Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Nifty likely to hit 22,500 in coming sessions

Technically, the overall sentiment remains in favour of bulls given the continuation of higher highs formation and the index staying above upward sloping resistance trendline, but the formation of Doji candlestick pattern at the top on March 4 indicates the possibility of consolidation in the coming sessions with support at 22,200 level, and the Nifty 50 may face hurdle at 22,500 on the higher side, followed by 22,600 level, experts said.

On March 4, the benchmark indices continued an uptrend for the fourth consecutive session and ended at a record closing high with the BSE Sensex rising 66 points to 73,872, while the Nifty 50 climbed 27 points to 22,406 amid consolidation.

"All short-term moving averages, particularly the 20-day moving average, served as immediate support. The Bollinger bands are expanding in the daily chart, with 22,500 being a psychological level that the Nifty may attempt to test," Om Mehra, technical analyst at SAMCO Securities said, adding strong support level is identified at 22,200.

Despite the formation of a Doji candle on the daily chart, Kunal Shah, senior technical & derivative analyst at LKP Securities believes the overall sentiment remains bullish. "On the downside, support is established at 22,200, presenting buying opportunities on any pullbacks towards this level," he said.

The India VIX, a fear gauge, has cooled and ended below 15, indicating that the bulls are in control.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 22,370 followed by 22,351 and 22,319. On the higher side, it may face resistance at 22,413 followed by 22,453 and 22,484 levels.

On March 4, the Bank Nifty also ended higher for four days in a row, rising 159 points to 47,456 and formed a bullish candlestick pattern on the daily charts. The banking index closed above the downward-sloping resistance trendline, which can be crucial for a further uptrend.

"The relative strength index (RSI) ended at 61 levels, indicating the positive momentum remains intact for the index. Private banking stocks are exhibiting strong support after a decent correction," Om Mehra said.

The index has immediate support at the 47,000 level with resistance around the 48,000-48,200 zone, he said.

As per the pivot point calculator, Bank Nifty is expected to take support at 47,263 followed by 47,184 and 47,055. On the higher side, the index may see resistance at 47,487 followed by 47,601 and 47,730.

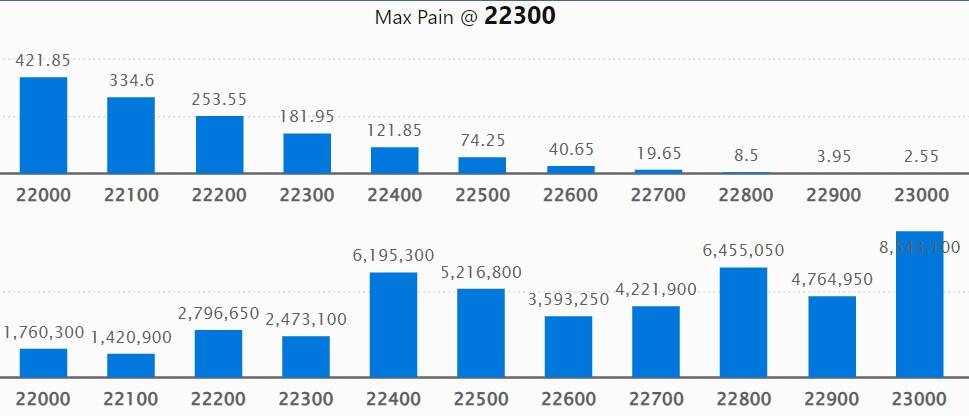

As per the weekly options data, the maximum Call open interest was visible at 23,000 strike with 85.43 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,800 strike, which had 64.55 lakh contracts, while the 22,400 strike had 61.95 lakh contracts.

Meaningful Call writing was seen at the 22,400 strike, which added 26.01 lakh contracts, followed by the 22,900 strike adding 11.25 lakh contracts, and 23,000 strike with 11.17 lakh contracts.

The maximum Call unwinding was at the 22,300 strike, which shed 8.84 lakh contracts, followed by the 23,100 and 22,000 strikes, which shed 2.36 lakh and 1.56 lakh contracts.

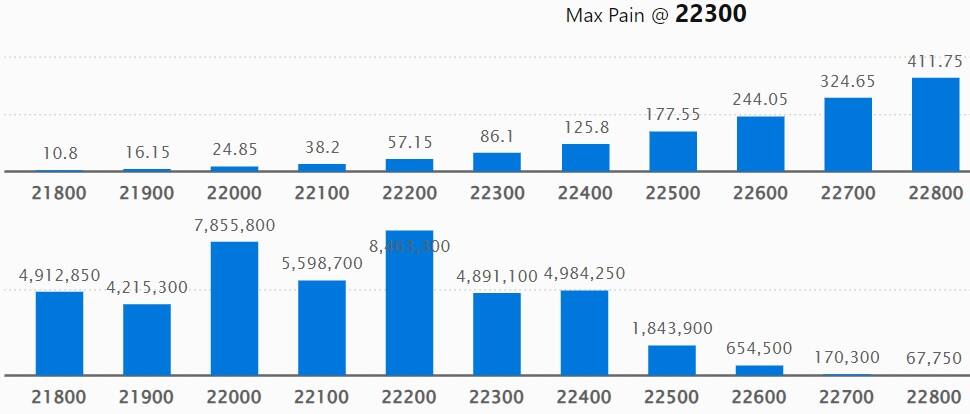

On the Put side, the 22,200 strike owned the maximum open interest, which can act as a key support for the Nifty, with 84.63 lakh contracts. It was followed by the 22,000 strike comprising 78.55 lakh contracts and then the 22,100 strike with 55.98 lakh contracts.

Meaningful Put writing was at the 22,400 strike, which added 24.73 lakh contracts, followed by the 22,200 strike and 21,800 strike, which added 17.41 lakh and 10.65 lakh contracts.

Put unwinding was seen at 21,400 strike, which shed 10.78 lakh contracts, followed by 20,800 and 21,200 strikes, which shed 8.5 lakh and 6.91 lakh contracts, respectively.

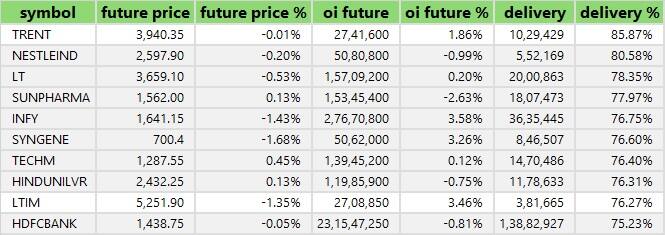

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Trent, Nestle India, Larsen & Toubro, Sun Pharmaceutical Industries, and Infosys saw the highest delivery among the F&O stocks.

A long build-up was seen in 52 stocks, which included SAIL, BHEL, Mahanagar Gas, Sun TV Network, and Bharat Electronics. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 39 stocks saw long unwinding. These include Page Industries, Siemens, Indian Hotels, Titan Company, and Maruti Suzuki India. A decline in OI and price indicates long unwinding.

47 stocks see a short build-up

A short build-up was seen in 47 stocks, including Info Edge India, Dr Lal PathLabs, Samvardhana Motherson International, Eicher Motors, and IndiaMART InterMESH. An increase in OI along with a fall in price points to a build-up of short positions.

47 stocks see a short covering

Based on the OI percentage, 47 stocks were on the short-covering list. These include MRF, NMDC, Bharat Forge, Voltas, and ONGC. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 1.30 on March 4 from 1.32 in the previous session. Above 1 PCR indicates that the trading volume of Put options is more than Call options, which generally suggests a bearish market ahead

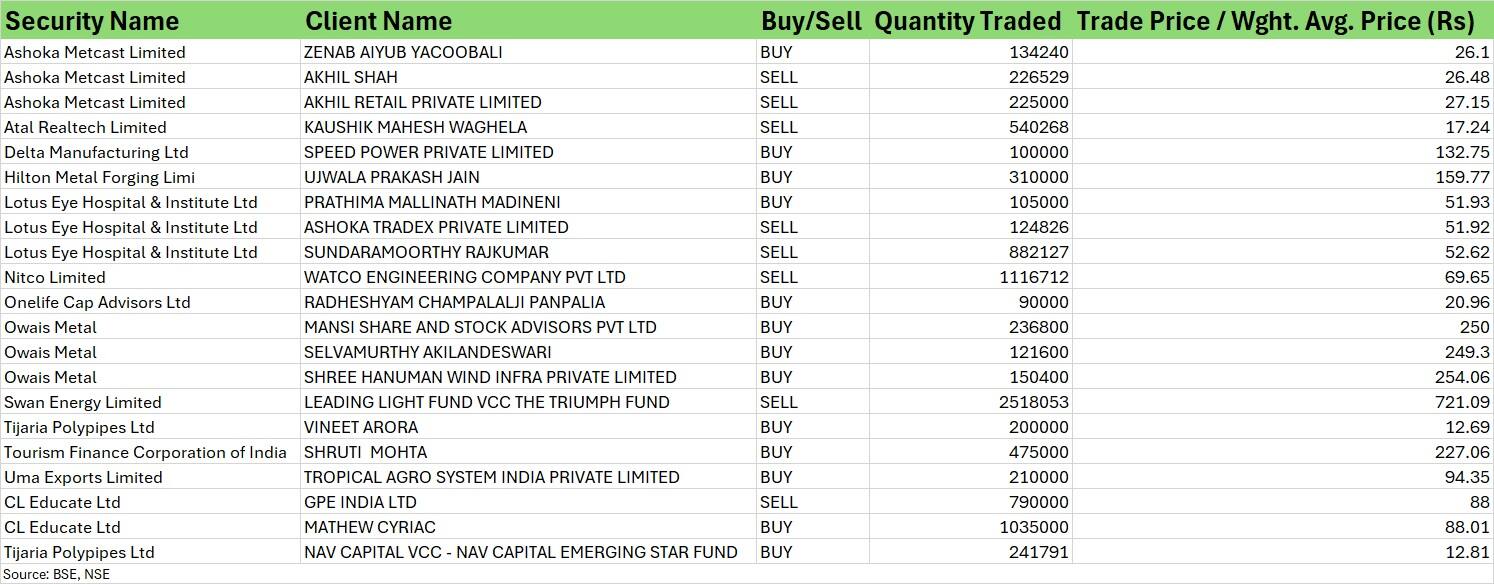

For more bulk deals, click here

Stocks in the news

Tata Motors: The Tata Group company said the board of directors approved the demerger of Tata Motors into two separate listed companies - one is the commercial vehicles business and its related investments in one entity, and the second is the passenger vehicles businesses including PV, EV, JLR and its related investments in another entity.

IIFL Finance: The Reserve Bank of India (RBI) has directed the company to cease, with immediate effect, from sanctioning or disbursing gold loans or assigning/ securitising/ selling any of its gold loans.

Macrotech Developers: The leading real estate developer launched its qualified institutions placement (QIP) issue on March 4. The floor price has been fixed at Rs 1,129.48 per share, which is a 4.68 percent discount on Monday's closing price.

Brigade Enterprises: The Bengaluru-based real estate developer has launched Dioro project at Brigade El Dorado. The project size is around 6.1 million square feet with a potential revenue value of Rs 380 crore.

Jindal Stainless: The stainless steel manufacturer commenced the usage of green hydrogen in its stainless steel plant in Hisar, Haryana, in association with Hygenco Green Energies.

AU Small Finance Bank: The Reserve Bank of India (RBI) has sanctioned the Scheme of Amalgamation of Fincare Small Finance Bank with AU Small Finance Bank.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 564.06 crore, while domestic institutional investors (DIIs) bought Rs 3,542.87 crore worth of stocks on March 4, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has retained Zee Entertainment Enterprises on the F&O ban list for March 5.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclsoure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.