Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty likely find support at 22,200

Given the ongoing tug-of-war between bulls & bears, the market is likely to consolidate further in the coming sessions, though overall trend remains positive, experts said, adding the 22,200 is expected to be immediate support for the Nifty 50 followed by 22,000 mark, with hurdle on the higher side at 22,500 mark.

On March 5, the benchmark indices snapped four-day winning streak with the BSE Sensex falling 195 points to 73,677, while the Nifty 50 declined 49 points to 22,356 and formed small bearish candlestick pattern with upper and lower shadows, which resembles Doji kind of candlestick pattern (not exactly on) on the daily charts with lower high, lower low formation, indicating the possibility of some weakness in the near term.

"We can see some correction towards 22,200 where support is seen as per the options data. Positionally, the 40 DEMA which has not been breached in the recent corrective phase is now placed around 21,860 and thus the support base is gradually shifting higher," Ruchit Jain, lead research at 5paisa.com said.

On the higher side, he feels the resistance is expected around the 22,500 mark followed by 22,700.

Jain advised traders to continue to trade with a positive bias and look for buying opportunities on intraday declines.

According to Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, the hourly momentum indicator has a negative crossover however has reached the equilibrium line indicating that the fall may have matured and once this consolidation has completed the upmove is likely to resume.

Meanwhile, India VIX was down by 3.63 percent from 14.92 to 14.38 levels. Volatility cooled off after steaming in the previous week and paved way for the bulls in the market for buy on decline stance, Chandan Taparia, senior vice president | analyst-derivatives at Motilal Oswal Financial Services said.

The broader markets were also under pressure with the Nifty Midcap 100 and Smallcap 100 indices down 0.3 percent and 1.2 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 22,291, followed by 22,256 and 22,200. On the higher side, it may face resistance at 22,370 followed by 22,439 and 22,495 levels.

On March 5, the Bank Nifty outperformed the Nifty 50 and rose 125 points to 47,581. The banking index has stayed above downward sloping resistance trendline for yet another session and formed bullish candlestick pattern on the daily timeframe.

The buying was visible in selective banking stocks. "Now it has to continue to hold above 47,250 level to make an up move towards 47,750 then 48,000 levels, while on the downside support is seen at 47,250 then 47,000 levels," Chandan Taparia said.

As per the pivot point calculator, Bank Nifty is expected to take support at 47,299 followed by 47,171 and 46,964. On the higher side, the index may see resistance at 47,631 followed by 47,840 and 48,046.

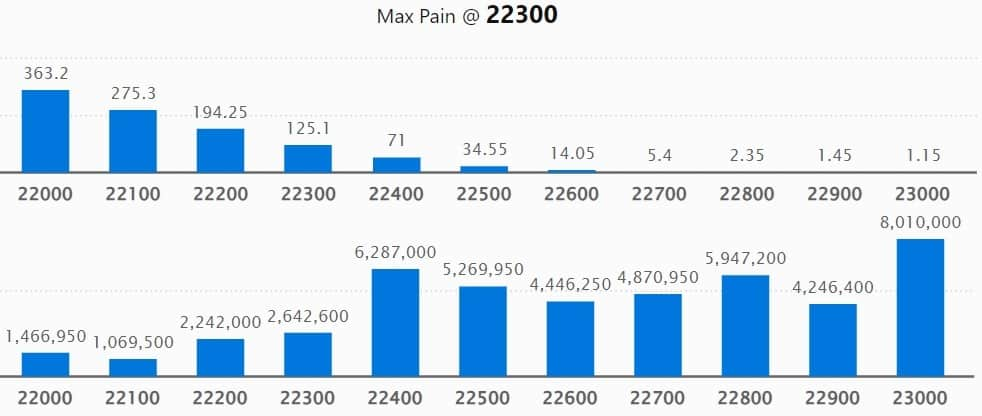

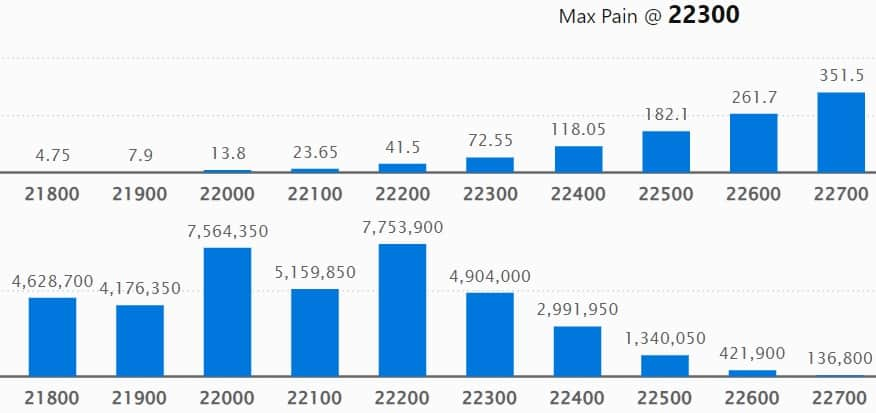

As per the weekly options data, the 23,000 strike owned the maximum Call open interest with 80.1 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,400 strike, which had 62.87 lakh contracts, while the 22,800 strike had 59.47 lakh contracts.

Meaningful Call writing was seen at the 22,600 strike, which added 8.53 lakh contracts, followed by the 22,700 strike adding 6.49 lakh contracts, and 22,300 strike with 1.69 lakh contracts.

The maximum Call unwinding was at the 23,300 strike, which shed 7.61 lakh contracts, followed by the 23,200 and 22,200 strikes, which shed 6.98 lakh and 5.54 lakh contracts.

On the Put side, the maximum open interest was visible at 22,200 strike, which can act as a key support for the Nifty, with 77.53 lakh contracts. It was followed by the 22,000 strike comprising 75.64 lakh contracts and then the 21,700 strike with 56 lakh contracts.

Meaningful Put writing was at the 21,700 strike, which added 15.87 lakh contracts, followed by the 22,300 strike and 22,800 strike, which added 12,900 and 6,750 contracts.

Put unwinding was seen at 22,400 strike, which shed 19.92 lakh contracts, followed by 21,600 and 22,200 strikes, which shed 11.39 lakh and 7.09 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Titan Company, Marico, Hindustan Unilever, ICICI Bank, and Coromandel International saw the highest delivery among the F&O stocks.

A long build-up was seen in 42 stocks, which included Manappuram Finance, Sun TV Network, Samvardhana Motherson International, Muthoot Finance, and M&M Financial Services. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 30 stocks saw long unwinding. These include Godrej Properties, Ipca Laboratories, Dixon Technologies, Berger Paints, and Hero MotoCorp. A decline in OI and price indicates long unwinding.

80 stocks see a short build-up

A short build-up was seen in 80 stocks, including Metropolis Healthcare, Ramco Cements, Cholamanadalam Investment & Finance, RBL Bank, and Bajaj Finserv. An increase in OI along with a fall in price points to a build-up of short positions.

33 stocks see a short covering

Based on the OI percentage, 33 stocks were on the short-covering list. These include BHEL, ICICI Prudential Life Insurance, ONGC, L&T Technology Services, and Bank of Baroda. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped further to 1.23 on March 5 from 1.30 in the previous session. Above 1 PCR indicates that the trading volume of Put options is more than Call options, which generally suggests a bearish market ahead

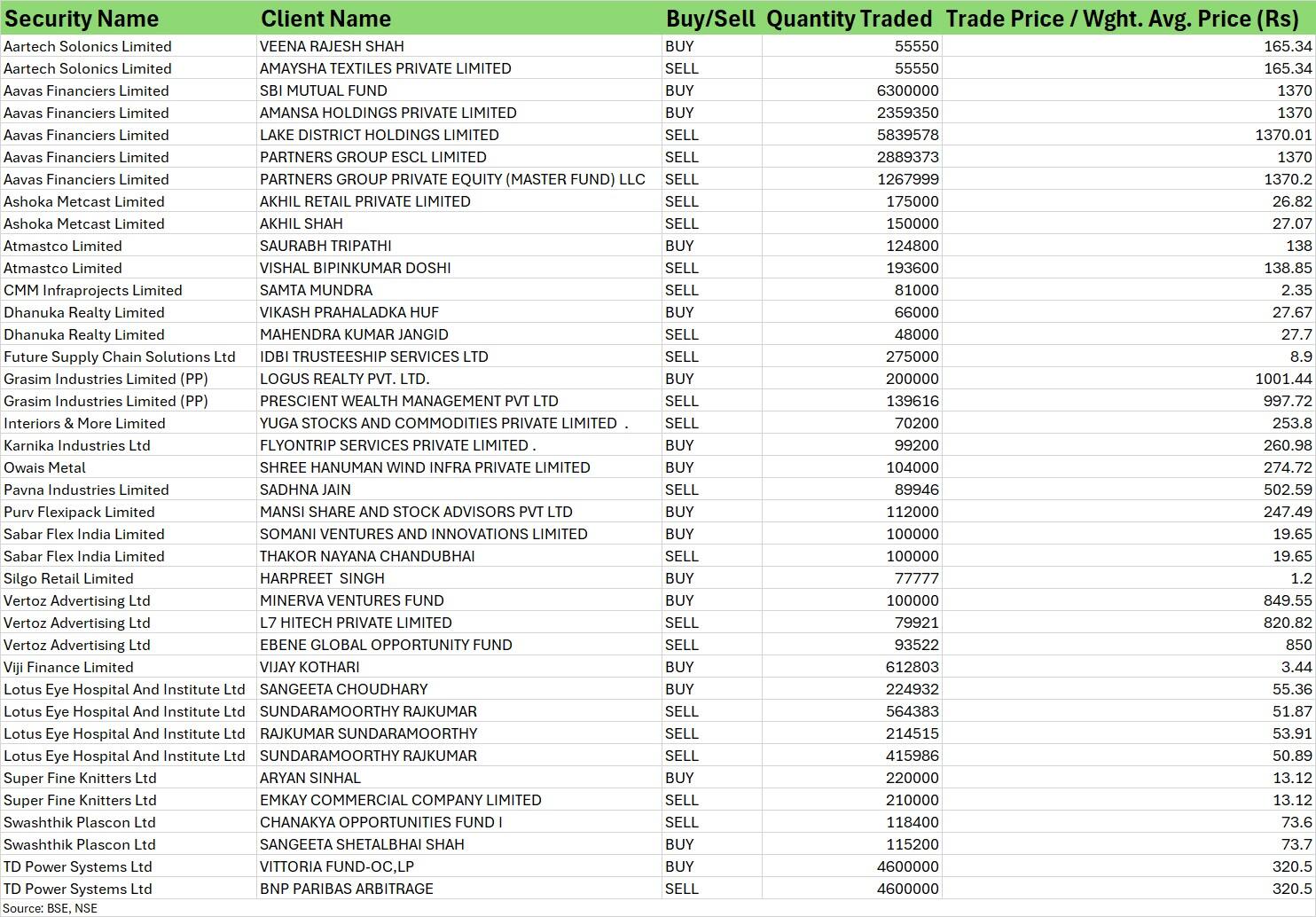

For more bulk deals, click here

Stocks in the news

JM Financial: The Reserve Bank of India (RBI) barred JM Financial Products (JMFPL) from giving loans against shares and debentures, including sanction and disbursal of loans against initial public offering (IPO) of shares, with immediate effect.

Zomato: China's Ant Group's arm Antfin Singapore Holdings Pte is likely to sell up to 2 percent stake (17.64 crore shares) in Zomato for Rs 2,800 crore through a block deal, sources told CNBC-Awaaz.

Samvardhana Motherson International: Sumitomo Wiring, a promoter entity in automotive company Samvardhana Motherson, is likely to offload 4.5 percent stake via block deal, CNBC Awaaz reported citing sources.

Coal India: Chhattisgarh-based Coal India subsidiary South Eastern Coalfield's Gevra mine is set to become the largest coal mine in Asia. The mine has been granted environmental clearance to expand production capacity to 70 million tons per annum from the current 52.5 million tonnes.

Wipro: The IT services company has acquired 27 percent stake in SDVerse LLC to strengthen its positioning as a leader in the software defined vehicle / cloudcar engineering services.

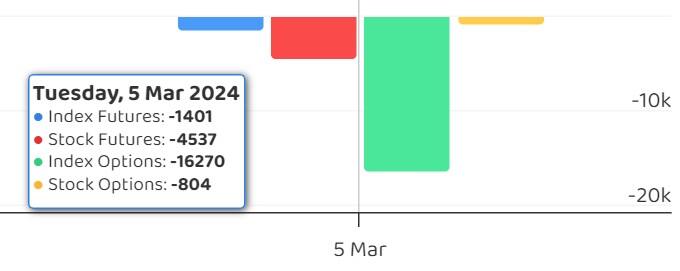

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 574.28 crore, while domestic institutional investors (DIIs) purchased Rs 1,834.61 crore worth of stocks on March 5, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has retained Zee Entertainment Enterprises on the F&O ban list for March 6.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclsoure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.