Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Data released by the statistics ministry on March 12 showed India’s headline retail inflation stood at 5.09 percent in February.

India's headline retail inflation rate would have been 40 basis points lower in February if the Consumer Price Index (CPI) measure was constructed using the results of the latest Consumer Expenditure Survey (CES).

"Recent release of CES may have an impact on food CPI and subsequently on overall CPI as the weights of major food items has (been) revised from 47.8 percent in 2011-12 to 42.8 percent in 2022-23 at all India level," Soumya Kanti Ghosh, State Bank of India's Group Chief Economic Adviser, said in a report on March 12.

Also Read: Consumer Expenditure Survey offers a look into the next CPI inflation series

"Since CPI is the basis for the Reserve Bank of India's monetary policy decisions it should be appropriately calculated. By substituting existing weights with new weights, the new headline CPI is lower than the old headline CPI in the recent period by around 40 basis points," Ghosh added.

Data released by the statistics ministry on March 12 showed CPI inflation stood at 5.09 percent in February, largely unchanged from 5.10 percent in January. However, inflation remained steady even as food inflation rose to 8.66 percent from 8.30 percent.

A combination of the high weight of food and beverages – 45.86 percent – in the CPI basket and the volatility in domestic food prices means food inflation exerts considerable influence over the headline inflation rate. However, with the statistics ministry having now completed the first of its two back-to-back Consumer Expenditure Surveys, the CPI basket can finally be updated - although not for another year-and-a-half at the minimum.

Also Read: RBI may have to wait until 2026 for updated CPI inflation series

The survey is key to restructuring the CPI as the goods and services included in the index as well as their weights – or how much of the CPI each good or service accounts for – depend on its findings. The current CPI series is based on the consumption patterns of the 2011-12 (July-June) survey, which has led to questions about how accurate the inflation measure really is.

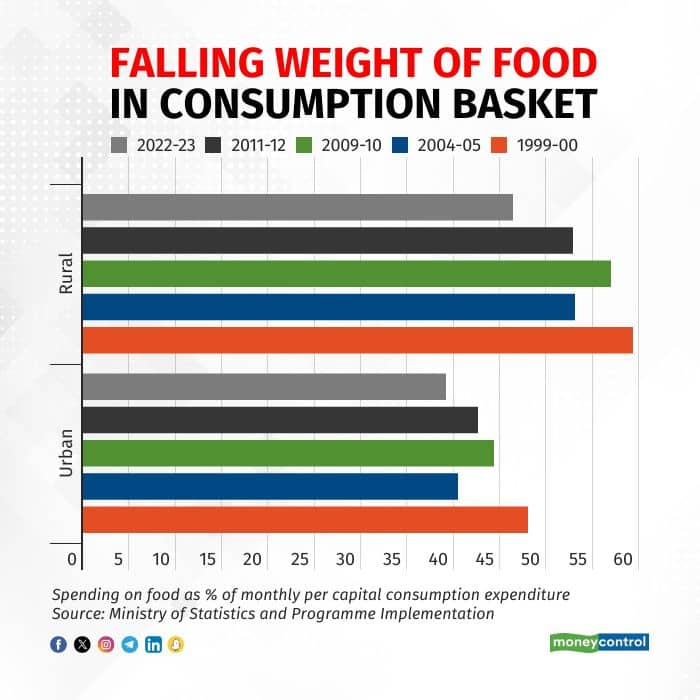

Food now accounts for a smaller proportion of household expenditure than it did a decade ago.

Food now accounts for a smaller proportion of household expenditure than it did a decade ago.

On February 24, the statistics ministry released the results of its 2022-23 (August-July) Consumer Expenditure Survey, which showed the weight of food items in monthly per capita consumption expenditure fell to 46.38 percent for rural India from 52.90 percent in 2011-12 and to 39.17 percent for urban India from 42.62 percent.

As per Engel's Law, as incomes increase, the percentage of it spent on food falls.

A lower weight for food in the CPI would mean the high food inflation would not contribute as much to the headline inflation rate and make it less volatile.

Economists from the RBI have previously argued that the 400-basis-point wide tolerance range of 2-6 percent for the inflation mandate is necessary because the share of food in India's consumption basket is the highest globally. The high volatility in food inflation means "there is a strong case for a wider tolerance band for India relative to the country experience," RBI staff wrote in the Report on Currency and Finance for 2020-21.