and then realized that we might be overlooking the most obvious factors of all.

I told you on Monday that the metal had soared $150 over just 10 days in an unrelenting rally higher. Well, it relented a bit on Tuesday, dropping about $25 after a slightly hotter than expected CPI number. It needed that break, as the market had gotten extremely overbought. That said, gold was back at it again here on Wednesday, up about $20, with silver leaping about 3%. Whatever it is that has been sending investors around the world flocking to gold is apparently still in play.

So what could that be? A prime candidate is something that’s been staring us in the face all along….

Accelerating Debt

You may have seen some commentators recently noting that the U.S. federal debt is now growing at an even more alarming pace of about $1 trillion every 100 days. That’s absolutely frightening. But a quick personal story shows that this debt growth could be even worse than that might indicate….

Check out the famous USDebtClock.org – a real-time running total of the federal debt. In the last week of February, the national debt grew by $137 billion! Instead of $1 trillion every 100 days, that equated to nearly $2 trillion. And if you annualize it? That translates to right about $7 trillion added to the federal debt in a year.

So far in March, we’ve added yet another $100 billion to the debt, so the rate has slowed to a projection of “only” a $4.3 trillion addition to the federal debt. What a relief. Granted, we’re in a period just before tax revenues start to pile in and the deficit is growing at a pace that is unlikely to continue throughout the entire year. But there’s also no doubt that the larger trend of ever-greater deficits and growing debt is accelerating.

President Biden just announced plans to double down on government spending, and I’ve seen nothing to indicate that President Trump will do anything to alter the trajectory in any meaningful way. Perhaps this is the issue that investors and savers around the world — including central banks — are concerned about. At this pace, it won’t be much longer before things come to a head. And when that happens, we’re going to want to own gold.

I’ll tell you again: Get prepared. The macro picture is telling us to own gold and silver, and to leverage the moves in these metals through the best mining stock opportunities. Don’t let this opportunity get away. – Brien Lundin

Other possibilities behind the stealth rally in gold prices

If you know WHO is buying gold, then you might understand their motivation … and if you know their motivation it follows you might be able to infer whether or not the current rally has legs to run.

Not all rallies are equal, some are ‘event-driven’ gains based upon say geopolitical events – these can rarely be sustained beyond a few weeks as we fall victim to ‘fear fatigue’. Others are speculative in nature which, being a zero-sum game, again suggests the market will revert lower as they seek to take profit.

And then there are rallies which are profoundly strong and of a high quality – bulls have high conviction and are entities not readily spooked into reversing their position. Quite possibly this might be one of those. I’ll explain …

It is clear that despite the West’s disaffection for gold – with gold ETFs in steep decline and physical demand for coins and bars showing an epic fall (Germany for example was the second largest market in the world with off-take dropping from 186 tonnes in 2022 to just 47 tonnes in 2023), demand in China is more than offsetting the shortfall, with monumental volumes flowing from West to the East.

As such, this rally seems to have caught Western experts and forecasters by surprise – a stealth rally if you like – which suggests to me the buying is beyond the immediate purview of most of us.

The conventional explanation might be that gold is rallying because the market is moving ahead of an expected rate cut at the June Fed meeting… which would see the dollar fall and by extension, gold to rise… maybe … but the dollar is actually up YTD and silver is not validating the move higher in the complex as evidenced by a decline in the gold/silver ratio as we would have expected.

Another explanation might be the decline in US treasury yields – down 1.2% in the last month and with gold up nearly 6% … but again no evidence that institutions are behind this as ETF demand remains lackluster.

For sure the rally has been enhanced by some short covering on the futures market but likely we are now beyond that … so something else is at play. A significant part of the answer is of course Chinese buying and not just the traditional ‘dama’ or Chinese grandmothers – Gen Z investors have joined the fray.

But Chinese premiums are slipping (down from a strong $45 premium to $38) as have Indian premiums (down from $5 discount to a $16 discount) suggesting Asia is behaving in a moderately price-elastic manner and easing back on purchases in the face of price strength.

I am going to go out on a limb here and suggest that the buying is from the official sector. With the US moving beyond simple sanctions and threatening to sequester $300 billion in Russian financial assets (to be sold and paid across to support Ukraine) … some Central Banks … even the non-aligned ones, will be alarmed for fear that they might be in the firing line themselves at some point potentially. It follows therefore that they might prudently wish to diversify into non-dollar assets. No evidence for this of course and just speculation on my part.

Rather like reading an Agatha Christie crime novel, the answer usually lies in finding what cannot have been by a process of elimination and what remains is likely the cause. Central banks are notoriously cautious in sharing information (let’s forget Gordon Brown’s gold sale 25 years ago for now) and we probably shall not know for a while yet.

Meanwhile gold is nudging a fresh all time high in the spot market at $2148 as I write … so regard this as a case of me running up the flag and see who salutes ? – Ross Norman

Gold Prices May Rise Despite Hotter-Than-Expected Inflation

Fawad Razaqzada – and were looking to bounce back following the -related drop on Tuesday, in a relatively quieter day for data and with the Fed in the blackout period ahead of next week’s FOMC meeting. Following last week’s sharp gains to repeated all-time highs, gold investors were not in a hurry to pile in and push the metal further higher at the start of this week.

There was always the possibility of a rebound in bond yields and the , given the importance of inflation data and following a mixed jobs report on Friday. As it turned out, today’s CPI report was hotter than expected on both the headline and core fronts, which triggered a quick rally in the dollar and a sell-off in government bonds. As yields rose, the opportunity cost of holding gold increased, and so did the selling pressure. Still, the weakness was not too significant in the grand scheme of things, with the metal shedding some $25 worth of gains.

Even if gold were to weaken more in the short term, this wouldn’t necessarily be a sign that the metal has topped. Many investors who missed the opportunity to buy gold when it started to rally last month will be waiting to pick up short-term dips. So, more gains could well be on the way soon.

Dollar Fails to Find Too Much Love From Hot CPI

Federal Reserve Chair Jerome Powell’s sunny take on inflation is still music to traders’ ears, even though the nudged up by 0.4% in February, a smidge higher than expected. But the market’s reaction? Not quite as wild as before when faced with similar surprises in inflation. It looks like traders are still hanging onto Powell’s less-than-hawkish vibe, which has everyone thinking about potential rate cuts in June and keeping the market response in check. In the rates futures market, there has only been a slight adjustment downwards since the week began, suggesting the expectation of easing hasn’t changed much despite the stronger inflation data.

Right now, traders are penciling in 19 basis points for the June rate decision and 85 basis points by December. Even though and inflation were a bit perkier than forecast, the market didn’t bat an eyelid much. It seems like the market’s feeling pretty steady, all thanks to Powell’s laid-back stance. Unless there’s a big shake-up in risk-taking by the end of the week, gold could head back towards last week’s record highs.

In case you missed it on Tuesday, at 3.2%, headline CPI accelerated against expectations from 3.1% recorded in the month before. Core CPI was expected to ease to 3.7%, but it came in at 3.8%, albeit a touch lower from the previous print of 3.9%. Still, this was the third month of above-forecast inflation, with prices of basic necessities like car insurance, transportation, and hospital services all rising noticeably.

Looking ahead, we have more inflation data coming up later in the week, with PPI on Thursday and UoM Inflation Expectations survey on Friday. But CPI was the main data highlight this week, and it didn’t disappoint those who were calling for a stronger print. However, the reaction was less than what the dollar bulls would have liked to see.

Can Gold Prices Regain Poise After CPI-Related Drop?

Well, stock market investors have certainly shrugged off the strong CPI print, so why can’t gold investors? Either that or stock markets are under-pricing the risks of inflation, which remain sticky for even longer. So, there is a chance that we may see gold and silver stage a comeback moving forward. As mentioned, the stronger and sticky inflation data caused gold to weaken, but US equity markets managed to rebound as technology stocks rallied.

Investors are clearly still expecting the Federal Reserve to cut interest rates this year, with the odds of a June trim being around 70%. With the market remaining confident of a rate cut in June, despite a slightly stronger CPI report, gold’s weakness should be short-lived.

Gold Prices – Technical Analysis and Trade Ideas

Source: TradingView.com

Looking at the gold chart, it was only on Friday when the metal reached a fresh record high, so there is no reason to be extremely bearish just because of a slightly above-forecast inflation print. While there is the potential for gold to weaken a bit more, key short-term support is now not too far, around $2146, which was the high made back in December. On an intraday basis, $2150 is also a key level, so there is a possibility it may not even reach $2146 before pushing higher again.

Regardless, below these levels, there are even stronger support levels to watch in case we get a deeper pullback. For example, $2100 is the next round level to watch, followed by long-term support, around the $2081/88 area, which was once strong resistance on multiple occasions in the past few years. Therefore, even if gold were to weaken more in the short term, this wouldn’t necessarily be a sign that gold has topped. Many investors who missed the opportunity to buy gold when it started to rally last month will be waiting to pick up short-term dips.

Truth behind the March rally in gold prices – A market searching for the trigger

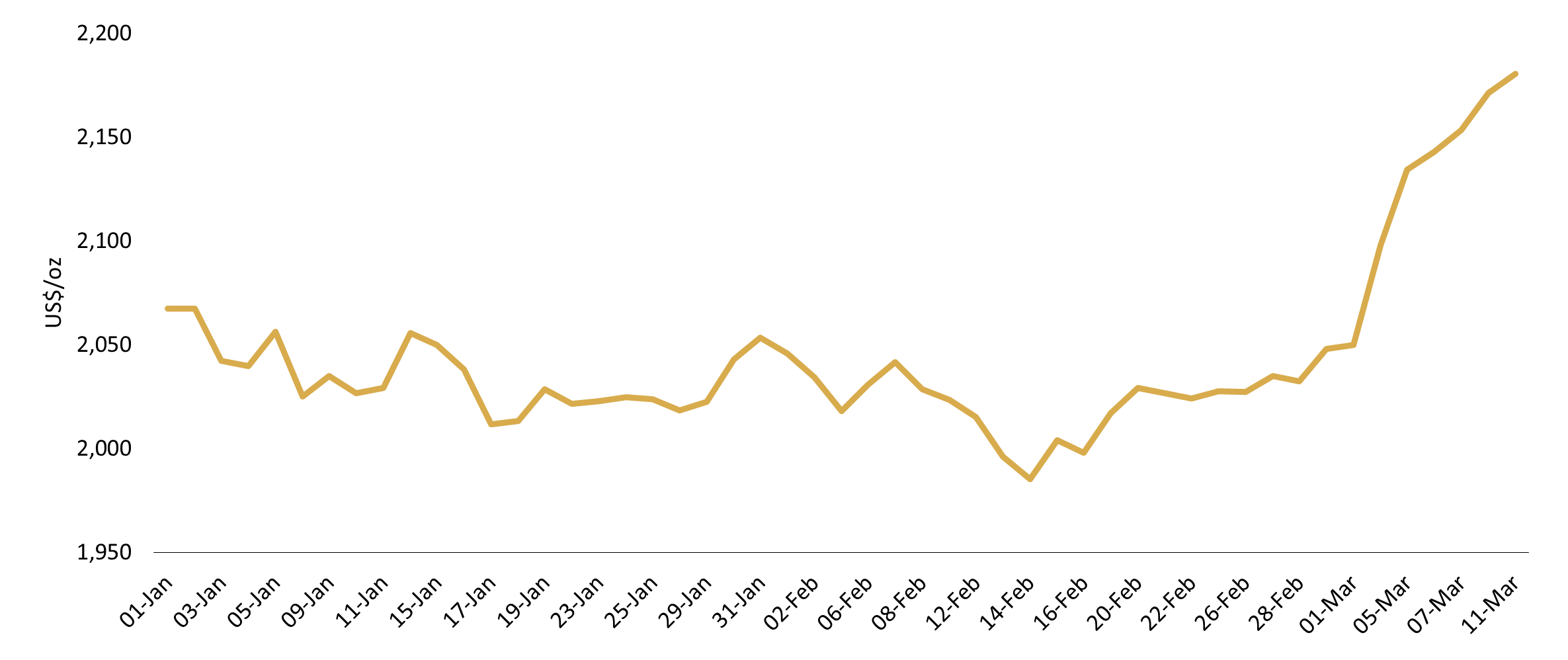

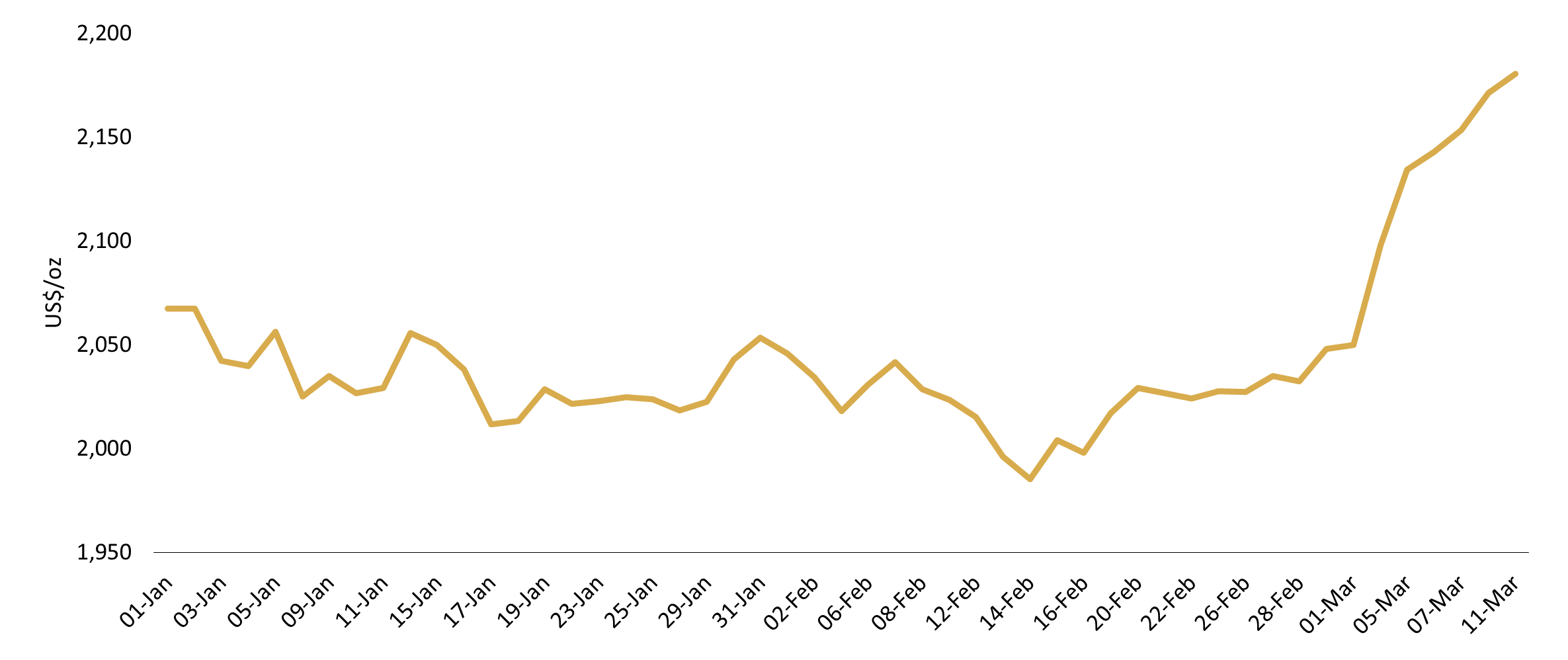

Juan Carlos Artigas – Gold prices have shot up since the end of February, with the LBMA Gold Price PM trading at US$2,180.45/oz as of 11 March – a 6.5% increase m-t-d. Gold has reached consecutive record highs six days in a row and flirted with US$2,200/oz last Friday (8 March) in intra-day trading.

Chart 1: Gold reaches new highs in early March

LBMA Gold Price PM in USD per ounce*

Gold’s sharp increase has since caught the attention of market participants. The initial trigger was linked to a weak ISM print in the US on 1 March, pushing bond yields and the US dollar down.

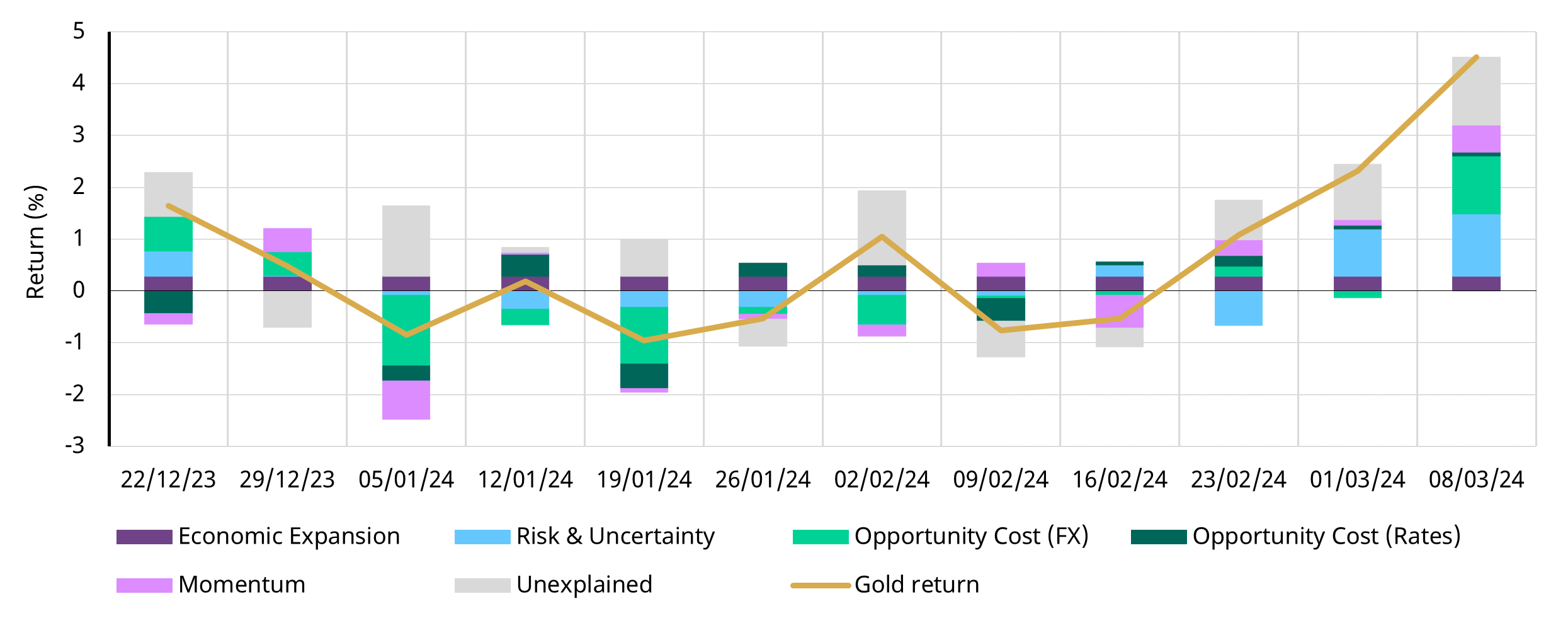

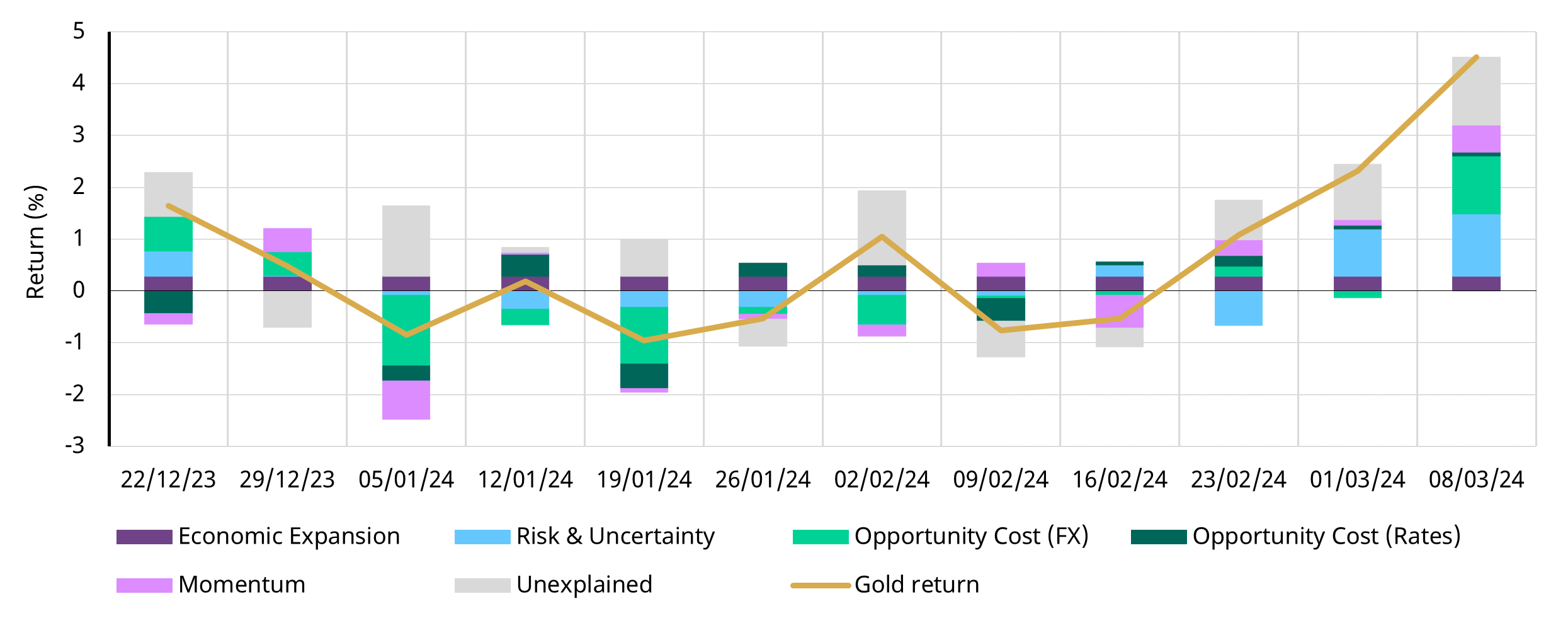

But that can only explain so much, so what’s behind gold’s move since? Our analysis, using a weekly version of our Gold Return Attribution Model (GRAM), indicates that gold’s performance can partly be explained by a few factors:

Chart 2: Gold’s recent move can be partly explained by the USD, risk and momentum

Key drivers of gold’s return by week*

There is, however, a good portion of gold’s recent performance that can’t be explained by GRAM which – as with any other model – depends on the strength of historical relationships. As such, there are a few other factors that may explain the additional increase.

Firstly, gold’s rapid increase and its surge above a series of technical resistance and psychological levels from US$2,050 to US$2,100/oz likely served as a catalyst to cover short option strategies and drove further tactical investor interest. COMEX net long positioning – used by GRAM – comes with a lag and may not yet capture this data, although it could be inferred by more timely information on Open Interest.

Secondly, there’s also activity in the OTC market that may not be reflected in COMEX positioning or gold ETF flows but that likely provided further fuel to the market.

What’s next?

The key question now is how sustainable gold’s rally is.

On the plus side, gold started March aided by strong Chinese demand during the Spring Festival. And central banks have continued with their buying spree in 2024. In fact, we have highlighted in previous reports that gold’s strong performance over the past few years can be partly explained by geopolitical risk as well as robust central bank purchases – which are often reported with a lag. Finally, upcoming expiries in options markets may bring additional investment flows if the gold price remains above key psychological levels such as US$2,100/oz, which can be supported by continued US dollar weakness.

On the flip side, the upcoming US Federal Open Market Committee meeting will shed light on the Fed’s appetite to loosen monetary policy amidst downward revisions to previous non-farm payrolls reports and a slight uptick in unemployment. And while the market is not currently expecting a rate cut in March, a more hawkish stance by the Fed may create short-term headwinds for gold. In addition, rapid gold price movements typically discourage gold jewellery consumers, who may choose to wait for volatility to subside.

Please check back for new articles and updates at Commoditytrademantra.com

request your views on the above article