Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

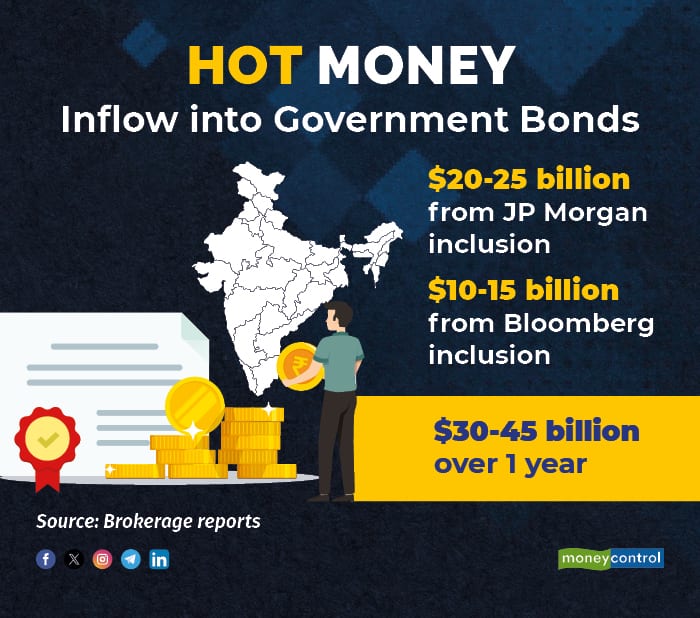

The inclusion in the JP Morgan and the Bloomberg global bond indices is estimated to bring about inflows of around $30-35 billion into India's debt market.

Foreign money is already pouring into Indian debt ahead of their scheduled inclusion into JPMorgan and Bloomberg's global bond indices in August and September, respectively.

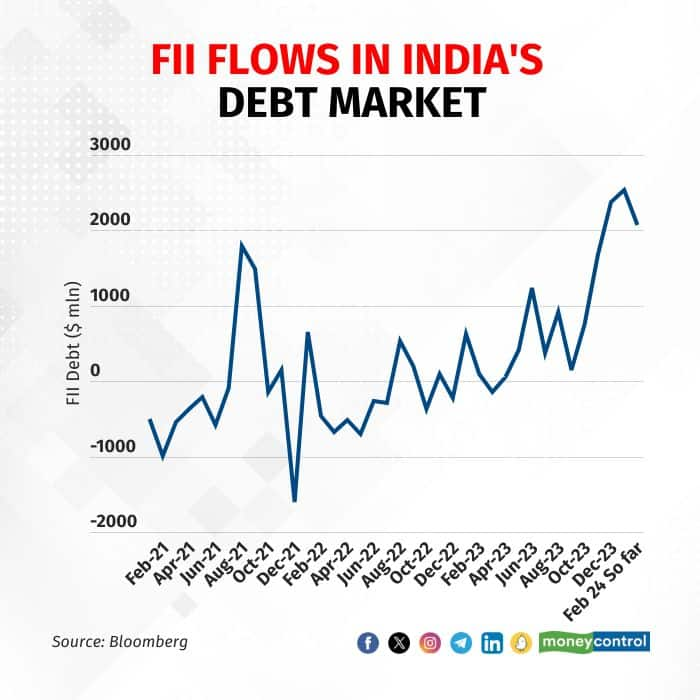

Foreign portfolio investors (FPIs) net bought a little over $2 billion of Indian debt in February, after having pumped in $2.5 billion last month. January’s purchases were the highest monthly inflows into the debt market in more than six years. In comparison, FPIs have net sold around $3.5 billion worth of equity shares so far in 2024.

FPI investments into Indian debt has been steadily rising since October when the proposed inclusion in the JP Morgan global bond index was announced.

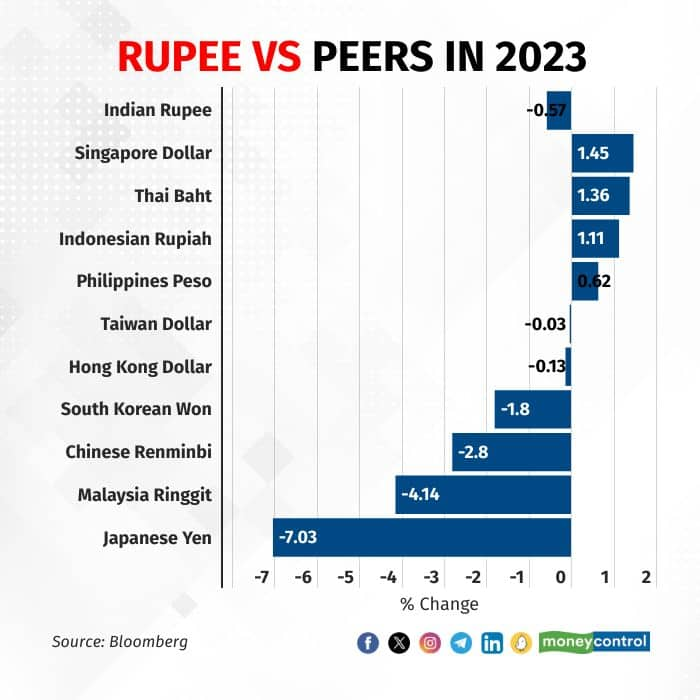

The strong foreign flows also provide a support to the rupee, because foreign investors need to convert dollars to rupees when investing in Indian bonds. This boosts demand for the rupee, and helped offset some of the pressure caused by FPI selling of equities.

So far in 2024, the rupee has risen 0.4 percent. It was also the top three least volatile emerging market currencies in 2023. However, a stronger rupee also has drawbacks too. India’s exports become less competitive compared to producers in countries with weaker currencies. If demand for exports goes down, it means less dollars coming into the country.

According to Neelkanth Mishra, Chief Economist at Axis Bank, the index inclusion will just be a trigger to bring in a one-time spike in foreign inflows that will run through 10 months, which he feels will keep the markets secured.

As for the rupee, looking at USD/INR rate, Mishra expects to see low volatility for the next 12 months. "The RBI also has the ammunition to dampen volatility on both sides, however, if we were modelling USD/INR, I would still anticipate mild depreciation. In case, we do start to get a lot of inflows, the RBI will tap into its reserves and keep the rupee down maybe 1-2 percent," Mishra stated in an interaction with Moneycontrol.

The inclusion in the two global bond indices is estimated to bring about inflows of around $30-35 billion into India's debt market. However, even with those estimates, Chetan Ahya, chief economist at Morgan Stanley believes the actual quantum of money flowing into India's debt market will hinge upon the sentiment around emerging markets at the time of the inclusion.

Regardless of that, Ahya said that India still runs a current account deficit and in that context, he feels that these inflows will be helpful and will ensure that the RBI will have more control of forex in case oil prices spike. "Meanwhile, that way, the increased inflows will provide an opportunity to the RBI to better manage macros and have a greater power of forex rates," he said in an interview with Moneycontrol.

Even though he feels the inflows will be of a relatively moderate size, they will nonetheless help sustain India's strong macro standing.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.