Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Forex-Reserves

The share of gold and special drawing rights (SDR) in India’s total foreign exchange reserves has fallen marginally so far this financial year due to the Reserve Bank of India (RBI) buying dollars to support the rupee, experts said.

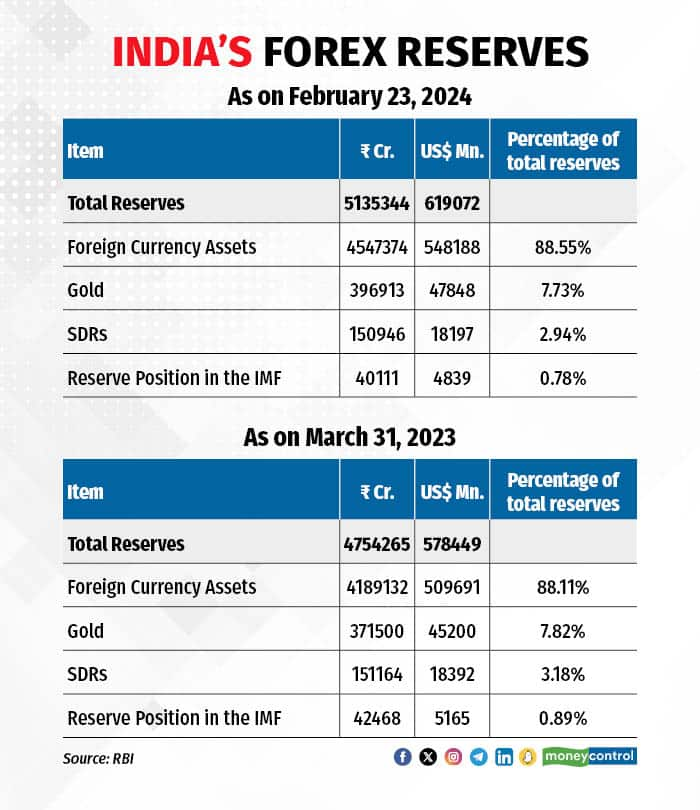

Gold reserves accounted for 7.73 percent of total forex reserves as on February 23, compared to 7.82 percent as on March 31, 2023, as per RBI data. Similarly, SDRs as a percentage of total reserves was 2.94 percent as on February 23, against 3.18 percent on March 31, 2023, the data showed.

“The key reason for the reduction in gold and SDR percentages is more buying by RBI of the dollar in percentage terms,” said Anil Kumar Bhansali, head of treasury and executive director, Finrex Treasury Advisors LLP.

Adding to this, Dilip Parmar, a foreign exchange analyst at HDFC Securities, explained that global Central Banks have accumulated gold in the past due to geopolitical uncertainty but as the hawkish stance continue from the US federal reserve the haven demand contained for dollar. .

On the other hand, foreign currency assets (FCAs), which constitute the vast majority of forex reserves, saw a marginal uptick of 41 basis points (bps) to 88.55 percent of total reserves as on February 23, according to RBI data. On March 31, 2023, FCAs stood at 88.14 percent of total reserves. One basis point is one-hundredth of a percentage point.

“The portion of FCAs has improved as the twin deficit (on both the current account and fiscal fronts) remained under control, which provided the RBI room to add foreign currency assets and that led to the increase in FCAs as a percentage of the total,” Parmar added.

Between April and December 2023, India's central bank remained a net buyer of the greenback in most month, as per the RBI’s bulletin data, with August, September, October and November being when it was a net seller.

As per latest data, the RBI net bought $2.067 billion from the spot market.

The numbers

In absolute terms, as on February 23, gold reserves stood at $47.848 billion, and SDRs at $18.197 billion. The corresponding figures for March 31, 2023, were $45.200 billion and $18.392 billion, respectively.

FCAs in absolute terms rose to $548.188 billion on February 23, compared to $509.691 billion as on March 31, 2024

India’s forex reserves stood at $619.072 billion as on February 23, versus $578.449 billion as on March 31, 2023.

RBI’s stance on forex reserves

Forex market experts are of the view that the central bank may intervene on both sides to curb volatility and control inflation.

Kunal Sodhani, vice president of Shinhan Bank India, said the RBI has been vigilant when it comes to intervention from either side. When flows remain positive, it tries to accumulate reserves without much depreciation and in case of any sharp rupee depreciation, it uses the reserves as ammunition to curtail excessive volatility.

“We have been maintaining an import cover of around 10 months, which seems to be decent. Overall, accumulation of reserves is expected to continue at a slow and steady pace and may soon break the all-time high of $645 billion seen in October 2021,” Sodhani added.

Experts said the inclusion of Indian bonds in JPMorgan's global bond index will increase dollar flows and the central bank is expected to act accordingly.

Rupee’s expected range

Money market experts feel that the rupee is likely to be range-bound till the end of this financial year.

“The rupee is expected to be in the narrow range of 82.90 to 83.10 and broadly between 82.70 to 83.40. For the fiscal year, it is likely to be 82.50 to 83.50 against US dollar,” Bhansali noted.

Sodhani was of the view that demand year-end rupee demand from Indian companies would prop up support for the domestic currency.

“Factors to watch out are elections in India, bond flows considering JPMorgan Bond index flows to begin in June, interest rate trajectory by the Fed and other major economies, and geopolitical issues in the Middle east shouldn't be taken lightly,” Sodhani said.

Currently, the rupee is trading at 82.90 against the US dollar.