Under this system, goods can be imported and exported in exchange for equivalent value goods, bypassing the need for foreign currency.

The policy allows for adjustment of import prices with export prices, enabling local entities to engage in countertrade agreements with foreign counterparts.

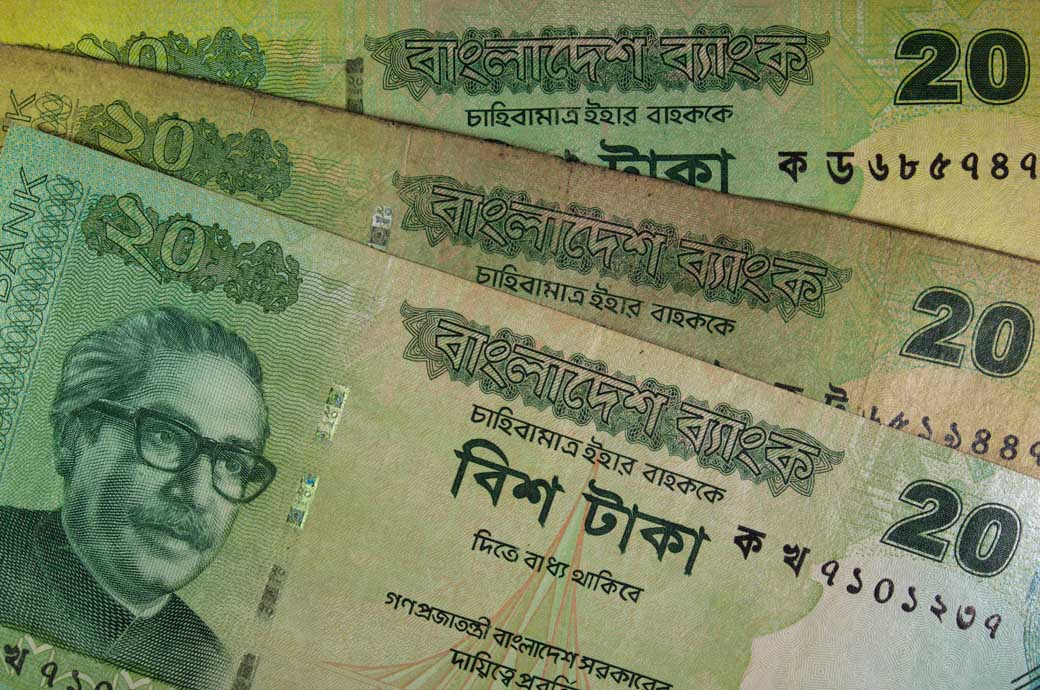

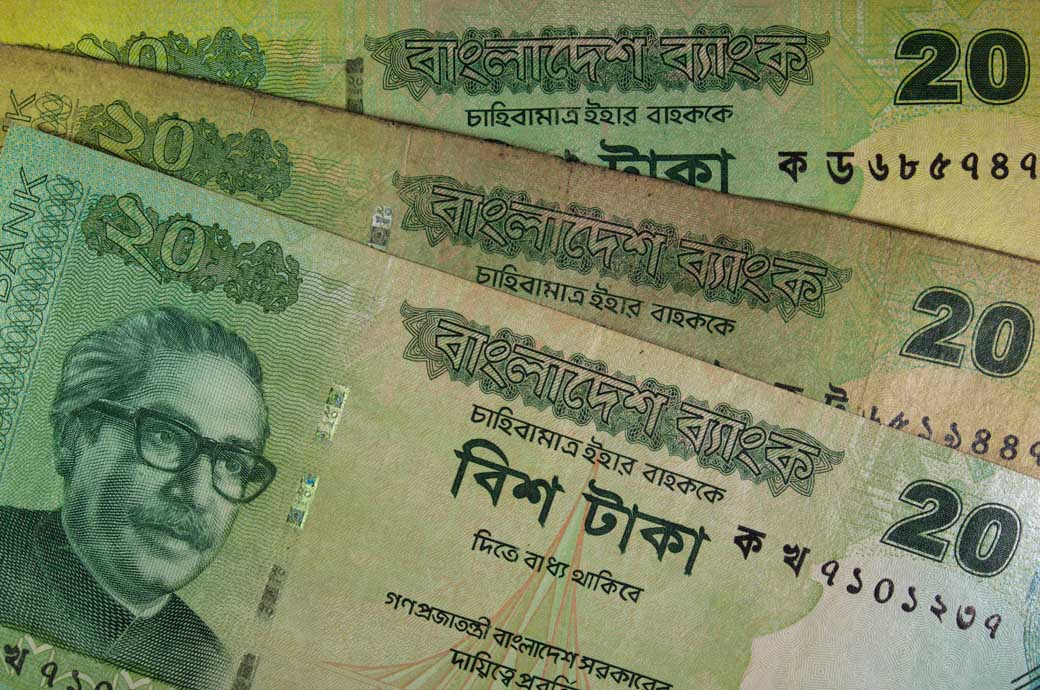

The Foreign Exchange Policy Department of Bangladesh Bank issued a circular, directing scheduled banks to implement the policy promptly.

According to the circular, local banks will manage escrow accounts either solely or jointly with Bangladeshi parties, wherein import payments will be deposited.

Corresponding payments for exports will be disbursed against the deposit status.

Regular communication regarding the escrow account status will occur with foreign institutions to ensure coordination.

Additionally, if Bangladeshi parties wish to operate an escrow account in a foreign bank, they must obtain permission from the central bank.

This policy aims to streamline import-export activities, offering flexibility in trade transactions and reducing reliance on foreign exchange.

By promoting countertrade, Bangladesh Bank seeks to boost trade opportunities and facilitate smoother international trade operations for local businesses and traders.

Fibre2Fashion News Desk (DR)