Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Expert picks these 3 stocks for strong returns

The Nifty ended the session on February 26 down 91 points at 22,122. Volumes on the NSE dipped a bit from the previous three sessions. Declining shares outnumbered their advancing peers as advance-decline ratio stood at 0.76 on the BSE.

The Nifty closed below its five-day moving average (DMA). In the derivatives, we have seen aggressive Call writing at 22,200-22,300 levels. Moreover, multiple tops have been formed around 22,200-22,300 levels during last few days suggesting on an upside of 22,200-22,300 levels would act as a very strong resistance. Therefore, traders are advised to remain cautious till the Nifty closes above 22,300.

On the downside, recent swing low of 21,875 to act as an immediate support. Any close below 21,875 would result into a bearish trend reversal which could drag the Nifty towards the next support of 21,400-21,500 levels.

After outperforming for a long period of time, midcap and smallcap indices have caught up in the narrow consolidation, where momentum is clearly lacking. However, primary trend remains strong and any sharp correction is a buying opportunity, we believe. Therefore, for traders our advice is to focus on midcap/smallcap space for short term trading gains.

Here are three buy calls for the next 3-4 weeks:

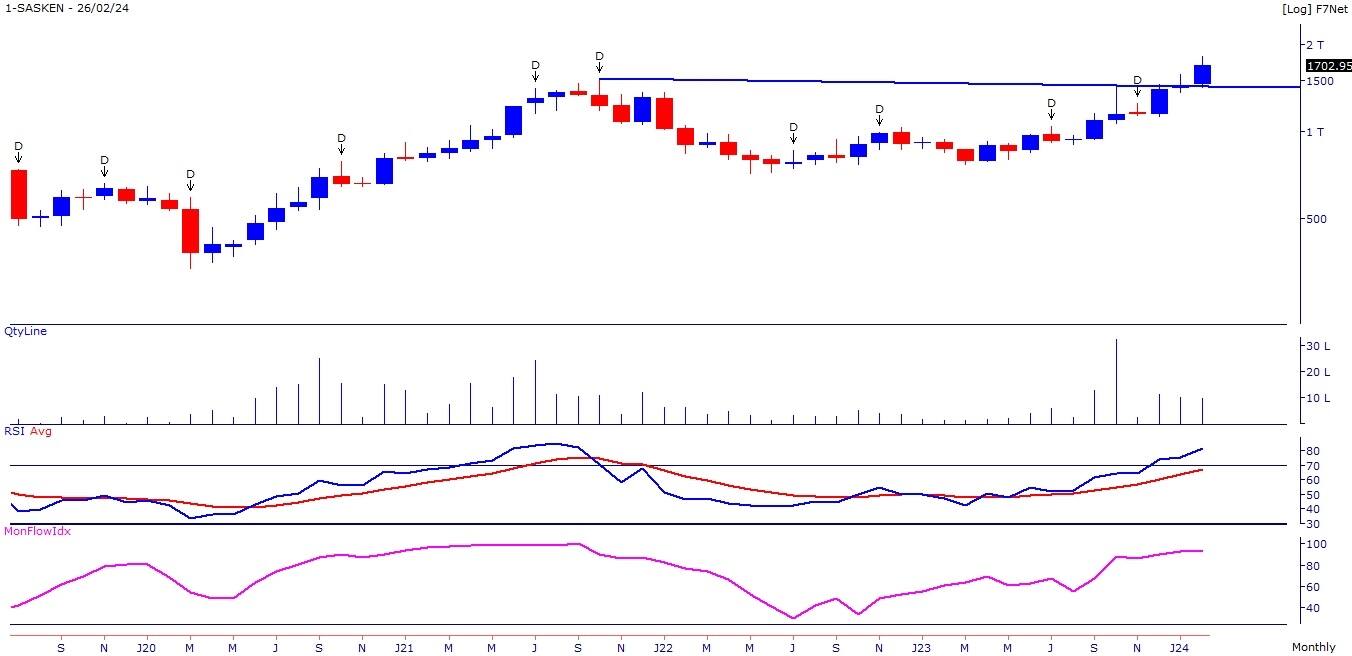

Sasken Technologies: Buy | LTP: Rs 1,703 | Stop-Loss: Rs 1,580 | Target: Rs 1,875-1,960 | Return: 15 percent

The stock price has broken out on the monthly chart by surpassing the resistance of Rs 1,525 levels. Momentum Indicators and Oscillators like RSI (relative strength index) and MFI (money flow index) are in rising mode and placed above 60 on the monthly chart, indicating strength in the stock.

IT stocks are expected to continue their outperformance in the coming weeks.

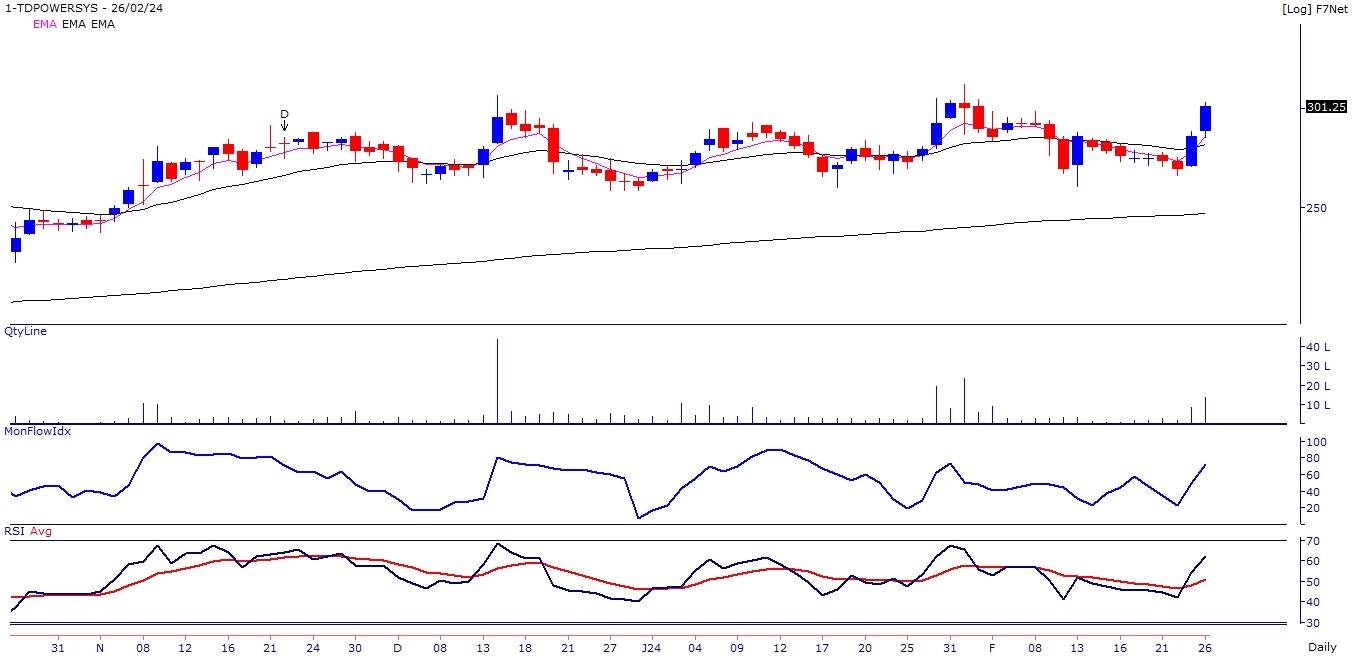

TD Power Systems: Buy | LTP: Rs 301 | Stop-Loss: Rs 280 | Target: Rs 325-340 | Return: 13 percent

The stock price has broken out on the daily chart from the downward sloping trendline with higher volumes. Primary trend of the stock is positive as stock price is trading above important short and long term moving averages.

Oscillators like RSI (11) and MFI (10) are sloping upwards and placed above 60 on the daily chart, indicating strength in the stock. The stock price has been trading in the narrow range since last few weeks and we expect stock to witness breakout in the days to come.

Indian Metals & Ferro Alloys: Buy | LTP: Rs 643 | Stop-Loss: Rs 600 | Target: Rs 695-720 | Return: 12 percent

The stock price has broken out on the monthly chart with higher volumes. Stock price has been forming bullish higher top higher bottom formation on the weekly chart.

Accumulation is visible in the stock from the beginning of the calendar year 2024 where average up days volumes are higher as compared to down days volumes.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.