Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

The Household Consumer Expenditure Survey is crucial to updating the Consumer Price Index and the resultant headline inflation rate, which is currently based on the consumption patterns from 2011-12.

The statistics ministry released the results of its 2022-23 (August-July) Consumer Expenditure Survey late on February 24. This finally provides data on the latest consumption patterns of Indians in rural and urban areas, with official statistics as well as researchers having had to work with data from the survey conducted in 2011-12 (July-June).

The survey is crucial not just for the information it provides on the changing consumption patterns of Indians and their spending power but also in the restructuring of key economic indicators, such as the Consumer Price Index (CPI).

The CPI-based inflation is the Reserve Bank of India's (RBI) target indicator, with the law mandating the central bank keep it at 4 percent in a band of 2-6 percent. However, given that the current CPI inflation series is based on the consumption patterns of the 2011-12 (July-June) CES, questions have been raised about how accurate the inflation measure really is.

The CES is supposed to be held every five years. However, the latest iteration comes more than a decade later than the last one after the government had controversially junked the 2017-18 survey citing data quality issues, with financial daily Business Standard having reported in November 2019 that the draft report of the survey found consumer spending had fallen.

Now that the key facts of the latest survey are available, what do they indicate about the revised CPI inflation series?

Falling weight of food

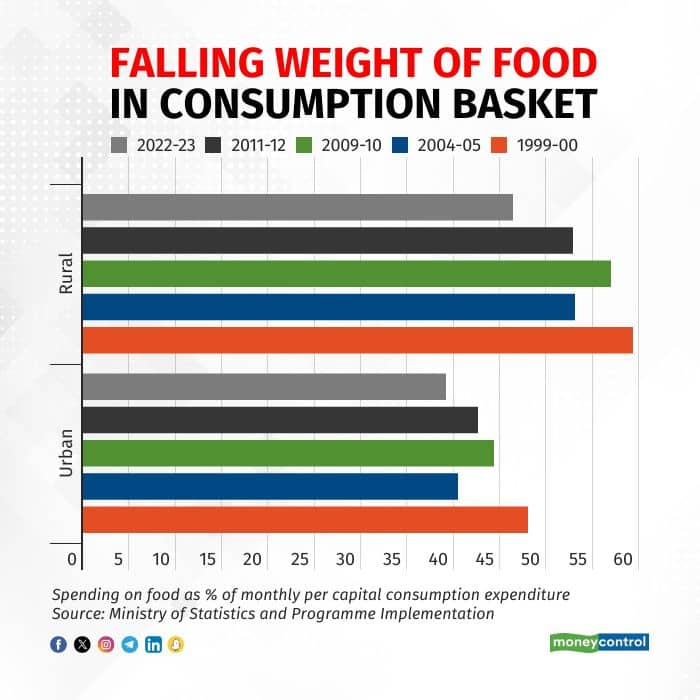

Perhaps the biggest issue with the current inflation series rooted in the 2011-12 CES is the fact that the weight of food items in CPI basket is as high as 45.86 percent – meaning that households spend nearly 46 percent of their expenditure on food items. While that may have been the case a decade ago, this proportion should fall as incomes rise – a relationship described by Engel's Law. There is, after all, only so much food that a person can eat.

And the 2022-23 CES does point to that, with the weight of food items in monthly per capita consumption expenditure (MPCE) falling to 46.38 percent for rural India from 52.90 percent in 2011-12 and to 39.17 percent for urban India from 42.62 percent in 2011-12.

Cereals slump, milk steady

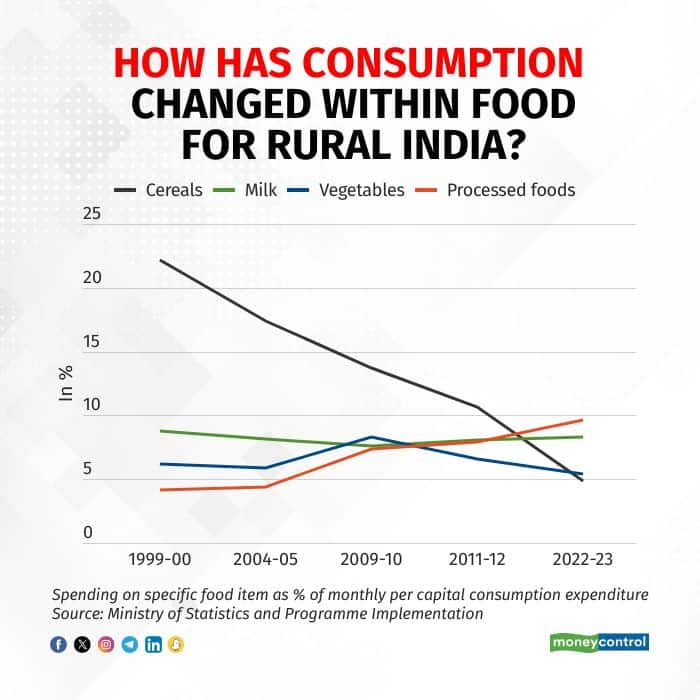

It's not just the percentage of consumption expenditure spent on food that falls over time. In addition, households also consume food differently as their incomes increase. This again shows up in the latest CES for 2022-23.

Take the rural food basket, for instance, where the percentage of MPCE spent on cereals has more than halved to just 4.89 percent in 2022-23 from 10.69 percent in 2011-12. Meanwhile, the share of consumption expenditure on milk and milk products has gone up slightly and that of vegetables edged down. The real gain, though, has been made in food items falling under the beverages and processed foods category, with rural households spending nearly a tenth of their MPCE on these items.

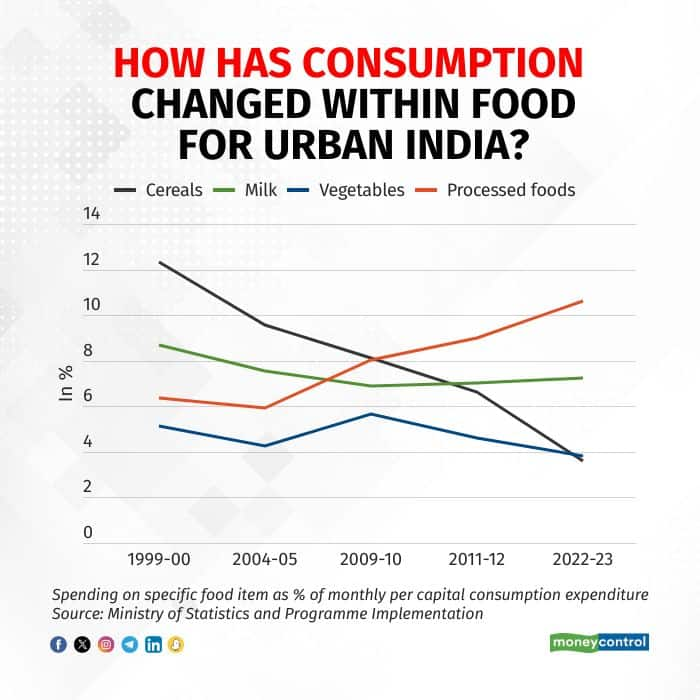

The story is similar when it comes to urban India: spending on cereals is down sharply, while that on milk and milk products and vegetables has moved in the same direction as the case in rural areas. However, the fraction of MPCE spent on beverages and processed foods in urban areas has not risen as sharply as in rural.

Reduced inflation volatility ahead?

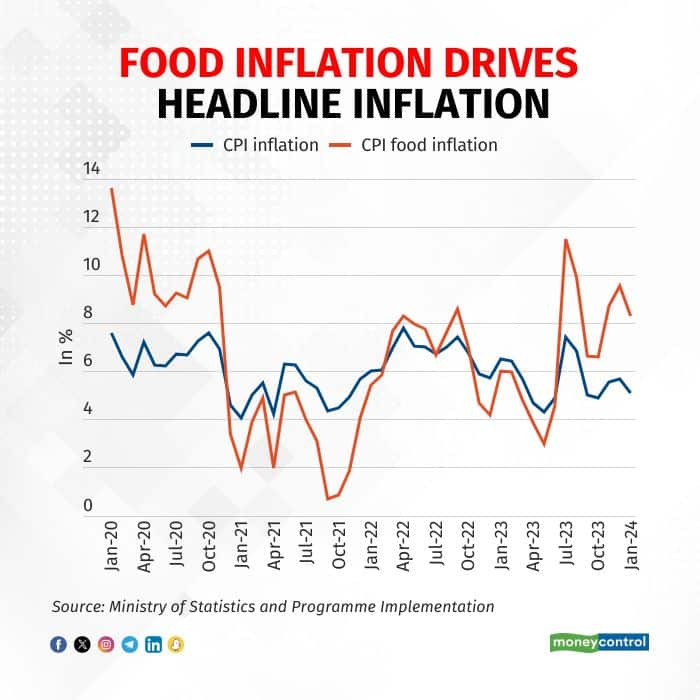

Given the fact that prices of food items can be volatile – as 2023 can testify – a high weight of food in the CPI basket means food inflation exerts extraordinary control over the headline inflation rate.

In fact, RBI economists have even argued that the 400-basis-point wide tolerance range for the inflation mandate is necessary due to the fact that share of food in India's consumption basket is the highest in the world. Add in the high volatility in food inflation and "there is a strong case for a wider tolerance band for India relative to the country experience," RBI staff wrote in the Report on Currency and Finance for 2020-21.

With the weight of food set to come down in the next iteration of the CPI series, it would also mean reduced volatility in the headline inflation rate and improved inflation forecasts as well.

What about non-food?

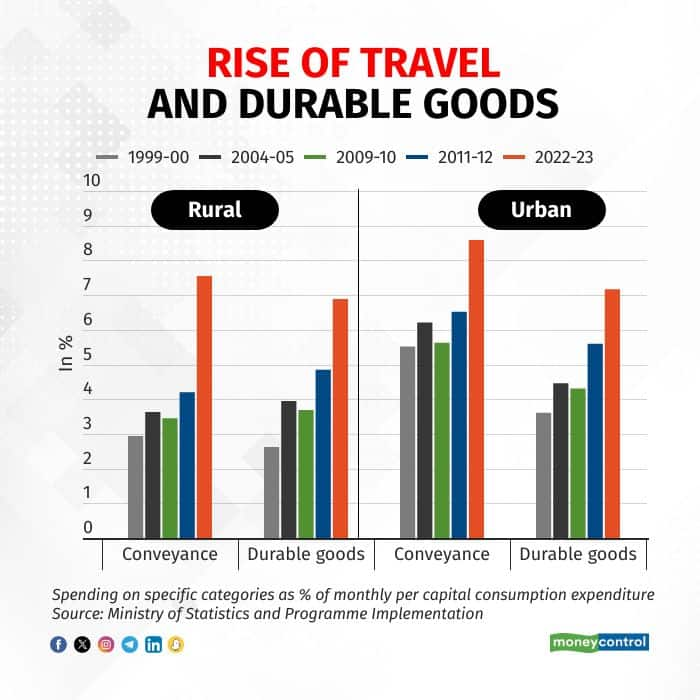

If the share of food in MPCE is falling, it means money is being spent on other items. And two of the biggest category gainers seem to be durable goods and conveyance – both in rural and urban India.

The rise in spending on conveyance to 7.55 percent in rural areas and 8.59 percent in urban is indicative of higher mobility for consumption purposes. No, Indians are not necessarily having to travel further to buy goods or avail of services, but are just moving around a lot more, be it to travel to work or elsewhere.

The other key consumption item that is seeing more spending is durable goods. In fact, such is the importance of durables now that one of three questionnaires in the 2022-23 CES was devoted to durable goods!

So when will the next CPI series be released?

Moneycontrol had exclusively reported as early as April 2023 that the new CPI inflation series may only be available in 2026. Why? Because a complete overhaul can only be performed once the statistics ministry has conducted both of its surveys, with the second CES scheduled to be completed in July this year.

The ministry is conducting two surveys this time around instead of just one on account of the changes made to the survey's questionnaire as well certain other methodological changes.

Once the fieldwork is done, a further six months may be needed to get the surveys' results, after which work will begin on updating the CPI series.