Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Market likely to climb towards 22,700 in coming days

Bulls continued to back the market for the fourth consecutive week ended March 7 and the buying interest was observed at lower levels that very week, which ultimately resulted in the benchmark indices reaching a new high. Positive economic conditions, an increase in FII flow amid a fall in US bond yields, and rising hopes for a fed funds rate cut by June after recent US economic data supported the market sentiment.

In the coming week, overall, the positive momentum is likely to sustain, and hence, a buy on dip is advisable despite possible intermittent some consolidation and minor profit booking, with a focus on US & India inflation numbers, and oil prices, experts said.

The benchmark indices ended at a record closing high with the BSE Sensex rising 313 points to 74,119, and the Nifty 50 climbing 115 points to 22,494, but the broader markets were under pressure on account of profit booking and valuations concerns.

The Nifty Midcap 100 and Smallcap 100 indices fell 0.4 percent and 2.85 percent, respectively, which as a result, experts feel, the money may be moving towards large caps.

"Upcoming inflation data from the US, and India next week will provide investors with insights into the global macroeconomic outlook," Vinod Nair, head of research at Geojit Financial Services said.

He expects volatility to persist in the upcoming week due to high valuations and forthcoming policy rate guidance releases.

According to, Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services, the ongoing rally may be focused towards large caps.

Here are 10 key factors to watch:

US Inflation

Globally, the market participants across asset classes will keep an eye on the US inflation numbers for February scheduled on March 12. Most experts feel the CPI inflation is likely to be around similar levels of January (3.1 percent) and there may be a moderate dip in core inflation from 3.9 percent in January, which is the most important data for the Federal Reserve before its next policy meeting scheduled on March 19-20.

The recent weak US economic data including downward revisions in jobs growth for December & January, and increasing unemployment rate which all indicate softening in the US labour market, along with falling US bond yields may be hinting that the rate cut is possibly before June instead of later this calendar year, experts said.

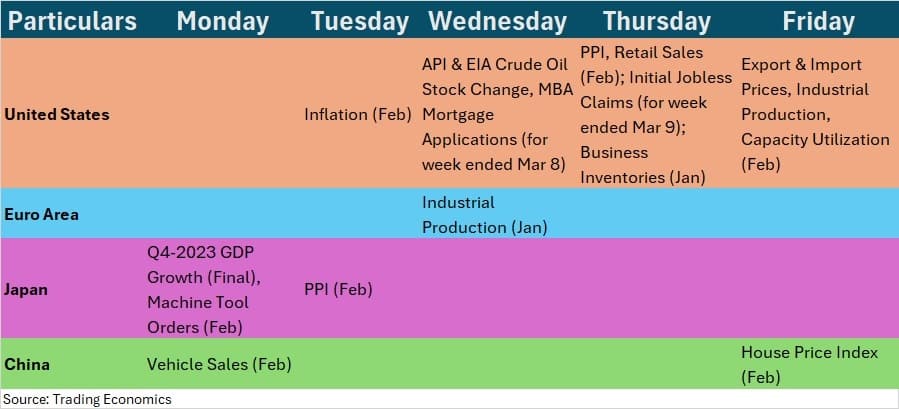

Global Economic Data

Further, participants will also focus on US PPI (producer price index) and retail sales data for February along with Japan's GDP numbers for the October-December quarter of 2023, and China's vehicle sales for February, next week.

CPI Inflation

Coming back to India, the key factor to watch out for would be the same, i.e. CPI inflation for February scheduled on March 12. The inflation for February is likely to be tad above the January level which was 5.1 percent, may be due to increasing food and core prices, while core inflation, too, is also expected to be slightly above 3.5 percent, the level seen in January, experts said.

This is an important data point ahead of the next RBI policy meeting scheduled for April 3-5, 2024.

"We forecast CPI inflation rose slightly, to 5.3 percent, in February, with a modest sequential rise in food and core prices. Price pressures largely remain in check, and food prices are coming off gradually. This should keep the RBI on the sidelines for longer, with no urgency to cut rates given robust growth," Rahul Bajoria, MD & Head of EM Asia (ex-China) Economics at Barclays said.

Also read: Cannot let AI models be brought into public domain without proper testing, says Ashwini Vaishnaw

Domestic Economic Data

Further, industrial & manufacturing production numbers for January will also be released on the same date, while WPI inflation for February (against 0.27 percent in January) will be announced on March 14.

Passenger vehicle sales data for February will be released on March 11, while the balance of trade numbers for February, and foreign exchange reserves for the week ended March 8 will be announced on March 15.

Apart from these above data points, the renewed buying interest from foreign institutional investors in the equity markets will be key to watch, though the Indian equities seem to be less dependent on the FII inflow given the rising and consistent DIIs inflow.

Also read: Tata Sons' IPO unlikely soon, company seeking options to comply with RBI norms

FIIs have net bought Rs 10,081 crore in the cash segment in the truncated week ended March 7, especially after the falling US bond yields, and better-than-expected growth in the Indian economy in Q3FY24 (and better than other larger economies), while domestic institutional investors have purchased more than FIIs, at Rs 10,129 crore worth of shares for the week.

The US 10-year treasury yields fell to 4.08 percent from 4.18 percent on a week-on-week basis, while the US dollar index dropped to 102.74, from 103.86 levels during the same period.

Oil Prices

Meanwhile, the Brent crude futures, the international benchmark for oil prices, remained volatile and ranged at around $80-84 a barrel for a month now. It struggled a lot to hold above $84 a barrel many times since February but failed to sustain the same on a closing basis, which continued to be supportive for India, the net oil importer. Experts largely expect the consolidation to continue in the coming week, too, amid concerns of a possible economic slowdown in the US and demand worries in China.

Brent crude futures closed at $82.08 a barrel, down 1.76 percent for the week with higher volumes.

The primary market will remain strong in the coming week with seven IPOs hitting Dalal Street for fund raising and eight companies are scheduled for listing. In the mainboard segment, Kerala-based automobile dealer Popular Vehicles & Services will open its IPO for a three-day subscription on March 12, and facilities management services provider Krystal Integrated Services public issue on March 14, while RK Swamy will be listing its equity shares on the bourses on March 12, JG Chemicals on March 13, and Gopal Snacks on March 14.

In the SME segment, Pratham EPC Projects will launch its IPO on March 11, while Signoria Creation as well as Royal Sense will open public issues on March 12, followed by AVP Infracon on March 13, and KP Green Engineering on March 15. On the listing front, V R Infraspace will debut on March 12, and Sona Machinery on March 13, while the trading in Shree Karni Fabcom and Koura Fine Diamond Jewelry equity shares will commence on March 14, and Pune E-Stock Broking on March 15.

Among others, Gopal Snacks, from the mainboard segment, will close IPO next week on March 11, while in the SME segment, Shree Karni Fabcom and Koura Fine Diamond Jewelry will also close public issues on March 11. The Pune E-Stock Broking IPO will be closing on March 12.

Technical View

Technically, the Nifty 50 is looking strong with higher high formation and positive bias in momentum indicators, along with the index sustaining above all key moving averages. Hence, the index is likely to climb to 22,600-22,700 levels in the coming days, with support at 22,200, experts said.

"Nifty decisively climbed back above the upward-sloping resistance trendline after a breakout and also defended the 10-day EMA (exponential moving average). It is likely to face resistance at 22,600-22,700 in the coming sessions, with support at 22,200-22,100," Arvinder Singh Nanda, senior vice president at Master Capital Services said.

F&O Cues & India VIX

The options data indicated that 22,500 is expected to play a crucial role in the market direction going forward, with a hurdle on the higher side seen at 22,700 and support at 22,400 and 22,000 zones.

On the Call side, the maximum open interest was seen at 22,500 strikes, followed by 23,000 and 22,700 strikes, with writing at 22,500 strikes, then 22,900 & 22,700 strikes, while on the Put front, the 22,500 strikes owned the maximum open interest, followed by 22,400 & 22,000 strikes, with writing at 22,500 strikes, then 22,400 strike.

The cooling down volatility substantially boosted the confidence among bulls. Falling the volatility further may give more comfort for bulls, but rising again towards the 16 mark may bring some consolidation and correction in the market, experts said. India VIX, the fear gauge, fell 9.2 percent during the week to 13.61 level.

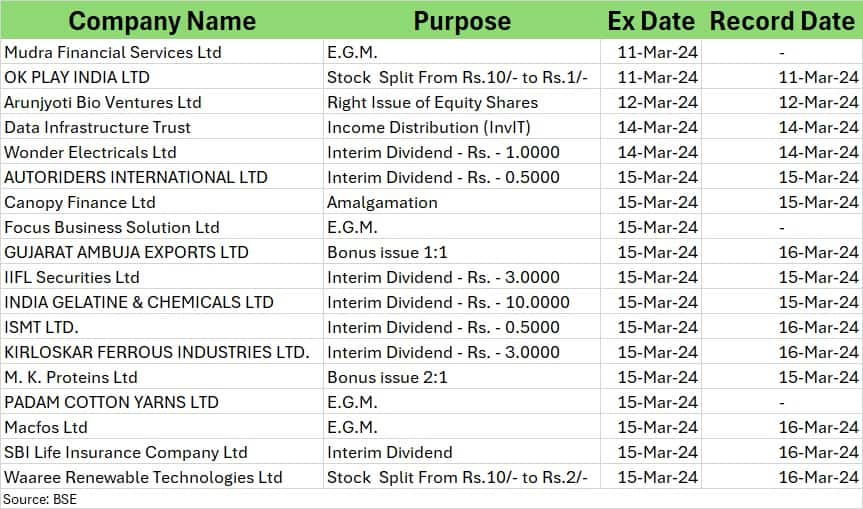

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.