Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

AMFI has prescribed several data points to demonstrate how liquid and over-valued your fund really is

Mutual fund industry trade body AMFI has laid out the detailed guidelines on stress tests that smallcap and midcap schemes will have to undertake.

The February 28 late evening communication came in the trail of a letter that the Association of Mutual Funds of India (AMFI) had sent out to all mutual fund (MF) houses on February 27, alerting them about instructions from the capital market regulator Securities and Exchange Board of India (Sebi).

AMFI has instructed fund houses to submit the stress test results once every 15 days, the first of which should be published by March 15. A portfolio’s stress test basically reveals how liquid it really is. The aim is to ascertain how soon investors can take their money back, if the equity markets were to collapse and there is rush on redemptions.

Since mutual funds boast of almost instant liquidity (equity funds give back investors’ money within 2-3 days), it speaks to distress if fund houses cannot liquidate their portfolio in time. And if they can manage somehow, at throwaway prices resulting in losses or much less gains for investors.

Periodic disclosures

Fund houses are required this information on their respective websites as well as on AMFI’s website. Sebi's concerns about a possible froth building up in equity markets stems from the stupendous rise in equity markets and the highs being reached repeatedly through 2023.

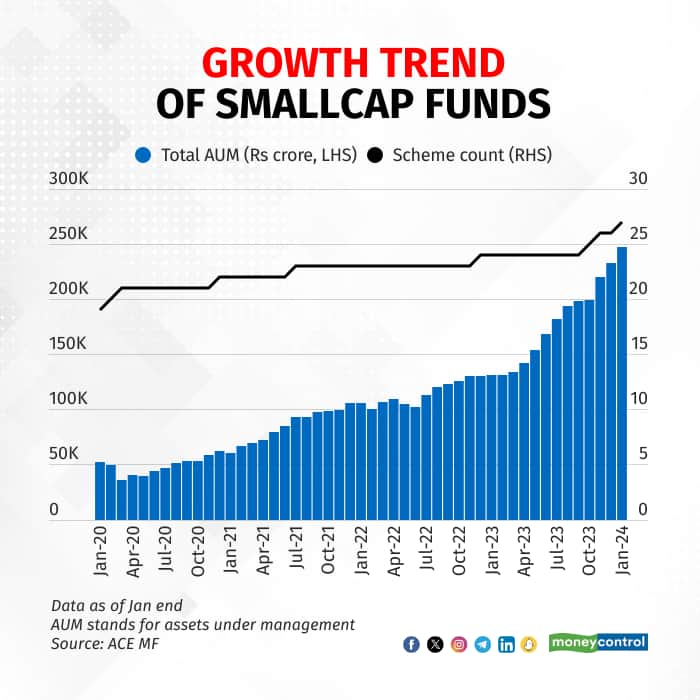

In 2023, the Nifty Midcap 150 index gave a return of 45 percent. The Nifty Smallcap 250 index went up by 49 percent. Smallcap MF schemes went up by 41 percent on the average, and midcap funds went up by 37 percent in 2023. This has resulted in a gush of inflows in small-cap and mid-cap funds.

AMFI has prescribed several data points to demonstrate how liquid and over-valued your fund really is. Aside from its standard deviation, your fund houses would also need to publish its midcap and smallcap equity schemes’ price-earnings ratio as well as those of their benchmark indices. This will show if your schemes are over-valued, as compared to their benchmark indices. A higher standard deviation indicates that the fund is volatile, not necessarily bad though, but as investors, that’s the risk level which you need to understand before investing.

AMFI has prescribed several data points to demonstrate how liquid and over-valued your fund really is. Aside from its standard deviation, your fund houses would also need to publish its midcap and smallcap equity schemes’ price-earnings ratio as well as those of their benchmark indices. This will show if your schemes are over-valued, as compared to their benchmark indices. A higher standard deviation indicates that the fund is volatile, not necessarily bad though, but as investors, that’s the risk level which you need to understand before investing.

Stress tests

Additionally, small-cap funds and midcap funds must also disclose how liquid their portfolios are. Here, AMFI wants the schemes to ascertain how many days it would take them to sell 50 percent and 25 percent of their portfolio.

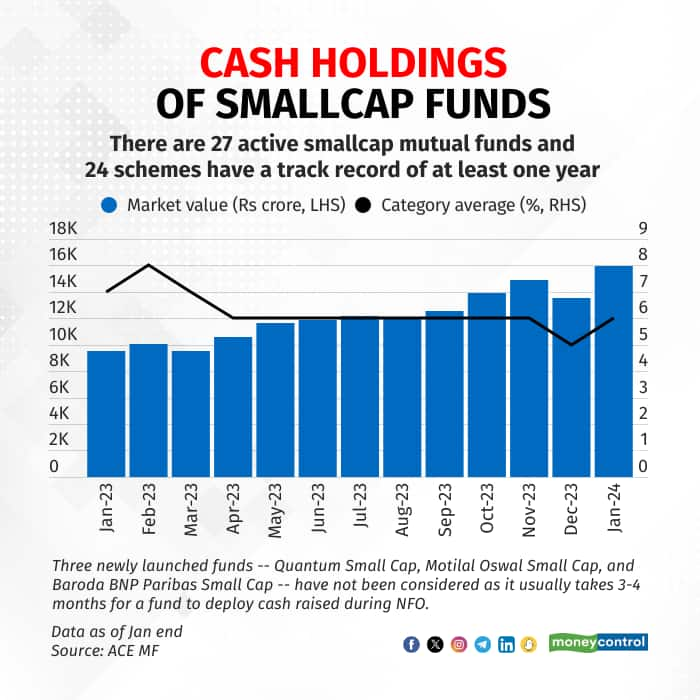

Typically, equity schemes provision (as per their offer documents) to hold up to 10 percent of their portfolios in cash, though most funds limit their cash holdings to up to 5 percent of their corpuses. As per a recent Moneycontrol analysis, small-cap funds have held around 6-7 percent of their portfolios in cash <see table>.

The asset sizes of small-cap funds have grown, but cash levels have pretty much remained at 6-7%

The asset sizes of small-cap funds have grown, but cash levels have pretty much remained at 6-7%

In simple words, a stress test refers to possible situations where liquidity of a stock (market participation) is curtailed, but volumes are multiplied to simulate a rush on redemptions during sharp market falls.

Other measures

Fund houses have resorted to some measures to decrease portfolio risk. Some managers have increased the number of stocks in their portfolios. Others have increased their cash levels.

Financial planners advice caution when investing in small and mid-cap funds at present. Existing systematic investment plans (SIP) can continue and even new ones can be started. Avoid lumpsum investment at this point. If you have a lumpsum amount to invest, then it’s better to do a Systematic Transfer Plan, wherein you invest your entire lumpsum amount in a liquid fund and then move money- systematically, once a month or 15 days, to your chosen small-cap or mid-cap fund.

With inputs from Abhinav Kaul