Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Market likely to consolidate further

The market started the week on a negative note, but experts considered it as a normal profit booking after the recent upward rally. Hence, the consolidation is likely to continue in the coming days with support at 22,300-22,000, while 22,500 is expected to be a key hurdle on the higher side as above the same 22,600-22,800 can be the possibility, experts said.

On March 11, the BSE Sensex plunged 617 points to 73,503, while the Nifty 50 declined 161 points to 22,333 and formed a long bearish candlestick pattern which indicates a reversal of the previous two sessions of upmove and resembles the Evening Star kind of pattern formation at the top (not an exactly one).

"Generally, this pattern indicates short-term top reversal for the markets," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels the short-term trend of Nifty seems to have turned down and the next lower levels to be watched around 22,100-22,050 levels. "Intraday resistance is at 22,525," Shetti added.

Shrikant Chouhan, head equity research at Kotak Securities also feels the chart pattern indicates temporary weakness is likely to continue shortly, though the short-term texture of the market is still on the positive side.

The broader markets, too, were under pressure as the Nifty Midcap 100 index was down 0.4 percent and Nifty Smallcap 100 index fell 2 percent, while the India VIX jumped for the first time in eight consecutive sessions, rising 2.8 percent to 14 level.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may face resistance at 22,353 followed by 22,524 and 22,608 levels. On the lower side, the index is likely to take immediate support at 22,305, followed by 22,253 and 22,169.

On March 11, major profit-taking was also seen in Bank Nifty after a consistent northward journey in the recent trading sessions. The banking index fell 508 points or 1.06 percent to 47,328 and formed a long bearish candlestick pattern on the daily charts.

"Immediate support for the index is at 47,000-46,800 levels, and a decisive close below this range could intensify selling pressure," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

To resume the uptrend towards all-time high levels, the index must decisively surpass the mark of 47,700, he feels.

As per the pivot point calculator, Bank Nifty may see resistance at 47,385 followed by 47,856 and 48,094. On the lower side, the index is expected to take support at 47,233 followed by 47,086 and 46,848.

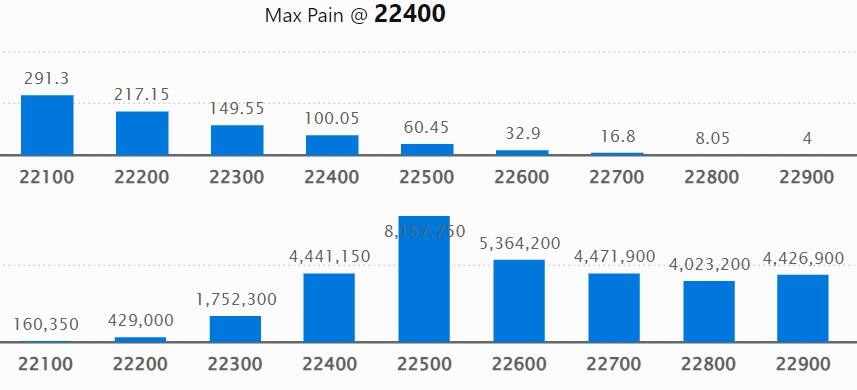

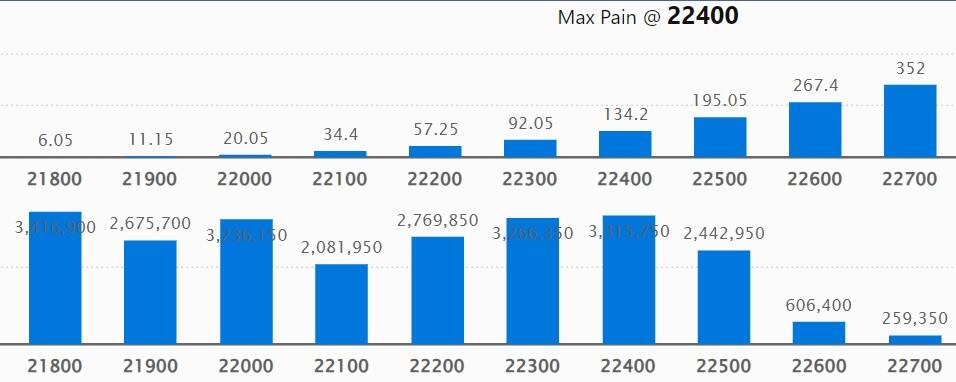

Weekly options data suggests the maximum Call open interest was seen at 23,000 strike with 81.86 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 81.57 lakh contracts, while the 22,600 strike had 53.64 lakh contracts.

Meaningful Call writing was seen at the 23,000 strike, which added 47.15 lakh contracts, followed by the 22,500 strike adding 39.6 lakh contracts, and the 22,400 strike with 32.5 lakh contracts.

The maximum Call unwinding was at the 22,000 strike, which shed 40,450 contracts, followed by the 21,900 and 21,500 strikes, which shed 9,250 and 7,050 contracts.

On the Put side, the 21,500 strike owned the maximum open interest, which can act as a key support level for the Nifty, with 35.13 lakh contracts. It was followed by the 21,800 strike comprising 34.16 lakh contracts and then the 22,400 strike with 33.15 lakh contracts.

Meaningful Put writing was at the 21,800 strike, which added 18.23 lakh contracts, followed by the 21,300 strike and 21,900 strike, which added 11.06 lakh and 8.54 lakh contracts.

Put unwinding was seen at 22,500 strike, which shed 11.8 lakh contracts, followed by 22,400 and 22,600 strikes, which shed 5.89 lakh and 2.78 lakh contracts, respectively.

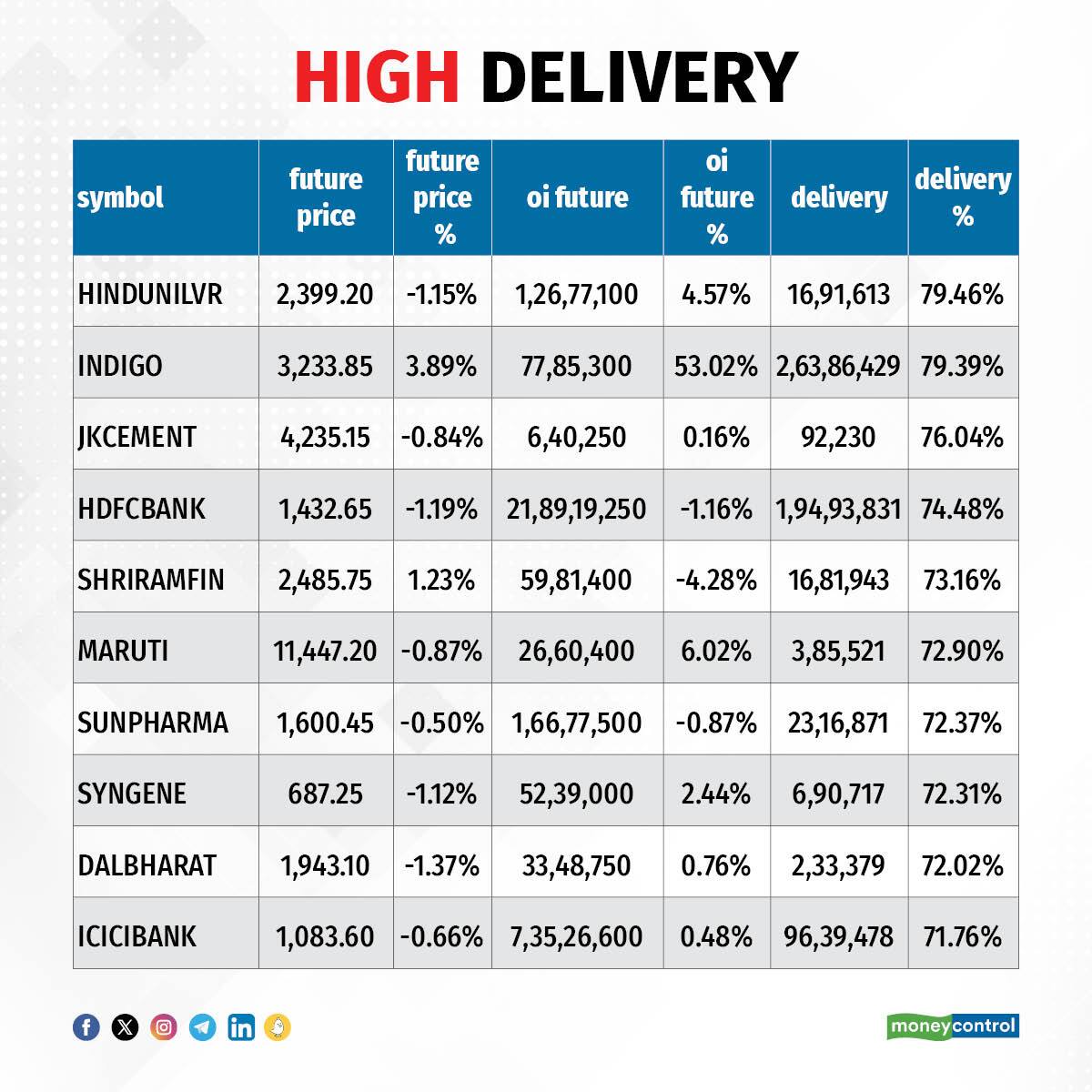

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Hindustan Unilever, InterGlobe Aviation, JK Cement, HDFC Bank and Shriram Finance saw the highest delivery among the F&O stocks.

A long build-up was seen in 24 stocks, which included InterGlobe Aviation, Siemens, ICICI Prudential Life Insurance Company, Zydus Lifesciences and MRF. An increase in open interest (OI) and price indicates a build-up of long positions.

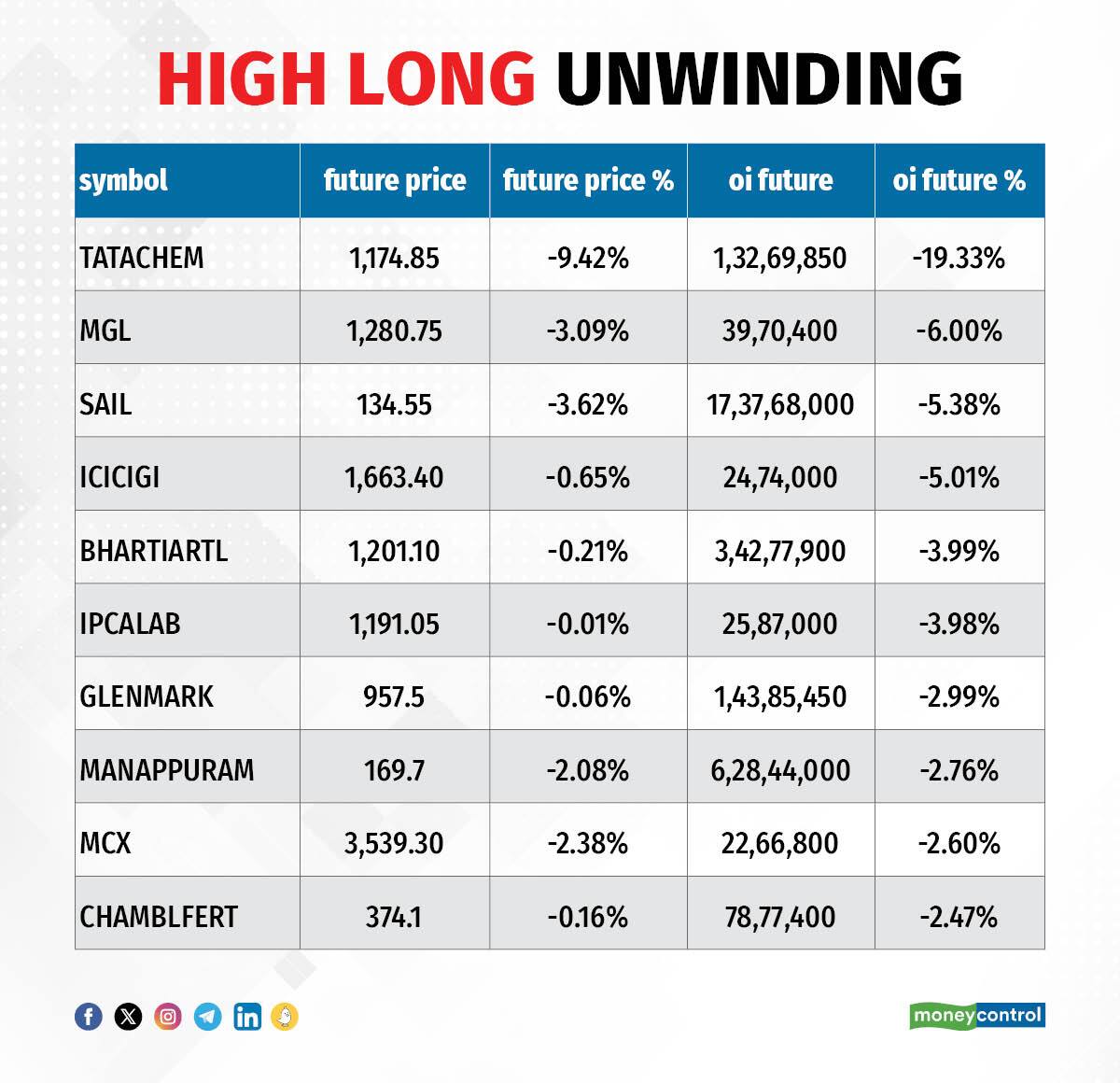

Based on the OI percentage, 40 stocks saw long unwinding. These include Tata Chemicals, Mahanagar Gas, SAIL, ICICI Lombard General Insurance Company and Bharti Airtel. A decline in OI and price indicates long unwinding.

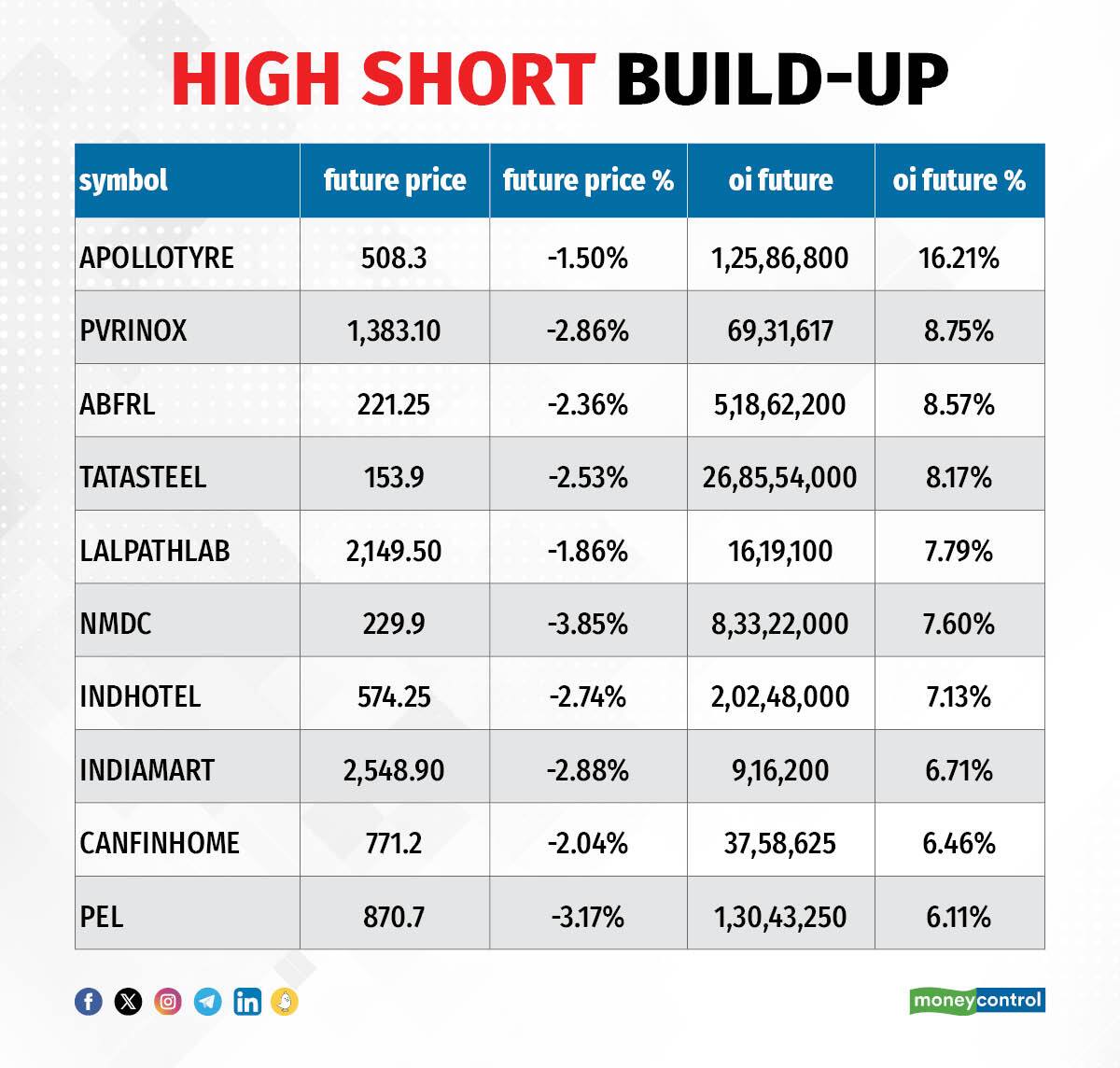

91 stocks see a short build-up

A short build-up was seen in 91 stocks, including Apollo Tyres, PVRINOX, Aditya Birla Fashion & Retail, Tata Steel and Dr Lal PathLabs. An increase in OI along with a fall in price points to a build-up of short positions.

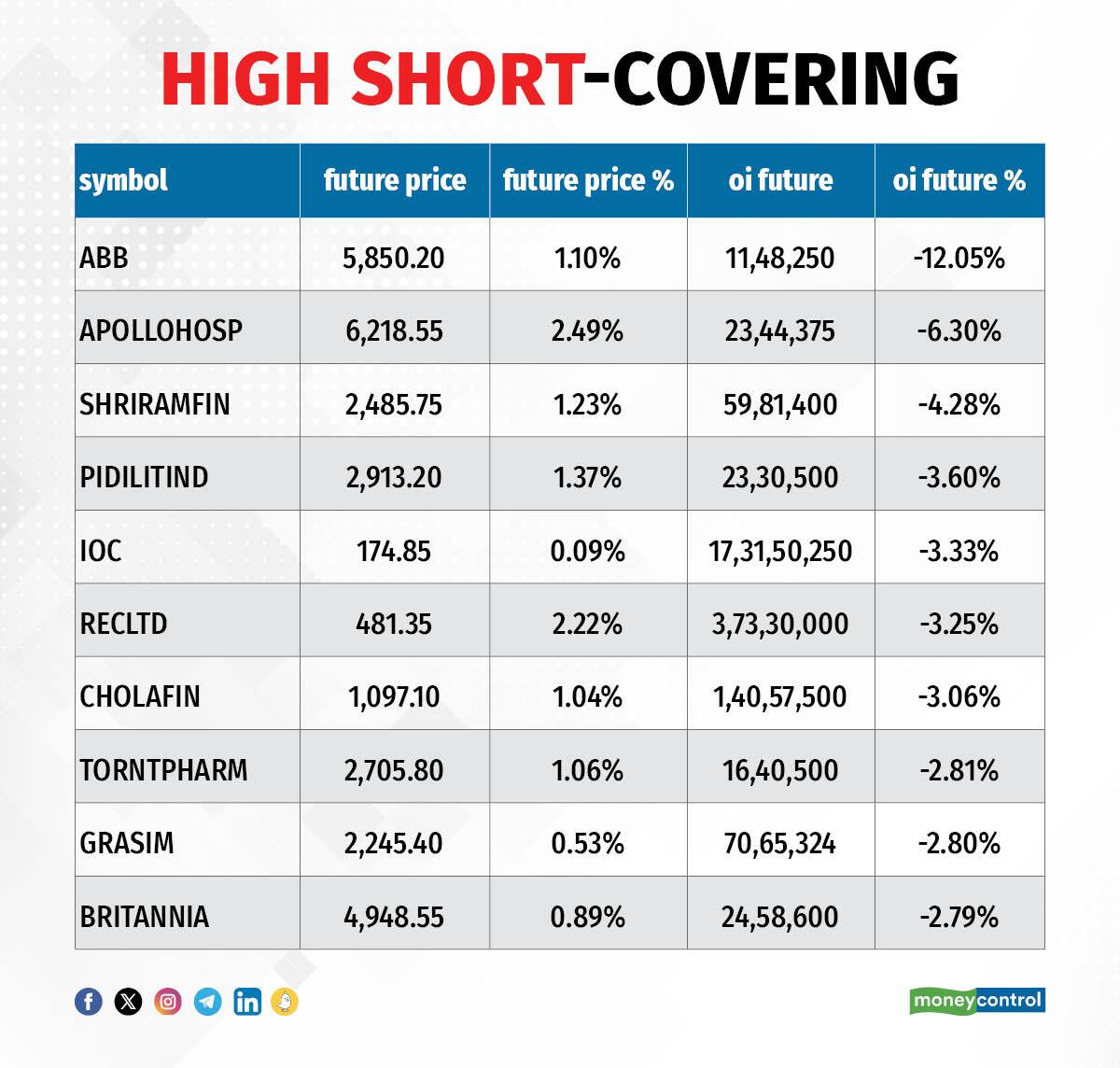

30 stocks see a short covering

Based on the OI percentage, 30 stocks were on the short-covering list. These include ABB India, Apollo Hospitals Enterprises, Shriram Finance, Pidilite Industries and Indian Oil Corporation. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 0.94 on March 11, from 1.27 in the previous session. Below 1 PCR indicates that the trading volume of Call options is more than Put options, which generally suggests a bullish market trend ahead.

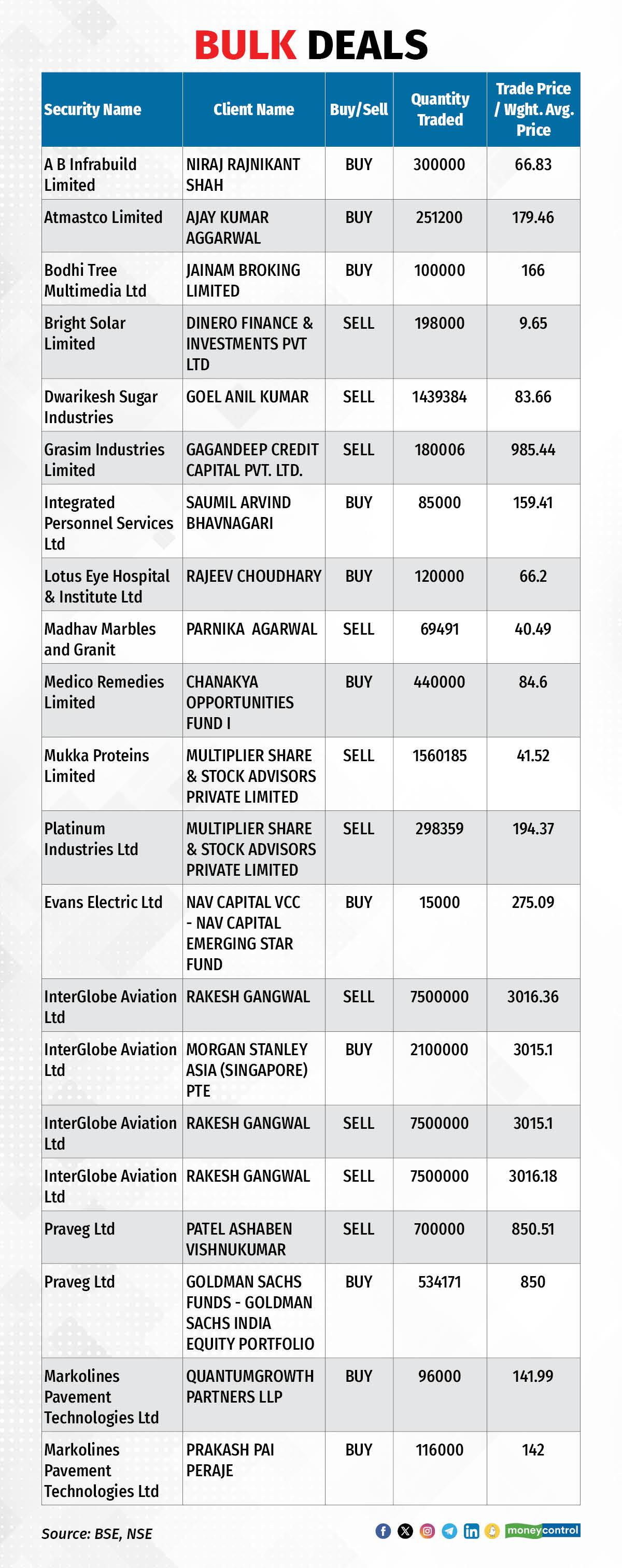

For more bulk deals, click here

Stocks in the news

HG Infra Engineering: The company has received the letter of award from the National Highways Authority of India (NHAI) for access controlled highway of 4-lane in Andhra Pradesh on Hybrid Annuity Mode. The project cost is Rs 862.11 crore and the construction period for the said project is 24 months.

Aurobindo Pharma: The Prequalification Unit Inspection Team (PQT-INS) of the World Health Organization (WHO) inspected Unit IV, a formulation manufacturing facility, of APL Healthcare, a wholly owned subsidiary of the company, in Andhra Pradesh, during September 11-15, 2023. After the inspection, the PQT-INS has decided to recommend to the Prequalification Assessment Team that the facility be named as a manufacturing site in the dossier for Dolutegravir, Lamivudine, Tenofovir Disoproxil Fumarate tablets in the 50/300/300 mg strengths.

Rail Vikas Nigam: The state-run railway company has emerged as the lowest bidder (L1) for signalling and telecommunication work for the provision of automatic block signalling on the Khapri-Sewagram section of the Nagpur division, from Central Railway. The project is worth Rs 47.36 crore. Further, RVNL has also emerged as the lowest bidder for the part of the Pune Metro Rail Project, from Maharashtra Metro Rail Corporation.

R K Swamy: The marketing services provider is set to debut on the BSE and NSE on March 12. The final issue price has been fixed at Rs 288 per share.

ESAF Small Finance Bank: The small finance bank said the Board of Directors has approved the raising of funds up to Rs 135 crore via the issuance of Tier II bonds, on a private placement basis.

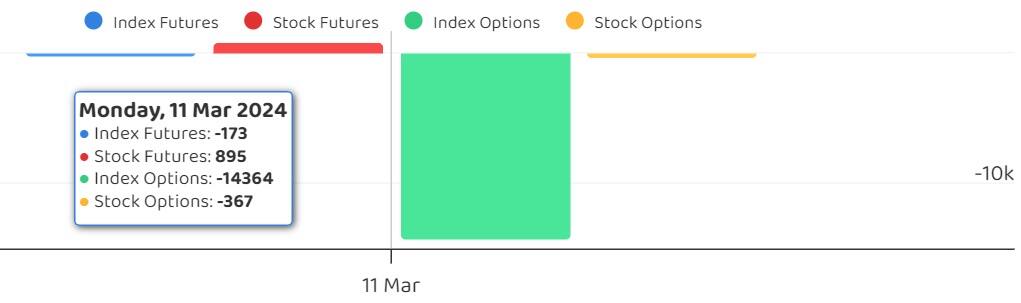

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 4,212.76 crore, while domestic institutional investors (DIIs) purchased Rs 3,238.39 crore worth of stocks on March 11, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Aditya Birla Fashion & Retail, and Hindustan Copper to the F&O ban list for March 12, while retaining Manappuram Finance, Mahanagar Gas, SAIL, Tata Chemicals, and Zee Entertainment Enterprises on the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclsoure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.