Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

The Consumer Price Index and Index of Industrial Production are two of the most important high-frequency indicators of the state of the Indian economy.

If it is becoming increasingly difficult to forecast India's quarterly and annual GDP growth rates, at least high-frequency monthly data are more predictable.

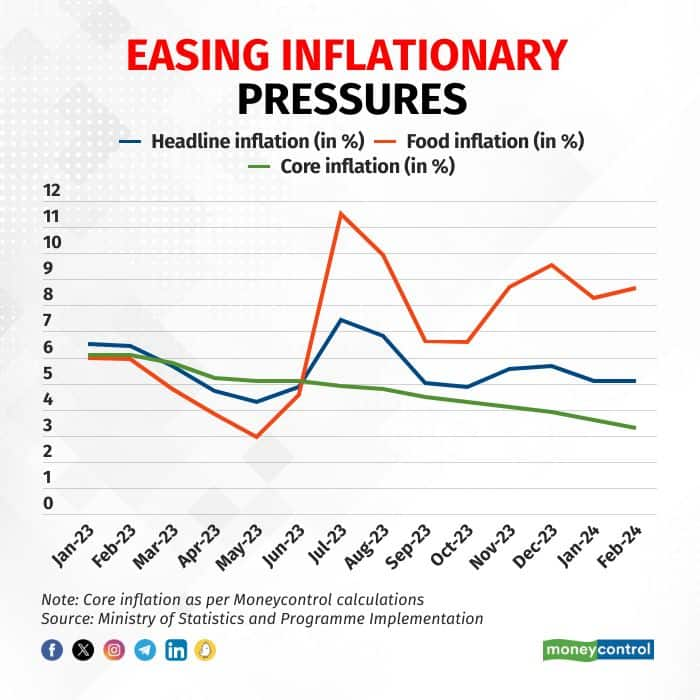

Data released by the statistics ministry on March 12 showed the headline retail inflation rate was stable at 5.09 percent in February compared to 5.10 percent in January. Economists surveyed by Moneycontrol had said Consumer Price Index (CPI) inflation would come in at 5.1 percent.

Also Read: Explained – 'Discrepancies' in GDP data and how they affect headline growth rate

Similarly, industrial growth as measured by the Index of Industrial Production (IIP) decelerated to 3.8 percent in January, only slightly lower than the consensus view of 4.2 percent.

But despite being along expected lines, both the monthly economic indicators contain some cause for concern.

Food for thought

While a combination of factors meant the headline inflation rate was largely unchanged in February, even scratching superficially below the surface throws up some risks. For instance, food inflation rose to 8.66 percent from 8.30 percent in January as the Consumer Food Price Index edged 0.1 percent higher on a month-on-month basis thanks to a sequential increase in prices of cereals and meat and fish, in particular.

"The ongoing high inflation in specific food categories, including cereals, pulses, spices, vegetables pose a risk of potentially broadening price pressures and de-anchoring inflationary expectations," said Rajani Sinha, chief economist at CareEdge.

Policymakers are acutely aware of the risks posed by food inflation. In its February 8 statement, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) had warned of "considerable uncertainty" on the food price outlook, with "large and repetitive food price shocks" not allowing steady disinflation.

"With food inflation still a pocket of concern, the central bank is likely to extend its cautious stance on the rates front," said Radhika Rao, senior economist at DBS Bank.

Industrial concerns

At 3.8 percent, IIP growth in January was perhaps a tad lower than the consensus view of 4.2 percent. However, one has to take into account the fact that the December 2023 print of 3.8 percent has now been revised to 4.2 percent, in line with data released on February 29, which showed that core sector growth for the last month of 2023 had been revised up to 4.9 percent from 3.8 percent.

The eight core industries make up around 40 percent of the IIP. As such, IIP growth broadly mirrors core sector growth.

But if the headline print was not far from expectations, some of the underlying numbers warrant vigilance. Take, for instance, the performance of consumer non-durable goods, whose output contracted by 0.3 percent in January after an increase of 2.4 percent in December.

According to economists Paras Jasrai and Sunil Kumar Sinha of India Ratings and Research, the lower output of non-durables is indicative of "the muted consumption demand especially from the household belonging to the lower 50 percent of the income bracket". Sinha of CareEdge concurred, saying the contraction reflects weakness in consumption.

If non-durables' production shrunk, that of durable goods jumped by 10.9 percent year-on-year in January as against a growth of 5.3 percent in December. However, Rahul Bajoria, managing director and head of EM Asia (ex-China) Economics at Barclays, warned against "reading too much" into the January figure given its volatile nature.