Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

A new CPI index with lower food weight will have a lower impact on overall inflation which will help MPC achieve its target more efficiently.

The Ministry of Statistics and Programme Implementation (MOSPI) released the much awaited findings of the Household Consumption Expenditure Survey (HCES) for the year 2022-23. The last round of HCES was done in 2011-12. The Survey is used to estimate various important economic indicators such as poverty line and new base year for consumer price inflation (CPI). The two important indicators of CPI and poverty line were also last estimated in 2011-12.

MOSPI has only released the Factsheet as of now and will release the detailed report later. The factsheet points to interesting trends and ongoing changes in the Indian economy.

First, the earlier Survey questionnaire had 347 items. The new questionnaire has 405 items which reflects both new categories and removal of obsolete categories. The survey was conducted at 2,61,746 Households (1,55,014 in rural areas and 1,06,732 in urban areas).

What MPCE Data Reveals

Second, the monthly per capita consumption expenditure (MPCE) for Rural India and Urban Indian has been estimated at Rs 3,773 and Rs 6,459 respectively. The MPCE has increased over the different survey rounds which is expected given growth in the Indian economy and incomes. However, the annual growth rate of MPCE (rural: 9.2 percent and urban 8.5 percent) has declined compared to previous surveys of 2009-10 and 2011-12. The growth rates at constant 2011-12 prices for rural and urban are even lower at 3.1 percent and 2.7 percent respectively.

The difference in expenditure between rural and urban (as a percentage of urban) has declined from 85-90 percent in previous surveys to 71 percent in the 2022-23 survey. This is because growth rate in urban MPCE has been lower than that of rural MPCE.

Third, there is wide disparity not just between States but in urban and rural within a State. The rural and urban MPCE is highest in Sikkim (Rural – Rs. 7,731 and Urban – Rs. 12,105) and lowest in Chhattisgarh (Rural – Rs. 2,466 and Urban – Rs. 4,483).

Fourth, there is also wide disparity across MPCE classes. The MPCE data is divided across 12 fractiles. The lowest class (0-5%) has MPCE in rural and urban areas at Rs 1,373 and Rs 2,001 respectively. Comparing it with the highest class (95-100%), we see MPCE in rural areas is nearly nine times at Rs 10,501 and in urban areas it is ten times at Rs 20,824.

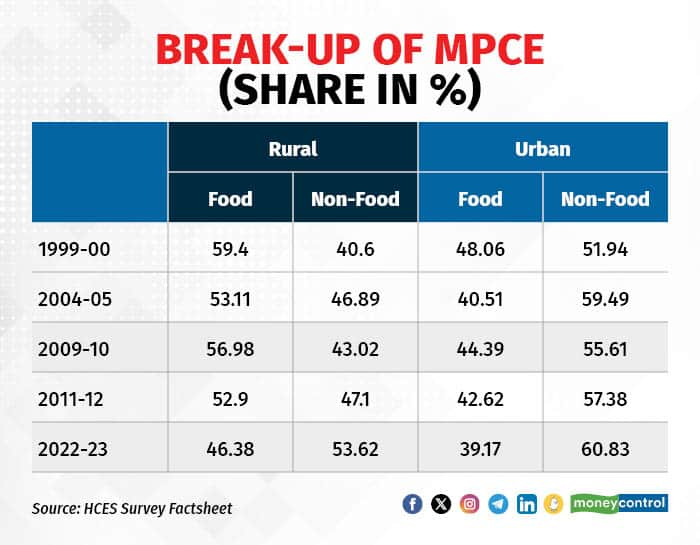

Fifth, the data shows how consumption is changing in rural and urban India. In every survey, we have seen that the share of MPCE spending on food has declined whereas that of non-food has risen. This is true in both rural and urban regions. In the latest round, we see the similar trend with share of food declining to 46 percent in rural areas and to 39 percent in urban areas. Within food, we see many changes. The share of cereals has declined sharply whereas share of beverages and processed food has increased significantly. In non-food, there is rise across categories: education, healthcare, transport, entertainment, housing rent and so on.

Impact On Consumer Price Index

This recent change in share of MPCE has wider implications for India’s macroeconomics and monetary policy. The survey data will eventually feed into the design of the new base year for CPI which has been pending for a while now. The decline in share of food and rise in share of non-food will reflect in the new CPI as well.

In the current CPI inflation data based on 2011-12 prices, the share of food is 46 percent and fuel is 7 percent. As a result, the weight of core CPI index, which excludes food and fuel components from the overall headline index, is just 47 percent. In the new CPI data, the share of food and fuel is likely to decline. This has two implications: headline inflation will be less volatile and core inflation will have higher weight.

Managing inflation has been a cause of concern for RBI. In October 2016, RBI constituted a Monetary Policy Committee which was given an inflation target of 4 percent with a band of +/- 2 percent. The central bank has struggled to keep inflation around the target in recent times. Each time inflation comes to the target, a shock in food prices pushes inflation above the target. In the Minutes of MPC meeting held in February 2024, most members expressed concerns over elevated food inflation and its impact on overall inflation.

A new CPI index with lower food weight will have a lower impact on overall inflation which will help MPC achieve its target more efficiently. However, there is a policy trade-off as well as higher weight of non-food items will make the inflation stickier as well. The food prices go up and come down relatively quickly. The non-food prices go up and come down in a much more gradual manner.

Overall, release of a new HCES survey and data that comes with it is highly welcome. The survey has been anticipated for a long time and is likely to occupy a lot of space in financial media and economic research going ahead.

Amol Agrawal teaches at Ahmedabad University, and is the author of 'History of Private Banking in South Canara district (1906-69)’. Views are personal, and do not represent the stand of this publication.